Hot economy, cold bonds

Why falling rates aren’t helping long Treasuries and where the real opportunities lie.

The Fed cut rates by 0.25% as expected, yet the FOMC remains somewhat divided on the extent and timing of future rate cuts. Treasury yields slipped, but long-duration bonds sold off anyway. Not exactly a sign of a renewed bull market in bonds.

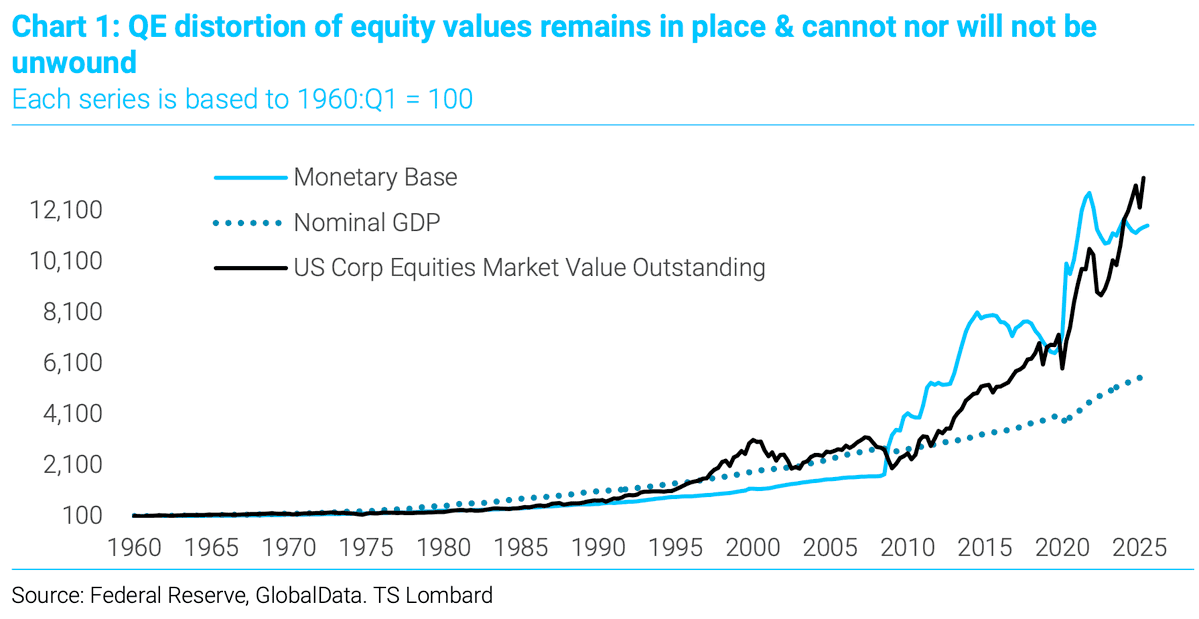

The market seems to be pricing in the fact that in the end Trump will likely get what he wants. Treasury Secretary Bessent has already said that his goal is to grow the economy faster than the debt.

That likely means lower rates, a hot economy, and a higher tolerance for inflation. Meanwhile, the Fed continues to expand the money supply.

This backdrop favors gold and equities while leaving long-term Treasuries exposed. We continue to avoid extended-duration bonds and maintain positions in hard assets and quality growth stocks.

Drones are reshaping defense

Ukraine is courting U.S. partners to scale drone production, underscoring how unmanned systems have become central to modern warfare. (Read)

Defense budgets are increasingly shifting toward drones because they deliver low-cost, high-impact capabilities. Which is why we positioned early with Kratos KTOS 0.00%↑ - which is now up 140% since we added it to the portfolio in May vs. 18% for the S&P 500.

Military spending is moving from traditional hardware to smart, networked systems. Companies with proven defense relationships and scalable drone platforms—like Kratos—stand to capture a disproportionate share of that growth, regardless of geopolitical uncertainty.

Fundamentals over FOMO

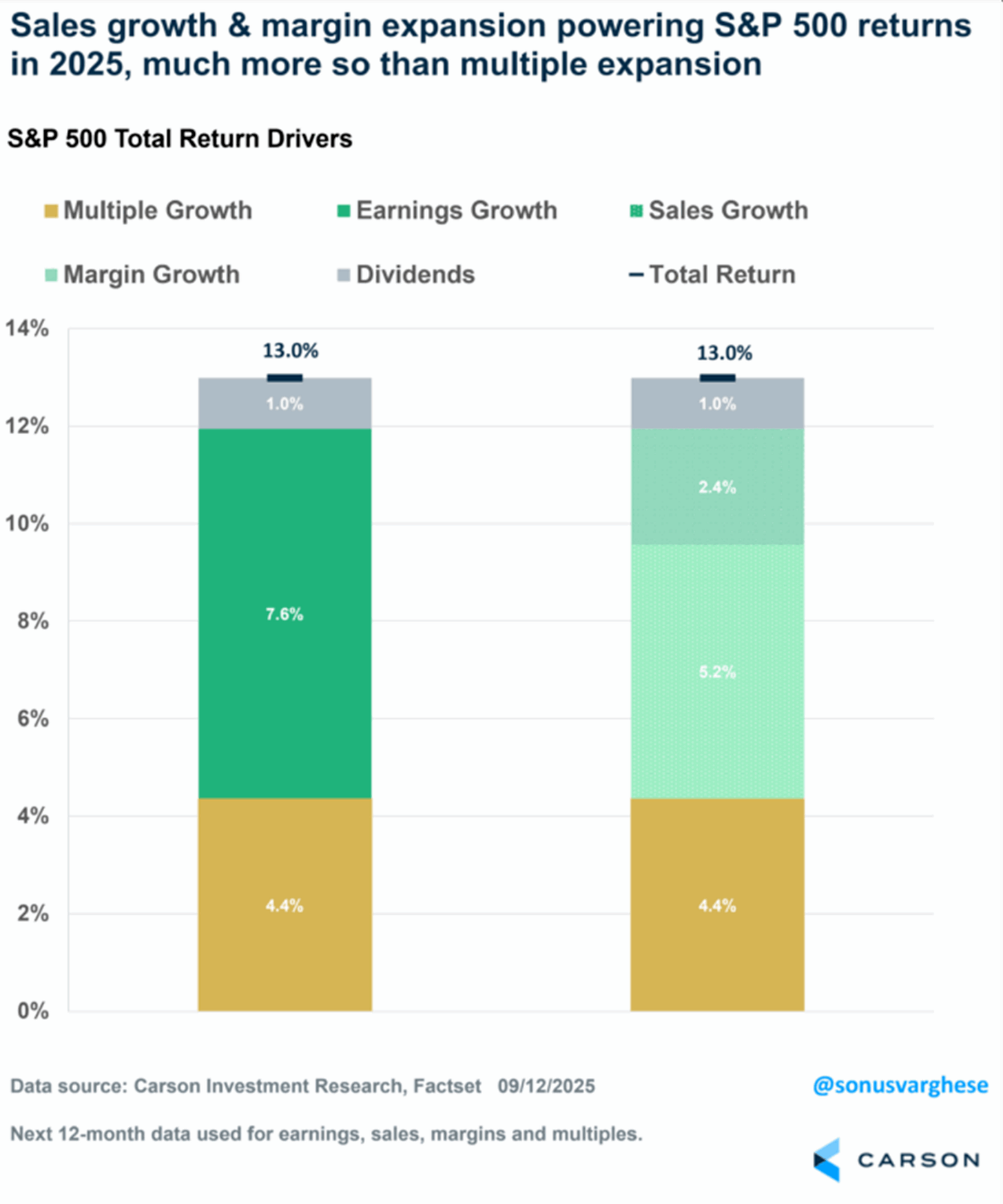

Analysts continue to raise earnings estimates through 2026, according to the latest research from FactSet.

Better yet, the market’s gains are coming from rising sales and expanding margins rather than stretched valuations.

Historically, rallies built on improving profitability prove more durable than those built on sentiment alone.

Companies growing earnings faster than the market remain the sweet spot. Our portfolio, tilted toward these growth leaders, is well positioned to capture the next leg higher if revisions keep trending positive.

All 4 major indices hit new highs

Last week the Dow, S&P 500, Nasdaq, and Russell 2000 all touched new all-time highs in unison for the first time since 2021, a show of strength that underscores just how broad this bull market has become.

Fresh highs across all major indices are technically bullish, but some short-term consolidation wouldn’t surprise, especially with the RSI in overbought territory.

For long-term investors, the signal is clear: fundamentals are driving this market, but be prepared for near-term pullbacks as part of a healthy uptrend.

GoPro’s AI play

Shares of GoPro GPRO 0.00%↑ have been under heavy accumulation since they announced their AI licensing program, which has already secured over 125,000 hours of subscriber video for AI training. (Read)

After Anthropic paid $1.5 billion to settle a copyright lawsuit, demand for legally sourced training data is only going to rise, and content libraries with clean rights are quickly becoming valuable AI assets.

I might pick up some shares of GoPro as a speculative bet on data-licensing economics. 🤔

Final thought

Fed policy debates, record debt levels, and geopolitical flashpoints create endless noise.

The signal is clearer: secular growth themes like defense and AI remain intact.

Staying disciplined keeps you positioned to profit no matter how loud the headlines get.