Big Tech: Bubble or Boom?

AI stocks, the Japan trade deal, and a surge in money supply: what investors need to know now

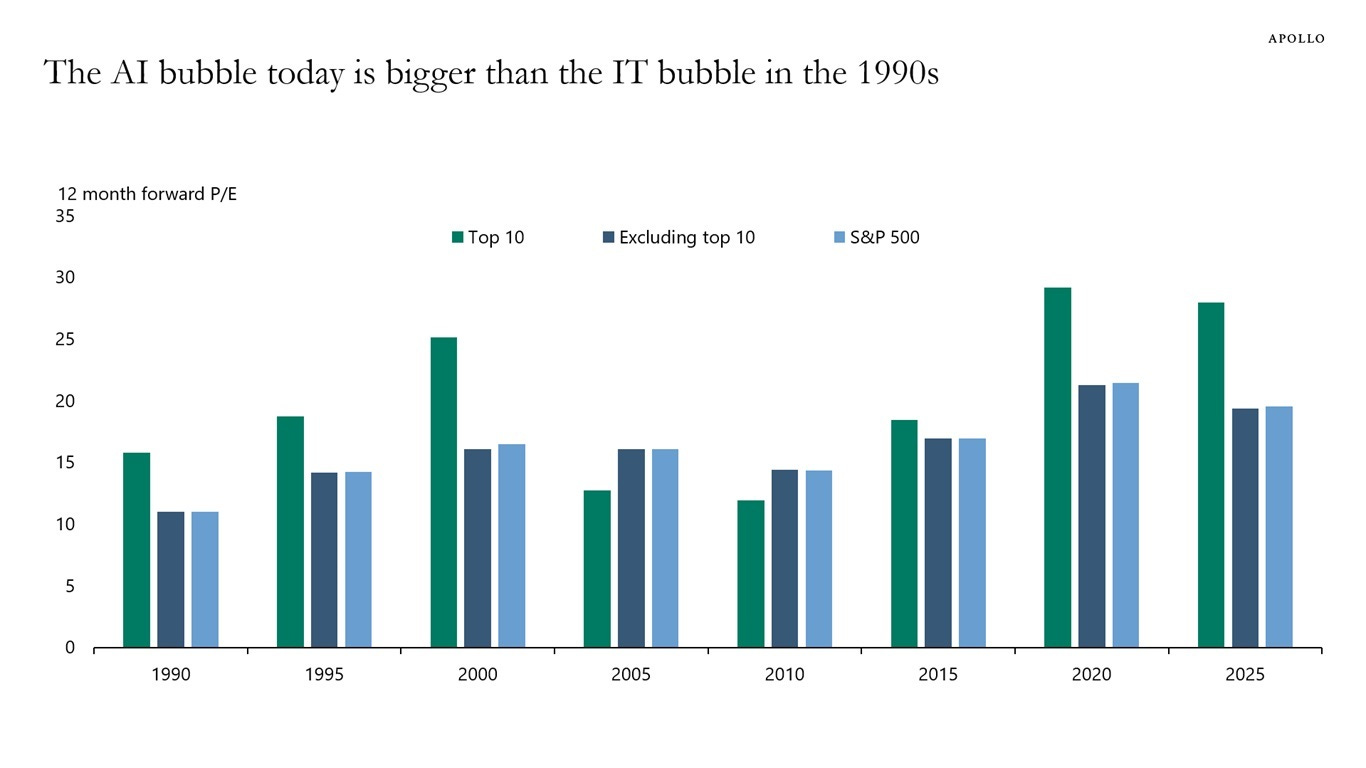

A new chart from Apollo comparing today’s AI mania with the dot-com bubble has sparked debate: are we in a repeat of the 1990s?

By Apollo’s measure, the top 10 companies in the S&P 500 are now more overvalued (on a P/E basis) than they were at the height of the internet bubble. That sounds ominous, until you zoom in on the fundamentals.

Today’s mega-cap giants are vastly more profitable, diversified, and cash-rich than their dot-com counterparts. Microsoft, Google, Meta, and Amazon aren’t just riding AI hype, they’re funding the buildout with free cash flow from dominant core businesses. And unlike the 90s, AI is already producing real productivity gains and tangible business impact.

So while valuations may look stretched, they’re not untethered from reality. It’s not 1999 all over again.

Wall Street is finally catching up on Palantir

This week, Wall Street began to wake up to what we identified months ago: Palantir (PLTR) is a long-term winner. (Read)

In a fresh analyst note, the stock was upgraded to a Buy despite its rich valuation. The rationale? Palantir’s role as a key enabler of AI adoption and government modernization makes it a secular growth story.

But here’s the thing: our rules-based framework led us to Palantir long before Wall Street gave it the green light. While many institutional investors stayed on the sidelines, stuck in outdated valuation paradigms, we followed the data and positioned early.

I’m not sharing that to brag - not every idea we have pans out so well. But this is a perfect example of why process beats prediction.

Rather than waiting for permission from analysts or chasing headlines, we rely on a repeatable system that consistently identifies high-upside opportunities over the long term.

Now, with Palantir continuing to execute and the big money entering, we remain very bullish.

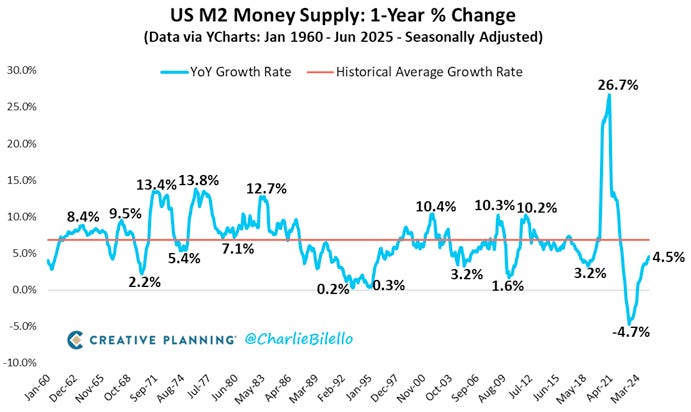

Money supply is surging again

The U.S. money supply grew at its fastest pace year-over-year since July 2022.

Amid calls for lower interest rates, the Trump administration is laying the groundwork for pro-growth, loose-money policies. Running the economy hot seems to be the chosen path to outgrow the mounting U.S. debt burden.

This shift has major implications: looser financial conditions could support risk assets, especially equities and real assets. But it could also reignite inflation pressures down the line. Hence our bearish posture on long term bonds, despite likely rate cuts later this year.

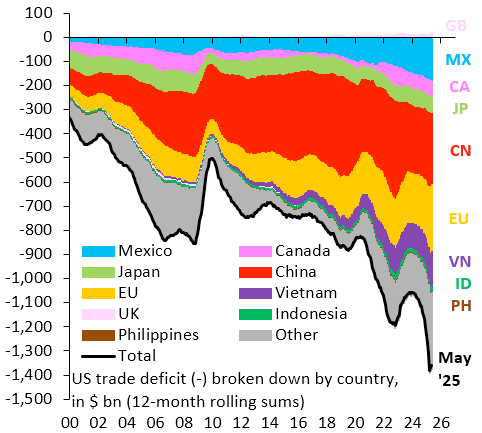

The Japan trade deal: a quiet win?

This week, the U.S. finalized a trade deal with Japan aimed at strengthening economic ties and reducing trade barriers across key industries.

The agreement includes provisions around semiconductors, supply chains, and digital trade - small but important steps as the U.S. continues to secure more predictable access to critical goods.

One overlooked takeaway? A growing number of U.S. trade relationships are now governed by formal deals, covering most of the current deficit. The big open question is what will happen with China. I continue to believe a trade deal will be worked out, simply because it’s in both country’s best interest to do so.

While headlines still scream "trade war," the data suggests an orderly decoupling is already underway. The fear may be louder than the reality.

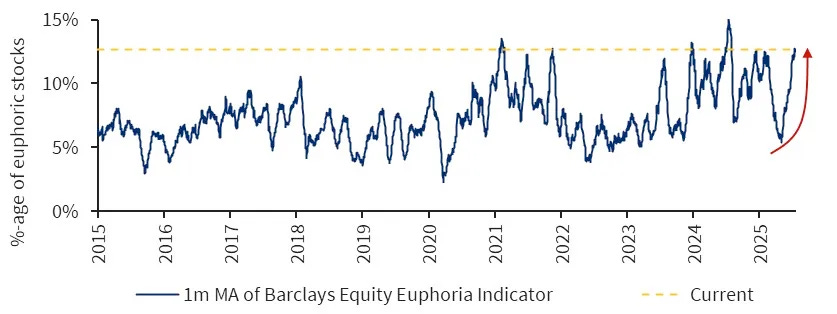

Euphoria flashing yellow

We’ve been highlighting some extremes in bullish sentiment over the last couple weeks as a reminder that markets don’t go up in a straight line.

The latest example of bullish extremes comes from Barclays’ equity sentiment indicator, which just hit its highest level since December. Historically, readings at these levels have been a sign that positioning is crowded. We may be in a similar place today.

This is not a signal to bet against the trend, it's a reminder that the next leg higher may come with bumps along the way.

Get your buy list ready now so you’re prepared to take advantage of a pullback should the market provide us the opportunity.

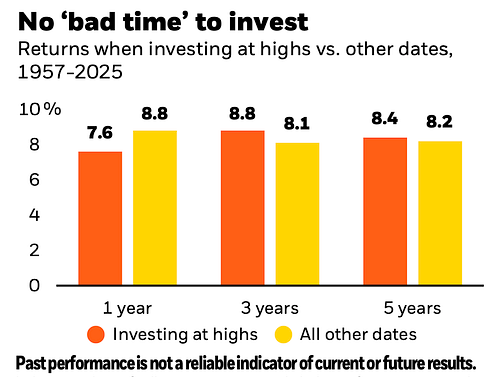

Buying at highs? It doesn’t matter much

Another reason we don’t try to time the market? There’s almost no difference in long-term returns between buying at all-time highs versus random dates, according to the latest research from Blackrock.

It’s a simple, powerful reminder: process beats timing.

Dollar-cost averaging and staying invested through cycles has always outperformed headline-chasing and prediction games. Markets climb walls of worry, and long-term investors are rewarded for tuning out the noise.

Final thought

AI isn’t a fad. It’s a transformation. But the path won’t be linear, and neither will investor psychology.

Stay grounded in fundamentals. Stick to your process. And remember: the biggest risk isn’t buying too high, it’s being uninvested when the future arrives.

New articles from The Predictive Investor

Why Most Market Timing Strategies Fail

Market timing strategies often fail due to emotional biases, high costs, and missed opportunities. A disciplined, rules-based approach is key to success. Read>

How to Measure Portfolio Performance Consistency

Learn how to assess the consistency of your investment portfolio through key metrics and disciplined strategies for long-term success. Read>