Bull markets are built on skepticism

From booming big tech investment to bearish small-cap bets, this market is full of contradictions. Here’s how to read the signs, and which ones to ignore.

This market is a reminder that returns often defy expectations.

It’s been a big year for stocks, and yet many investors are still sitting on the sidelines, clinging to the same fears that held them back months ago: high valuations, a potential recession, inflation, and seasonal volatility.

The problem? Most of what passes for research these days is just noise.

Let’s take a look at some of the signals that actually matter.

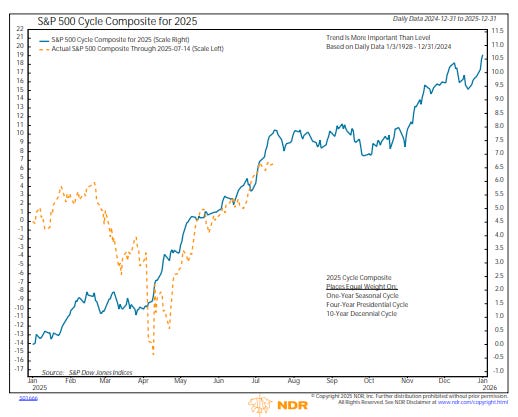

Seasonality suggests a choppy but positive second half

Ned Davis Research’s S&P 500 Cycle Composite shows the market entering a historically weaker stretch into early fall. In line with the seasonality and sentiment trends I flagged last week. But the pattern still calls for upside into year-end.

I wouldn’t be surprised in the least if Wall Street uses some “unexpected” event to engineer a pullback.

Why? Investment banks make more money when the market is volatile. Goldman, Morgan Stanely and Citigroup all beat the Street’s expectations due in part to increased trading revenue when the market tanked back in April.

Don’t let volatility shake you out of your plan. The long-term outlook remains bullish.

Valuations are not as predictive as many believe

Fisher Investments published a timely piece reminding investors that P/E ratios have much less predictive power than many believe. (Read)

Stocks can stay “expensive” for years.

High multiples don’t necessarily precede crashes.

And low multiples don’t guarantee gains.

Valuation is a poor timing tool, but a great excuse to stay scared. Luckily, our strategy is based on earnings growth, which is what actually drives stock prices. So we don’t need to guess whether a 23x multiple is “too high.”

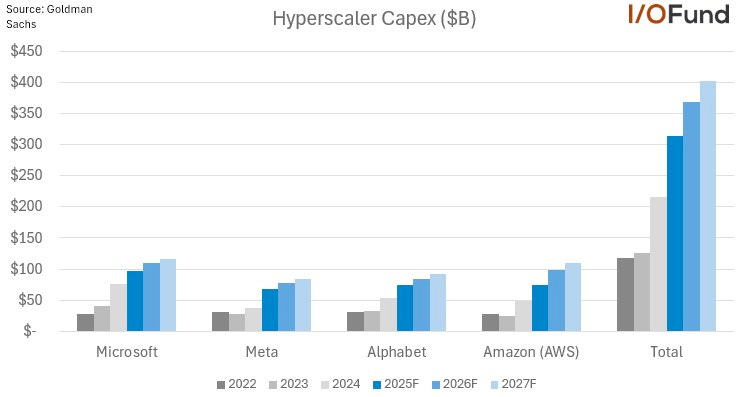

$400 billion in hyperscaler capex = long term tailwind

Goldman Sachs projects that Microsoft, Amazon, Meta, and Alphabet will collectively spend over $400 billion on Capex by 2027, most of it on AI, infrastructure, and cloud.

The race to build a long term moat in AI and compute power is on. And all of these companies have highly profitable core businesses to sustain capex growth.

These investments have historically driven productivity booms, which boost GDP, corporate profits, and equity returns.

A contrarian setup in small caps

Speculators and hedge funds are net short on the Russell 2000 at levels close to the 2022 bear market low.

Sentiment is deeply negative on small caps, which could set up a short squeeze, especially if the Fed cuts rates later this year.

Luckily we’re positioned well, with roughly 50% of our portfolio in small caps, many of which are already outperforming the market. Like TSS, Inc. $TSSI — up 200% in just 9 weeks.

If you’re not already a paid member, upgrade today to get our best ideas first.

CPI vs. PPI

The two most important inflation readings gave contradicting readings:

CPI (Consumer Price Index): Slightly hotter than expected.

PPI (Producer Price Index): Flat. Cooler than expected.

So which is right?

The key here is directional trend. PPI often leads CPI, and this cooling in producer prices suggests consumer inflation could moderate again in the months ahead.

That’s good news for profit margins, Fed policy outlook and consumer confidence.

In short, inflationary pressure is not as bad as many feared when the tariffs were announced.

Final thought

We’re in a market that continues to climb despite widespread skepticism. That’s the signature of a bull run that’s just starting to broaden out.

If you’re waiting for a perfect entry point, you may be waiting forever.

Success comes from staying disciplined through the noise, not from timing the market.