Countdown to the dot plot

Next week’s rate decision could jolt markets, but a balanced portfolio is built for any outcome.

Short update this week, as where we go from here depends on the outcome of this week’s Fed meeting.

September is often cited as the market’s weakest month, yet the S&P 500 pushed to fresh highs despite weak jobs data.

Margins, a classic early-recession signal, are holding steady, and the market isn’t pricing in a downturn. Still, this is the perfect time to evaluate your risk and rebalance. Lock in gains, trim oversized positions, and build a cash cushion so you can buy when the next pullback inevitably arrives.

Job growth revised down again, and markets shrug

Revisions to nonfarm payrolls data for the year prior to March 2025 showed a drop of 911k jobs.

Despite the embarrassment for the BLS, markets shrugged.

After months of inconsistent data, investors simply don’t trust the numbers. It’s also beyond clear that the Fed is late in cutting rates.

The real driver now is next week’s Fed meeting: investors expect a faster pace of rate cuts than the Fed’s own projections. A dovish dot plot and the widely anticipated rate cut could spark another rally, especially in small caps and financials. But if the Fed forward guidance disappoints, we could see a quick bout of profit-taking.

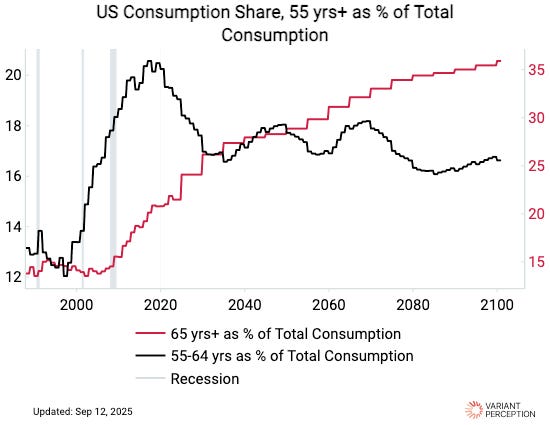

Consumers keep spending, thanks to retirees

The Consumer Discretionary ETF XLY 0.00%↑ just logged its largest fund inflows in two years.

Surprising? Maybe not.

Retirees continue to prop up consumption, with little signs of a slowdown given they are less dependent on the labor market.

Remember, the stock market isn’t the economy; consumer spending can stay resilient even as payroll growth cools.

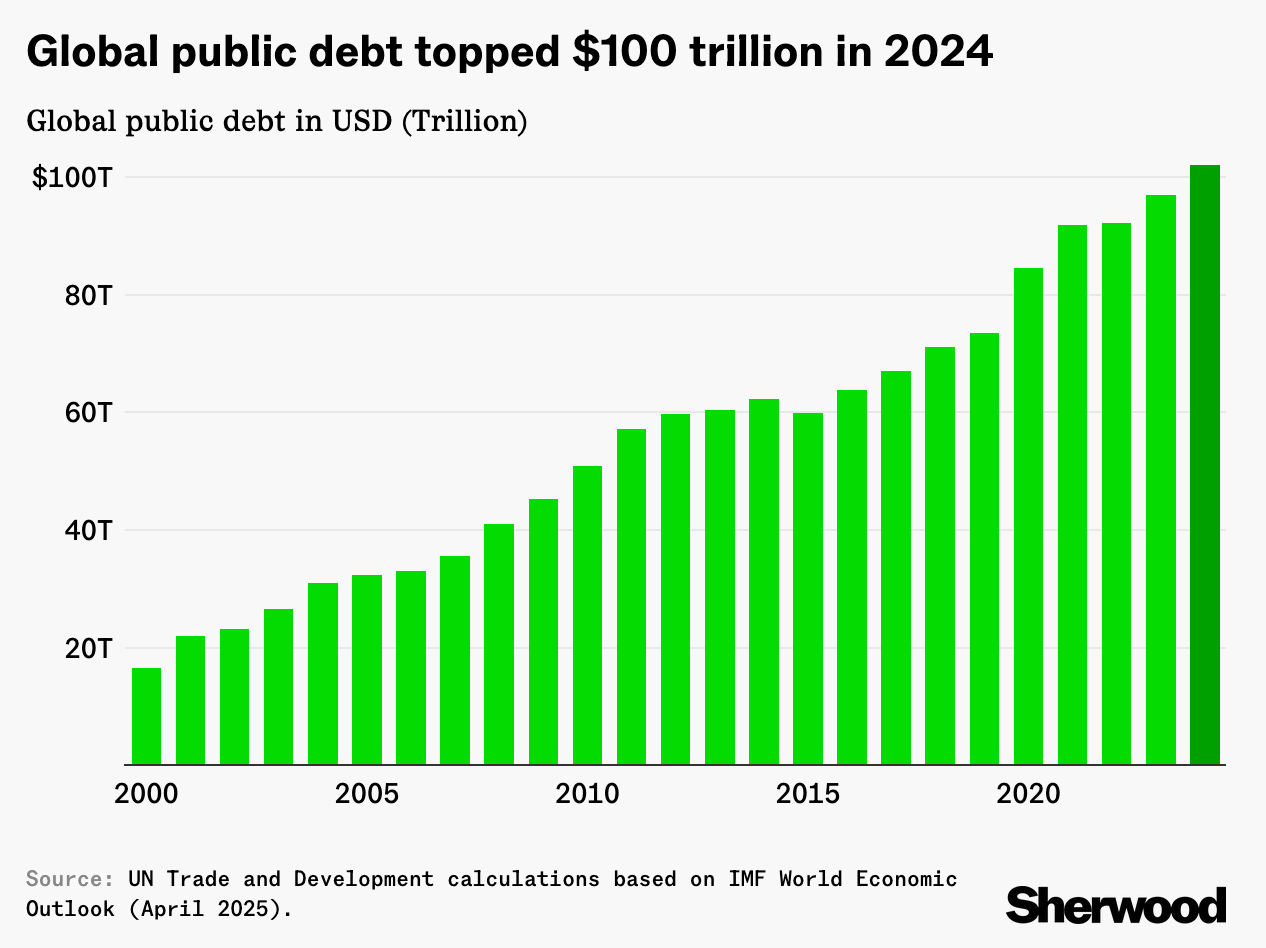

Global debt hits $102 trillion

Forget the latest CPI print. The real story with regard to inflation is that global public debt now tops $102 trillion, and governments have no realistic path to paying it down.

History suggests they’ll rely on inflation and currency debasement. That’s why, despite potential short-term relief from Fed cuts, long-term Treasuries remain unattractive in our view.

One alternative to reduce interest rate risk and still generate income is to add exposure to floating rate fixed income. Here are two ETFs we favor:

FLOT (iShares Floating Rate Bond ETF): Invests in investment-grade floating rate bonds. Payments reset with changes in short-term interest rates, so it’s less sensitive to rising rates.

TFLO (iShares Treasury Floating Rate Bond ETF): Exposes you to U.S. Treasury floating rate bonds. The interest payments adjust to prevailing rates, keeping duration near zero (which means minimal interest rate risk) while still delivering yield.

These ETFs offer a middle ground: avoiding the major downside in long-duration bonds, yet still getting income. In a regime of rising debt and uncertain long-term rates, these alternatives make sense. Full disclosure: I own shares of FLOT.

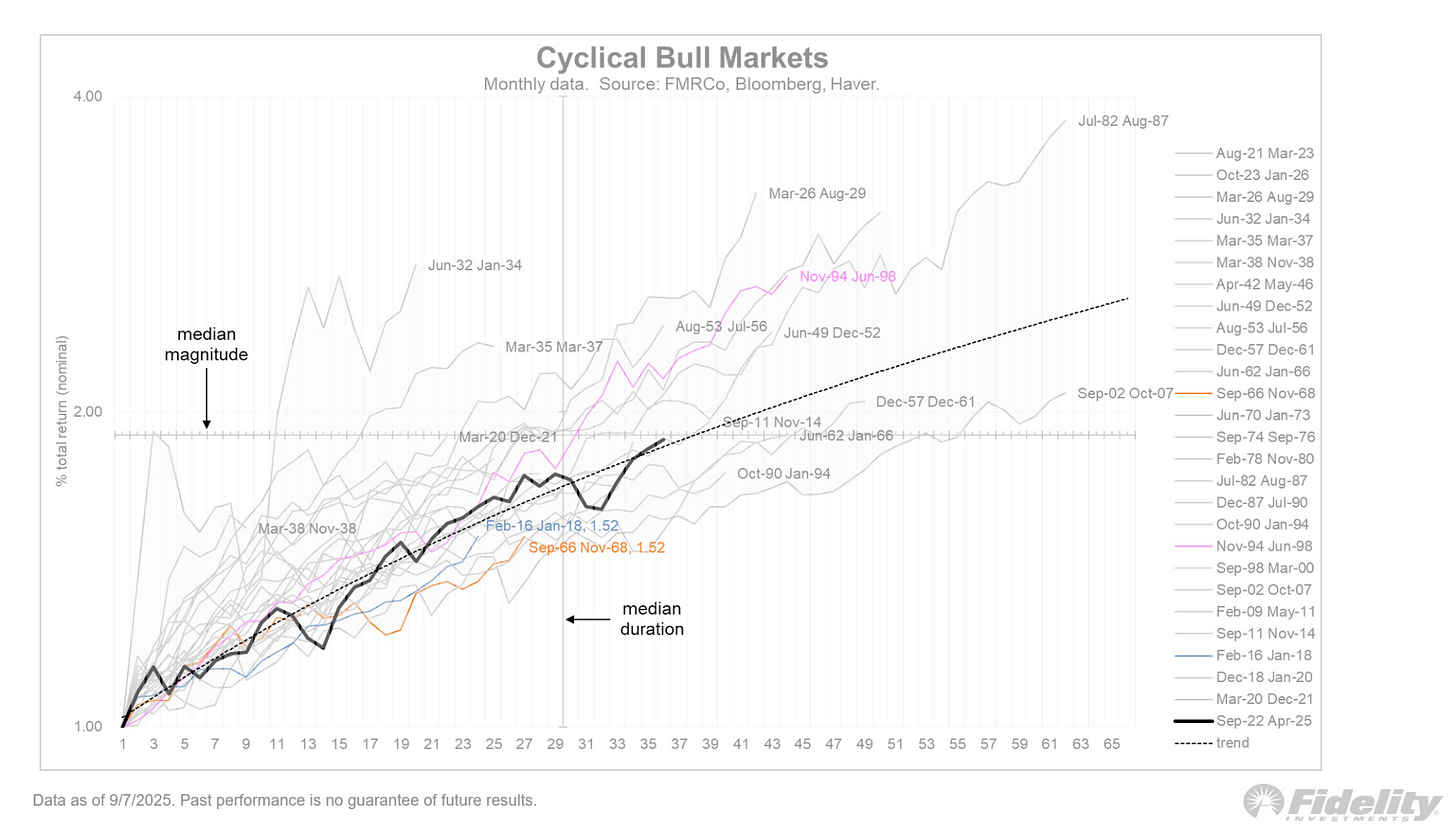

A bull market that’s comfortably average

With all the talk of an imminent top, the current rally is right in line with historical averages.

Nothing about this bull market is extraordinary, and that’s actually comforting.

If you’ve been waiting on the sidelines because you fear a bubble, history suggests that’s a costly strategy. Bull markets rarely end simply because they’re old or because valuations make headlines. They tend to roll over when fundamentals, like earnings growth and credit conditions, deteriorate. Right now, margins remain firm and credit markets healthy.

Market noise will tempt you to time the top, but the data show this advance is behaving like countless others before it, providing opportunity for disciplined investors rather than danger.

Final thought

Markets continue to climb the wall of worry, and while it’s easy to get caught up in the noise, the themes we’re invested in - AI, defense and industrial reshoring - continue to play out as expected. That’s the bigger picture.

Our long-term edge comes from sticking to a proven, rules-based strategy, not reacting to every hot take or scary forecast.

Stay diversified. Rebalance. Keep dry powder ready. The next leg higher will reward the disciplined.