5 Personal Finance Strategies for Financial Freedom

Explore essential personal finance strategies to achieve financial freedom, including budgeting, debt repayment, savings, investing, and passive income.

Want to take control of your money and achieve financial freedom? Here are 5 actionable strategies to help you manage your finances, eliminate debt, save consistently, invest wisely, and build passive income:

Create a Budget That Works

Use the 50/30/20 rule to divide your income into needs, wants, and savings.

Track your spending with tools like YNAB or a simple spreadsheet.

Adjust your budget as prices or life circumstances change.

Pay Off Debt the Smart Way

Choose the Debt Snowball (smallest debt first) or Debt Avalanche (highest interest first) method.

Lower interest rates by refinancing or negotiating with lenders.

Stay debt-free by building an emergency fund and avoiding lifestyle inflation.

Set Up Automatic Savings and Investing

Automate paycheck transfers to savings accounts or retirement plans.

Build an emergency fund with small, consistent contributions.

Max out retirement accounts like 401(k)s and IRAs to benefit from tax advantages.

Invest Using Rules-Based Methods

Create a diversified three-fund portfolio (domestic stocks, international stocks, bonds).

Minimize taxes by using tax-advantaged accounts and placing tax-efficient investments in taxable accounts.

Stick to your plan during market downturns and rebalance your portfolio regularly.

Create Passive Income Streams

Invest in dividend-paying stocks, REITs, or rental properties for steady income.

Explore digital products like online courses, templates, or e-books that sell repeatedly.

Quick Tip: Start small - track expenses, automate savings, and focus on one goal at a time. With patience and discipline, you’ll build a strong financial foundation and gain the freedom to live life on your terms.

7 Simple Steps to Financial Freedom | What Step Are You In?

1. Create a Budget That Works

A good budget is like a roadmap - it guides your spending while staying simple and flexible. Below are three key strategies to help organize your finances effectively.

1.1 Use the 50/30/20 Rule to Split Your Income

The 50/30/20 rule is a straightforward way to divide your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment [2].

Needs: These are essentials like rent or mortgage, utilities, groceries, insurance, and minimum debt payments [1].

Wants: This category covers non-essentials such as dining out, entertainment, and hobbies [1].

Savings: This includes building an emergency fund, retirement contributions, and paying off debt beyond the minimum [1].

For instance, if your take-home pay is $4,000 a month, you’d allocate $2,000 for needs, $1,200 for wants, and $800 for savings and debt repayment.

You can tweak these percentages to fit your priorities. If paying off debt is your main goal, you might shift to 50% for needs, 20% for wants, and 30% for savings and debt payments. On the other hand, if you’re debt-free with a solid emergency fund, you could give yourself more room for discretionary spending.

Start by calculating your actual after-tax income and tracking your current spending. Many people are surprised by the gap between where they think their money is going and where it’s actually going. Once you have a clear breakdown, it becomes easier to align your spending with your goals.

1.2 Track Your Spending to See Where Money Goes

Tracking your expenses is key to making sure your budget reflects your actual financial habits. Thankfully, technology makes this process easier than ever.

Apps like YNAB, PocketGuard, and Simplifi can automatically track your spending and categorize your expenses, offering various pricing plans to suit your needs [3] [5]. These tools connect directly to your financial accounts, saving time and effort [3].

If you prefer a manual approach, a simple spreadsheet or even pen and paper works just as well - as long as you’re consistent. Regularly review your account statements and categorize your spending. This can help you spot forgotten subscriptions, small purchases that add up, or areas where you’re overspending [4]. Once you clearly understand your spending patterns, you’ll be better equipped to cut back on unnecessary expenses [4].

1.3 Update Your Budget When Prices Rise

Your budget isn’t meant to be static - it should grow and change as your life evolves. With prices constantly shifting, especially due to inflation, being flexible is essential for staying on track.

"Remember that a budget isn't set in stone; you should let it evolve with your life. As months go by, your perspective may change on the way you spend your money." – Heather Hurilla, Member Development Officer, Affinity Federal Credit Union [6]

One way to build flexibility is by setting spending ranges instead of fixed amounts for variable costs like groceries and utilities [7]. For example, instead of budgeting exactly $400 for groceries, you could plan for $350 to $450 to account for price fluctuations.

Review your budget every month and adjust as needed. For instance, if grocery prices rise, you might need to spend less on entertainment to balance things out. Even a small buffer - say, $50 a month - can help cover unexpected costs without derailing your plan [6].

Take a closer look at each expense. For fixed costs, try negotiating better rates on subscriptions or services [7]. For variable expenses, consider practical changes like buying store brands, purchasing in bulk, or tweaking your shopping habits.

"Inflation isn't something you can control - but with the right strategy, you can control how it impacts your life." – Thrive Wealth Management [7]

A flexible budget that evolves with your circumstances will always serve you better than a rigid one you abandon after a few months. As your income grows or your financial goals shift, make sure your budget reflects these changes to keep you moving toward success.

2. Pay Off Debt the Smart Way

Getting rid of debt is a crucial step toward freeing up money for savings and investments. The key is to use a strategy that fits your situation and keeps you motivated.

2.1 Debt Snowball vs. Debt Avalanche Methods

When it comes to managing multiple debts, there are two popular strategies: the debt snowball and the debt avalanche. Both methods involve paying the minimum on all debts while focusing extra payments on one specific balance until it’s fully paid off.

Debt Snowball Method: This approach prioritizes paying off your smallest balance first, regardless of the interest rate [8]. Once that debt is paid, you redirect those payments to the next smallest balance. The idea is to build momentum with quick wins, which can keep you motivated along the way.

Debt Avalanche Method: Here, you focus on the debt with the highest interest rate first [8]. After eliminating that, you move to the next highest interest rate. This method is designed to save the most money on interest over time.

For example, the debt avalanche method saved $2,213 in interest payments in one case, while the debt snowball method saved $2,251 [8]. Another scenario saw interest payments drop from $57,249 (with no strategy) to $45,340 using the avalanche approach [9].

"The best debt payoff option depends on your personal debt payoff goals. The debt snowball method can help you pay off your smallest balances faster, which can be motivating. But the debt avalanche method could save you more money overall." – Ben Luthi [8]

Ultimately, the choice depends on what drives you. If seeing quick progress keeps you on track, the snowball method might be better. If minimizing interest costs is your top priority, go with the avalanche method. Before starting, double-check that your loans don’t have prepayment penalties [9].

Once you’ve chosen your approach, you can take things further by lowering your interest rates.

2.2 Lower Your Interest Rates Through Refinancing

Reducing interest rates is another way to speed up debt repayment. Even small reductions can make a noticeable difference.

Negotiate with Credit Card Issuers: Contact your credit card company and ask for a lower rate. Highlight your track record of on-time payments and any improvements to your credit score. If you’ve faced financial hardships, such as job loss or medical expenses, sharing your story may help [12]. If a permanent rate reduction isn’t possible, ask for a temporary one [12].

Refinance Loans: Replacing an existing loan with one that has better terms can save money [10][11]. Check current rates to see if they’re lower than what you’re paying. Many lenders offer pre-qualification without affecting your credit score, so you can shop around safely [11]. For personal loans, compare rates and fees to ensure the refinancing benefits you [11]. Once approved, use the new loan to pay off your old one immediately.

Mortgage Refinancing: This can significantly lower monthly payments, but keep in mind that closing costs typically range from 3% to 6% of the loan amount. Calculate how long it will take to recoup these costs [10].

Auto Loan Refinancing: Review your current loan and your car’s value to ensure you’re not upside-down on the loan [14]. Your credit score will play a big role in determining the rates you qualify for [14].

If these options don’t work, consider a balance transfer to a lower-rate credit card or consolidating your debt with a single loan [13]. These strategies can help reduce your interest burden and simplify payments.After lowering interest rates, focus on building habits that keep you debt-free.

2.3 Stay Out of Debt Once You're Free

Getting out of debt is an achievement, but staying debt-free requires ongoing effort and smart money habits.

Build an Emergency Fund: Even a modest fund can prevent small emergencies from pushing you back into debt.

Set Up Sinking Funds: Save monthly for predictable expenses like car repairs, home upkeep, or vacations [15]. This way, you can pay cash instead of borrowing when the time comes.

Avoid Lifestyle Inflation: Resist the urge to spend more as your income grows [16]. Stick to living below your means and use extra income to boost savings or investments.

Curb Impulse Spending: Remove saved credit card details from online stores and wait 24 hours before making big purchases [15].

Pay Off Credit Cards Monthly: Once debt-free, make it a habit to clear your credit card balance every month. If you can’t, it’s a sign you’re overspending.

Be Careful with New Debt: Only borrow when you have a clear plan for repayment [16]. If you’re unsure how you’ll pay it back, it’s better to save up and pay in cash.

The habits that helped you pay off debt - living within your means, planning for expenses, and making thoughtful spending choices - are the same ones that will keep you debt-free for the long haul.

3. Set Up Automatic Savings and Investing

Once you've got your debt under control, it's time to shift focus toward building wealth. Automating your savings and investments makes this process easier and helps you stay consistent with your financial goals. By setting up automatic transfers, you can save money before you even get the chance to spend it.

3.1 Direct Money from Your Paycheck to Savings

One of the simplest ways to save is by directing a portion of your paycheck straight into a savings account. Many employers allow you to split your direct deposit into multiple accounts, so you can allocate part of your income to savings and the rest to your checking account for everyday expenses. If your employer doesn’t offer this option, you can set up automatic transfers through your bank to move money on payday.

"Automate a monthly savings and investment plan so that you can force yourself to always spend less than you make." - Elliot J. Pepper, CPA, CFP, financial planner and director of tax at Northbrook Financial [18]

Start small if you're unsure about how much to save. Even 3% or 5% of your income is a good starting point. Over time, as you get more comfortable, you can increase this amount. Any raises or bonuses you receive are also great opportunities to boost your savings without feeling the pinch of reduced spending.

High-yield savings accounts are an excellent option for automatic transfers, as they typically offer better interest rates than standard accounts. You can also create separate accounts for specific goals - like an emergency fund, a house down payment, or a vacation fund - to keep things organized and track your progress more effectively.

3.2 Build Your Emergency Fund Step by Step

An emergency fund is your financial safety net, helping you cover unexpected expenses without derailing your plans. Automating contributions to this fund ensures steady growth without requiring constant effort.

Take Ashley, for example. She set up automatic transfers of $150 from each paycheck, adding up to $300 a month. Over time, her balance grew steadily, and the interest earned on her savings compounded, further increasing her funds [19]. Even small contributions, like $50 a month, can add up to $600 a year - especially when combined with interest.

You can also use round-up apps to save the spare change from your purchases. While the amounts might seem small, they add up surprisingly fast with regular use. Keep your emergency fund separate from your primary checking account to reduce the temptation to dip into it for non-urgent expenses. Start with a goal of $1,000 and then work toward saving three to six months' worth of living expenses.

The importance of saving is clear when you consider that, in 2023, the U.S. Bureau of Economic Analysis reported a personal savings rate of just 3.8% of total income - well below the long-term average [17]. Automating your savings can help you buck this trend.

3.3 Max Out Your Retirement Account Contributions

Retirement accounts come with tax benefits that make them a cornerstone of long-term financial planning. Automating contributions ensures you consistently take advantage of these benefits and allows your investments to grow through compounding.

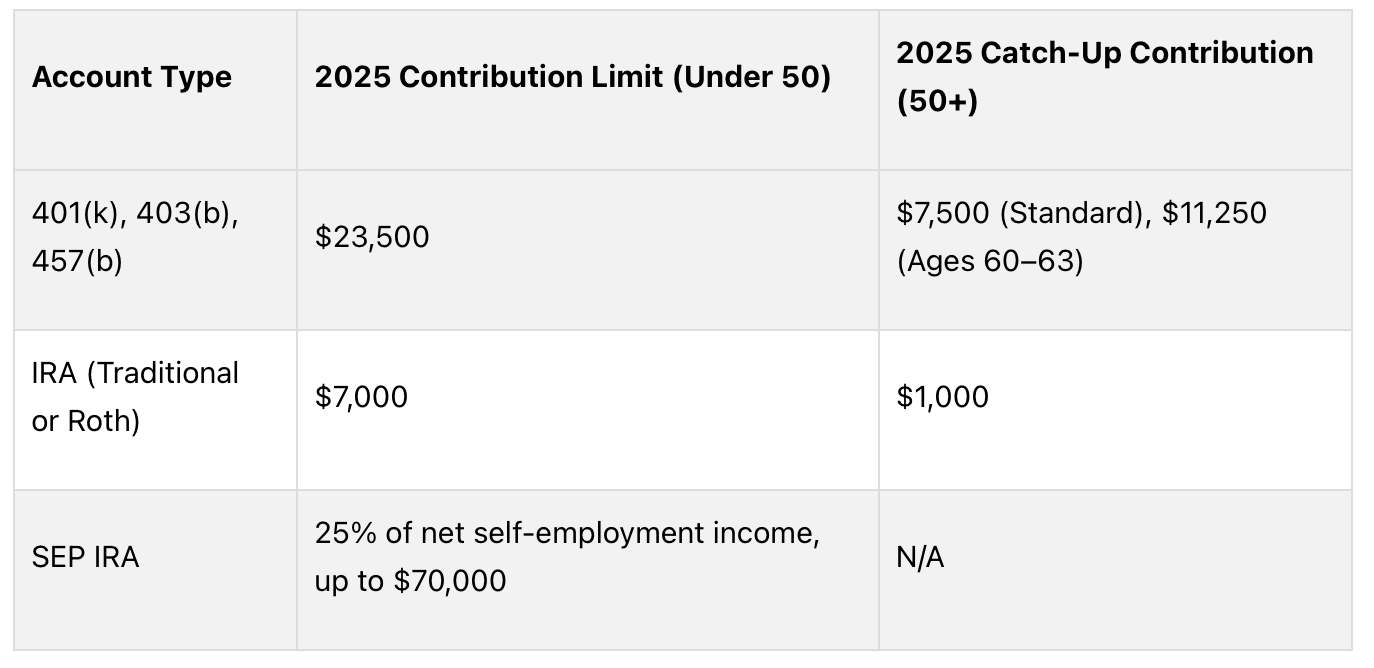

Start with your 401(k) if you have one. Contribute enough to get the full employer match - it’s essentially free money. For 2025, the maximum contribution limit for 401(k) plans is $23,500, with an additional $7,500 catch-up contribution for those aged 50 or older. Employees aged 60–63 can contribute an extra $11,250 during these years [21][22].

Next, focus on Individual Retirement Accounts (IRAs). For 2025, the contribution limit is $7,000, with a $1,000 catch-up option for those 50 and older. Deciding between a Traditional IRA and a Roth IRA depends on your current tax situation and future expectations. Traditional IRAs provide immediate tax deductions, while Roth IRAs offer tax-free withdrawals in retirement.

"The Roth election makes sense if you expect your tax rate to be higher at retirement than it is at the time you're making the contribution." - David Littell, professor emeritus of taxation at The American College of Financial Services [20]

If you’re self-employed, consider a SEP IRA or a Solo 401(k). A SEP IRA allows you to contribute up to 25% of your net self-employment income or $70,000, whichever is less. Solo 401(k)s are another great option for business owners without employees.

Automating monthly contributions to your retirement accounts simplifies the process and takes advantage of dollar-cost averaging, which spreads your investments over time. As your income grows, review and adjust your savings rate. What starts as a modest 5% can eventually grow to 15% or more, helping you secure your financial future.

4. Invest Using Rules-Based Methods

Investing successfully often comes down to sticking to a structured, emotion-free approach. Rules-based investing relies on predetermined guidelines to avoid emotional decision-making and helps you grow your wealth steadily [23].

4.1 Construct a Three-Fund Portfolio

One of the simplest and most effective strategies in rules-based investing is the three-fund portfolio. This approach includes a domestic stock index fund, an international stock index fund, and a bond index fund. Together, these funds provide broad global diversification at a low cost [25]. Taylor Larimore, co-author of The Bogleheads' Guide To Investing, highlights its benefits:

"Advantages of the three-fund index portfolio...Diversification. Over 10,000 world-wide securities...Very low cost...Very tax-efficient...Simplicity" [25].

If you're wondering how to build one, several brokerages offer options to get started:

Your asset allocation should align with your risk tolerance and life stage. A common guideline suggests holding a percentage of bonds equal to your age - for instance, a 30-year-old might allocate 30% to bonds and 70% to stocks. While this rule leans conservative, it’s a helpful starting point [25]. Additionally, for the stock portion, consider dividing your investment between U.S. and international markets. Vanguard's recent shift from a 20% to a 40% international allocation in their target-date funds underscores the importance of global diversification [25].

Tony Drake, CEO of Drake & Associates, explains the logic behind the three-fund portfolio:

"The concept is based on boiling down to three inverse asset classes that are very different. The theory is that when one goes up, another will go down" [26].

4.2 Minimize Taxes on Your Investments

Once your portfolio is diversified, managing costs - especially taxes - is essential. Tax efficiency is a cornerstone of rules-based investing. Start by maximizing contributions to tax-advantaged accounts like 401(k)s (especially to capture employer matches) and IRAs before turning to taxable accounts. This ensures you're taking full advantage of available tax benefits.

For taxable accounts, think about asset location. Tax-inefficient investments, such as bonds, are better suited for tax-advantaged accounts, while tax-efficient options like index funds can remain in taxable accounts. Index funds are naturally tax-friendly because they trade less frequently than actively managed funds, resulting in fewer taxable events. Additionally, using dollar-cost averaging - automatically investing a fixed amount each month - can help smooth out market fluctuations and keep your strategy consistent.

4.3 Stick to Your Plan When Markets Get Scary

Even the best-laid plans are tested during market downturns. Staying disciplined and following your rules-based strategy is critical during these times. By focusing on what you can control - your asset allocation, costs, and discipline - you can navigate market turbulence with confidence. History has shown that pulling out of the market during downturns often means missing the subsequent recovery, which can significantly impact long-term gains [27].

As John Maynard Keynes famously said:

"Markets can stay irrational longer than you can stay solvent." [24]

When markets fluctuate, rebalancing your portfolio can help you stay on track. This involves selling assets that have performed well and buying those that have underperformed, ensuring you maintain your target allocation. You might rebalance quarterly, semi-annually, or whenever your portfolio drifts more than 5% from its intended allocation.

Market volatility can also present opportunities. Marci McGregor, head of CIO Portfolio Strategy at Merrill and Bank of America Private Bank, notes:

"Volatility can open up potential growth opportunities as some investments become more reasonably priced" [28].

Keeping a long-term perspective is vital. Writing down your investment goals and revisiting them during stressful times can serve as a helpful reminder of why you’re investing. If you’ve set up automatic contributions to your investment accounts, continue them during downturns to take advantage of lower prices and potentially enhance your returns over time.

5. Create Income That Works While You Sleep

Building income streams that require minimal ongoing effort is a smart way to achieve financial independence. While your investment portfolio grows through market gains, passive income can provide consistent cash flow to cover expenses. The trick is to choose sources that grow in value over time. Beyond dividend-paying stocks, real estate is another solid option for generating steady, hands-off income.

5.1 Buy Stocks That Pay Growing Dividends

Dividend-paying stocks are a dependable way to generate income that keeps pace with or outpaces inflation. Companies with strong financials, steady profitability, and a history of increasing dividends are the ones to focus on [30].

For example, Dividend Aristocrats - companies in the S&P 500 that have raised dividends for at least 25 years - are known for their reliability. Even more impressive are Dividend Kings, which have maintained this streak for over 50 years [34]. As of June 2, 2025, Franklin Resources, Inc. (BEN) had the highest dividend yield among Dividend Aristocrats, offering 5.98% [34].

When evaluating dividend stocks, check the dividend payout ratio (DPR) - the percentage of earnings paid out as dividends. A DPR below 50% is considered stable, giving companies flexibility to maintain payouts even in challenging times [30]. Be wary of yields that seem unusually high; anything over 4% should be carefully examined, and yields above 10% are typically risky [33].

Real Estate Investment Trusts (REITs) are another great option since they are legally required to distribute a large portion of their income as dividends [30]. Realty Income (O), for instance, has raised its dividend for 110 consecutive quarters - approximately 30 years - and maintains a payout ratio of 75% of its projected 2025 funds from operations [31].

Energy companies are also worth considering. In Q1 2025, ConocoPhillips (COP) distributed $2.5 billion to shareholders, including $1 billion in ordinary dividends at $0.78 per share quarterly [32]. Similarly, Diamondback Energy (FANG) returned $864 million to shareholders through stock buybacks and a base dividend of $1.00 per share, representing about 55% of adjusted free cash flow [32].

To find the best dividend stocks, tools like the Morningstar Dividend Leaders Index and the Morningstar Investor Screener can help. These resources highlight high-yield stocks with strong performance and favorable valuations [29].

Reinvesting dividends is a powerful strategy to grow your wealth. By using your dividend income to buy more shares, you can take advantage of compounding returns, creating a larger income stream over time [30].

5.2 Get Started with Rental Property Investing

Real estate offers a combination of monthly cash flow and long-term appreciation, but it requires careful planning. As Robert Kiyosaki, founder of the Rich Dad Company, puts it:

"Real estate investing, even on a very small scale, remains a tried and true means of building an individual's cash flow and wealth" [36].

Start by improving your credit score to 720 or higher for better loan terms. Down payments typically range from 20% to 25% of the property price, and you’ll also need to budget for closing costs and potential renovations [36].

Location is critical in real estate. Properties near schools, public transit, and shopping areas tend to attract more tenants and command higher rents [38]. Starting locally can reduce overhead and allow you to manage the property more easily. Alternatively, consider areas with growing job markets or vacation destinations [35].

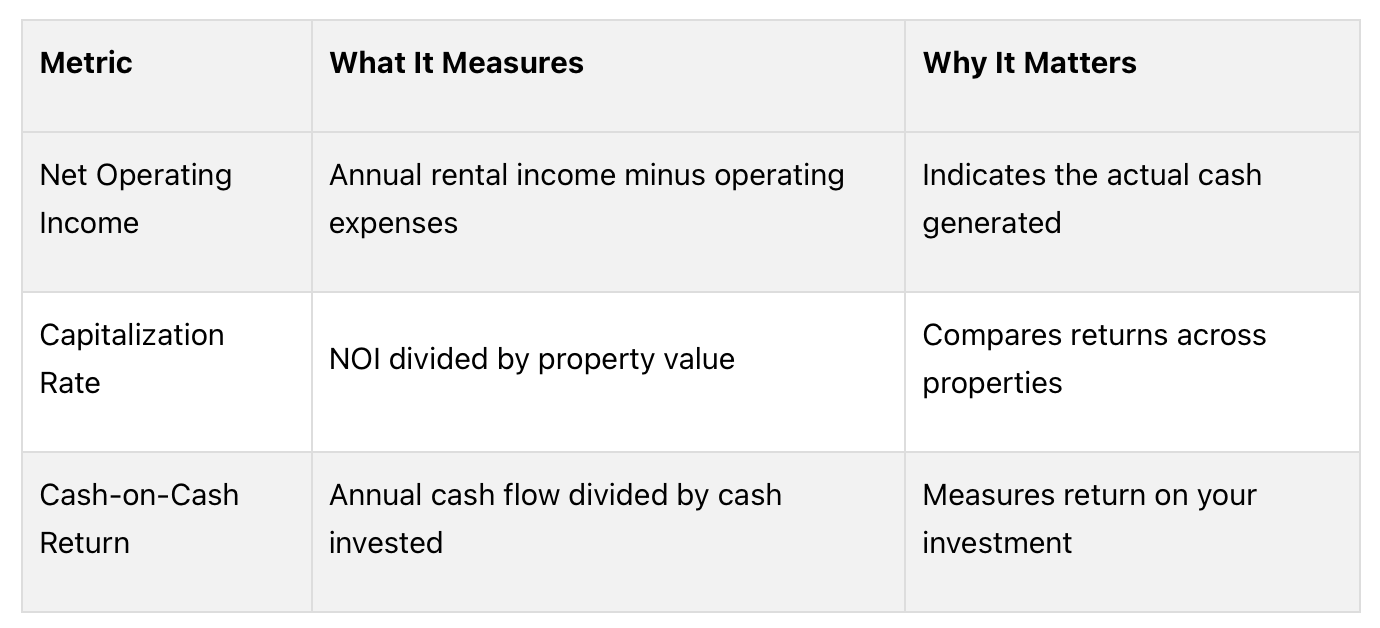

Before purchasing a property, analyze key financial metrics:

Websites like Redfin can help you research average property costs and rental prices in your target area [35]. Always validate rental income projections with local data.

Managing the property effectively can make or break your returns. If you’re just starting, you can handle management yourself using landlord software for tasks like tenant screening, rent collection, and maintenance [35]. As your portfolio grows, professional management firms - charging 8% to 12% of gross rental income - can take over [37].

Single-family homes generally appreciate faster and command higher rents than condos, though condos often require less maintenance [37]. Tools like Stessa can help you track income and expenses, simplifying tax preparation and monitoring performance [36].

5.3 Sell Digital Products for Passive Income

If physical assets don’t appeal to you, digital products offer a scalable, inventory-free way to earn passive income. Once created, digital products can be sold repeatedly without the need for restocking [39]. The market for digital goods is projected to hit $26.06 trillion by 2034, with spending on digital items currently making up about 2.9% of the average consumer’s wallet [40][41].

Online courses are particularly lucrative. For instance, Kate Terentieva created a mini-course titled "How To Become a Creative Director" using AI tools. In just a week, she made 10 sales, earning $199 in passive income [39].

The key to success in this space is solving real problems for your audience. Research their needs and pain points to identify valuable product ideas [39]. Your existing skills and expertise can serve as the foundation for creating products that resonate [40].

Popular digital products include:

Online courses and tutorials teaching specific skills

E-books and guides addressing common challenges

Templates and worksheets that save time

Software tools and apps that simplify tasks

Stock photos and design elements for creative projects

Marketing is essential to get your digital products in front of the right audience. Build an email list to keep followers updated on new products and promotions [39]. Use social media and targeted ads to increase visibility, and optimize your product listings with keyword research to ensure they appear in search results [40].

The digital content market is expected to grow by 11.3% annually through 2030, creating more opportunities for creators [41]. Staying updated on trends and adapting to customer feedback will help you succeed. While creating digital products requires effort upfront, the long-term rewards can be substantial, making it a valuable addition to your wealth-building strategy.

Conclusion: Start Your Journey to Financial Freedom

Achieving financial freedom doesn’t happen overnight, but every journey starts with a single step. The strategies we’ve discussed - budgeting with the 50/30/20 rule, tackling debt strategically, automating savings, disciplined investing, and building passive income - create a strong foundation for long-term financial stability.

Here’s a striking fact: 96% of people with a written financial plan feel confident about reaching their goals, and 76% report feeling more in control of their money [49]. Yet, only 36% of Americans have taken the time to create such a plan [49]. That’s a gap worth closing.

Start by defining what financial independence means to you. For some, it’s being debt-free. For others, it’s having enough savings to retire early or simply covering monthly expenses without stress [45]. Write down your personal short-term and long-term goals, calculate your debts, and list your monthly expenses [45][46]. With clear goals in place, consistent actions will help you make steady progress.

Patience is key. As Fulton Bank reminds us:

"Changing your financial habits and meeting your financial goals takes time, so be patient with yourself" [42]

Christopher W. Brown, CFP®, CIMA®, highlights another essential truth:

"Financial discipline is the key to benefit from a stable and independent financial status" [43]

To turn these concepts into action, set up automatic transfers for savings and debt repayment. Regularly review your accounts to stay on track [42]. If you need guidance, consider working with a financial advisor who can act as both a mentor and accountability partner [43].

Don’t forget to celebrate your progress along the way. Sasha Grabenstetter, AFC®, BFA™, captures the essence of financial freedom:

"Financial discipline allows individuals to pursue their passions, seize opportunities, and live life on their own terms without being shackled by financial constraints" [44]

Your financial plan isn’t set in stone - it should grow and adapt as your life changes. Review your progress each year, adjust for market shifts, and refine your goals as needed [48]. As Jordan Patrick, CFP at Commas, advises:

"Creating a plan that's flexible and then consistently reviewing it can allow you to both stay on track and make adjustments as needed" [47]

FAQs

Which debt repayment method is better for me: Debt Snowball or Debt Avalanche?

Choosing between the Debt Snowball and Debt Avalanche methods comes down to what drives you and how you approach financial goals.

The Debt Snowball method prioritizes paying off your smallest debts first, ignoring interest rates. The idea here is to create momentum with quick wins - knocking out smaller balances feels rewarding and can keep you motivated to tackle the next one. If you're someone who thrives on visible progress, this approach could be a great fit.

On the flip side, the Debt Avalanche method zeroes in on debts with the highest interest rates first. By addressing these costly debts upfront, you’ll save more money over time. This strategy works well if your main focus is cutting down the overall cost of your debt rather than seeking immediate milestones.

At the end of the day, the right method is the one that keeps you consistent and motivated to stick with your plan. Whether you’re inspired by quick successes or long-term savings, choose the approach that aligns with your financial goals and keeps you on track.

How can I set up and maintain a three-fund portfolio for long-term financial growth?

To build a three-fund portfolio, focus on three key pieces: a domestic stock index fund, an international stock index fund, and a bond index fund. This straightforward method simplifies investing while providing broad diversification. A typical starting point might allocate 80% to stocks (split between domestic and international funds) and 20% to bonds. However, you can tweak this based on your personal risk tolerance and financial goals.

Once your portfolio is set up, it’s important to rebalance periodically. This means adjusting your investments to maintain your target allocation, helping you manage risk and stay aligned with your long-term growth strategy. Also, aim to choose funds with low expense ratios - this keeps costs down and helps you get the most out of your investments over time.

How can I start earning passive income with digital products if I have no prior experience?

Starting with digital products is an excellent way to dip your toes into passive income, even if you're just starting out. The first step? Choose a topic or skill that excites you or one you know well. Popular options for digital products include eBooks, online courses, templates, and printables - all of which are relatively simple to create and sell on platforms like Etsy, Gumroad, or your own website.

To begin, aim for something straightforward that doesn’t demand a big upfront investment. For instance, you could write an eBook using free tools like Google Docs or design printable templates with Canva. Once your product is ready, promote it through social media and email marketing to connect with potential buyers. Growing an audience takes time, so stay patient and use customer feedback to fine-tune your products as you go.