Here’s when the correction will be over

The Predictive Investor - 3/30/25

Welcome to The Predictive Investor weekly update for March 30th, 2025!

The Trump administration has designated April 2nd as “Liberation Day,” marking the beginning of a series of tariffs aimed at reducing the country’s reliance on foreign goods. This includes a 25% tariff on all imported vehicles and auto parts, as well as reciprocal tariffs that mirror the tariffs imposed by other countries on U.S. goods.

Whether these announced policies will actually be implemented is anyone’s guess. The lack of clarity on tariff policy is a reflection of the fact that the administration has been changing its tune by the day. The truth is no one really knows what will happen next.

But here’s what I’ll be looking for:

Will the tariffs that are implemented be more moderate versions of what was announced last week? Many analysts still believe these tariffs are a negotiating tactic. But if the tariff announcements made so far are actually implemented, the U.S. economy will likely go into a recession in Q2.

How do other countries react? The market doesn't like uncertainty. So we need both clarity on US policy and clarity on the response from other countries for the market volatility to subside.

Will the Trump administration shift its focus to tax cuts and deregulation? With tariff policy resolved, I am hopeful the administration will focus on more pro-growth policies that it promised in the wake of last year’s election.

Here’s my takeaways from the week.

When the correction ends

The S&P 500 failed at the 2/19 AVWAP (blue line), which represents the average price paid since the market’s high. This means bears are still in control of this market, and traders are selling into strength.

The correction will end when the weak hands are flushed out and the index decisively breaks above this line.

Despite last week’s selloff, volume was below average. The index needs to hold the 10/27/23 AVWAP (red line) or we’ll be in for a more prolonged correction.

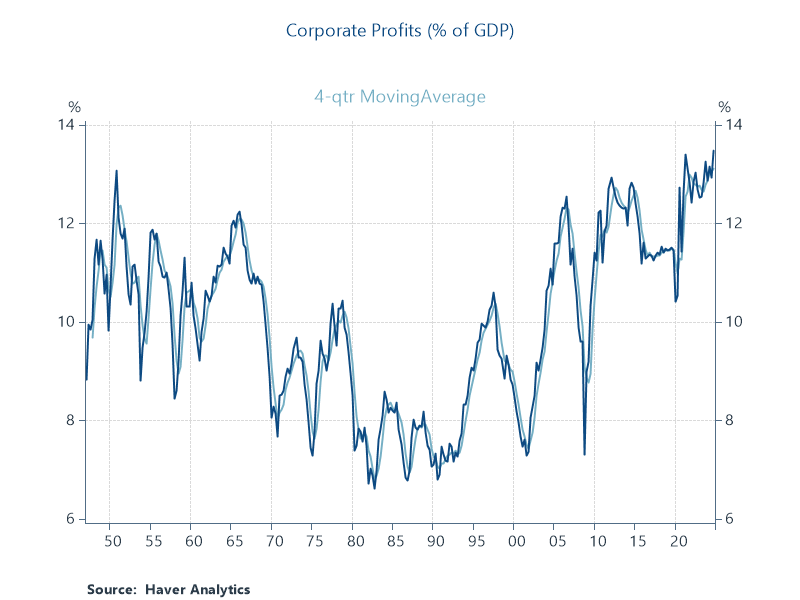

Corporate profits are rising

Corporate profits as a percent of GDP hit a record high last quarter.

While 2025 EPS estimates have been revised lower in the last few weeks, they still indicate 10% growth year-over-year, above the long-term average of ~7%. (Read)

This is supportive of continued growth, despite the very obvious headwinds.

Valuations are reasonable

While mega cap tech skews market valuations higher, on an equal-weighted basis the S&P 500 forward P/E is just below its 10-year average.

You may have noticed that YTD returns on many of our holdings are still positive for the year, including KINS 0.00%↑ and ADMA 0.00%↑. There are still many companies trading at attractive valuations for those willing to look beyond the most popular names.

Bearish sentiment has not (yet) caused a recession

Recession risks are rising, and the big question is to what degree will how people feel affect how they spend.

Consumers have already adjusted spending, and the majority of retailers who provided first quarter earnings and revenue guidance lowered estimates. But that is not enough to cause a recession.

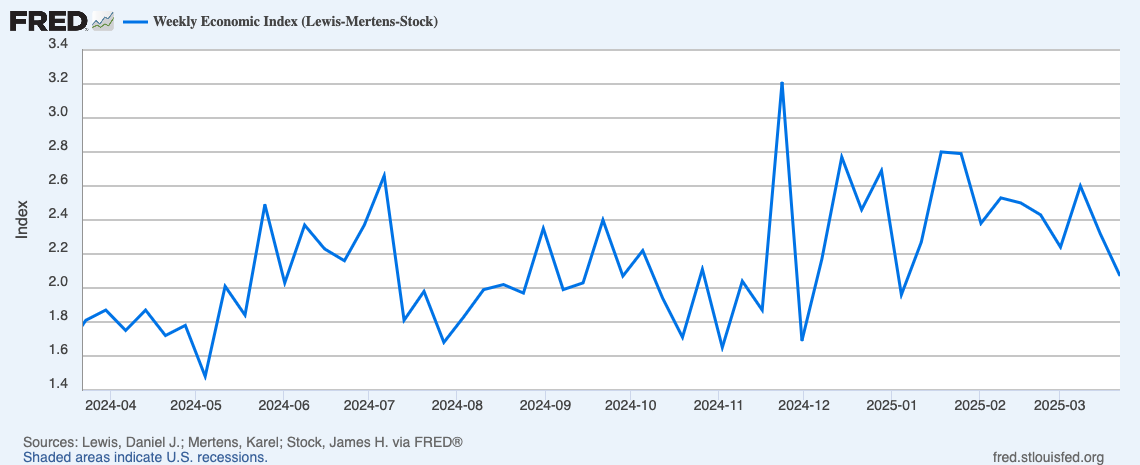

The Weekly Economic Index is a measure of real economic activity, combining ten daily and weekly indicators covering consumer behavior, the labor market, and production, and scaled to the four-quarter GDP growth rate.

While the WEI has declined in recent weeks, it has averaged 2.4% YTD, suggesting positive year-over-year GDP growth this quarter.

This suggests the recent drops in consumer and small business sentiment have yet to materially impact the real economy. While this could all change on April 2nd, as of now it’s supportive of a continuation of the bull market.