Best Savings Vehicles for Emergency Funds 2025

Tiered emergency-fund plan: keep 1–2 months in high-yield savings, 2–3 months in money market accounts, and the rest in CD ladders for higher returns and liquidity.

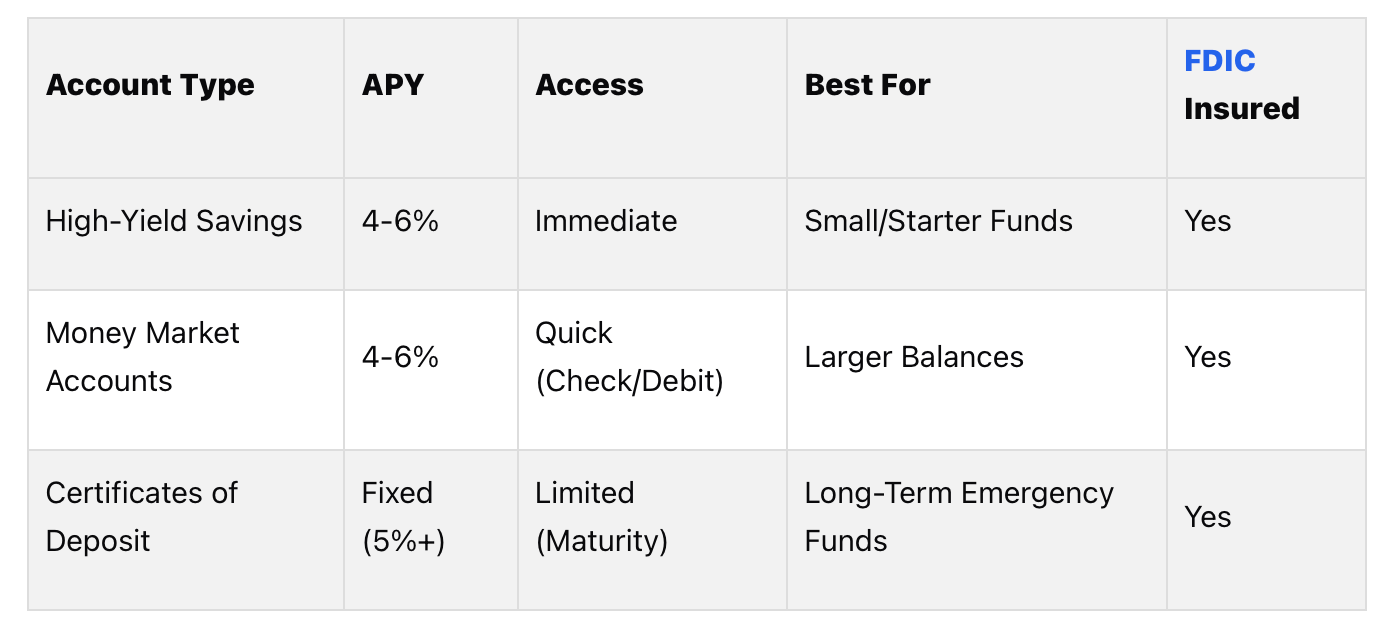

Need quick access to funds while earning interest? High-yield savings accounts, money market accounts, and CDs are the top choices for emergency funds in 2025. Here’s a breakdown:

High-Yield Savings Accounts (4-6% APY): Best for immediate access and no minimum balance. Ideal for starting or maintaining smaller emergency funds.

Money Market Accounts (4-6% APY): Great for larger balances with added features like check-writing or debit access but may require $2,500+ to avoid fees.

Certificates of Deposit (CDs): Lock in higher rates for funds you won’t need immediately. Use a CD ladder for periodic access without penalties.

Key Tip: Combine these options for a tiered emergency fund - keep 1-2 months of expenses in a high-yield account, 2-3 months in a money market account, and the rest in CDs for higher returns. Avoid risky investments or retirement accounts for emergencies due to penalties and potential losses.

Quick Comparison:

Start with automatic transfers to build your fund and review it yearly to match your needs. Safeguard your finances by keeping your emergency savings liquid, secure, and separate from retirement accounts.

Where To Keep Your Emergency Fund

High-Yield Savings Accounts: Easy Access with Better Interest Rates

High-yield savings accounts have become a popular choice for building emergency funds in 2025. They strike a balance between earning interest and keeping funds accessible when you need them most. Let’s break down what makes these accounts ideal for safeguarding your financial safety net.

What Are High-Yield Savings Accounts?

High-yield savings accounts are bank accounts that pay much higher interest rates compared to traditional savings accounts. While your local bank might offer a meager 0.01% to 0.10% interest rate, high-yield accounts are currently offering between 4% and 6%. These accounts are available through both online and traditional banks, but online banks often lead the pack with the most competitive rates. Why? They save on overhead costs by not operating physical branches, passing those savings on to you in the form of higher interest.

These accounts work just like standard savings accounts - you deposit money, earn interest, and can withdraw your funds as needed. Plus, they’re protected by FDIC insurance up to $250,000 per depositor per institution. This means even if your bank were to fail, your money would still be safe. For anyone looking to securely grow their emergency fund, this government-backed guarantee makes high-yield savings accounts a solid option.

Another big perk is accessibility. High-yield savings accounts often have low minimum balance requirements and little to no monthly fees. This makes them an easy and practical choice, even if you’re just starting to build your emergency fund.

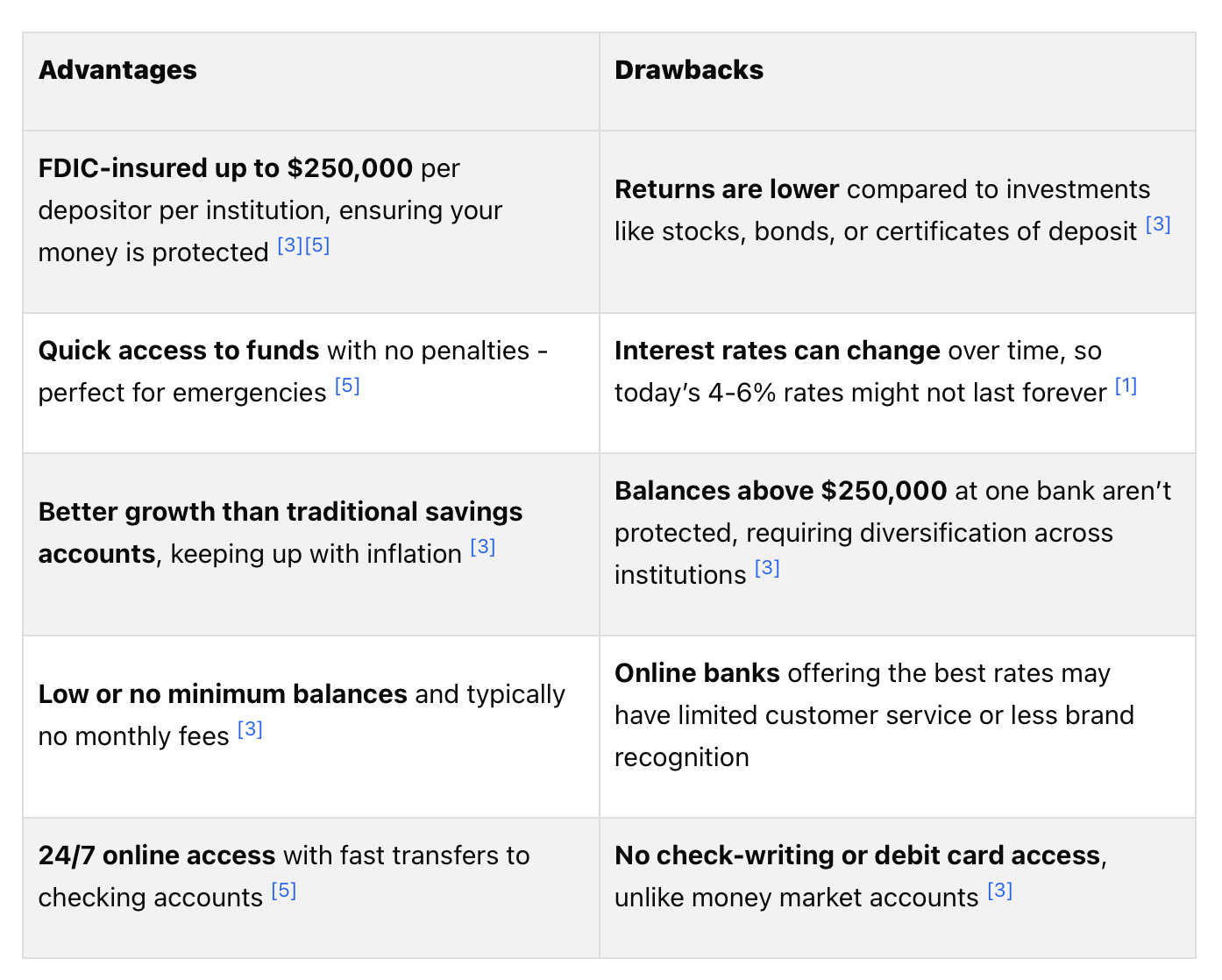

Pros and Cons of High-Yield Savings Accounts

Like any financial product, high-yield savings accounts come with their own set of benefits and limitations. Here’s a closer look at the trade-offs to help you decide if they’re the right fit for your emergency fund:

High-yield savings accounts are designed to keep your money safe, accessible, and growing steadily. While they’re not meant to deliver the kind of returns you’d get from riskier investments, they’re ideal for emergency funds. The 4% to 6% interest ensures your money doesn’t lose value to inflation while remaining readily available for life’s unexpected expenses.

However, these accounts aren’t without their limitations. The returns are still relatively modest, so if you’re open to locking away part of your emergency fund for slightly higher yields, options like money market accounts or short-term CDs could complement your strategy. But for the portion of your fund you might need immediately, high-yield savings accounts are tough to beat.

Considering that only 41% of Americans can handle a $1,000 emergency expense from savings, and 80% haven’t added to their emergency funds this year, now is a great time to take advantage of these high rates. High-yield savings accounts make it simple, secure, and rewarding to build or grow your financial safety net.

Money Market Accounts: Higher Returns with Quick Access

Money market accounts strike a balance between earning higher returns and maintaining quick access to funds, making them a great option for emergency savers. These accounts combine the benefits of savings accounts and money market mutual funds, offering competitive interest rates while ensuring your money is readily available for unexpected expenses. Let’s break down how they work and what makes them stand out.

How Money Market Accounts Work

Money market accounts operate with tiered interest rates, rewarding larger balances with higher returns. Unlike certificates of deposit (CDs), they allow penalty-free and immediate access to your funds. Plus, they’re FDIC insured up to $250,000 per depositor per bank, providing peace of mind that your savings are secure.

The tiered structure makes these accounts especially useful for emergency funds. As you save toward the recommended six to twelve months of living expenses, you can benefit from increasing returns. However, they often come with higher minimum balance requirements - typically ranging from $2,500 to $10,000 to qualify for the best rates. Falling below these thresholds may result in lower interest rates or monthly fees, which could make high-yield savings accounts a better choice for those just starting out.

Another key feature is that money market account interest rates fluctuate with market conditions and Federal Reservepolicies. While this means rates can drop, they can also rise when the economy improves, making them a flexible option for long-term savers who want their returns to keep pace with economic trends.

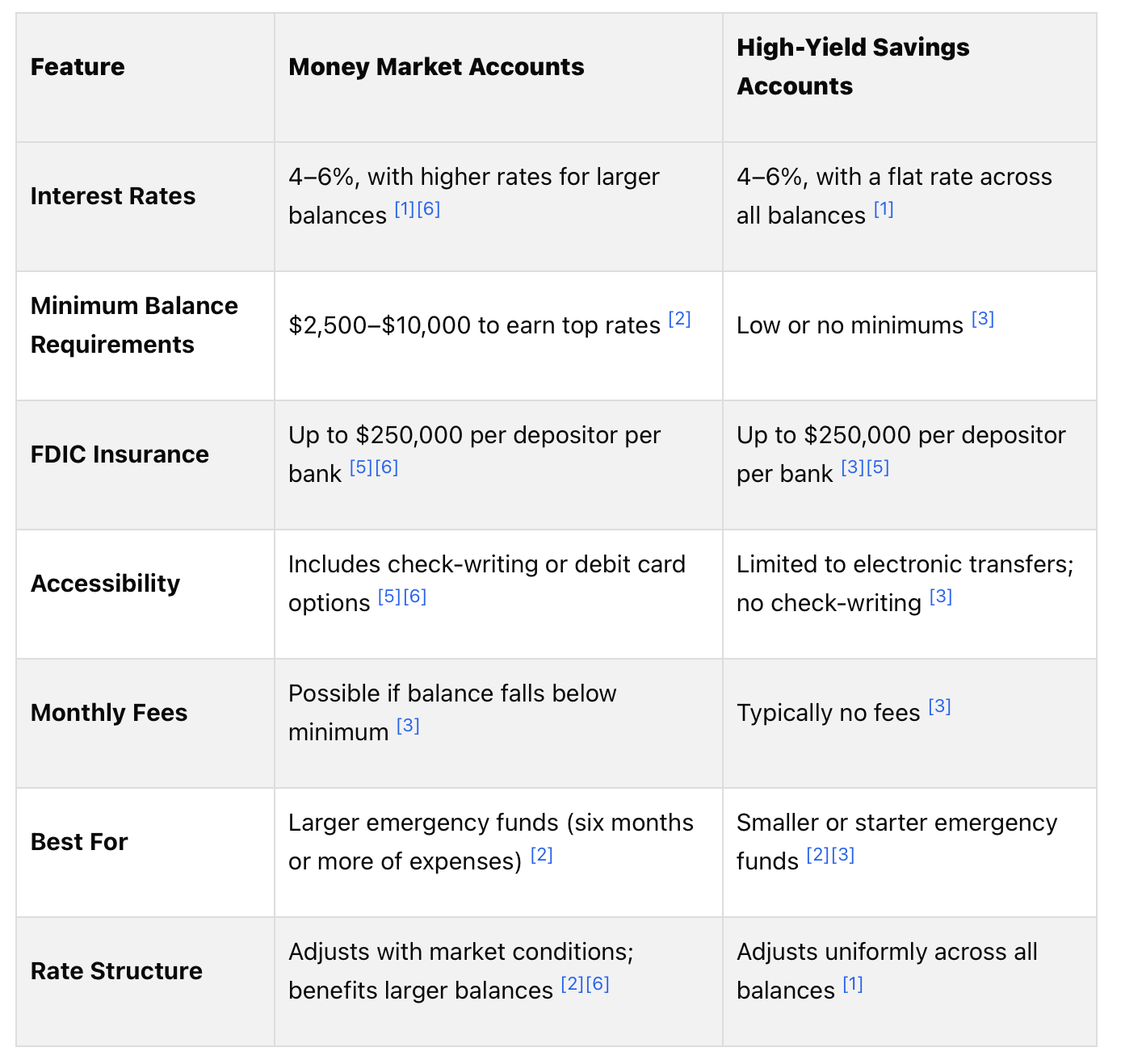

Comparing Money Market Accounts to High-Yield Savings Accounts

Both money market accounts and high-yield savings accounts prioritize accessibility and growth, which are vital for emergency funds. Here’s a side-by-side comparison of their features:

If you’re just starting to save or have a small emergency fund, high-yield savings accounts are simpler and don’t require high balances. But once you’ve saved six months or more of living expenses, money market accounts can offer better returns through their tiered rate structure.

A smart approach is to use both account types as part of a tiered strategy. For instance, you could keep one to two months of expenses in a high-yield savings account for quick access and move the rest into a money market account to take advantage of higher rates without compromising liquidity.

Some money market accounts also come with added perks like check-writing or debit card access, which can be handy in emergencies. However, the main factors to weigh are interest rates, FDIC protection, and how easily you can transfer funds when needed.

When choosing a money market account, compare rates from various institutions, as they can differ widely. Be sure to check the minimum balance requirements and any associated fees to find an account that matches your savings goals and financial situation.

Certificates of Deposit (CDs): Higher Returns with a Ladder Strategy

Certificates of Deposit (CDs) strike a balance for savers who want better returns than a traditional savings account but can afford to set aside some funds for a fixed period. While CDs lack the instant accessibility of savings accounts, they offer predictable, guaranteed returns, making them a smart choice for the part of your emergency fund you’re less likely to need right away.

Understanding CDs for Emergency Funds

A CD is essentially a time deposit. You commit a specific amount of money for a set term - ranging from a few months to several years - and in return, you earn a fixed interest rate. The trade-off? Your money is locked in until the CD matures.

What makes CDs appealing is their stability. Unlike high-yield savings or money market accounts, where rates can fluctuate, CD rates are locked in for the entire term. For instance, if you open a 12-month CD at 5% APY today, you’re guaranteed that rate for the full year, no matter what happens in the economy.

CDs also come with the added security of FDIC insurance, protecting up to $250,000 per depositor per bank. This ensures your principal is safe even if the bank fails. However, there’s a catch - early withdrawals usually come with penalties, which can range from a few months’ interest to a portion of your principal, depending on the terms and the bank.

For emergency funds, CDs work best for money you can set aside for several months without needing immediate access. For example, if you’re building a six-month emergency fund, the first one or two months of expenses should remain in liquid accounts. Meanwhile, the remaining three to six months could be placed in CDs to earn higher returns without compromising your financial safety net.

The Ladder Strategy for CDs

A CD ladder is a smart way to balance higher returns with accessibility. Instead of locking all your money into one long-term CD, you spread it across multiple CDs with staggered maturity dates. This strategy ensures you have regular access to your funds while still benefiting from the higher interest rates CDs offer.

Here’s how it works: Imagine you need six months of living expenses, totaling $18,000 (assuming monthly expenses of $3,000). You could structure your emergency fund like this:

Keep $3,000 in a regular savings account for immediate emergencies.

Place $6,000 in a high-yield savings account for quick access within a few days.

Split the remaining $9,000 across three CDs: $3,000 in a 3-month CD, $3,000 in a 6-month CD, and $3,000 in a 12-month CD.

With this setup, one CD matures every three months, giving you access to those funds without penalties. When a CD matures, you can either withdraw the money if needed or reinvest it into a new CD to maintain the ladder. This approach ensures you’re never completely locked out of your funds while still earning higher returns than a standard savings account.

A ladder strategy also adapts to changing circumstances. If your 3-month CD matures and you haven’t needed the money, you might roll it into a new 12-month CD to boost returns. On the other hand, if you’ve had unexpected expenses, you could keep the matured funds in a high-yield savings account to rebuild your liquid reserves.

The length of your CD terms should match your personal situation. If you have stable income and predictable expenses, you might allocate more to longer-term CDs with higher rates. If your income is less predictable or you have dependents, shorter CD terms and more liquid savings may offer better protection. For example, someone in a volatile industry might keep only one or two months of expenses in CDs, whereas a dual-income household with stable jobs could safely ladder three or four months of expenses.

Interest rate trends also play a role. If rates are high and likely to drop, locking in longer-term CDs can be advantageous. If rates are expected to rise, shorter-term CDs give you the flexibility to reinvest at higher rates as they mature.

Ultimately, CDs should complement, not replace, your liquid emergency savings. The goal is to earn better returns on funds you’re unlikely to need immediately while maintaining access to enough cash for true emergencies. A well-structured CD ladder achieves both - higher returns and regular access points - making it a valuable addition to your overall savings plan.

Building a Tiered Emergency Fund Across Multiple Accounts

A tiered emergency fund divides your savings based on how quickly you might need access to the money. This strategy ensures you have cash ready for immediate needs while allowing less urgent funds to grow in accounts with better interest rates.

Allocating Funds Across High-Yield Accounts, Money Markets, and CDs

The idea is simple: match your savings to your potential need for liquidity. Money you might need right away goes into highly accessible accounts, while funds you don’t plan to touch for months can be placed in accounts offering better returns. Start by calculating your monthly essential expenses and multiplying by six. For example, if you spend $4,000 per month, aim for an emergency fund of $24,000.

Here’s how you could allocate that $24,000:

Tier 1 – Immediate Access ($4,000): Keep one month’s worth of expenses in a high-yield savings account. This gives you quick access to cash through online transfers or ATMs, often within minutes.

Tier 2 – Quick Access ($8,000 to $12,000): Place two to three months of expenses in a money market account. These accounts usually offer higher interest rates for larger balances and allow withdrawals within one business day.

Tier 3 – Scheduled Access ($8,000 to $12,000): Put the remaining two to three months of expenses into Certificates of Deposit (CDs) with staggered maturity dates. For example, split the funds across 3-month, 6-month, 9-month, and 12-month CDs. This creates a ladder, giving you periodic access to money while earning higher returns.

If your income is steady and predictable, you might allocate 20% to immediate access, 40% to money market accounts, and 40% to CDs. However, if your income varies or you face unpredictable expenses, consider keeping more in liquid accounts. Factors like household size also matter - larger families or homeowners, who might face surprise repair costs, often need a bigger emergency fund and should keep more in accessible accounts. This tiered system helps you earn better returns without sacrificing access to your money when emergencies arise.

Keeping Enough Money Accessible

While it’s important to maximize returns, the primary goal of an emergency fund is to have money readily available when you need it. One common mistake is locking away too much in accounts that are hard to access, like CDs, which can lead to penalties if you withdraw early.

Using a money market account as a middle layer can provide a safety net if you’ve already used the funds in your high-yield savings account. This prevents you from needing to break into CDs prematurely.

Your liquid reserve should reflect your personal situation. If you work in an industry with unpredictable income or face health risks, you might want a larger percentage of your fund in accessible accounts. On the other hand, if your income is steady and you have comprehensive insurance, you might feel comfortable allocating more to CDs.

Another helpful tip? Keep your accounts at different banks. This can make it easier to resist the temptation to dip into your emergency fund for non-emergencies. Just make sure each account is insured by the FDIC, up to $250,000 per depositor per institution.

Finally, automate your savings. Setting up recurring transfers into each tiered account ensures you consistently build your emergency fund without the hassle of manual adjustments. Revisit your allocations after major life changes - like a new job, a baby, or a big move - to make sure your fund still meets your needs.

A tiered emergency fund strikes a balance: it protects you during financial emergencies while helping your money grow by aligning accessibility with your potential needs.

Savings Vehicles to Avoid for Emergency Funds

While knowing the best places to park your emergency fund is essential, it’s just as important to understand which options to steer clear of. Not all financial vehicles are suited for emergencies. Some may offer growth or tax advantages but fail to provide the accessibility and security needed when unexpected expenses arise.

Why Risky Investments Aren’t Suitable for Emergency Funds

Emergency funds should be safe, accessible, and reliable. Risky investments like stocks fail on all three counts. The stock market’s ups and downs might help build wealth over time, but they can wreak havoc on your finances if you need access to your money during a downturn.

Imagine this: You’ve saved $10,000 in stocks for emergencies, but a market dip slashes its value by 40%. Now, you’re left with just $6,000 when you need the full amount most urgently. Market risk means your emergency fund could lose 20%, 30%, or even more at precisely the wrong moment - like during a job loss or medical crisis. These funds take time to recover, which defeats the purpose of having them readily available.

Even more stable investments, like corporate bonds, aren’t ideal for emergencies. While they’re less volatile than stocks, bond values can still fluctuate with interest rates. Selling them before maturity could result in losses. Similarly, real estate is a poor choice for emergency savings because it’s not liquid - you can’t quickly sell a property to cover an unexpected expense.

High-yield savings accounts, by contrast, currently offer returns between 4% and 6% with FDIC protection. While the returns may not match the potential gains of stocks, they guarantee your principal is safe and accessible when you need it. The small trade-off in potential earnings is worth the peace of mind.

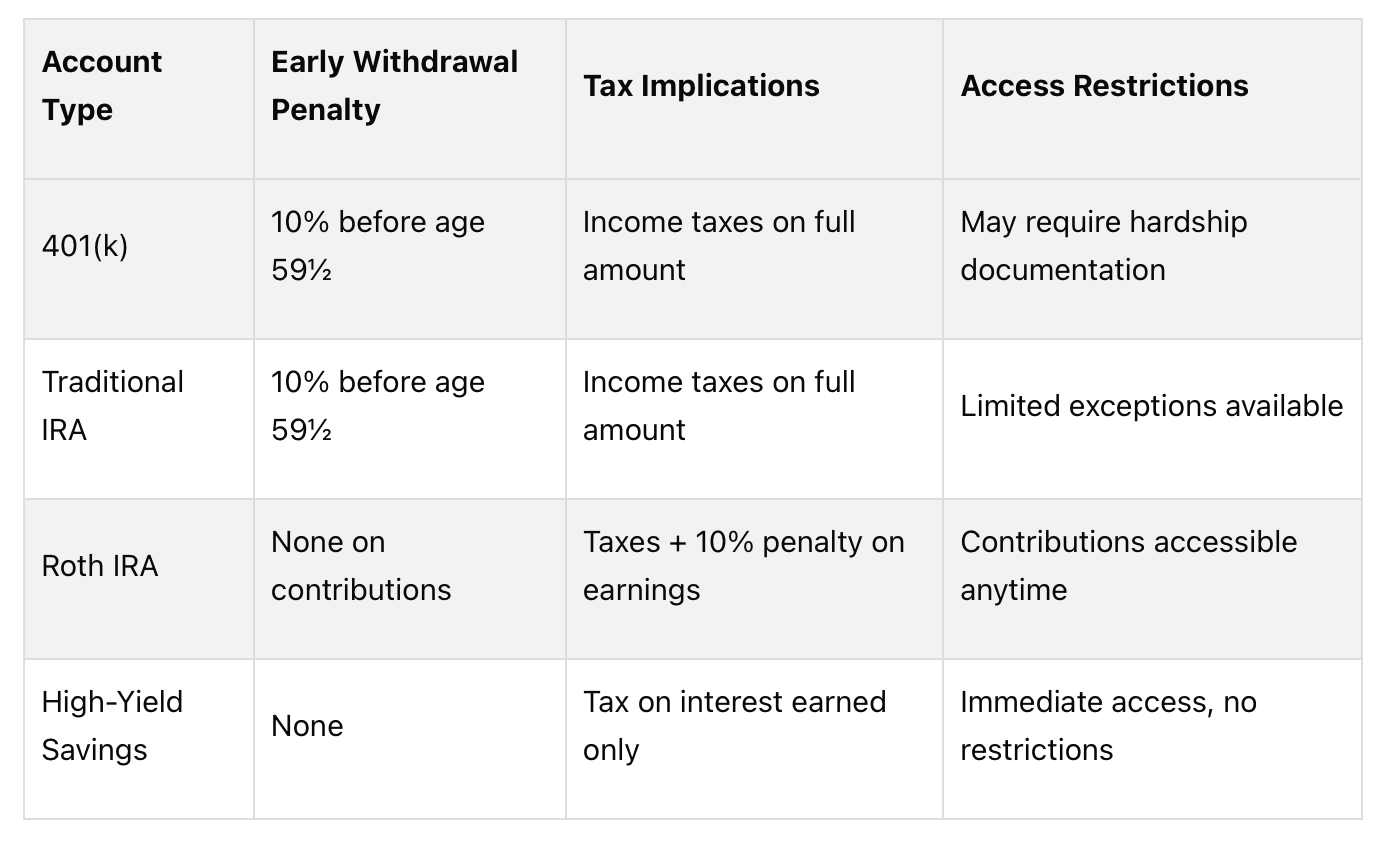

Why Retirement Accounts Aren’t a Good Fit for Emergency Savings

Retirement accounts like 401(k)s and IRAs are designed for long-term growth, not short-term cash needs. Using these accounts for emergencies can lead to hefty penalties, taxes, and missed opportunities for future growth.

Take a 401(k), for instance. If you withdraw $5,000 before age 59½, you’ll face a 10% penalty plus income taxes. Depending on your tax bracket, you might lose $1,500 or more to penalties and taxes, leaving you with just $3,500 of the $5,000 you needed. On top of that, many 401(k) plans limit withdrawals to specific hardship situations and often require extensive documentation.

Roth IRAs offer a bit more flexibility since you can withdraw contributions (but not earnings) penalty-free and tax-free at any time. However, dipping into these funds still undermines your long-term financial security. Every dollar you pull out is a dollar that could have grown tax-free for your retirement. The opportunity cost of early withdrawals makes these accounts unsuitable as primary emergency reserves.

Here’s a quick breakdown of why retirement accounts fall short for emergencies:

The best strategy is to keep emergency funds entirely separate from retirement accounts. This ensures you have accessible cash when you need it most and protects your long-term financial goals. If you’ve already placed emergency savings in a retirement account, consider reallocating those funds to a high-yield savings account or money market account. Building a dedicated emergency fund from your current income is a more practical and secure approach.

Ultimately, emergency funds and retirement savings serve distinct purposes. Keeping them in separate accounts helps maintain financial discipline and ensures you’re prepared for both short-term surprises and long-term goals.

How to Build and Maintain Your Emergency Fund

Creating and maintaining an emergency fund becomes much easier when you automate your savings and regularly review your progress. This consistent approach, paired with a tiered savings strategy, ensures your emergency fund stays accessible while continuing to grow.

Automating Contributions and Staying Consistent

Set up automatic transfers from your checking account to your emergency fund to make saving effortless. Most banks let you schedule these transfers to align with your pay cycle - whether that’s weekly, biweekly, or monthly. If your employer offers direct deposit options, you can allocate a portion of your paycheck directly into your emergency fund before it even hits your checking account. For instance, if you earn $5,000 a month and decide to save $500 for emergencies, you can have that amount deposited straight into your emergency fund. This strategy helps your savings grow steadily without relying on willpower.

To protect your emergency fund from impulsive spending, consider keeping it in a separate account, ideally at a different bank. Avoid linking this account to your debit card or mobile payment apps. These extra steps can make it harder to access the funds, ensuring you reserve them for genuine emergencies, such as unexpected medical expenses, major car repairs, urgent home repairs, or job loss. It’s also helpful to define what qualifies as an emergency so you can make clear, thoughtful decisions when the time comes.

Once you’ve automated your savings, discipline becomes much easier. However, don’t set it and forget it - regularly reviewing your fund ensures it remains aligned with your financial needs.

Reviewing and Adjusting Your Fund

Even with automatic contributions in place, it’s essential to reassess your emergency fund periodically. Financial experts suggest reviewing your fund at least once a year - or more often if you experience significant life changes. Events like job changes, promotions (which can increase both income and expenses), paying off large debts, or transitioning from renting to homeownership are all good reasons to revisit your savings target. For homeowners, unexpected maintenance or repair costs might require a larger fund compared to renters.

When reassessing your emergency fund, calculate your target by multiplying your average monthly living expenses - such as housing, utilities, food, insurance, and transportation - by the number of months you want to cover. For example, if your monthly expenses are $4,000 and you aim to cover six months, your target should be $24,000. This is also a great opportunity to evaluate where your money is stored. Depending on interest rates, you might benefit from shifting funds between high-yield savings accounts, money market accounts, or certificates of deposit to maximize returns while keeping access flexible.

It’s worth noting that only 10% of Americans have enough emergency savings to cover six months of expenses, while 37% have less than three months’ worth. By automating your contributions, setting clear guidelines for emergencies, and regularly reviewing your fund, you can build a strong financial safety net.

Once you’ve hit your emergency fund target, consider redirecting those automated contributions toward other financial goals, like maximizing your 401(k) match or contributing to a Roth IRA. Until then, keeping your emergency fund fully funded should remain a top priority - it’s the foundation that supports all your other financial goals.

Conclusion

Building a reliable emergency fund means juggling three key factors: liquidity (easy access to your money), security(keeping your savings safe), and earning potential (getting competitive interest rates). Right now, high-yield savings accounts strike a great balance, offering solid interest rates along with quick access to your cash. But relying solely on one type of account might not be the best approach. A smarter plan could involve diversifying your savings - keeping some cash in a high-yield savings account for immediate needs, using a money market account for slightly better returns, and setting up a CD ladder for funds you won’t need right away.

Once you’ve explored your options, the next step is to figure out your emergency fund target. A good rule of thumb is to aim for six to twelve months’ worth of living expenses. After that, choose the right mix of savings accounts to hit your goal. Keep in mind, emergency funds should stay separate from retirement accounts like 401(k)s or Roth IRAs. These accounts come with penalties and tax issues that can make accessing funds quickly both difficult and costly.

If you’re just starting, open a high-yield savings account and set up automatic contributions to build your reserves. For those with a fully funded emergency fund, consider layering your strategy - combine immediate access with higher-yield options like money market accounts or a CD ladder. Your emergency fund is the bedrock of your financial security, so putting the right plan in place now is a step that will pay off in the long run.

FAQs

What’s the best way to divide my emergency fund between high-yield savings accounts, money market accounts, and CDs?

Choosing how to allocate your emergency fund depends on your financial priorities and how quickly you might need access to your cash. High-yield savings accounts are a solid choice for funds you may need right away. They offer easy access while earning some interest - a practical mix of liquidity and growth. Money market accounts provide a bit more interest and often include limited check-writing features, making them a middle ground between accessibility and returns. Certificates of deposit (CDs), on the other hand, are ideal for money you can set aside for a fixed period. They generally offer the highest interest rates but require you to commit to locking up your funds.

For a well-rounded strategy, you could consider dividing your emergency fund like this: keep 50-70% in a high-yield savings account for immediate expenses, allocate 20-30% to a money market account for slightly less urgent needs, and place the remaining 10-20% in short-term CDs to earn higher returns while maintaining some flexibility. Of course, these percentages can be adjusted to fit your unique situation and comfort level with risk.

What are the risks of using a retirement account as an emergency fund, and how can I avoid them?

Using your retirement account, like a 401(k) or IRA, as an emergency fund might seem tempting, but it comes with some serious downsides. For starters, early withdrawals usually trigger a 10% penalty, and on top of that, you’ll likely owe income taxes on the amount you take out. Even more concerning, dipping into your retirement savings can disrupt the growth of your investments, potentially putting your long-term financial plans at risk.

A smarter move? Set up a dedicated emergency fund in a more accessible account, like a high-yield savings account or a money market account. These options let you access your money quickly without penalties or tax headaches, all while keeping your retirement savings untouched and working toward your future.

What are the best ways to automate savings and grow a reliable emergency fund?

Automating your savings is one of the easiest ways to steadily grow an emergency fund. The process is simple: set up automatic transfers from your checking account to a separate savings account. Most banks and financial apps let you schedule these transfers on a weekly, biweekly, or monthly basis, making it easy to stay consistent without constantly thinking about it.

To make your money work harder, consider placing your emergency fund in a high-yield savings account or a money market account. These options allow you to earn interest while still keeping your funds accessible for emergencies. It’s also helpful to set a clear target, like saving enough to cover 3 to 6 months of living expenses. As your financial situation evolves, you can adjust the transfer amounts to stay on track. Automating this process takes the guesswork out of saving and helps you build your fund with less hassle.