Gridlock in the labor market

Slower hiring points to a Fed cut, but earnings and AI adoption keep the bull case intact.

Markets ended the week with modest gains despite a heavy focus on jobs data. Payroll growth slowed sharply, unemployment ticked up slightly, and for the first time in years the ratio of job openings to unemployed workers fell below 1.

It all points to a state of gridlock: companies aren’t ramping up hiring, but they’re not laying people off either.

For the Fed, that’s enough to move. Futures markets now price a 100% probability of a rate cut this month (CME FedWatch).

The big question for investors: how to position for the next leg higher.

Q2 GDP revised higher

The government revised Q2 GDP growth upward, primarily on stronger business investment and consumer spending. (Read)

Imports dropped sharply as companies had pulled forward purchases earlier in the year to get ahead of tariffs. Other key highlights include:

Average pace of expansion in the first half of 2025: 1.4%.

AI-related investment continues to prop up growth.

Consumer spending remains resilient despite higher borrowing costs.

Even with slow growth, businesses and consumers are still spending. The “AI multiplier” is keeping growth from slipping toward recession territory.

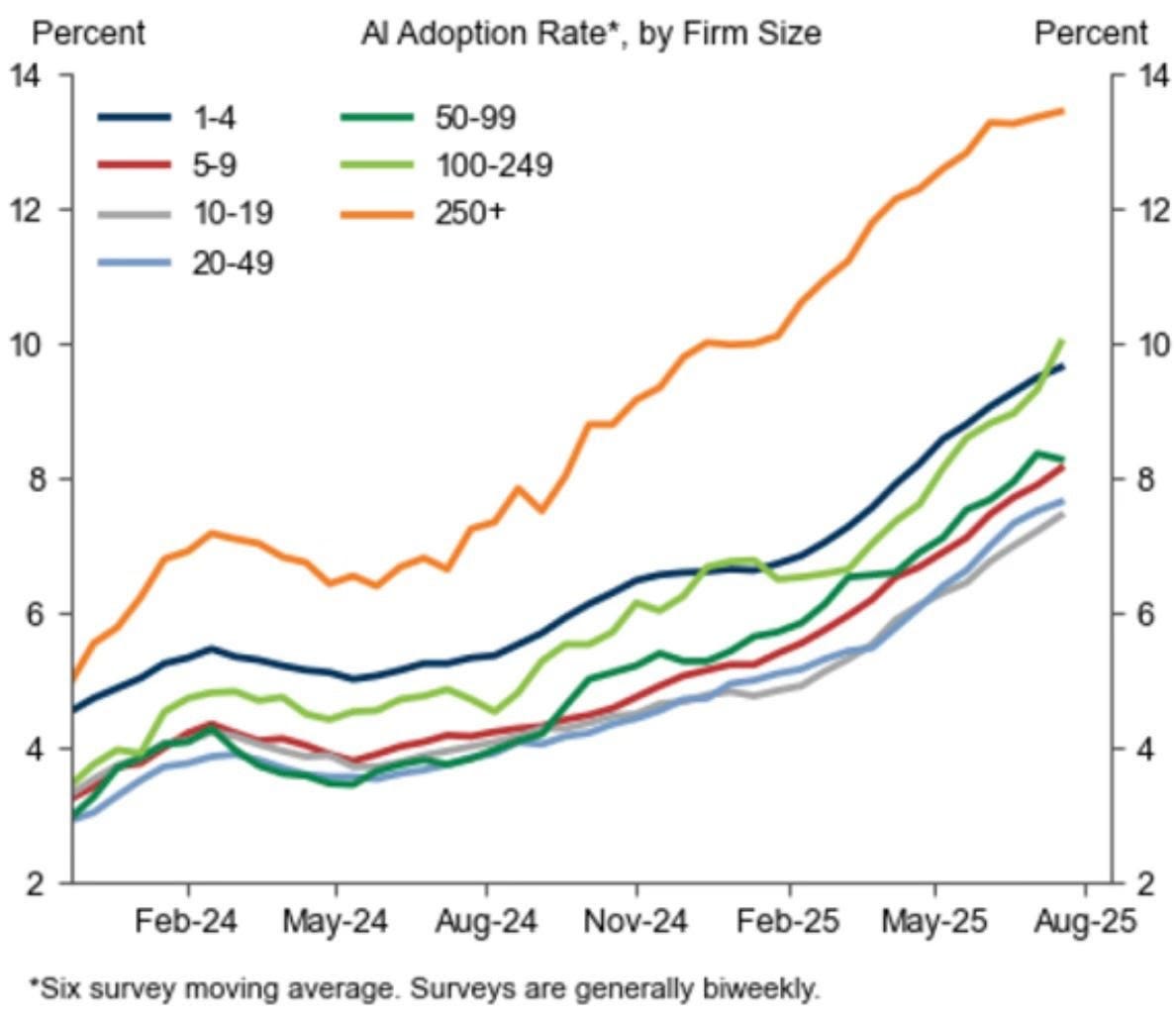

AI adoption has a long runway

Worried that AI spending will run out of steam? The data doesn’t support it. Adoption remains below 15% across most company size segments, which means we’re still early in the cycle.

Not to mention, in just the last few weeks:

Nvidia (NVDA) reported record revenue, driven by data center demand.

Anthropic closed another major funding round to expand its AI model development.

Statisg was acquired, adding momentum to AI software consolidation.

Alibaba unveiled its latest AI chip, stepping up competition in China.

287 S&P 500 companies cited AI on earnings calls, with many highlighting new AI deployments and use cases.

This is not the late innings of an AI bubble, it’s the early innings of broad corporate adoption. We will continue to focus our portfolio on companies best positioned to benefit from this secular growth trend.

Google gets a lifeline

Google scored a win in its long-running antitrust battle. (Read)

Regulators ruled that AI search competitors reduce Google’s market dominance, giving the company breathing room in the near term.

Ironically, the very force disrupting Google is what regulators pointed to as evidence of competition.

This ruling removes some near-term uncertainty. But Google must disrupt itself to keep pace with the AI shift.

We’re not buying here. Our indexed investments already provide exposure, and Google doesn’t meet our rules-based criteria for inclusion in the portfolio. To beat the market, we need companies growing much faster than the averages, and Google just doesn’t make the cut.

Yield curve steepens

Long term treasury yields rose as investors digested payroll data and shifted expectations for Fed policy. (Read)

But the deeper story is about the supply and demand for government debt. The government has been leaning on short-term issuance because demand just isn’t there for longer maturities.

Confidence in U.S. debt sustainability is weakening, a problem that won’t disappear with one rate cut.

We remain bearish on long-term bonds. With debt levels climbing, the only option is to print more money, making long-dated Treasuries a poor bet.

Final thought

Last week brought news of a softening economy, but investors should resist the urge to panic.

Short term, volatility may pick up as jobs, Fed policy, and politics dominate the headlines.

But looking ahead, there are powerful stimulants in place:

Rate cuts will free up capital for small and mid-sized businesses, broadening market leadership.

The new tax bill provides fresh incentives for Capex and R&D spend, fueling investment.

AI adoption remains a secular driver of productivity and growth.

Our thesis around AI spend, defense modernization, and industrial reshoring continues to play out in real time, and our rules-based approach keeps us positioned in the companies set to lead.

You’ll never get certainty in the markets. But with a rules-based strategy and a focus on fundamentals, uncertainty becomes less of a threat, and more of an opportunity.