Big tech gets a lifeline (sort of)

The Predictive Investor - 4/13/25

Welcome to The Predictive Investor weekly update for April 13th, 2025!

Volatility continued throughout the week, but markets closed higher after Trump announced a 90-day pause on reciprocal tariffs for all countries except China.

The shift toward de-escalation continued though the weekend, with an announcement that tech products, including chips, smartphones, PCs and servers, would be exempt from the reciprocal tariffs (but still subject to the baseline tariff). However, not even 24 hours later, Commerce Secretary Howard Lutnick said in an interview that these exceptions are only temporary.

It’s hard to believe there is any sort of strategy here, with how fast these policies are shifting. While that’s certainly possible, instead it appears the administration is reacting to market volatility.

Treasury yields surged as many institutional investors faced margin calls and had to raise cash fast. With ballooning deficits, the U.S. simply cannot afford higher interest rates. So recent events seem more geared toward stabilizing the bond market rather than backing away from tariffs. But now that the world knows our weak spot, it could incentivize countries to sell Treasuries as a way to pressure the administration to reverse course.

While most agree that China has not been playing fair, alienating the rest of the world in an attempt to deal with that may prove to be counterproductive. The wave of business leaders and investors flooding social media to praise Trump’s “art of the deal” approach indicates how desperate the business community is to help Trump find an off-ramp. Whether he listens or not is anyone’s guess.

Here’s my takeaways from the week.

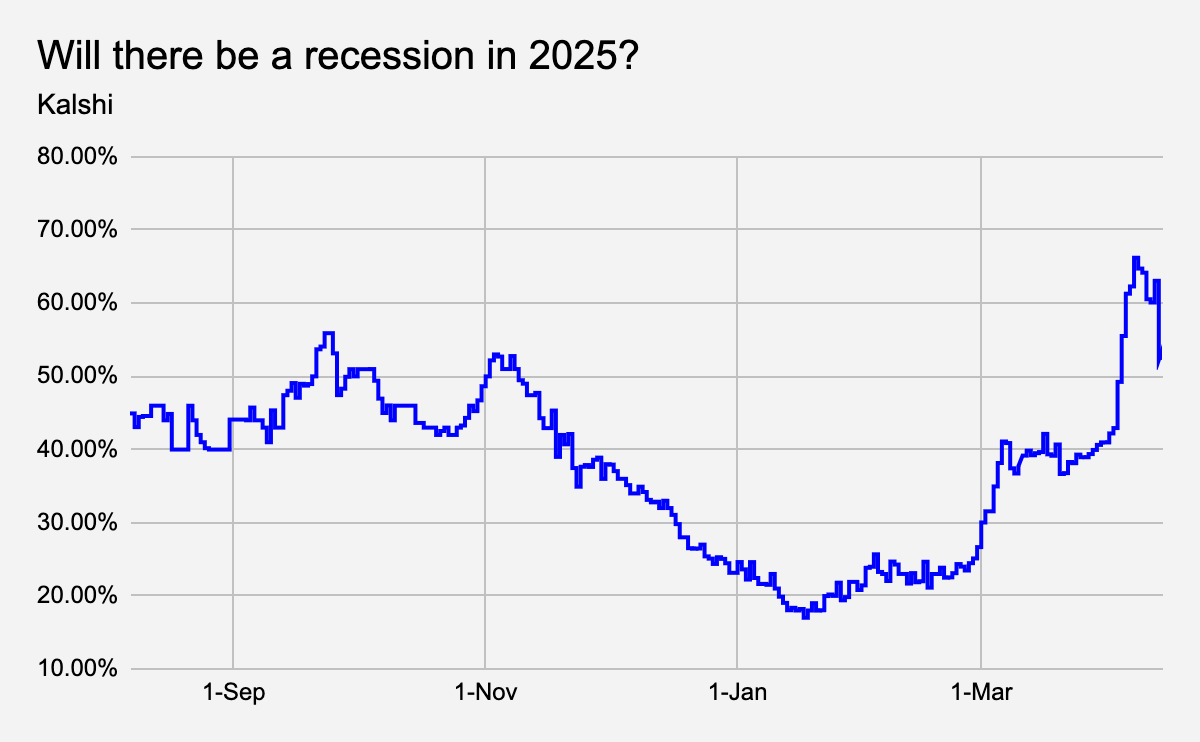

Recession odds skyrocket - but it might not mean what you think

Recession odds on prediction markets hit 66% last week, before retreating a bit.

While it’s true that the Fed’s GDP growth estimates for Q1 were revised down to -2.4%, much of that drop was due to a sharp rise in gold imports, likely by financial institutions hedging against market volatility and dollar weakness. There’s also been reports of companies accelerating their imports of other goods to beat various tariff deadlines.

In the GDP formula, imports are subtracted, because GDP is meant to reflect domestically produced goods and services. And a recession is technically defined as two consecutive quarters of negative GDP growth.

If GDP contracts primarily due to front-loaded imports, any resulting recession would likely be far less severe than feared.

That said, none of this is in our control. What is in our control is to plan ahead of time for various outcomes and invest accordingly.

If you need some guidance, upgrade to a paid membership to track our moves in real time.

Inflation softer than expected

Both CPI and PPI declined month-over-month vs. expectations for continued increases. No surprise there. We’ve flagged many times that real-time inflation data has been trending lower for weeks.

Truflation tends to lead by 5-6 weeks, so if tariffs change the trend it will show up here first.

Earnings season kicks off

According to Factset, the S&P 500 is set to report year-over-year earnings growth of 10% for Q1. (Read)

Currently, most S&P sectors are trading below both their 5- and 10-year P/E ratios. So the potential for some upside surprises is high. The market reaction will tell us whether investors are ready to focus on actual results, or continue to be driven by this haphazard trade war.

The good news is innovation continues either way. Doordash DASH 0.00%↑ announced an expansion of its partnership to offer sidewalk robot delivery. (Read)

And AI companies continue to raise billions of dollars.

With over $7 trillion in money markets, investors will at some point be putting that money to work. Our job is to get ahead of that by staying focused on companies that can adapt and thrive despite the uncertainty.

S&P 500 attempts to consolidate

Despite much technical damage over the last few weeks, the index found support near 4,800 - an area of interest we highlighted last week.

Regardless, we remain in a correction until a decisive break of the 2/19 AVWAP.

Until then, I’ll be dollar cost averaging slowly into the market to capitalize on this decline.