Cooler inflation, hotter earnings

The Fed’s pivot and strong Q3 results reinforce a bullish setup, even as volatility keeps skeptics on edge.

A softer September inflation print gave the market exactly what it was hoping for: confirmation that the Federal Reserve’s next move is a cut. Futures now price in an October rate reduction, with more easing expected into 2026. The Fed could also use its upcoming meeting to signal an end to quantitative tightening, reinforcing a supportive backdrop for equities.

After a summer of volatility and mixed signals, this is a clear sign that policy and fundamentals are starting to align.

Macro Focus

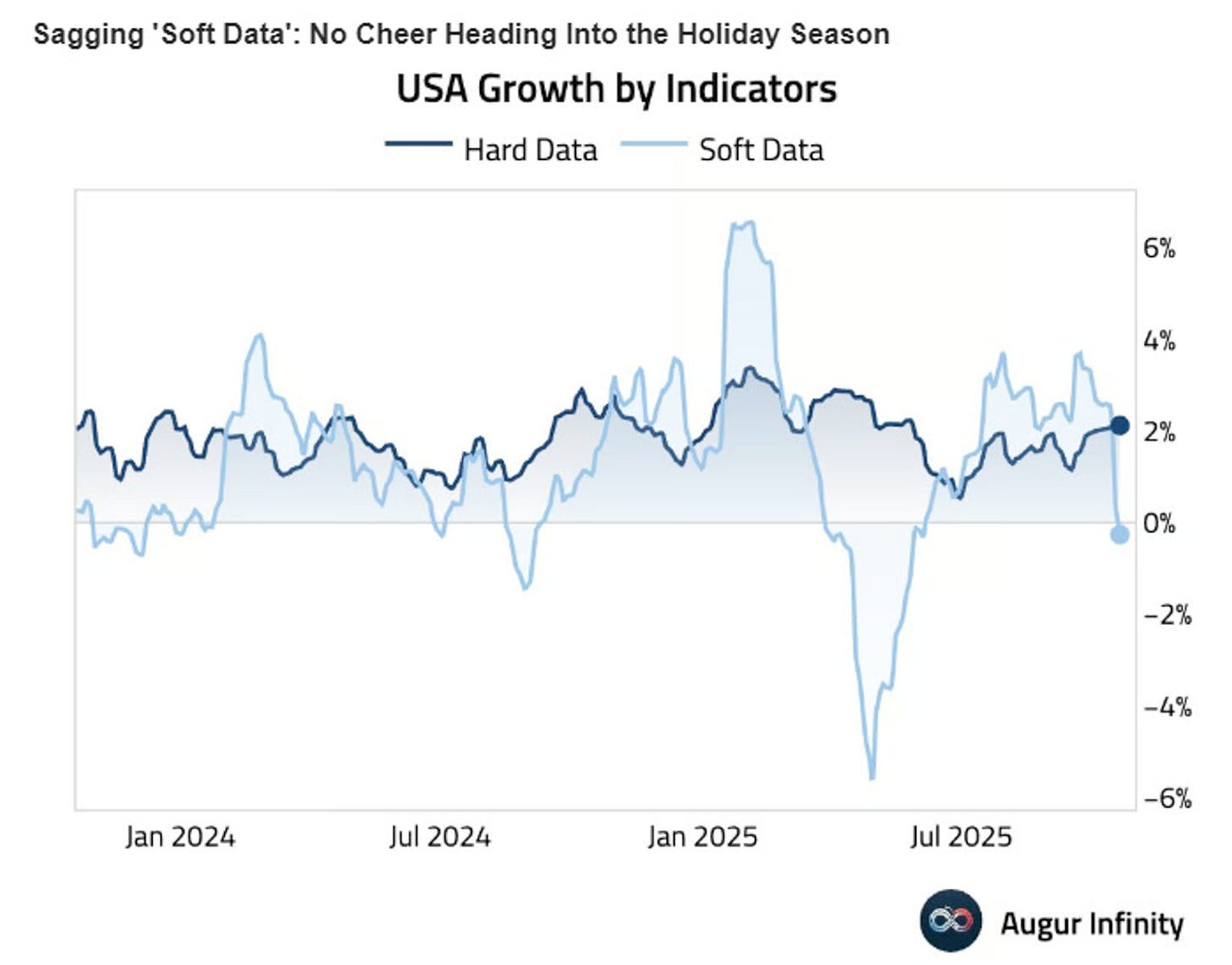

Hard data holding strong

Sentiment surveys have sounded gloomy, but real-world activity tells a different story. Consumers are still spending, CEOs are still making deals, and capital expenditures are holding strong.

Corporate America is voting with its wallet, through robust M&A activity, hefty capex, and record stock buyback announcements.

In short: the headlines are cautious, but the behavior is bullish.

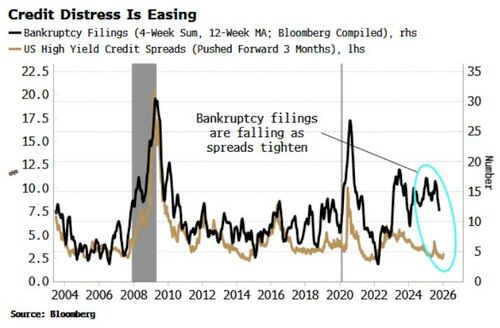

Bankruptcies down

One major reason the hard data is holding up is that bankruptcy filings are down.

Despite the selloff in regional bank stocks, U.S. bankruptcy filings — one of the most forward-looking indicators of credit stress — are falling sharply.

That’s not what you see when the system is breaking; it’s what you see when conditions are stabilizing.

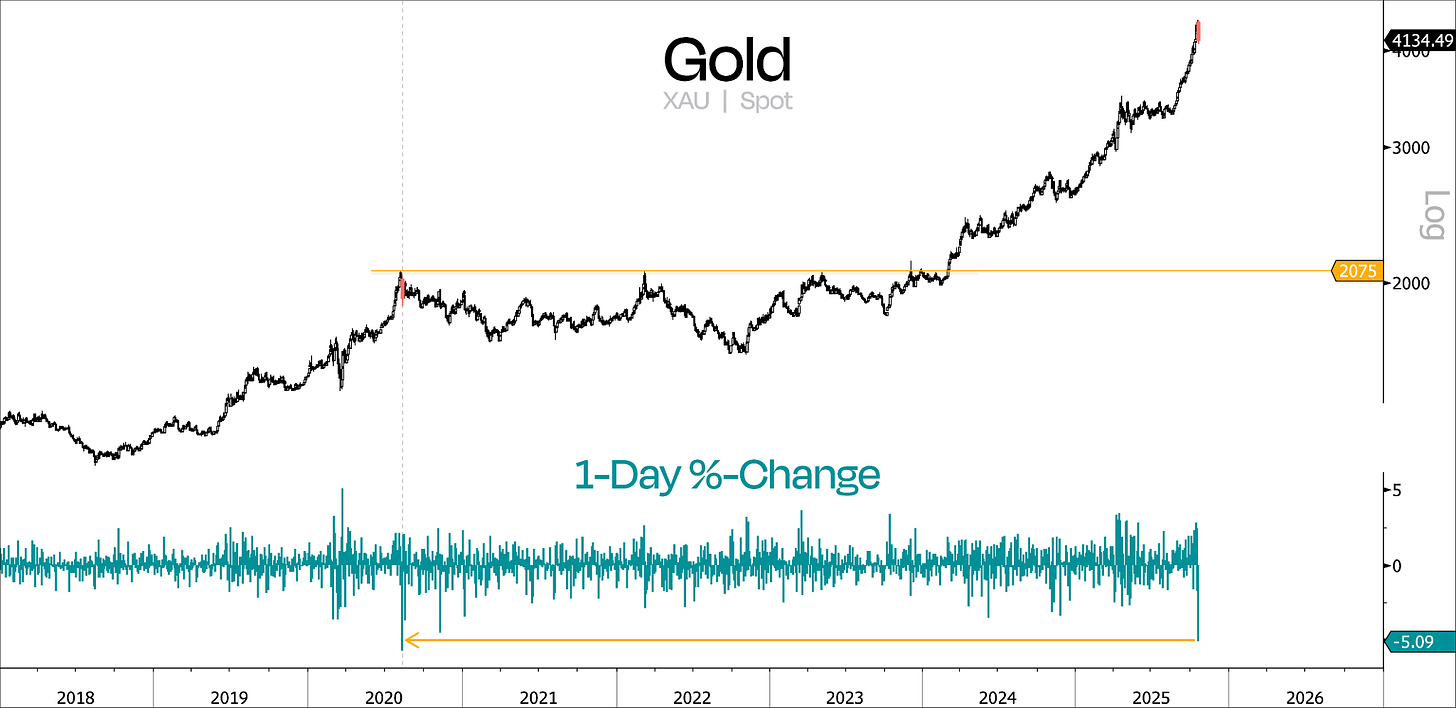

Precious metals: from surge to stall

Last week we flagged silver’s extreme RSI levels as a sign that a pullback was coming. Seems we may have been on to something. Both gold and silver sold off hard last week.

Historically, moves like this have often marked the start of a long consolidation phase.

After such a strong run up, some consolidation is healthy. But what’s different this time is central bank demand is not slowing down. I’m looking for a further 5-10% drop in gold and silver prices before committing additional capital.

AI adoption accelerates

According to Axios, BNY Mellon now employs over 100 digital workers performing tasks from payment remediation to code repair. They have managers, email addresses, and even performance reviews. But they’re not human.

While skeptics continue to call it

a bubble, the story of AI remains one of expanding adoption and growing profits.

Look for a new recommendation later this week to take advantage of the continued expansion in AI use cases.

Final thought

Earnings season is off to a strong start, and the numbers are confirming what price action has been hinting at.

So far, 29% of S&P 500 companies have reported Q3 results, and the data looks solid across the board. According to FactSet, 87% have reported earnings above estimates, well above the 5-year average of 78% and the 10-year average of 75%. If this pace holds, it would mark the strongest beat rate since Q2 2021.

Put simply: fundamentals are improving, not deteriorating.

Combine that with cooling inflation, a likely Fed pivot, and signs of a U.S.-China trade thaw, and you get a market backdrop that still favors disciplined investors. The key is to stay invested in the companies driving this growth and have a plan to take emotion out of the equation when volatility inevitably returns.

The market’s sending a clear message: the bull trend still has fuel left in the tank.