Factor Investing: The Ultimate Guide for Investors

A Comprehensive Guide to Factor Investing Strategies and Techniques

Are you tired of feeling left out when it seems like everyone around you is making money in the stock market? Are you ready for a smarter, more data-driven approach to investing? Then it’s time to consider factor investing.

Here’s the deal: traditional stock-picking methods are unreliable, and the process of analyzing individual stocks can be time consuming and frustrating.

But with a factor-based investing strategy, you’re investing in a smarter way – by focusing on specific factors or characteristics that have historically driven excess market returns.

Think of it like this: instead of trying to predict the future of a single stock, you’re tapping into proven market factors that have consistently driven higher returns over time.

And the best part? You don’t have to be a Wall Street insider to take advantage of these strategies.

So if you’re ready to take your investing game to the next level, factor investing might just be the smartest move you’ll ever make.

In this ultimate guide to factor investing, we'll cover everything you need to know about building a market-beating portfolio using factors to select stocks. So let's get started!

How To Pick Stocks

Before we get into factor investing, let’s review the different methods of selecting stocks, and why we think they present too many challenges to use effectively.

Fundamental Analysis

The traditional method for picking stocks, fundamental analysis involves researching a company's financial statements, industry trends, management team, competitive landscape, and other relevant information to determine the value of the company. While it’s true that fundamentals like earnings drive stock prices over time, the problem with fundamental analysis is that it can be very subjective and requires a significant amount of research to accurately analyze a company’s financial statements and competitive position. Fundamental analysis is often wrong, as unexpected events or changes in the market can impact a company’s financial performance in ways that are difficult to predict.

Technical Analysis

Technical analysis involves evaluating securities by analyzing trends gathered from trading activity, such as price and volume. Technical analysts use charts and other tools to identify patterns and trends in the market and individual securities in order to predict future movements in price. While we often use technical analysis to identify trends, it’s impossible to predict the potential of a company on technical analysis alone. Technical analysis is also highly subjective, and analysts can come to very different conclusions by looking at the same data. While technical analysis is a useful tool to identify supply and demand of shares, it’s best used as a tool to validate other strategies of selecting stocks.

Story Stocks

"Story stocks" refer to stocks of companies that have a compelling narrative behind them, often involving a unique or disruptive business model, innovative technology, or a charismatic founder or CEO. In the post-COVID market, they were often referred to as meme stocks. This is probably one of the worst ways to select stocks. The appeal of story stocks is often emotional rather than rational, as investors are drawn to the excitement and potential of these companies, rather than their current fundamentals or valuations. While the media covered many investors who made millions from story stocks like Gamestop, independent research has since shown that thousands of investors lost money on these stocks. It is also nearly impossible to replicate success, because story stocks involve a high degree of speculation and emotion, and the story often creates high expectations that are difficult for companies to live up to.

Factor Investing

Rather than selecting stocks based on a subjective analysis of individual companies, factor investing involves selecting stocks with specific characteristics that have historically outperformed the market. These factors can include things like value, momentum and quality, among others. Because these factors are quantitative, factor investing is an objective rules-based approach to buying and selling stocks, and we believe it offers investors the best opportunity to build wealth in the stock market.

What are Factors?

At a basic level, factors are the underlying characteristics of stocks that drive their returns. In factor investing, these characteristics are used to construct portfolios that aim to capture the performance of specific factors. For example, the value factor focuses on stocks that are priced cheaply relative to their fundamentals, while the momentum factor looks for stocks that have shown strong recent performance.

It's worth noting that factors are different from asset classes, which are broad categories of investments such as stocks, bonds, and real estate. While asset classes can be broken down into subcategories (such as small-cap stocks or emerging market bonds), factors are more specific and tend to focus on particular drivers of returns.

So how are factors used in investing? Factor investing strategies seek to overweight or underweight different factors within a portfolio in order to achieve specific investment goals. For example, a value factor investing strategy might overweight stocks with low price-to-earnings ratios and underweight stocks with high price-to-earnings ratios.

There are a variety of ways to implement factor investing strategies, including through individual stock selection, factor investing ETFs, and factor investing funds. For example, BlackRock offers a suite of factor investing ETFs that allow investors to easily gain exposure to specific factors.

We'll dive deeper into how to leverage factors in your portfolio. But first, a little history lesson.

History of Factor Investing

The origins of factor investing can be traced back to the early 20th century, when investors began to notice that certain stocks tended to outperform others based on specific characteristics. For example, Benjamin Graham and David Dodd, the fathers of value investing, observed that stocks with low price-to-earnings ratios tended to outperform stocks with high price-to-earnings ratios over time.

In the decades that followed, researchers continued to study the performance of different factors and how they could be used to construct portfolios. One of the most influential studies in this area was published by Eugene Fama and Kenneth French in 1992, which identified the size and value factors as significant drivers of stock returns.

Since then, factor investing has continued to evolve, with new factors identified and new ways to implement factor investing strategies. One notable development in recent years has been the rise of smart beta ETFs, which use factors to construct portfolios that aim to outperform traditional market-weighted indices.

Today, there are a variety of factors that investors can use in their portfolios, including the size, value, momentum, quality, and low volatility factors. Each factor has its own unique characteristics and performance history, and investors can use a combination of factors to construct a well-diversified portfolio that delivers superior returns.

The 5 Factor Investing Criteria that Beat the Market

Source: Visual Capitalist

In their book Your Complete Guide to Factor-Based Investing, Andrew Berkin and Larry Swedroe propose a set of criteria for deciding on which factors to focus on. In addition to delivering higher returns, the factor must be:

Persistent: the enhanced return should hold up across long periods of time and through various economic climates.

Pervasive: it should hold across various countries, sectors and asset classes.

Robust: it should hold no matter which metric you select to measure it. For example, the value premium should hold whether you’re measuring it by price-to-book, price-to-earnings, or price-to-sales.

Investable: the premium should hold up not just in backtesting on paper, but also after taking into account the costs of implementing the strategy in an actual portfolio.

Intuitive: there should be a logical explanation for why the premium exists and why it should continue to exist in the future.

With that in mind, here are the 5 factor investing criteria that meet these stringent requirements.

Value

The value factor focuses on stocks that are priced cheaply relative to their fundamentals, such as their earnings or book value. The theory behind the value factor is that these stocks are often overlooked by the market or have fallen out of favor and therefore have the potential to generate higher returns over time.

Berkin and Swedroe’s study shows that the odds of value outperforming growth are 78% over a 5-year period and 94% over a 20-year period.

Metrics used to screen for value stocks: price-to-earnings ratio, price-to-book ratio, price-to-sales ratio

Size

The size factor focuses on micro-cap and small-cap stocks, which are typically companies with a market capitalization of less than $2 billion. The theory behind the size factor is that these smaller companies have more room to grow and can generate higher returns over time. Small companies also tend to have greater leverage than large companies and can adjust to changing economic conditions faster than large companies.

Berkin and Swedroe’s study shows that the odds of small companies outperforming large companies is 70% over a 5-year period and 86% over a 20-year period.

Metric used to screen for small company stocks: market cap (under $300 million for micro cap stocks and $300 million to $2 billion for small cap stocks).

Momentum

The momentum factor focuses on stocks that have shown strong relative 12-month price performance. The theory behind the momentum factor is that trends in the stock market tend to persist over time and stocks that have strong recent momentum will continue to outperform in the future.

Berkin and Swedroe’s study shows that the odds of high momentum stocks outperforming low momentum stocks are 91% over a 5-year period and 100% over a 20-year period.

Metrics used to screen for momentum stocks: relative strength, 12-month performance vs. benchmark (such as S&P 500)

Quality

The quality factor focuses on companies with strong fundamentals, such as high profitability and low debt levels. The theory behind the quality factor is that these companies are more likely to generate sustainable earnings growth over time.

Berkin and Swedroe’s study shows that the odds of stocks of the most profitable firms outperforming stocks of the least profitable firms are 77% over a 5-year period and 93% over a 20-year period.

Metrics used to screen for quality stocks: earnings per share, return on equity, operating margin, return on capital, earnings yield.

Low Volatility

The low volatility factor focuses on stocks that have low price fluctuations over time. The theory behind the low volatility factor is that these stocks are less risky and therefore generate more stable returns over time.

Metrics used to screen for low volatility stocks: beta, standard deviation

The low volatility factor tends to work best when used in conjunction with other factors such as quality or momentum. In their article “The Volatility Effect: Lower Risk without Lower Return,” David Blitz and Pim van Vliet show that for developed market large-cap stocks, the lowest volatility group outperformed the highest volatility group by 5.9% annually over a 20-year period.

Factor Investing Beats The Market. Here’s the Proof

We’ve all been told that it’s impossible to beat the market, but that simply isn’t true.

When people talk about beating the market, they typically are referring to the S&P 500, which is really just a collection of stocks based on the size factor, or market cap.

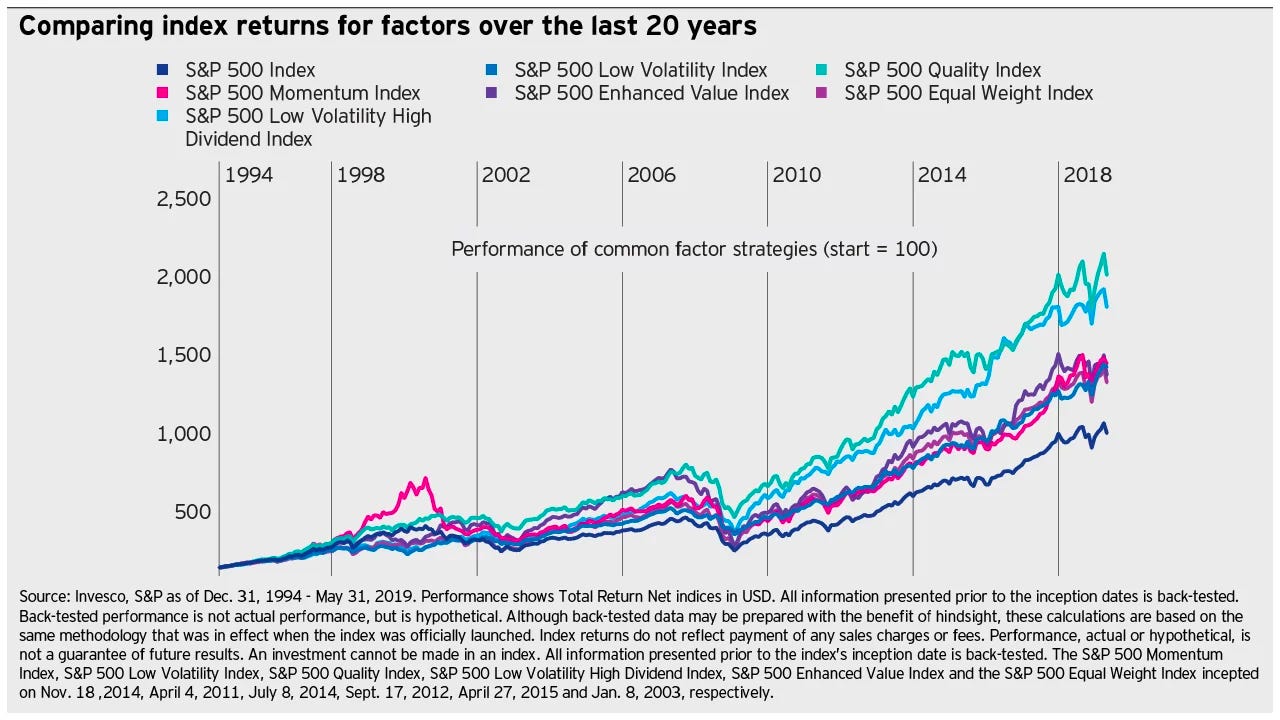

But if you change the factors by which you’re selecting stocks, it’s very much possible to beat the market. The chart below shows the S&P 500 indexed by various factors, all of which beat the market-cap weighted S&P 500 over a 20-year period.

Source: Invesco

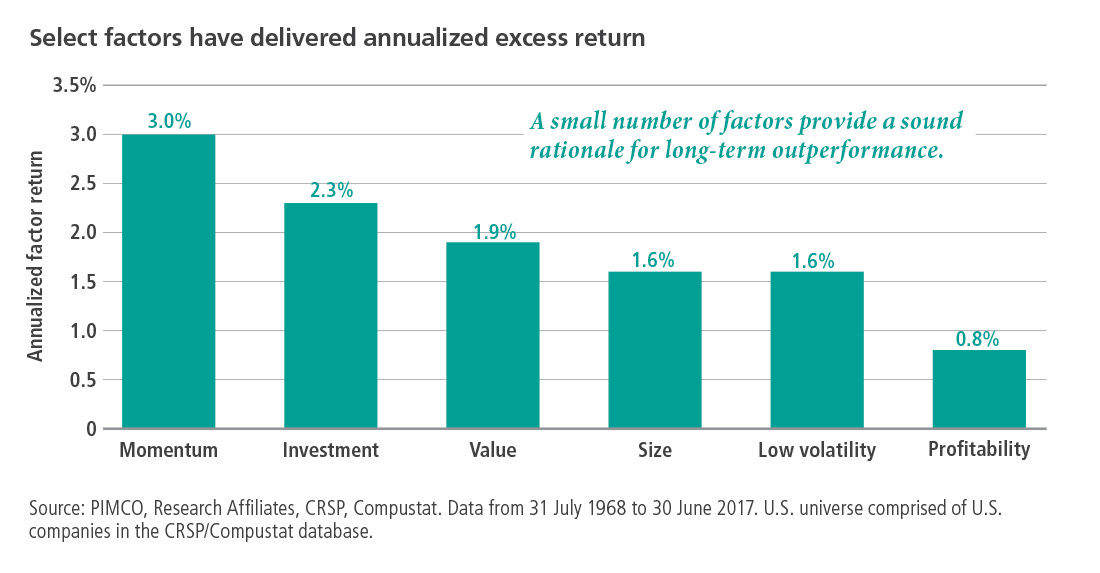

The outperformance of factors is not just a short term anomaly. Numerous studies, including the one in the chart below done by PIMCO, show that factors deliver outperformance over long periods of time.

Source: Barron’s

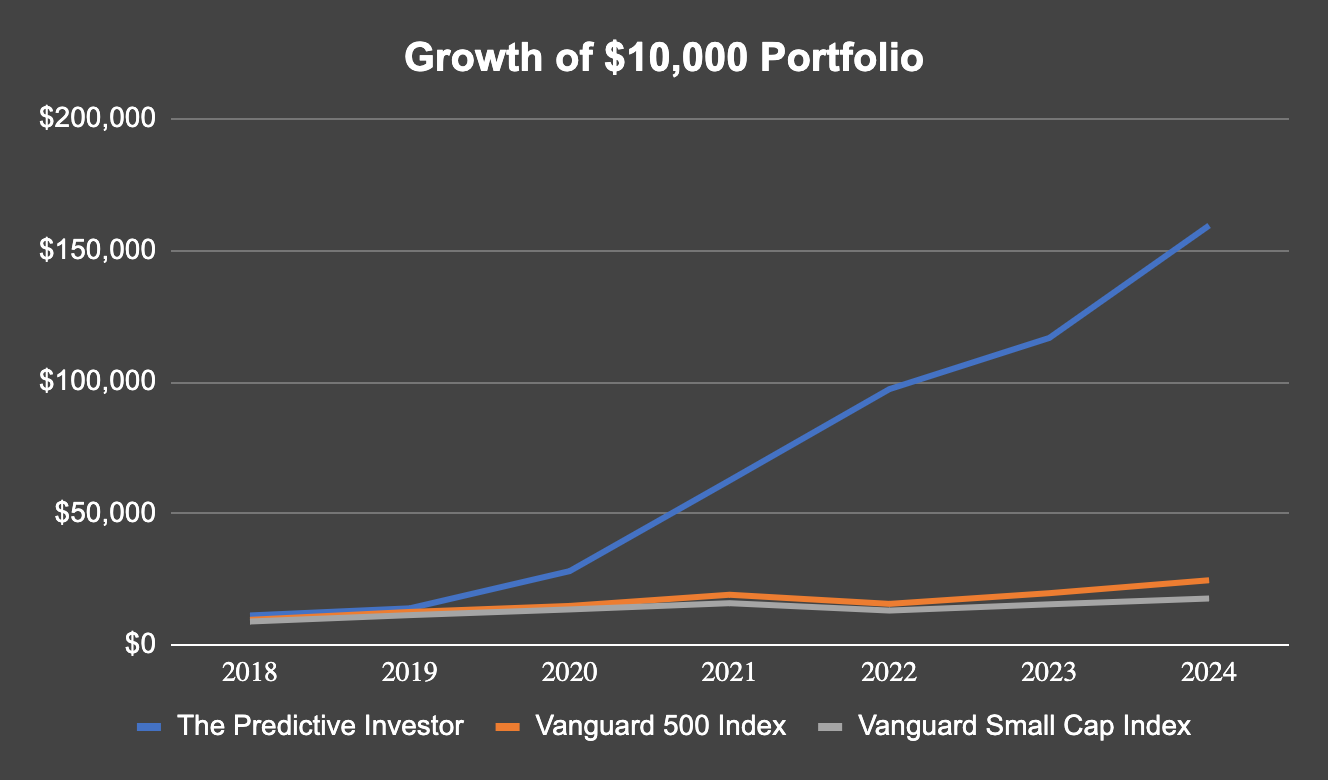

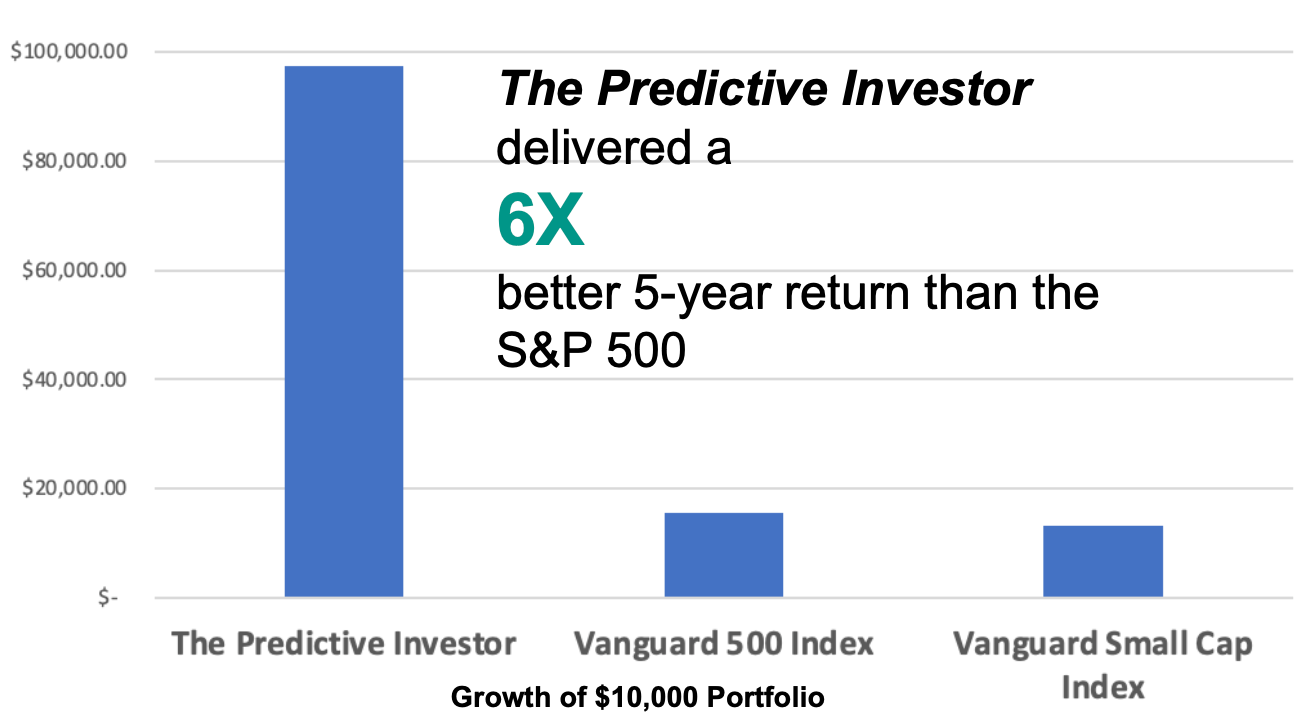

Additionally, our own experience running The Predictive Investor newsletter shows the superiority of selecting stocks based on factors. The chart below shows our 7-year performance against Vanguard’s 500 and small cap index funds. A $10,000 portfolio following The Predictive Investor grew to nearly $160,000 (vs. $25,000 for the S&P 500).

How to Implement Factor-Based Investing Strategies

The first decision to make is whether you want to invest by actively selecting individual stocks or passively through ETFs and mutual funds.

It’s relatively easy to gain broad exposure to single factors through low-cost ETFs. For example, BlackRock's iShares Edge MSCI USA Value Factor ETF (VLUE) is an ETF that invests in companies with low valuations relative to their earnings, sales, and book values. The fund is designed to track the performance of the MSCI USA Enhanced Value Index, which is made up of large and mid-cap U.S. stocks.

If you’re going to use a passive set it and forget it strategy, it’s best to combine factor ETFs with index funds to reduce risk as you move closer to retirement. For example, Paul Merriman’s Two Funds for Life strategy combines a small cap value ETF with a target date retirement mutual fund. Tilting the portfolio toward the size and value factors significantly outperformed the target date fund alone in more than 99% of 40-year periods, while only increasing portfolio downside risk by 2%-6%.

For the investor who’s willing to put in more time, we believe the best opportunities to beat the market involve using factors to select individual stocks. And the best part is, most of the work is already done for you.

Using Factors to Select Individual Stocks

There’s a huge body of published research detailing how to best use factors to select individual stocks.

For example, Joel Greenblatt’s Magic Formula strategy is a rules-based approach using the value and quality factors to select stocks that have historically beaten the market over time.

The book High Returns From Low Risk: A Remarkable Stock Market Paradox details a multi-factor strategy that uses the size, low volatility, quality and momentum factors to build a portfolio.

Here at The Predictive Investor, we use the size, value and momentum factors to build a portfolio of undervalued micro cap companies.

The most important thing is to select a strategy that best reflects your objectives and the kind of companies you want to be invested in. No factor strategy outperforms the market over all time periods. So aligning the strategy with your objectives will ensure you stick with it long enough to deliver the kind of results you’re looking for.

Here are some general guidelines when picking a factor investing strategy to select individual stocks:

1. Choose your factor strategy. This will most likely depend on your investment objective. If you are primarily investing for capital appreciation, the size and momentum factors are ideal. If you want income and stability, a quality and low volatility approach is best.

2. Backtest for proven results. The research should include rigorous backtesting that shows historical performance over a long period of time and through various economic climates to avoid any biases. This is critical to understanding how the strategy will perform and whether it matches your risk tolerance. The data should also show drawdown, volatility and portfolio turnover. For example, our micro cap portfolio historically has outperformed the S&P 500 by nearly 2 to 1, but has also been twice as volatile. Understanding how a strategy performs is critical to giving you the confidence to stick through it during uncertain times.

3. Don’t just buy a stock screen. Every factor strategy starts with screening the market for stocks that match the buy criteria. But just because a stock qualifies for the screen one month and then drops off the screen 2 months later doesn’t mean it should be automatically sold. A proven factor strategy should come with clear buy and sell rules that are supported by backtested results.

4. Establish target allocations. In general you’ll want to risk an equal amount per stock and diversify across industries. The goal is to create a diversified portfolio of at least 10-15 stocks that will be representative of the factor strategy you’ve chosen to invest in.

Advantages and Disadvantages of Factor Investing

Advantages:

Potential for higher returns: Factor investing targets factors that have historically generated higher returns than the broader market. By investing in these factors, investors have the potential to earn higher returns than they would with a traditional market-cap weighted portfolio.

Diversification: Factor-based investing offers investors a way to diversify their portfolio beyond traditional market cap index funds or target date retirement funds. By targeting specific factors, investors can potentially reduce their portfolio's overall risk.

Objectivity: Factor-based investing is typically rules-based, and the factors and buy/sell rules used to construct a portfolio are based on historical probabilities of delivering higher returns. This transparency allows investors to make logical, data-driven buy and sell decisions.

Disadvantages:

Risk: Just like any investment strategy, factor investing comes with its own set of risks. Factors that have historically generated higher returns may go through long periods of underperforming the market indices.

Complexity: Factor-based investing can be complex, with many different factors and strategies to choose from. It can be challenging for investors to navigate these options and choose the strategy that is right for them.

Fees: Unless you’re selecting individual stocks, factor-based ETFs and mutual funds can come with higher fees than traditional index funds, which can eat into investors' returns over time.

Risks Associated with Factor Investing

Factor-specific risks: Each factor has its own set of risks that investors should be aware of. For example, the value factor may be susceptible to economic downturns, while the momentum factor may be vulnerable to sudden market shifts. It's important for investors to understand the specific risks associated with the factor strategy they are investing in.

Overconcentration risk: Investing in a single factor can lead to overconcentration risk. If a factor suddenly falls out of favor or experiences a sharp decline, investors who are heavily invested in that factor could suffer significant losses. To mitigate this risk, investors should consider diversifying their factor exposure across multiple factors.

Performance chasing risk: Investors may be tempted to chase after the best-performing factors, which can lead to buying high and selling low. Instead, investors should focus on a well-diversified portfolio of factors and stick to their long-term investment plan.

Implementation risk: Factor investing can be complex and difficult to implement, especially because many of these strategies involve buying stocks of companies that are not well known, making it seem more risky. Poor implementation can lead to tracking error and underperformance compared to the backtested results.

In summary, the most important thing is to choose a strategy that matches your objectives. No factor strategy beats the market all the time. For example, even though over the long term value outperforms growth, there are long periods of time where growth outperforms value. Matching a strategy to your objectives will ensure you stick with it and maximize the probability of taking advantage of the long term outperformance.

Bottom Line: Factor Investing is the Best Way to Maximize Returns in the Stock Market

Based on the evidence, factor investing is clearly a superior strategy to building wealth in the stock market over traditional technical and fundamental analysis.

A rules-based approach to selecting stocks helps investors make decisions based on data, not emotions.

While factor investing offers several benefits, it is not without its potential drawbacks and risks. Investors should carefully consider their investment objectives, risk tolerance, and time horizon when choosing a factor investing strategy. They should also be aware of the potential risks associated with factor investing, such as exposure to concentrated sectors and potential for factor performance to change over time.

Looking to the future, factor investing is likely to continue to evolve and new factors may emerge as markets change. Investors who stay ahead of the curve and continually keep up to date on the latest factor investing research are likely to be well-positioned for long-term success.