Are we headed for a recession?

Recession risks remain, but forward-looking earnings trends suggest strength ahead. Here's how we're navigating the crosscurrents.

Economist Mark Zandi made headlines again this week, warning the U.S. is on the “precipice of recession.” If that sounds familiar, it should. Zandi has been calling for a downturn for over a year. To be fair, he’s not alone. The economic landscape has been filled with reasons to stay on the sidelines: interest rate hikes, geopolitical instability, inflation shocks, and more.

But here’s the thing: analysis and investing are different skill sets. Forecasting macro trends can be intellectually impressive, but making money in markets requires discipline, structure, and the ability to tune out noise.

That’s our edge. We don’t try to predict the future. We focus on investing in companies that will benefit regardless of the chaos. The market rewards results, and we’ve built a system designed to capture that.

Are we headed for a recession?

The truth? No one actually knows.

There are real risks to consider. Sticky inflation, ongoing geopolitical instability, and a cooling job market. But none of these automatically translate to a recession. And more importantly, none of them should be your primary input for investment decisions.

Here's what we do know: 84.1% of S&P 500 companies have seen positive 3-month forward earnings revisions.

That’s a strong, measurable signal of improving fundamentals across the market.

In our view, that data matters more than recession fears. Markets are forward-looking machines, and when earnings expectations are rising, price tends to follow.

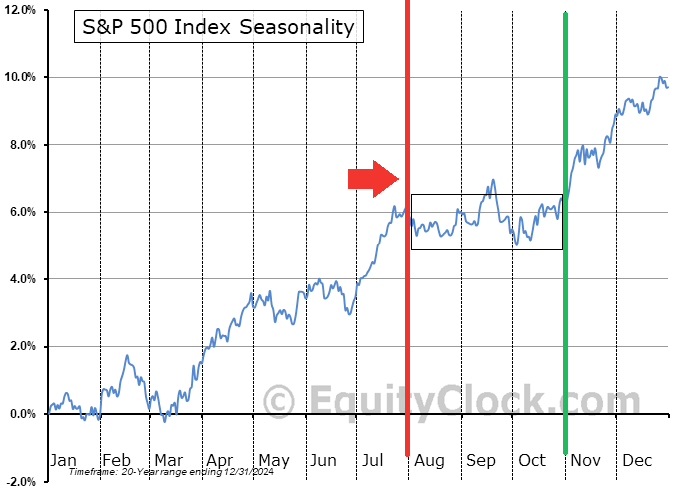

Is seasonality dead?

As we’ve said over the last few weeks, we’re heading into a historically weak stretch for stocks. But that’s not a reason to get out of the market. It’s a sign to be prepared to take advantage of the volatility that comes with corrections.

Markets move fast. Could the brief pullback earlier this month have already priced in seasonal weakness. Maybe. But with earnings season coming to an end, geopolitics could take center stage in the short term, creating increased headline risk for markets.

But volatility isn’t something to fear, it’s something to prepare for. And for long-term investors, it can actually be an advantage.

One strategy we like: adjusting your dollar-cost averaging. When markets are making all-time highs, consider slowing your pace. When fear takes over and prices pull back, that’s when you speed it up.

If you’ve been waiting for the perfect entry, don’t. It doesn’t exist. But pullbacks can offer better risk/reward entry points if you’re ready with your buy list ahead of time.

Stay invested. Stay patient. And don’t let short-term noise derail your long-term strategy.

Meta is spending $29 billion on AI infrastructure

Another massive confirmation of our industrial reshoring thesis.

Meta just announced a record $29 billion investment in AI infrastructure, mostly on data centers. (Read)

That’s not hype. That’s capital being deployed at scale.

Focus on owning the businesses selling the tools, chips, software, and services that power this revolution.

Our portfolio is well-positioned to benefit from industrial reshoring, a multi-year tailwind that’s beginning to hit full stride. Meta’s spend is just one data point, but it’s a powerful one.

Palantir shorts are back. We’re still long.

Famed short-seller Andrew Left is now betting against Palantir. His reasoning? “It’s become absurd.”

We disagree.

Palantir is one of the most mission-critical software providers to the U.S. government, and just closed a $10 billion deal with the U.S. Army. And that’s just one out of many long term contracts worth billions in revenue.

And let’s not forget: Andrew Left was one of the prominent short sellers who got steamrolled during the GameStop saga.

He may win this trade. Honestly, I hope he does, because it could give me a chance to add to my Palantir position at even better prices.

Final thought

There’s always a reason not to invest. But the market doesn’t reward hesitation. It rewards action grounded in process.

That’s why we don’t trade on predictions. We invest based on earnings momentum and technical strength, data points that actually drive stock performance.

And remember: some of the best opportunities come when it feels the most uncomfortable. That discomfort is often where the edge lies.

You don’t need to predict the future. You just need a repeatable system that helps you stay invested when it matters most.

We’ve got one.