Does Trump want to tank the economy?

The Predictive Investor - 3/9/25

Welcome to The Predictive Investor weekly update for March 9th, 2025!

While I consider myself to be more of a micro investor, it’s been impossible to ignore the steady stream of macro news since Trump took office in January.

It’s also getting increasingly harder to sort through the noise. The traditional news media has become far too sensationalized to be taken at face value, and social media tends to amplify all the wrong things.

Nevertheless, we must try to understand what’s going on from a rational perspective, because that is the first step in keeping our emotions in check.

Here’s my takeaways from the week.

Current market behavior is not unusual

Over the last couple weeks I’ve highlighted that the market is performing in line with seasonal patterns from mid-February through mid-March.

Last week I came across a chart that compares the S&P 500 YTD with price action from 2018-2019, when Trump launched tariffs during his first term.

The similarities are hard to ignore, and show that the uncertainty around tariffs is often a bigger factor than the tariffs themselves.

When tariffs are clear and predictable, businesses and markets can adapt. But when uncertainty lingers, it paralyzes decision-making, creates volatility, and drags stock prices down.

I suspect we’ll see a relief rally when trade policy is settled. In the meantime, investors will be best served by using this opportunity to buy stocks in companies that will succeed despite the tariffs.

Does Trump want to tank the economy?

There’s been much speculation this week on the idea that Trump is deliberately trying to cause a recession. (Read)

I’m not sure if the administration wants to cause a recession or not. But Trump has made clear he wants the Fed to lower rates, and he is willing to inflict some short term pain to achieve this.

There’s a case to be made that the Fed is behind the ball once again with regard to interest rates. The Truflation reading is at 1.4%, well below the Fed’s 2% target. By escalating trade tensions, the administration forces the Fed to act more quickly to stimulate the economy to offset the downsizing of the government.

The tariffs on Canada and Mexico are also clearly about more than immigration and fentanyl. The Trump administration wants Canada and Mexico to join the U.S. in countering China. Agreeing to a joint North American tariff on Chinese imports is likely the only thing that Canada and Mexico can do to avoid tariffs by the U.S. It’s a risky gamble, but it could very well pay off.

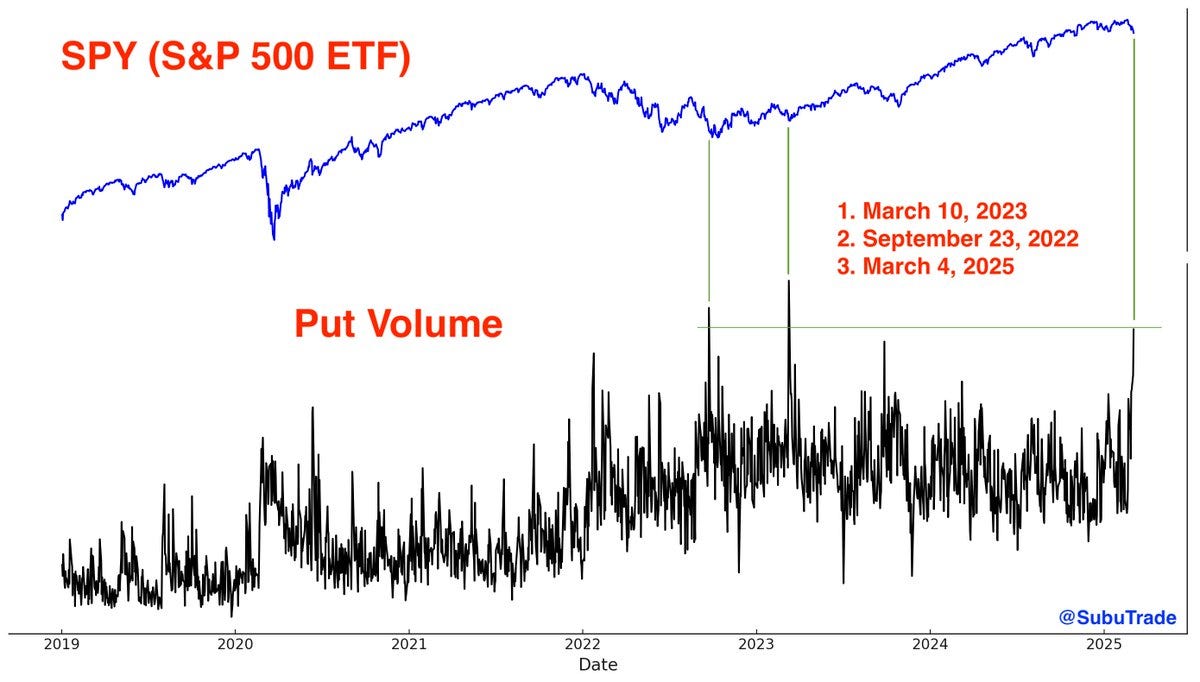

Put volume skyrockets

In another sign of peak pessimism, put volume on the S&P 500 ETF reached one of the highest levels in history. Historically, put volume spikes at these levels coincided with price lows for the index.

Why you want to buy on weakness

I’m sure you’ve seen charts similar to the one below, that show leaving the market during times of volatility is often a losing strategy. That’s because some of the market’s best days occur near some of the market’s worst days.

The biggest challenge with investing is managing your emotions. A rules-based strategy like the one we advocate here is critical to picking stocks that deliver better returns than the market. But sticking to it through thick and thin is what determines success or failure.