Berkshire bets on Google

Should we stop worrying about tech valuations?

Stocks started the week on firmer footing after the U.S. government shutdown officially ended. The hit to Q4 GDP will be real, federal workers missing paychecks and delayed contracts will shave growth this quarter, but I expect activity to re-accelerate next quarter as operations normalize.

Meanwhile, we’ve seen a rotation out of AI leaders, driven by concerns about elevated capex, debt levels, and potential margin compression. These concerns reflect sentiment, not fundamentals, and may set up compelling opportunities as the dust settles.

Berkshire discloses $4.3B Alphabet stake

The biggest value shop in the world just bought Alphabet, at a $2+ trillion valuation. (Read)

For all the bears claiming AI spending is unsustainable and margins are peaking, Berkshire’s move suggests the opposite.

Alphabet’s AI infrastructure is turning into an economic moat, earnings growth is accelerating, not slowing and free cash flow is enormous and rising.

This reminds me of the commentary after Berkshire first invested in Apple:

“Berkshire Hathaway buys into slumping Apple” — CNN Money (2016)

“Berkshire’s Apple bet raises eyebrows as Buffett shuns tech” — Reuters (2016)

“Buffett’s Apple buy: A sign of trouble?” — Fortune (2016)

“Apple is no longer a growth stock” — Business Insider (2016)

“Tim Cook can’t save Apple from its iPhone problem” — WSJ (2016)

“Berkshire’s Apple investment came at a bad time” — Motley Fool (2016)

The themes were clear: iPhone sales have peaked, innovation is slowing and margins are shrinking.

And yet, Apple went on to become Warren Buffett’s greatest investment of all time, worth more than $100 billion in profit.

When conservative capital allocators buy a mega-cap compounder at this scale, it raises a simple question: What are the naysayers missing?

Mag 7 valuations: surprisingly normal

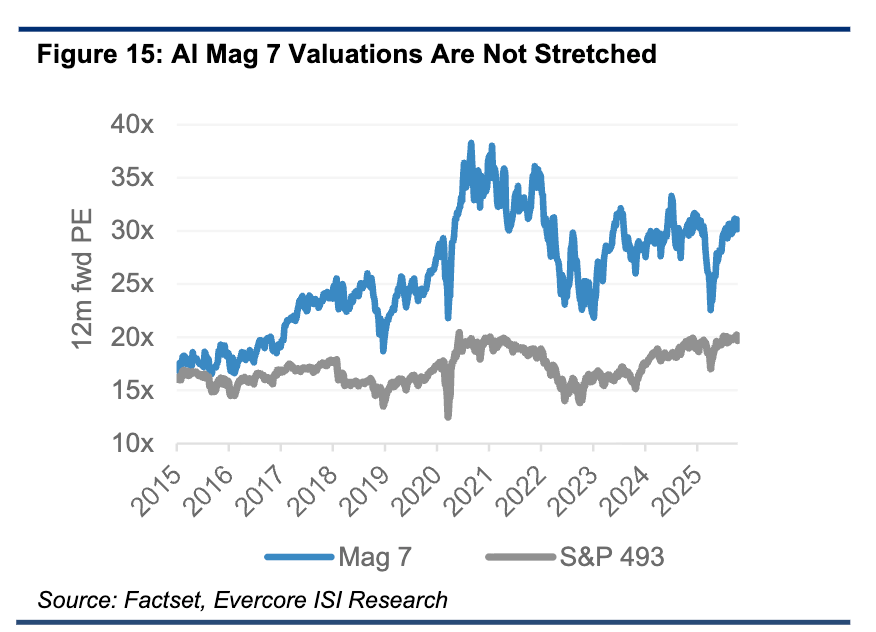

It’s possible Berkshire sees the hysteria on valuations as overblown. Despite the noise, the Magnificent 7’s valuations are near their 5-year averages.

Meanwhile, the 12-month forward multiple for the S&P 493 is near historic highs.

This distinction matters:

Tech’s rally has been powered by earnings, not multiple expansion.

Broader market valuations are being distorted by slower-growth sectors catching a bid.

Market concentration looks scary, but the leaders continue to justify their size with actual performance.

This is not the dot-com era, it’s earnings-driven leadership.

TSSI plunges

Shares of TSSI collapsed last week after a valuation-driven selloff and concern that revenue growth may be outpacing the company’s ability to scale profitably.

That said, the underlying story hasn’t changed:

Revenue continues to surge as demand for infrastructure automation and security solutions grows.

Management reaffirmed strong growth expectations for 2025.

Profitability remains the key question, not demand.

Despite the selloff, we’re still sitting on a 21% gain from our original buy point. While the long term outlook remains intriguing, execution risk is higher than initially expected.

I’m downgrading this to a speculative bet. If you plan on keeping it in your portfolio, position size accordingly.

Growth of AI startups is unprecedented

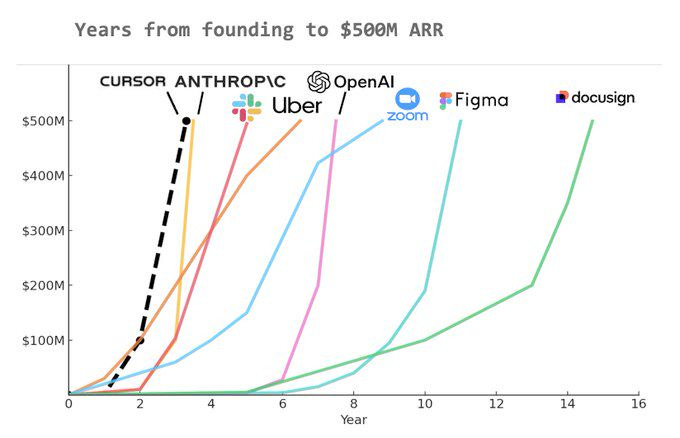

For anyone still arguing that this bull market is built on hype, look at the numbers: OpenAI, Anthropic, and Cursor each scaled to $500 million ARR in record time, among the fastest in enterprise software history.

Demand is real, customers are paying, and the monetization curves are steep.

This is what a fundamental breakthrough looks like: rapid adoption, massive capex deployment, and an expanding addressable market.

This bull run is not story-driven. It’s cash-flow driven.

Final thought

Our formula remains very simple:

Identify key macro trends → Own the companies that benefit → Ignore the noise.

Whether the market is up or down, the winning set of companies rarely changes. Pullbacks simply give you better entry points.

Staying focused, and staying invested, is how long-term wealth is built.