Economic Trends to Watch in 2025

Explore the economic trends shaping 2025, including growth forecasts, inflation, technology advancements, and investment strategies amidst geopolitical tensions.

Economic Trends to Watch in 2025

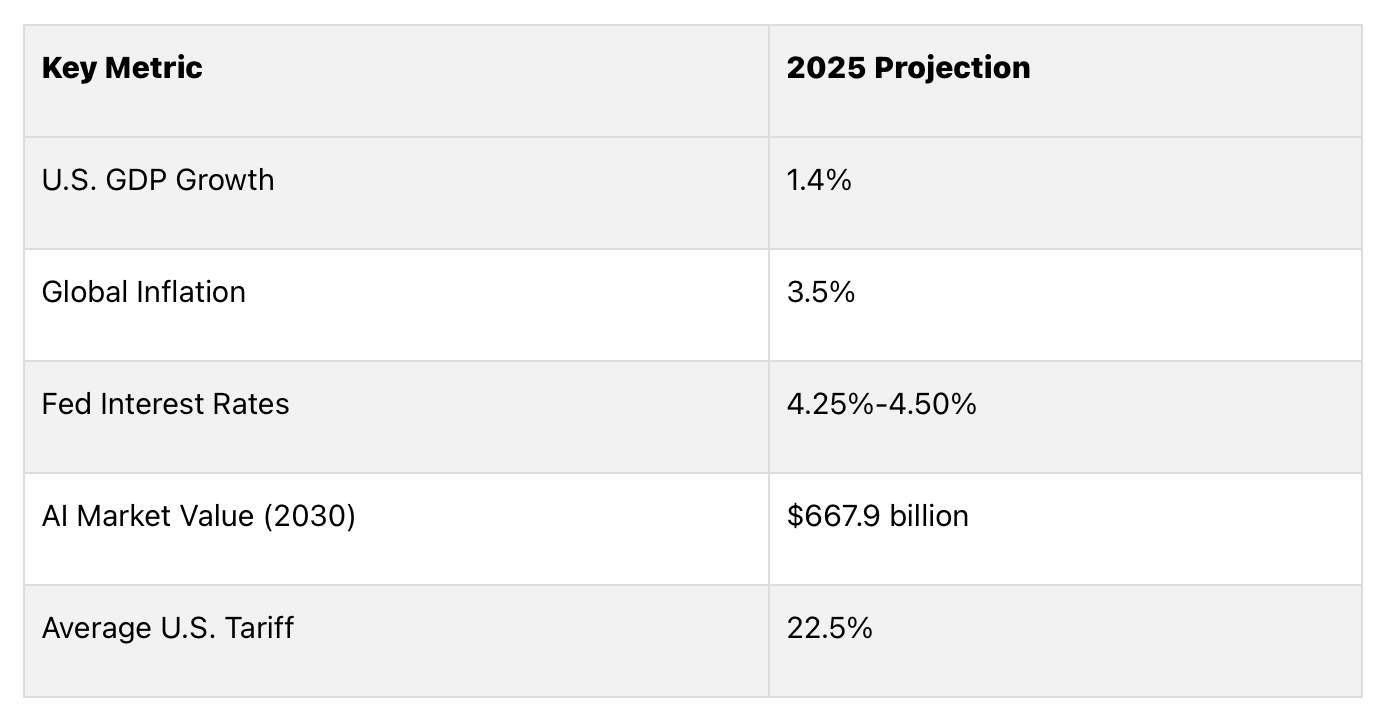

Global Growth Slowdown: The U.S. economy is projected to grow at 1.4% in 2025, while global GDP growth is expected to average 2.5% for the decade - the slowest since the 1960s. Inflation is predicted to ease but remain above target levels at 3%.

Interest Rates and Inflation: The Federal Reserve's interest rates remain steady at 4.25%-4.50%, with inflationary pressures from tariffs and geopolitical tensions complicating monetary policy.

Technology Opportunities: Artificial Intelligence (AI), quantum computing, and renewable energy are reshaping industries, offering growth potential in sectors like cybersecurity, energy storage, and HealthTech.

Trade and Policy Risks: High tariffs, immigration policies, and tax uncertainties are driving market volatility, impacting GDP growth and consumer spending.

Investment Strategies: Diversify geographically, balance high-growth tech with stable sectors, and consider alternative assets like inflation-linked bonds and infrastructure to manage risks.

Prepare for 2025 by focusing on disciplined investing, leveraging technology, and staying informed about economic and political shifts. Diversification and long-term strategies will be critical in navigating these challenges.

Kristina Hooper’s Economic Outlook: What’s in Store for 2025

2025 Economic Outlook

The U.S. economy is bracing for a slowdown in 2025, with forecasts pointing to sluggish growth and persistent inflation. These challenges are adding layers of complexity for portfolio planning.

U.S. GDP Growth and Jobs

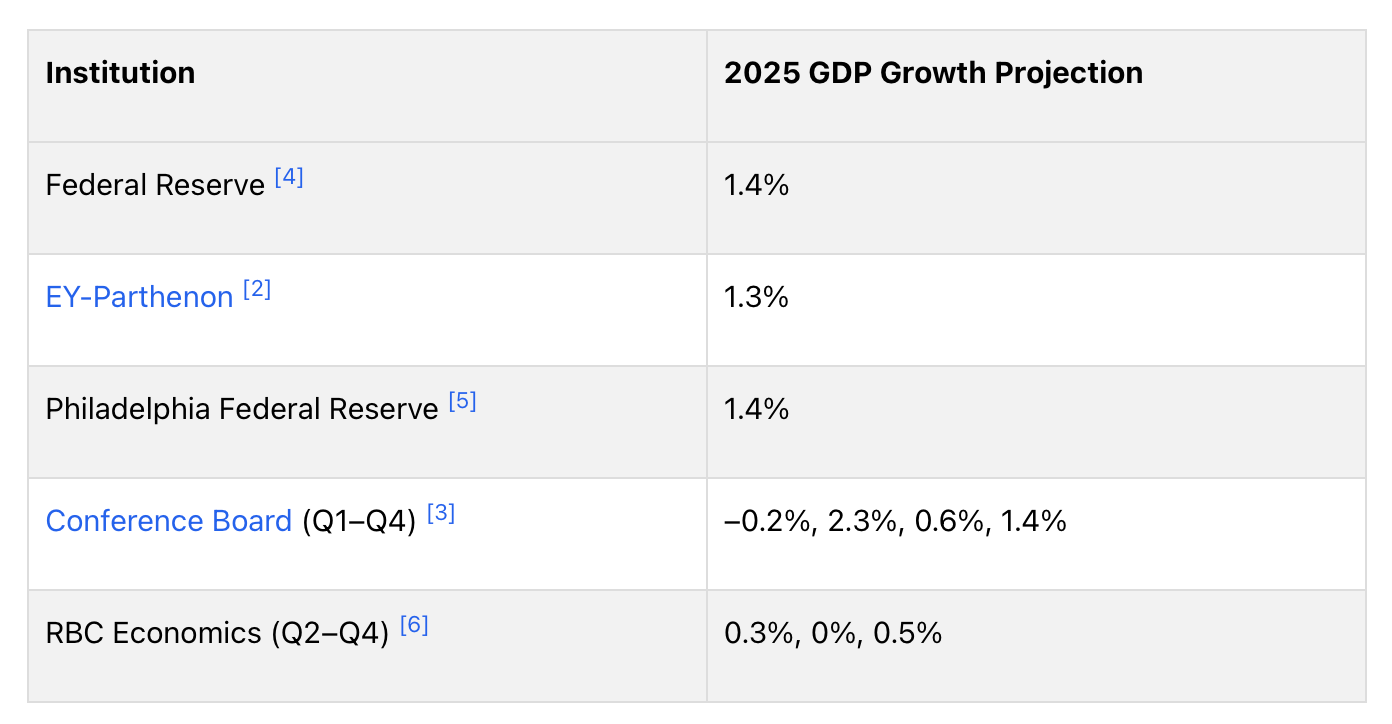

Projections for U.S. GDP growth in 2025 suggest a steady decline. The Federal Reserve has reduced its forecast for GDP growth to 1.4%, down from an earlier estimate of 1.8% in March. This aligns with the Philadelphia Federal Reserve's Survey of Professional Forecasters, which also predicts a 1.4% rise in real GDP for the year.

Quarterly growth forecasts paint a mixed picture, ranging from a slight contraction of -0.2% in Q1 to a modest 1.4% by Q4. RBC Economics warns that growth may hover near zero for much of the year, with estimates of 0.3% in Q2, 0% in Q3, and 0.5% in Q4. As RBC analysts explain:

"We aren't forecasting a technical recession in 2025, but we have a significant slowdown in growth which flirts around 0% for three quarters (0.3% in Q2, 0% in Q3, 0.5% in Q4), and could fairly easily tilt the U.S. economy into recession should it experience further downside shocks."

This slowdown is expected to push unemployment to 4.5% by the end of the year, with tariffs potentially adding another 0.4 percentage points to the rate.

These figures highlight the challenges ahead and set the stage for careful adjustments in Federal Reserve policy.

Federal Reserve Policy and Interest Rates

The Federal Reserve remains cautious as it navigates the dual challenges of slow growth and inflation. Its benchmark overnight interest rate is currently in the 4.25%–4.50% range. Fed Chair Jerome Powell has underscored the uncertainty of future policy decisions, remarking:

"No one is confident in the rate path, and everyone would agree that they're all going to be data-dependent."

While officials anticipate two rate cuts in 2025, there’s little agreement on when they might occur.

Inflation is expected to remain a concern, likely settling around 3% by the end of 2025 - still above the Fed’s 2% target. Powell also highlighted the inflationary impact of tariffs, stating:

"Everyone that I know is forecasting a meaningful increase in inflation in coming months from tariffs, because someone has to pay for the tariffs ... between the manufacturer, the exporter, the importer, the retailer."

With slower growth and persistent inflation, investment strategies face mounting pressure. Jack McIntyre, portfolio manager for global fixed income at Brandywine Global, observes:

"There's still bias towards some version of stagnation, lower growth with rising sticky inflation."

These monetary policy uncertainties add to the broader economic risks tied to trade and government spending.

Trade and Government Spending Policies

Trade policy remains a key variable for economic performance in 2025. With the implementation of new tariffs, the average effective U.S. tariff rate is expected to climb to 22.5% - the highest since 1909. These tariffs are projected to generate $3.1 trillion in revenue over the next decade (2026–2035) but could reduce U.S. GDP growth by 0.9 percentage points in 2025.

The impact on households will be significant. Tariffs are forecasted to raise prices by 2.3%, leading to an average loss of $3,800 per household, with lower-income families bearing the brunt of the burden.

While government spending initiatives may provide some relief, their overall effectiveness remains uncertain. The Conference Board has warned of "sizable shocks to growth, inflation, and employment in the coming months as tariffs reverberate through the economy". Similarly, EY-Parthenon researchers caution:

"Equity markets have reacted with unwarranted optimism, overlooking the persistent economic drag posed by elevated tariffs."

These policy dynamics underscore the importance of flexible and well-informed investment strategies heading into 2025.

Inflation and Interest Rate Changes

The connection between inflation and interest rates has become increasingly intricate, shaped by persistent price increases and cautious monetary policies. Grasping these shifts is essential for making smart investment choices in a world where traditional economic patterns are being challenged. Below, we delve into the key drivers of inflation, the influence of interest rates on stock performance, and the role of the U.S. dollar in global markets.

What's Driving Inflation in 2025

Inflation continues to surpass the Federal Reserve's 2% target, standing at 2.4% in May 2025, with projections suggesting it could hit 3% by the end of the year. A significant factor behind this rise is the impact of tariffs. Additionally, geopolitical tensions are fueling energy market volatility and disrupting global supply chains, further contributing to price pressures.

These conditions have nudged the economy toward stagflation - a mix of sluggish growth and rising prices. As Wells Fargo Chief Economist Jay Bryson pointed out:

"The summary forecasts that were published today imply that the FOMC sees a bit more stagflation than it did in March".

This challenging combination complicates investment strategies, emphasizing the importance of understanding these inflationary drivers to build disciplined, data-informed portfolios.

How Interest Rates Affect Stock Values

The Federal Reserve has maintained a cautious stance, keeping interest rates steady at 4.25%-4.5% amidst uncertainty about future adjustments. This policy has had a noticeable impact on equity markets. Defensive sectors like utilities and consumer staples, trading at 21 times earnings, have shown resilience despite cost pressures.

On the other hand, growth-sensitive areas such as energy and technology are more vulnerable to shifts in economic outlooks, presenting both risks and opportunities for investors. Eric Freedman, Chief Investment Officer at U.S. Bank Asset Management, explains:

"The 10-year Treasury yield is a key barometer for risk assets such as stocks. At 4.50%, we're in a pretty good spot. If 10-year Treasury yields jump to 5% or higher, that would be more problematic".

In the healthcare sector, providers are currently valued at 13 times forward earnings, just below their historical average of 14 times. This suggests there may be selective opportunities, even as overall valuations remain high. These trends are critical for guiding portfolio adjustments and managing risk effectively.

U.S. Dollar Impact on Global Investing

Interest rate changes aren’t the only factor influencing markets - currency strength plays a significant role too. In 2024, the U.S. dollar gained 7%, even as the Federal Reserve implemented two rate cuts, underscoring its resilience. This strength is bolstered by robust U.S. economic growth, projected at 2.7% for 2024, compared to just 1.7% for other developed markets. Additionally, the yield gap between U.S. 10-year bonds and those of major trading partners has reached its highest point since 1994.

A strong dollar presents challenges for global investors. It can reduce the U.S. dollar value of foreign earnings and make American exports less competitive. Emerging markets with significant dollar-denominated debt also feel the strain. However, some experts suggest that the current strength of the dollar already reflects U.S. economic outperformance. If other economies exceed expectations, their currencies could strengthen in turn.

For investors following structured strategies, these dynamics highlight actionable options. As of June 17, 2025, money market funds are yielding 4.10%, while CDs with durations from three months to five years offer rates between 4.35% and 4.5%. These instruments provide appealing alternatives to riskier investments.

Technology and Industry Changes

Technological progress is reshaping industries at an unprecedented pace, creating fresh opportunities while transforming established markets. Innovations like artificial intelligence, quantum computing, and advancements in connectivity are not only driving growth but also redefining strategies across various sectors.

Major Technology Advances in 2025

Artificial intelligence (AI) continues to dominate the tech landscape, with the generative AI market projected to hit $667.9 billion by 2030, growing at an annual rate of 24.4% from 2023 to 2030. Beyond its economic scale, generative AI is expected to contribute an impressive $4.4 trillion annually to the global economy. This rapid adoption is already reshaping hiring trends - 71% of business leaders say they are more inclined to hire candidates with generative AI skills, even if they lack extensive experience, over those with more experience but no AI expertise. Upskilling in AI has become a priority for many organizations.

Meanwhile, quantum computing is moving from theory to practicality, making strides in areas like cryptography and drug discovery. Additionally, the rollout of 5G continues to expand, delivering speeds up to 10 times faster than 4G and peak rates of 20 Gbps. This boost is fueling the growth of the Internet of Things (IoT), with connected devices predicted to reach 30 billion by 2025. These advancements also support technologies like augmented reality and autonomous vehicles, setting the stage for a wave of innovation.

New Industries and Growth Opportunities

As these technologies evolve, they are driving the emergence of new industries and unlocking growth in existing ones. Global IT spending is forecasted to grow by 9.3% in 2025, with software leading the charge at an annual growth rate of 14%.

One of the most pressing areas of opportunity is cybersecurity. With the global cost of cybercrime expected to reach $10.5 trillion by 2025, demand for security solutions is surging. The market for security products alone is projected to hit $200 billion by 2028. Companies like Palantir illustrate this trend, reporting 45% year-over-year revenue growth in 2024, driven by a growing base of commercial clients.

Renewable energy is another sector with immense potential. Solar power generation is expected to grow by 276% between 2023 and 2033, while wind energy will see a 115% increase over the same period. Tesla’s energy storage business highlights this growth, with a 40% revenue jump year-over-year in 2024.

Space technology is also gaining traction, with private companies advancing satellite internet, space tourism, and resource exploration. Meanwhile, HealthTech and telemedicine are expanding rapidly, fueled by demand for remote healthcare and AI-driven advancements in drug discovery and diagnostics. This sector is also seeing heightened interest in mental health technologies and personalized medicine.

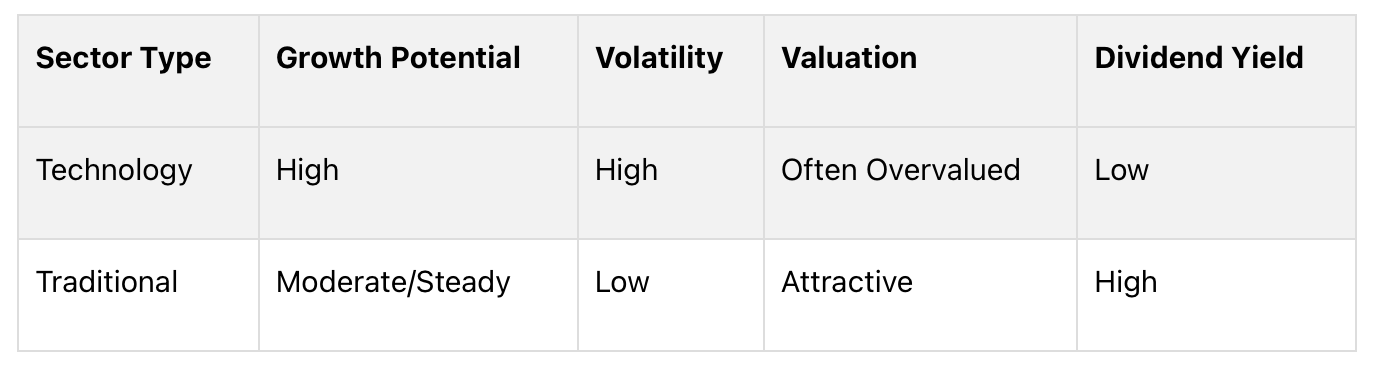

Mixing Old and New Sectors

In a time of rapid technological change, balancing investments in high-growth tech sectors with traditional industries is essential for managing risk. Analysts project an 11% price gain for the S&P 500 by the end of 2025, signaling opportunities across both emerging and established markets.

For instance, NVIDIA demonstrated its potential with 36% year-over-year revenue growth in Q4 2024, driven by its H100 GPUs powering AI infrastructure. On the other hand, traditional sectors like financials, healthcare, and consumer goods offer stability, attractive valuations, and reliable dividend income, making them a valuable counterbalance in a portfolio.

Thematic investing offers another way to achieve diversification. By targeting areas like renewable energy and robotics, investors can align with long-term trends while maintaining balance. McKinsey estimates that automation could add $1.2 trillion to the global economy by 2030, underscoring the growing promise of robotics and automation technologies.

Success in blending these sectors depends on a disciplined approach - carefully evaluating company fundamentals, valuations, and broader economic trends. This strategy allows investors to harness the potential of cutting-edge technologies while ensuring stability through traditional sector exposure.

Political and Policy Changes

The political landscape in 2025 is fueling market uncertainty. These shifts not only create challenges but also shape the investment strategies discussed later.

Major Political Risks

Trade tensions are a top concern for investors. The average effective tariff rate has surged past 15%, the highest since the Great Depression in the 1930s. These tariffs, many aimed at China, have disrupted global trade patterns and increased the likelihood of retaliatory measures. As a result, global investors are reevaluating their international allocations.

Immigration policy changes present another challenge. The reinstatement of the "Remain in Mexico" policy could reduce net migration from 1.1 million to 800,000 annually, potentially shrinking GDP by 0.5% over five years. This would also impact consumer spending and limit workforce growth.

Debt-ceiling debates add to the uncertainty. These debates often stall legislative agendas and have historically caused market volatility, influencing government spending priorities.

Cybersecurity threats are escalating, putting critical infrastructure at risk. These attacks can destabilize financial institutions and disrupt global trade, adding another layer of volatility to markets.

"The market is not currently pricing in any second inflationary impact in the form of a wage-inflation spiral, which could happen fast, and the market is not pricing in any recession impact." Gang Hu, Trader, WinShore Capital Partners

Policy Changes and Market Effects

Tax policy uncertainty looms large as the Tax Cuts and Jobs Act (TCJA) is set to expire at the end of 2025. If the TCJA expires, taxes could rise for 62% of filers. Meanwhile, new proposals suggest increasing the Section 199A deduction to 23% and raising standard deductions to $26,000 (joint), $19,500 (head of household), and $13,000 (single) for 2025–2028. These changes could influence consumer spending and investment decisions.

Trade agreements offer some relief amidst broader tensions. For instance, on May 8, 2025, the U.K. removed its 20% retaliatory tariff on U.S. beef imports and introduced a tariff-free quota for U.S. beef. Additionally, a preferential duty-free quota of 1.4 billion liters of U.S. ethanol was established. Separately, the U.S. and China agreed to reduce tariffs by 115% starting May 14, 2025, temporarily setting a 30% baseline tariff on Chinese goods for 90 days.

Healthcare policy changes are raising concerns for the pharmaceutical sector, managed care beneficiaries, and insurance providers. These shifts could create sector-specific risks that require close monitoring by investors.

Managing Political Risk in Portfolios

In a world already grappling with economic and technological disruptions, these political risks demand thoughtful portfolio adjustments.

Diversification strategies are essential. Spreading investments across various asset classes and regions can help mitigate risks tied to specific markets or policies. With geopolitical tensions and supply chain realignments on the rise, geographic diversification has become increasingly important for managing challenges and capturing opportunities across global markets.

Enhanced liquidity management is another key strategy. Maintaining sufficient cash reserves and liquid assets allows investors to act quickly during periods of market instability, taking advantage of opportunities as they arise.

Alternative investments can reduce exposure to traditional market risks. Options like market-neutral strategies, inflation-linked bonds, gold, infrastructure investments, and short-term bonds can offer stability in politically turbulent times.

Scenario analysis has become a valuable tool for understanding how different political outcomes might impact portfolios. This approach helps investors prepare for a range of policy changes and adjust their holdings accordingly.

Tax-aware planning is increasingly important in light of potential tax law changes. Investors should explore strategies that minimize tax impacts on their portfolios.

Emphasizing quality investments - companies with strong financials and consistent earnings - can also help mitigate risks during times of political and economic uncertainty."This is not the moment to be passive." Nigel Green, CEO, deVere Group

Navigating political risks requires a disciplined yet flexible approach. Reacting emotionally to geopolitical events often leads to poor investment decisions, so sticking to a systematic strategy is critical. This aligns with the methods outlined in the next section, which focuses on applying trends to rules-based investing.

These political dynamics highlight the importance of proactive risk management, setting the foundation for a disciplined investment approach.

How to Apply These Trends to Rules-Based Investing

The economic landscape of 2025 calls for systematic, data-driven portfolio management that removes emotional decision-making. Below, we break down practical strategies for rebalancing, stock selection, and maintaining discipline.

Portfolio Rebalancing and Risk Controls

Dynamic rebalancing is more important than ever, especially with the S&P 500 gaining over 20%, leading to increased portfolio concentration risks. International equities have also outpaced U.S. equities in Q1 2025, with European indexes outperforming U.S. markets by the largest margin in two decades. This opens up new opportunities for geographic rebalancing.

AI-powered tools are reshaping asset allocation by analyzing real-time data and using predictive analytics to adjust portfolios based on market conditions. For those regularly contributing to their investments, directing new funds toward underweight assets - known as Accumulation Rebalance - can be a smarter alternative to the traditional sell-and-buy approach.

Pay attention to changing correlations. For instance, low-volatility factors now offer similar returns with less risk. Strengthen portfolio resilience by incorporating market-neutral strategies, inflation-linked bonds, gold, infrastructure, and short-dated bonds. While cash has its place, holding too much can be costly; since 1981, cash has delivered annualized returns of 4.1%, compared to 6.8% for U.S. investment-grade bonds.

Sector rotation should also consider sensitivity to economic changes. Utilities and consumer staples are less affected by shifts in growth and inflation, while energy and technology sectors tend to be more volatile.

"Higher volatility alongside unreliable stock/bond correlation demands that investors think critically about diversification." - Gargi Pal Chaudhuri, Chief Investment and Portfolio Strategist

Finding Growth Stocks with Data

Quantitative screening tools have made stock selection more precise. For example, stocks rated "A" by WallStreetZen's quant ratings system have historically delivered annual returns of 32.52%.

The technology sector remains attractive despite recent market swings. The global AI market is expected to grow at an annual rate of 35.9% from 2025 to 2030, while cloud computing is projected to hit $2.39 trillion by 2030.

"The AI opportunity is moving from theory to practical application. While generative AI gets headlines, the real opportunity lies in applied AI solutions." - Marcel Miu, CFA, CFP, founder of Simplify Wealth Planning

Access to alternative data sources provides an additional edge. Platforms like Quiver Quantitative track congressional trading, insider activity, and even government contracts. Other unique data points - such as social media sentiment, corporate jet movements, and supply chain disruptions - can enrich stock analysis.

Factor-based screening is another powerful tool for finding undervalued opportunities. Developed markets outside the U.S. often feature higher dividend and earnings yields, offering both diversification and potentially stronger returns.

"Don't confuse innovation with profitability. A compelling product or visionary mission doesn't always translate into sustainable business fundamentals. Look for companies that not only lead in innovation but have competitive moats that can hold over time." - Jason Gilbert, CPA/PFS, CFF, CGMA, founder of RGA Investment Advisors

Staying Disciplined During Market Swings

Identifying growth opportunities is critical, but staying disciplined through market volatility is what ensures long-term success. Systematic execution helps investors avoid emotional decisions during turbulent times. With slower growth and shifting trade policies creating complex macroeconomic signals, discipline is key.

Automated trading systems can execute pre-set rules, eliminating emotion from the equation. Real-time data feeds and technical analysis tools allow for quick, systematic reactions to market movements, while custom alerts notify investors of significant price changes or news events.

Robo-advisory platforms are also playing a larger role, with global robo-advisory services expected to manage over $2.5 trillion in assets by 2025. These platforms automatically build and rebalance portfolios based on individual risk preferences.

Scenario modeling is another valuable tool, helping investors project portfolio performance under various market conditions. This reduces the likelihood of panic selling during downturns. Automating risk management protocols - like stop-loss orders and maintaining diversification - can also mitigate downside risks, especially when investing in high-volatility sectors such as disruptive technologies.

In 2025, success hinges on leveraging technology effectively, from basic mobile apps to advanced analytics, while adhering to disciplined, systematic strategies. By staying adaptable and focused on long-term goals, investors can navigate changing markets with confidence, guided by data-driven decisions.

Conclusion: Getting Ready for 2025 and Beyond

As we look toward 2025, the economic outlook presents both hurdles and openings for investors ready to rethink their strategies. Constraints from the Federal Reserve and massive investments in AI signal a shift that calls for a more data-informed approach to portfolio management. These forces challenge traditional methods and encourage investors to align their strategies with emerging realities.

The performance of international equities, outpacing U.S. markets by the widest margin in two decades, highlights the potential for those willing to expand their horizons. For instance, Latin American equities are trading at notable discounts, while China's tariffs are estimated to shave 2% off GDP. This underlines the importance of geographic diversification - not just as a way to find value but also as a means to mitigate risk.

Meanwhile, the ongoing technological transformation continues to reshape investment opportunities. While AI and other innovations dominate headlines, success lies in identifying ventures that create genuine value rather than chasing trends. Significant investments in AI infrastructure reflect a broader pivot toward tech-driven growth, but experts stress that innovation must be anchored in sustainable profitability and a strong competitive edge.

In this shifting landscape, disciplined investing remains critical. Political uncertainties and policy shifts will undoubtedly persist, but a rules-based approach can help investors navigate these challenges with greater confidence. This includes managing the inflationary effects of tariffs and tapping into opportunities created by the reconfiguration of global trade. Gargi Pal Chaudhuri of BlackRock emphasizes the importance of diversification in today’s market:

"Diversification today requires looking beyond duration. Investors should consider layering in alternative and market neutral strategies, alongside inflation-linked bonds, gold, infrastructure, and short dated bonds to seek to reduce correlation risk and enhance resiliency across asset classes".

Integrating technology into investment strategies - such as AI-powered portfolio rebalancing and systematic risk management - can enhance the precision and efficiency of decision-making. However, the core principles of investing remain unchanged: thoughtful diversification, staying informed about economic and geopolitical shifts, and maintaining a steady long-term perspective, even during market turbulence.

FAQs

How could a global economic slowdown in 2025 impact your investment strategy?

A potential global economic slowdown in 2025 might lead U.S. investors to take a more cautious approach. Many could gravitate toward high-quality fixed-income investments and dividend-paying stocks to manage risk while ensuring consistent returns. Exploring options like municipal bonds or hedge funds might also offer ways to navigate market volatility and uncertainty.

With the possibility of slower growth paired with higher inflation, focusing on stability and risk management becomes crucial. Sectors like renewable energy and advanced technology, which show promise even during challenging economic times, may offer attractive opportunities. Building a well-diversified portfolio around these trends could provide a solid foundation for achieving long-term financial objectives.

How might high tariffs and geopolitical tensions affect the U.S. economy and consumer spending in 2025?

High tariffs and ongoing geopolitical tensions are set to weigh heavily on the U.S. economy and consumer spending in 2025. Experts predict these challenges could slow economic growth, with real GDP potentially dropping by about 0.9 percentage points. Long-term GDP may also take a hit, shrinking by around 0.6%, which translates to roughly $160 billion annually when adjusted for 2024 dollars.

For consumers, the impact of higher tariffs is expected to show up in household budgets, increasing costs by about 2.3%. This spike in expenses could lead to weaker retail sales and slower consumption growth, possibly falling to around 1.5%. That’s a clear drop compared to previous years. With rising prices and an uncertain economic environment, households may feel compelled to cut back on discretionary spending, further cooling economic activity. These factors paint a cautious picture for both businesses and consumers heading into 2025.

What key technological advancements in 2025 could create major investment opportunities, and how can investors take advantage of them?

In 2025, artificial intelligence (AI), 5G and advanced connectivity, and renewable energy technologies are shaping up to be key areas for investment. AI and machine learning are transforming industries, offering businesses tools to improve efficiency and spark innovation. At the same time, the expansion of 5G networks is opening doors to new applications and services, particularly in telecommunications, IoT, and infrastructure.

For investors, the focus should be on companies driving advancements in AI, building 5G infrastructure, or creating cutting-edge renewable energy solutions. Renewable energy stands out as a sector with strong growth potential, thanks to ongoing technological progress and increasing policy support for cleaner energy options. By strategically diversifying into these forward-thinking industries, investors can set themselves up for potential long-term gains.