How to Analyze Past Trades for Better Results

Analyze your past trades to uncover patterns and improve your trading strategy for better performance and consistent growth.

How to Analyze Past Trades for Better Results

When it comes to improving your trading performance, one of the most effective steps you can take is reviewing your past trades. Think of it like an athlete watching game footage - analyzing your decisions helps you identify patterns, correct mistakes, and refine your strategies. Here’s how to get started:

Organize your trade data: Use a spreadsheet or journal to log all details - entry/exit prices, dates, position sizes, and reasoning behind each trade.

Group trades by categories: Break down trades by asset type, sector, or strategy to see what’s working and what’s not.

Calculate key metrics: Track win rate, average profit/loss, risk-reward ratio, and maximum drawdown to measure your performance.

Spot patterns and errors: Identify habits like selling winners too early or holding losing trades too long. Look for emotional triggers that may impact decisions.

By turning these insights into clear rules, like improving risk management or refining entry/exit points, you can make better decisions and avoid repeating costly mistakes. Tools like spreadsheets or trading analysis software can simplify the process and provide deeper insights.

The key takeaway? Regular trade analysis isn’t just helpful - it’s essential for consistent growth. Start small, review often, and let the data guide your next move.

How to Analyze Trades Like a Pro - Unlock Your Performance

How to Review Your Past Trades: 4 Simple Steps

Breaking down your trade analysis into smaller, actionable steps can make the process easier to handle and more productive. Whether you’re a day trader or a long-term investor, these four steps can help you uncover useful insights from your trading history.

Step 1: Collect and Organize Your Trade Data

Start by gathering all the essential details of your trades: the date (MM/DD/YYYY), ticker symbol, entry and exit prices (in USD), position size, trade direction (buy or sell), commissions, fees, and the reasoning behind each trade. A basic spreadsheet can work wonders for this - set up columns for each data point and log your trades in chronological order.

If spreadsheets aren’t your thing, consider using a trading journal with a pre-made template to keep things consistent. Once your data is compiled, you can begin categorizing it for deeper analysis.

Step 2: Group Trades by Type or Asset

Organize your trades by asset class (stocks, ETFs, options, etc.), sector (technology, healthcare, energy, etc.), or strategy(swing trading, day trading, long-term investing). This step helps you compare performance across different categories and identify what’s working best for you.

For example, you might notice that your tech stock trades tend to outperform your healthcare trades, or that your options trades, while riskier, yield higher average profits. Using filters in your spreadsheet can make this process smoother. Grouping your trades also helps you understand how market conditions impact your performance across different strategies or sectors. Once your data is categorized, you’re ready to crunch the numbers.

Step 3: Calculate Your Performance Numbers

Start with your win rate, which is the percentage of trades that were profitable. To calculate it, divide the number of winning trades by the total number of trades. For instance, if you had 20 trades and 12 were winners, your win rate is 60%.

Next, figure out your average profit or loss by dividing your total profit (or loss) by the number of trades. For example, if your total profit was $2,000 over 20 trades, your average profit per trade is $100. This metric shows whether your gains come from frequent small wins or a few larger ones.

Another key metric is your risk-reward ratio, which compares your average profit per winning trade to your average loss per losing trade. A ratio above 1:1 means your winners are typically larger than your losers. Finally, look at your maximum drawdown, which measures the largest drop in your account balance during a given period. This number reveals the level of risk involved in your trading approach.

Step 4: Find Your Trading Patterns and Errors

This is where serious traders separate themselves from the rest. Analyze your records for patterns or habits that might be holding you back. Common culprits include holding onto losing trades for too long, selling winners too quickly, or entering trades without proper confirmation signals.

Your notes and timing can provide valuable clues. For example, if you often buy stocks after they’ve already surged 20% in a week, you might be chasing momentum instead of finding solid entry points. This could explain why some trades immediately start in the red.

Pay attention to emotional triggers as well. Do you tend to overtrade on volatile days or second-guess your plans during major market events? Spotting these tendencies allows you to build safeguards into your trading strategy, minimizing their impact. These insights can help you refine your approach and make better decisions moving forward.

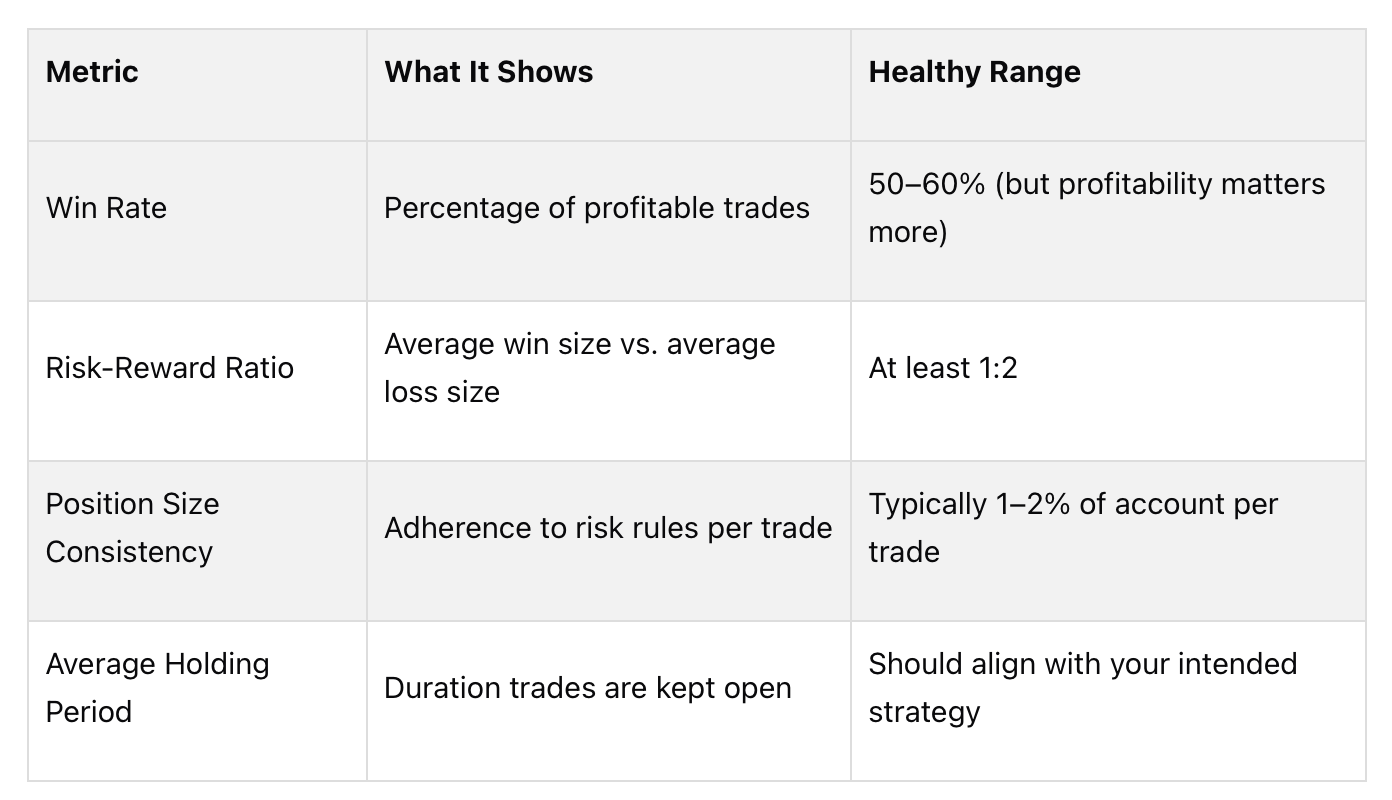

Important Numbers to Track in Your Trade Analysis

Once you’ve organized your trading data and identified patterns, it’s time to dive into the numbers that truly matter. These key metrics help you measure your performance, spot areas for improvement, and refine your trading strategy.

Win Rate and Average Profit/Loss

Your win rate is calculated by dividing the number of winning trades by the total number of trades, then multiplying by 100. While this figure can give you a sense of how often you’re “right”, it doesn’t tell the whole story. A trader with a 70% win rate could still lose money if their losing trades outweigh their winners.

To get a clearer picture, calculate your average profit/loss. Divide your total profit (or loss) by the number of trades. This metric highlights whether you’re earning consistent small wins or relying on occasional big ones.

Interestingly, many professional traders succeed with win rates below 50%. How? By ensuring their winning trades far exceed their losses. For instance, a system that averages $200 in profit on winning trades and $75 in losses on losing trades can thrive, even with fewer wins.

Risk-Reward Ratio and Position Size

The risk-reward ratio compares how much you stand to gain versus how much you’re risking. You can calculate this by dividing your potential profit by your potential loss. A solid ratio is at least 1:2, meaning you aim to make two dollars for every dollar you risk. This approach ensures long-term profitability, even if your win rate isn’t high.

Position sizing is another critical factor. It determines how much of your capital you allocate to each trade. A common rule is to risk only 1–2% of your account per trade, based on your stop-loss distance. Reviewing past trades can reveal whether you’ve been sticking to this rule or letting emotions lead to oversized, risky positions.

How Long You Hold Trades and Market Conditions

Your holding period - the length of time you keep a trade open - can reveal whether your trading style aligns with your strategy. For example, if you consider yourself a day trader but your trades often last several days, this mismatch could be hurting your results. Group your trades by holding periods (e.g., under one hour, one to 24 hours, one to seven days, and longer) and analyze the win rates and profits for each. This can help you identify the timeframe that works best for your strategy.

Market conditions also play a huge role in your performance. Keep track of factors like trend direction (uptrend, downtrend, or sideways), volatility levels, and major news events during your trades. You might discover that most of your losses occur in high-volatility markets or that your best trades happen during clear uptrends. Recognizing these patterns lets you adapt your strategy to the conditions that suit you best.

Tools That Make Trade Analysis Easier

The right tools can simplify trade analysis and help you improve your performance. Whether you’re new to trading or managing a high volume of trades, having the proper setup can save time and ensure consistency in your reviews.

Trading Journals and Spreadsheets

Microsoft Excel and Google Sheets are excellent starting points for traders. These tools let you create personalized tracking systems tailored to your needs. You can log essential details like trade dates, tickers, entry and exit prices, position sizes, stop-loss and take-profit levels, your reasoning behind each trade, and the outcomes.

Using formulas, you can automate the calculation of key metrics such as profit/loss, win rate, and risk-reward ratios. This not only saves time but also minimizes errors, giving you accurate, real-time insights into your trading performance.

Many successful traders organize their spreadsheets by strategy or time period. For instance, you might dedicate one tab to swing trades and another to day trades, or track performance month by month. This structure makes it easier to identify which strategies are working best for you.

Google Sheets offers an added advantage for traders who need flexibility. Since it’s cloud-based, you can update your journal on your phone immediately after closing a trade and then analyze the data later on your computer.

Start with the basics - track the key data points mentioned above. As you gain experience, you can add more layers of detail to your journal, focusing on the metrics that provide the most value. For traders with higher volumes or those seeking deeper insights, advanced software may be the next step.

Advanced Trade Analysis Software

If your trading activity increases, platforms like TrendSpider and TradingView can take your analysis to the next level. These tools go beyond spreadsheets, offering features like automated data imports directly from your brokerage accounts.

TrendSpider specializes in automated pattern recognition. It can draw trendlines, pinpoint support and resistance zones, and identify chart patterns like head and shoulders, double tops, or triangles. These features help you spot recurring mistakes, such as entering trades prematurely or overlooking key reversal signals.

TradingView combines advanced charting tools with a strong community aspect. You can overlay multiple indicators on your past trades to evaluate how different signals might have influenced your decisions. Its replay feature allows you to review historical price movements step by step, helping you understand how trades unfolded and where adjustments could have been made.

These platforms typically range in cost from $20 to over $100 per month, depending on the features you choose. While this may seem like an investment, the time saved and insights gained can more than make up for the expense.

Automation is another key advantage of these tools. When your trades sync automatically with the software, you eliminate the risk of forgetting to log transactions. Performance metrics are calculated instantly, and the software can highlight patterns you might miss during manual reviews.

Many professional traders use a combination of manual journaling and automated tools. Manual journaling allows for emotional and psychological reflection, while automated platforms provide the technical insights needed to refine strategies. Together, these approaches offer a well-rounded view of your trading habits and results.

For those seeking to identify new opportunities, services like Trending Tickers can complement your analysis. By spotlighting where capital is flowing before it becomes widely apparent, these tools can help you understand which sectors or themes drove your best and worst trades. This broader perspective can reveal macro trends that influenced your performance.

How to Use Your Analysis to Trade Better

Analyzing your trades is only as valuable as the actions you take based on what you’ve learned. The patterns and insights you uncover should directly influence how you approach the market. In short, your analysis needs to drive meaningful changes in your trading strategy.

Write Down What You Learn

A thorough trade review is just the starting point. To make it actionable, convert your insights into written notes. This step transforms vague observations into clear, practical rules for your future trades. For instance, your review might reveal a tendency to exit winning trades too early or highlight that you perform better in specific market conditions. These findings need to be documented in a way that you can easily reference later.

Create a dedicated section in your trading journal for lessons learned. After every analysis session, jot down the most important takeaways in straightforward, actionable terms. For example, instead of writing, “Be more patient”, be specific: “Hold breakout trades at least 15% longer before considering an exit, as data shows higher gains when trades are allowed to develop.”

Add context to these notes. Detail the specific metrics or scenarios behind each insight. If your analysis shows that trading during earnings announcements reduces your success rate, include the exact win rate difference and the time period analyzed. This context not only helps you remember why you set certain rules but also makes it easier to adjust them as market dynamics evolve.

Before entering new trades, review these written lessons. Many successful traders use a simple checklist to stay aligned with their analysis. This could include reminders like “Verify a volume surge before entering momentum trades.” Writing down your insights builds accountability and helps you avoid repeating costly mistakes.

Improve Your Risk Rules and Entry/Exit Points

Use the lessons from your analysis to refine your approach to risk management and timing. Your historical trade data is a goldmine for improving how you handle risk and determine when to enter or exit positions. Make small, data-driven adjustments to optimize your strategy.

Start by revisiting your risk management rules. For example, if your analysis shows that risking more than 2% of your account per trade leads to significant losses, set a stricter limit. Review periods of maximum drawdown - these often coincide with taking on excessive risk or failing to cut losses quickly enough.

Pay close attention to stop-loss placement. If your analysis reveals that your stops are too tight and frequently triggered before the trade moves in your favor, consider giving your trades more breathing room. Conversely, if large losses dominate your worst trades, it may be time to tighten your stops.

Refine your entry and exit strategies by studying which patterns or signals delivered the best results. For example, Tesla‘s head and shoulders pattern from January to March 2021 led to a 25% decline after breaking the neckline, offering a clear signal for action. Similarly, Autodesk‘s inverse head and shoulders pattern in late 2021 resulted in a 40% gain, showing the potential of pattern-based entries. Nike‘s double top pattern in late 2021 provided a clear exit signal when prices broke below $167, confirming a downtrend.

If your analysis shows that relying on a single indicator, like moving average crossovers, produces inconsistent results, consider combining it with other signals, such as volume confirmation. Adjust your criteria to include multiple confirmations for better outcomes.

Timing is another critical factor. Your analysis might reveal that trades made during the first hour of market open are less successful or that holding positions over weekends increases volatility. Use these insights to establish rules about when to trade and how long to hold positions.

Set Clear Goals for Getting Better

Turn your refined strategies into measurable goals that promote continuous improvement. The lessons from your analysis should guide the creation of specific targets that address your weaknesses and build on your strengths.

Focus on process-oriented goals rather than just profit targets. Instead of aiming to earn a specific amount, set goals like “Increase win rate from 45% to 55%” or “Reduce average loss per trade by 20%.” These goals directly tie to behaviors you can control and improve.

Tailor your goals to the weaknesses revealed in your analysis. For instance, if you find your risk-reward ratio averages 1:1.5 while successful traders aim for 1:2 or higher, commit to only taking trades that meet this threshold. Track this metric regularly to ensure progress.

Set time-bound objectives to create urgency and facilitate progress checks. For example, aim to “Reduce maximum single-trade loss from 4% to 2% of account value within 60 days.” This timeframe provides enough data to assess improvement while keeping your focus sharp.

Break larger goals into smaller, monthly milestones. For instance, aim to improve your win rate by 2–3 percentage points each month. This makes your goals feel more achievable and provides regular opportunities to celebrate progress.

Document your progress using the same tools you use for trade analysis. Update your performance metrics monthly and compare them to your goals. If you’re falling short, analyze why and adjust your approach. If you’re exceeding expectations, consider setting more ambitious targets.

You can also incorporate broader market trends into your goals. Tools like Trending Tickers can help you understand macro conditions that may have influenced your past performance. For example, if your analysis shows better results during specific market cycles, factor that into your expectations and strategies.

The key is to make your goals specific enough to measure but adaptable as you learn more about your trading patterns. Regularly reviewing your goals ensures you stay focused on improvement and avoid relying on luck for better results.

Conclusion: Make Trade Analysis Part of Your Routine

Consistent trade analysis is what sets successful traders apart from those who keep making the same mistakes. By making it a regular part of your routine, you can turn trading into a disciplined, data-driven process that helps you grow your wealth over time.

Stick to a schedule for your analysis sessions. Many seasoned traders set aside time at the end of each week or month to review their closed trades. This habit keeps patterns fresh in your mind and avoids the temptation to skip reviews during tough periods. For instance, a weekly review session can help you stay on track and catch trends in your performance.

Take this example: One trader discovered through monthly reviews that their largest losses happened when they ignored entry criteria during high-volatility periods. By recognizing this pattern and adjusting their trading rules, they boosted their win rate from 45% to 60% in just three months. On top of that, their average loss per trade dropped by 30%. These kinds of insights can pave the way for more effective trading systems.

Use journaling tools and software to make the review process easier. The simpler it is, the more likely you are to stick with it.

You can also bring in external insights, like those from Trending Tickers, to align your strategies with broader market movements. By understanding where capital is flowing, you can refine your approach using both your personal performance data and market trends. Combining these practices ensures that every trade you make is intentional and informed.

Even if you’re just starting out with a handful of trades, begin implementing these strategies. The habit of analyzing your performance helps you understand what’s working, what’s not, and why - no matter how much data you have.

Research shows that about 90% of traders who commit to disciplined analysis see noticeable improvements in their decision-making and risk management. The real question isn’t whether trade analysis works - it’s whether you’re ready to make it a key part of your trading routine. With every session of focused, data-driven review, your trading performance gets stronger.

FAQs

How can I analyze my past trades to improve future performance?

Reviewing your past trades is a crucial step in sharpening your trading strategy. One of the best ways to do this is by maintaining a detailed trading journal. In this journal, make sure to log the date, time, entry and exit prices, position size, and the reasoning behind each trade. This practice allows you to spot patterns in your decisions - both those that worked and those that didn’t.

Pay close attention to recurring mistakes, like poor timing or letting emotions drive your choices, and work on addressing these issues. It’s also important to evaluate the market conditions during your trades to see how external factors might have impacted your results. By regularly reflecting on your performance, you’ll be better equipped to make smarter decisions and improve your trading outcomes over time.

What emotional triggers can affect trading decisions, and how can I handle them?

Emotions such as fear, greed, and overconfidence can heavily influence trading decisions, often steering them off course. Fear might push you to sell too soon, cutting potential profits short. Greed, on the flip side, can tempt you to hold onto investments longer than you should, risking losses. Then there’s overconfidence, which can lead to reckless decisions, like taking on unnecessary risks without thorough analysis.

How can you keep these emotions in check? Start with a solid, well-thought-out trading plan - and stick to it. Take time to review your past trades; this can help you spot recurring patterns and learn from any missteps. Additionally, practicing mindfulness and stepping away from trading when emotions run high can help you maintain a clear head, ensuring your decisions remain logical rather than impulsive.

How can I determine the right risk-reward ratio for my trading strategy?

Determining the right risk-reward ratio for your trading strategy means weighing how much you’re prepared to risk against the potential profit. A common benchmark is a 1:2 ratio - risking $1 to potentially make $2. Of course, this can vary depending on your trading style and how much risk you’re comfortable taking on.

To figure out your ratio, you’ll need to factor in things like your entry and exit points, stop-loss levels, and target prices. Take a close look at your past trades to spot patterns and fine-tune your approach. What worked? What didn’t? This kind of analysis can help you tweak your strategy to better match your financial goals and current market conditions. And don’t forget - revisiting your risk-reward ratio regularly ensures it stays aligned with your trading plan as it evolves.