A healthy pause for an AI-driven bull

Pullbacks test conviction, but the fundamentals remain intact.

While some investors took profits last week, corporate earnings remain strong, and AI spending plans show no signs of slowing. And given the widespread fear of an AI bubble, recent market action is more about sentiment than weakening fundamentals.

Let’s just remember that the S&P 500 averages 3 declines of 5% or more per year. Given the record rally since April, what we’re seeing now is incredibly normal.

Dip buyers emerge

The S&P 500 briefly dipped below its 50-day moving average on Friday before rallying to close above it, a sign that dip buyers are still active. If the government shutdown ends soon, that could add another tailwind.

Meanwhile, corporate fundamentals remain solid. According to FactSet, the S&P 500 is on track for double-digit earnings growth for the fourth straight quarter, the longest such streak since 2012. With earnings trending up and sentiment cooling, this looks more like consolidation than the beginning of prolonged correction.

Dot-com comparisons miss the point

Talk of an AI bubble is everywhere, with comparisons to the dot com mania. But unlike the 1999–2000 period, today’s bull market is fueled by capital expenditures from highly profitable companies, not speculative startups.

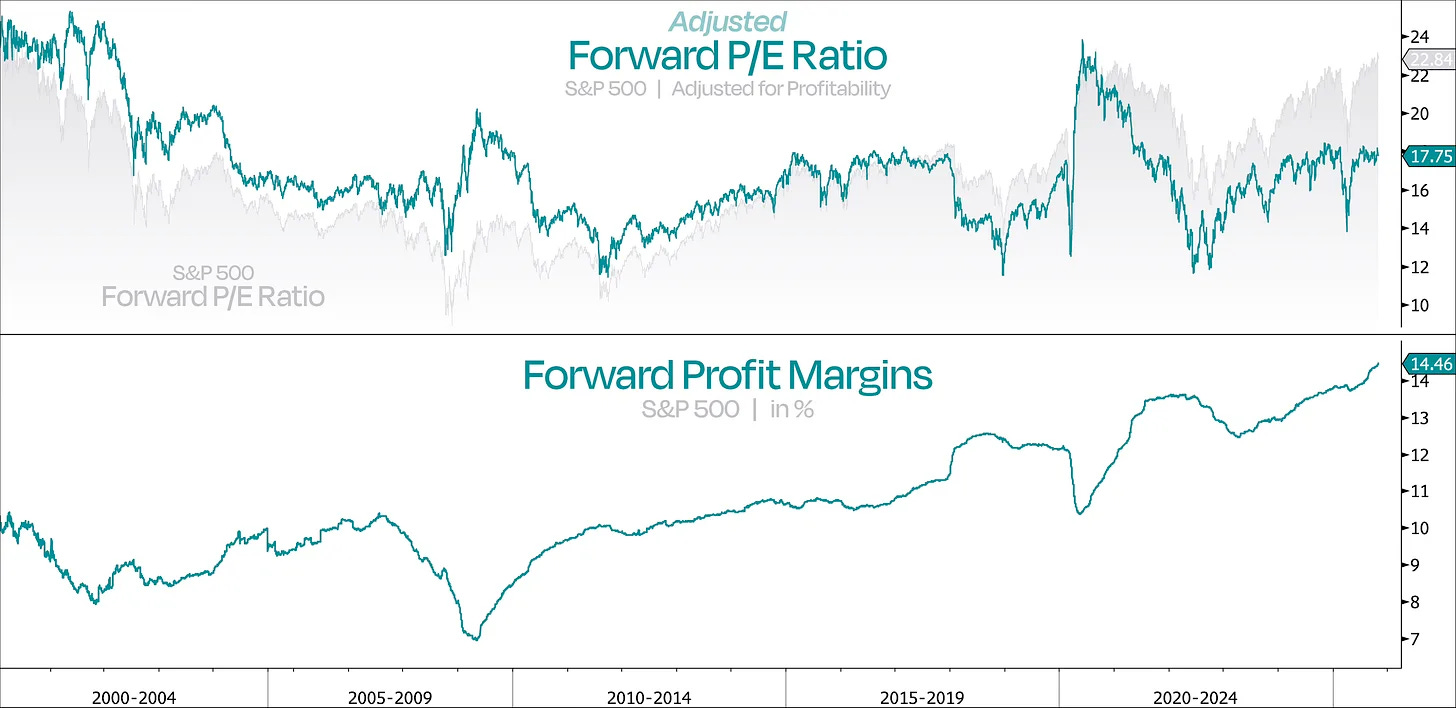

Duality Research found that the profitability-adjusted P/E for the S&P 500 is just 17.75x, less than one standard deviation above its 20-year average of 16.2x.

In other words, valuations are elevated, but nowhere near extreme bubble territory. The difference this time is that companies like NVIDIA, Microsoft, and Amazon are reinvesting record profits into real infrastructure — AI, chips, and data centers — that can sustain long-term growth.

Central banks keep buying gold

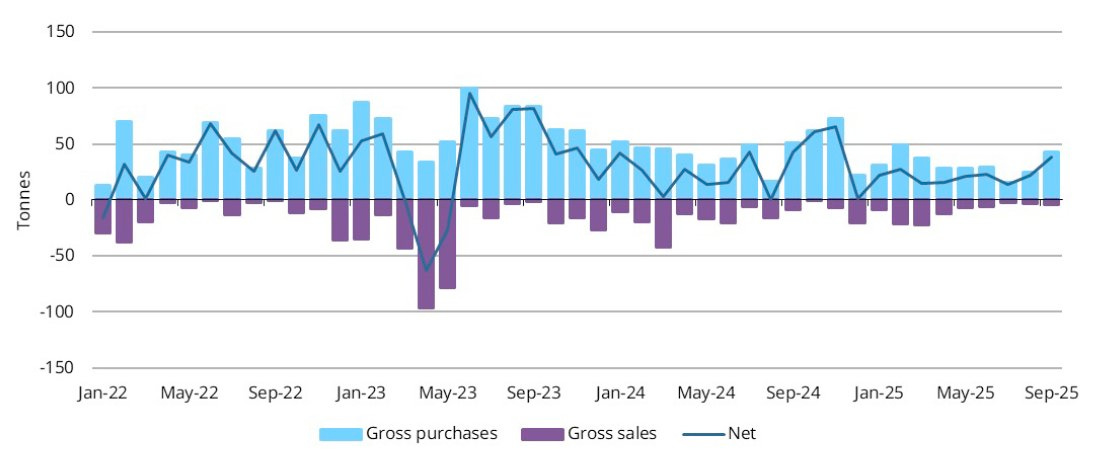

Central banks aren’t slowing down. Global gold purchases jumped 79% month-over-month, and represent the largest month of net buying all year. With governments carrying record levels of debt and inflation risks lingering, central banks appear to be diversifying away from fiat exposure, a trend we’ve been flagging for months.

For investors, this continues to support a case for some allocation to hard assets, both as a volatility hedge and a store of value in an increasingly debased currency environment.

Burry shorts Palantir. We’re still holding

News that Michael Burry shorted Palantir PLTR 0.00%↑ made headlines last week, though reports suggest the disclosure came earlier than usual, likely designed to influence market action in his favor while the trade was underwater.

This reminds us of when Andrew Left shorted the stock back in August. Left’s disclosure caused a brief pullback in the stock, which then set new highs weeks later.

Meanwhile, the company reported record growth in its earnings call last week. Q3 highlights include:

Revenue grew 63% year-over-year and 18% quarter-over-quarter to $1.181 billion

Customer count grew 45% year-over-year and 7% quarter-over-quarter

Closed 204 deals of at least $1 million, 91 deals of at least $5 million, and 53 deals of at least $10 million

Closed a record-setting $2.76 billion of total contract value (”TCV”), up 151% year-over-year

We see PLTR as a key beneficiary of the AI buildout, not the peak of a bubble. As long as investors keep calling it the poster child for AI mania, this bull market still has room to run.

Final thought

I don’t like pullbacks any more than you do. But they’re an inevitable and healthy part of the market cycle. No one can consistently time the bottom, which is why having a plan for deploying cash when stocks go on sale matters so much.

Our job as investors is to stay focused on companies that will profit regardless of the headlines and to avoid emotional decision-making when volatility strikes. Those who stay disciplined and view corrections as opportunities, not threats, will come out ahead.