How to Build a Rules-Based Investing Plan

Learn how to create a disciplined, rules-based investing plan that aligns with your financial goals and mitigates emotional decision-making.

Rules-based investing is a strategy that uses predefined rules to guide investment decisions, helping you avoid emotional and impulsive choices. Here’s how you can create a plan:

Set Clear Goals: Define specific, measurable financial objectives using the SMART framework (e.g., “Save $500,000 for retirement by age 65”).

Match Goals to Timeframes and Risk: Align your investments with your timeline and risk tolerance. For example, long-term goals like retirement may favor growth-focused investments, while short-term goals require safer options.

Establish Investment Rules: Create specific criteria for stock selection, entry/exit points, position sizing, and diversification. For instance, only invest in companies with a P/E ratio below 15 or use a stop-loss to limit losses.

Diversify and Rebalance: Spread investments across asset classes and adjust your portfolio regularly to stay aligned with your goals.

Avoid Emotional Traps: Stick to your rules during market swings and automate decisions to reduce emotional bias.

Setting Clear Investment Goals

Defining Your Financial Objectives

Every successful rules-based investing plan begins with one crucial step: defining clear financial objectives. These goals should follow the SMART framework, meaning they are specific, measurable, achievable, relevant, and time-bound.

For instance, instead of vaguely saying, "I want to save more money", a SMART goal would be: "I will save $30,000 for a down payment on a house in five years by setting aside $500 per month". This approach transforms a general aspiration into a structured plan with clear steps and milestones.

Noah Damsky, founder of Marina Wealth Advisors, underscores the importance of clarity in goal setting:

"The earlier you get clear on these priorities, the earlier you can actually start planning for where you want to go - and the more likely it is that you'll succeed."

Financial goals generally fall into three categories: short-term (less than a year), mid-term (one to five years), and long-term (more than five years). For example:

Short-term goals might include saving $10,000 for an emergency fund.

Mid-term goals could involve setting aside $50,000 for a child’s education.

Long-term goals often focus on retirement, such as building a $1.2 million nest egg by age 65.

A critical part of this process is separating needs from wants. Essential goals, like retirement savings or an emergency fund, should take precedence over discretionary items. This prioritization ensures your investment dollars are allocated effectively and that your rules-based system supports your long-term financial security. Once your objectives are clear, the next step is to align them with your investment timeline and risk tolerance.

Matching Goals with Time Horizon and Risk Tolerance

Your investment strategy is heavily influenced by your time horizon. Longer timelines allow for more growth-focused investments, while shorter ones require a more cautious approach.

For example, if you’re 25 and saving for retirement at 65, you have 40 years to weather market ups and downs and benefit from compounding. This extended timeline often supports a more aggressive allocation to stocks. On the other hand, if your goal is to save for a home down payment in two years, market volatility could jeopardize your plans, making safer investments a better choice.

Nevenka Vrdoljak, senior quantitative analyst at Merrill and Bank of America Private Bank, highlights the dual aspects of risk:

"People tend to focus just on their comfort level with risk. But your financial capacity for risk based on your financial situation is just as important."

Risk tolerance has two components: your willingness to take risks and your financial ability to do so. For instance, you might be comfortable with the ups and downs of the stock market, but if you’re supporting elderly parents on a limited income, your financial capacity for risk is restricted. Both factors must align to create a realistic investment plan.

Here’s how strategies might differ based on risk tolerance and timelines:

Conservative strategies focus on preserving capital and generating steady income, ideal for low-risk tolerance or short-term goals.

Balanced strategies combine growth and stability, suitable for medium risk tolerance and mid-term goals.

Aggressive strategies prioritize growth potential, fitting for high-risk tolerance and long-term objectives.

Regular reviews are crucial as your circumstances evolve. Anil Suri from Merrill’s Chief Investment Office explains:

"Considering both your willingness and your financial ability to take on risk is the best way to make asset allocation choices that work for you."

With your goals defined and aligned to your risk profile, the next step is to make them actionable by assigning specific dollar amounts and timelines.

Using Dollar Amounts and Timelines

Turning goals into actionable plans requires specific dollar amounts and clear timelines. These details create measurable targets, guiding your investment decisions and helping you track progress.

For instance, if your goal is to save $1 million for retirement in 30 years, you can calculate how much to invest monthly to reach that target. This clarity not only keeps you focused but also makes it easier to adjust your strategy if needed.

Rob Williams, managing director at the Schwab Center for Financial Research, stresses the importance of starting early:

"Saving for retirement may not seem like a top priority when you're younger - especially when you're trying to pay off student loans or managing other financial obligations. But saving enough to fund a 30-year retirement is a big undertaking, so the earlier you start, the better off you'll be."

That said, flexibility is key. Daniel Milks, founder of Woodmark Wealth Management, reminds us:

"Your financial goals aren't set in stone. Life changes - like marriage, having children, or switching careers - can impact your financial priorities."

How to Invest with a Plan

Defining Your Investment Rules

Once you've set clear investment goals, the next step is creating a set of rules to guide your decisions. These rules serve as a disciplined framework, helping you avoid emotional pitfalls and manage your portfolio effectively.

Creating Rules for Stock Selection

Stock selection is all about filtering companies that align with your investment strategy. Did you know that over 90% of stock pickers underperform over a 15-year period?. This highlights the importance of a systematic approach.

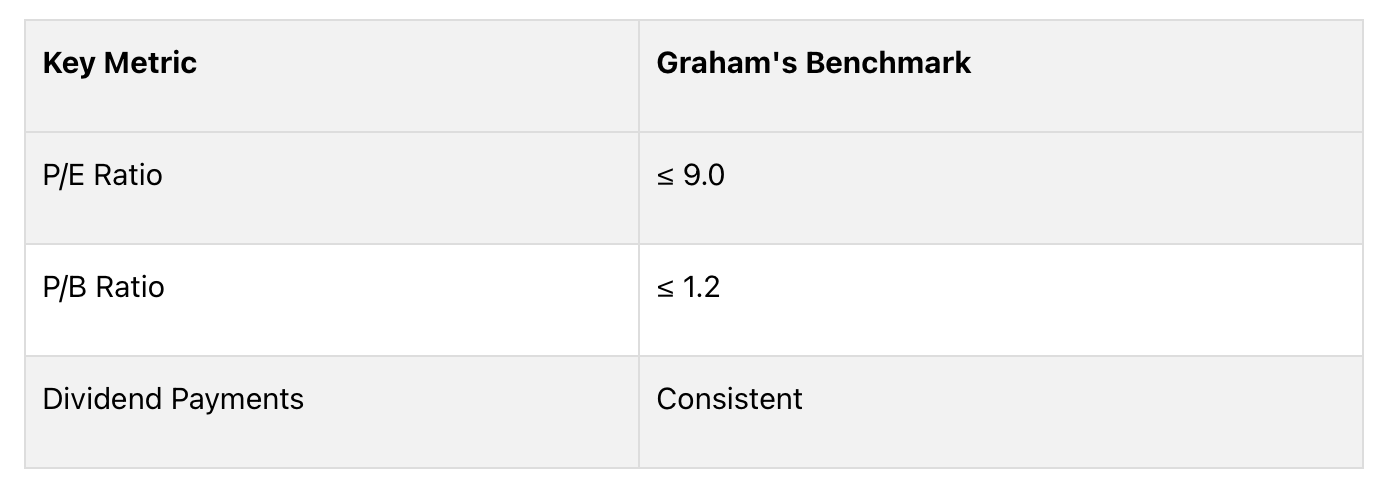

Fundamental analysis is a popular method to identify stocks with strong growth potential at reasonable prices. It involves evaluating a company's business model, industry trends, and the broader economy. Benjamin Graham, a pioneer of value investing, set benchmarks that are still widely used today:

Some investors also incorporate technical analysis - like chart patterns or moving averages - to time their trades. For example, you might screen for companies with strong fundamentals and buy when the stock breaks above its 50-day moving average.

Alex Campbell, head of communications at FreeTrade, offers a valuable reminder:

"The worst investment decisions are those driven by fear or greed".

By setting clear selection criteria in advance, you can make more rational, objective decisions.

The next step is defining when to enter and exit your positions.

Setting Entry and Exit Rules

Having clear entry and exit rules is crucial for keeping emotions in check and sticking to your strategy. Entry rules should outline specific conditions for buying a stock, such as purchasing when its price falls below intrinsic value or breaks above a key resistance level. Similarly, exit rules should include parameters for taking profits and cutting losses. For instance, you might use stop-loss orders to limit risk and set take-profit targets with a 1:2 risk-reward ratio.

Swing traders often look for bullish trends, entering when a stock crosses above its moving average and setting exit points at resistance levels. The key is to establish these rules before you invest so that you can stay disciplined, even during market turbulence.

After this, it's time to focus on position sizing and diversification to manage risk effectively.

Setting Position Sizing and Diversification Guidelines

Position sizing is a cornerstone of risk management - it determines how much of an asset you should trade. Research shows that systematic position sizing can lead to an annual performance boost of 1.2%. A common rule for retail investors is the "2% rule", which suggests risking no more than 2% of your total capital on a single trade.

Adjusting position sizes based on market volatility is another effective strategy. For example, during periods of high volatility, you might reduce your position sizes to safeguard your capital. Here's a handy framework:

Diversification is equally important. By spreading your investments across different assets, you can reduce risk and smooth out your portfolio's performance. Regular rebalancing ensures that your portfolio stays aligned with your target allocation, allowing you to respond to market changes in a disciplined manner.

For instance, The Predictive Investor newsletter demonstrates how a rules-based strategy can identify high-growth stocks while maintaining strict risk management. This structured approach enables investors to achieve consistent results without relying on guesswork or market timing.

Building and Implementing the Plan

Now that you've established your investment rules, it’s time to put them into action. This is where your strategy transitions from theory to practice, with the goal of achieving measurable results.

Selecting the Right Investment Accounts

The first step in executing your plan is selecting the right type of account. The account you choose should align with your financial goals - whether that’s flexibility through a brokerage account or tax advantages with a retirement account.

Brokerage Accounts

These accounts offer access to a wide range of investments and provide flexibility for frequent trading or adjustments. However, earnings in brokerage accounts are taxed in the year they’re received, and capital gains taxes may apply when selling investments. On the plus side, there are no contribution limits, and you can withdraw funds whenever needed.

Retirement Accounts

Retirement accounts come with specific tax benefits but also certain restrictions. Traditional IRAs and 401(k)s provide upfront tax breaks, while Roth IRAs and Roth 401(k)s allow for tax-free withdrawals in retirement. For 2025, the maximum individual IRA contribution is $7,000 ($8,000 for those aged 50 or older). Be aware that withdrawing funds before age 59½ may result in penalties and taxes.

When opening a brokerage account, you’ll typically decide between a cash account (where you use deposited funds to invest) or a margin account (which involves borrowing funds from your broker). Cash accounts are generally better suited for disciplined, rules-based strategies. If your employer offers a matching retirement plan, it’s often wise to maximize that benefit before contributing to an IRA. On the other hand, if you anticipate needing access to your funds earlier, a Roth IRA may offer more flexibility. Whether you manage your investments through an online broker or opt for a robo-advisor, the key is to choose an approach that complements your strategy.

Once your account is set up, you can start applying your rules to construct a well-diversified portfolio.

Building a Diversified Portfolio

With your accounts ready, the next step is building your portfolio based on your predetermined rules. This includes your stock selection criteria, position sizing, and diversification guidelines.

The goal is to avoid having all your investments move in the same direction at the same time. Research consistently highlights that asset allocation plays a major role in portfolio performance. As Marci McGregor, head of Portfolio Strategy at Merrill and Bank of America Private Bank, notes:

"Diversification is one of the most fundamental strategies for building an investment portfolio focused on long-term growth."

To reduce risk, spread your investments across various asset classes and sectors. Adding global exposure can help protect against risks tied to a single market. You might also consider alternative investments like REITs, commodities, or reinsurance to further diversify. However, stick to your position sizing and risk limits - over-diversifying can dilute your returns. Finding the right balance is key.

Finally, staying invested is critical. BofA Global Research reported in February 2024 that investors who missed the 10 best market days of the 2010s saw returns of only 95% for the decade, compared to 190% for those who stayed fully invested. This highlights the importance of maintaining discipline and resisting the urge to time the market.

Scheduling Reviews and Rebalancing

Once your portfolio is built, ongoing maintenance is essential to keep it aligned with your strategy. Regular reviews and rebalancing ensure your investments stay on track with your goals and risk tolerance. Vanguard suggests checking your portfolio at least once a year.

Rebalancing can be done in two ways:

Calendar-Based Rebalancing: Adjust your portfolio on a fixed schedule, such as annually.

Threshold-Based Rebalancing: Make changes when your portfolio drifts 3-5% from your target allocation.

Studies show that roughly 30% of people haven’t rebalanced their 401(k) or IRA accounts. Among those aged 25–54, this figure climbs to over 33%, while it averages about 29% for individuals aged 55–64.

To stay disciplined, set clear markers for when to review your portfolio. Compare your current holdings to your target allocation and make adjustments by buying or selling investments as needed. This structured approach helps keep your rules-based strategy aligned with your long-term objectives, no matter how the markets fluctuate.

Avoiding Common Pitfalls in Self-Directed Investing

Even the best-laid investing plans can crumble when emotions take over. Self-directed investors face unique challenges, and without a clear strategy, it’s easy to veer off course. Understanding these common pitfalls - and knowing how to sidestep them - can make a big difference in achieving long-term success.

Recognizing Emotional Traps

Emotions like fear and greed often cloud judgment, leading to impulsive decisions. Common biases such as FOMO (fear of missing out), overconfidence, loss aversion, herd mentality, confirmation bias, anchoring, and recency bias can derail even the most disciplined investor.

Studies show that people tend to overreact to favorable data, making decisions that don’t align with their long-term goals. The key to overcoming these traps? Automation and self-awareness. By automating your investment decisions, you can avoid reacting emotionally to market volatility. For example, set up automatic transfers to your investment accounts and stick to pre-determined rules for buying and selling.

When emotions run high - whether it’s fear during a downturn or excitement about a “hot” stock - pause and ask yourself: Am I following my plan, or am I reacting to emotions? This kind of awareness helps you stay on track, even when the market feels unpredictable.

Sticking to Your Plan During Market Swings

Market turbulence is inevitable. On average, intra-year market drawdowns hover around 14%, and these swings can test your discipline. Emotional reactions during these periods can lead to costly mistakes.

As Drew O'Connor, CFA, CFP, and Portfolio Manager at CapWealth, explains:

"A loss only becomes real when you lock it in by selling. Selling during a downturn often means missing the rebound. For long-term investors, that can do more harm than riding out a temporary decline."

O'Connor also highlights the importance of having a clear plan in place:

"We tell our clients at CapWealth to make decisions based on a plan, not as a reaction to market turbulence. That plan should reflect your time horizon, your goals, and your tolerance for risk. In times like these, the best approach is often the one that was already in place before things got rocky. That's the benefit of knowing what you own."

To stay disciplined during volatile times, create a written investment policy statement outlining your financial goals, time horizon, and risk tolerance. Regularly review your portfolio to ensure you’re sticking to your plan, rather than focusing solely on market performance. Avoid obsessively checking your accounts or consuming sensational financial news, which can trigger unnecessary stress.

Tactics like dollar-cost averaging or systematic rebalancing can also help. These strategies encourage you to buy more shares when prices are low and fewer when prices are high, removing the emotional element from decision-making. By focusing on your plan instead of reacting to short-term market swings, you can stay on course toward your long-term goals.

Focusing on Process Over Outcome

Investing isn’t about perfection; it’s about probabilities. As Benjamin Graham famously said, the biggest threat to an investor is often their own emotions. Instead of fixating on daily portfolio changes, focus on following your rules for stock selection, position sizing, and rebalancing.

Consider this: From 1961 to 2015, the S&P 500 delivered an average annual return of 9.87%. However, missing just the 25 best trading days during that time would have slashed the return to 5.74%. This highlights why sticking to your process is far more important than trying to time the market.

Former Treasury Secretary Robert Rubin echoes this sentiment:

"Any individual decision can be badly thought through, and yet be successful, or exceedingly well thought through, but be unsuccessful. But over time, more thoughtful decision-making will lead to better results, and more thoughtful decision-making can be encouraged by evaluating on how well they were made rather than an outcome."

When faced with a string of poor results, resist the temptation to abandon your rules-based approach. Instead, review your process to ensure it’s sound and being applied correctly. Market cycles often span years, and patience is what separates successful long-term investors from those who chase short-term gains.

The goal isn’t to avoid every mistake - it’s to make fewer of them and recover faster when they happen. By focusing on your process and staying disciplined through market ups and downs, you give your investing plan the best shot at delivering long-term success.

The Power of Rules-Based Investing

Achieving success in investing often stems from a structured, emotion-free approach that eliminates guesswork and keeps your focus on strategies that build long-term wealth. Rules-based investing transforms the unpredictability of markets into a disciplined, data-oriented method designed to endure even the toughest conditions.

Mamdouh Medhat, PhD, Research Director and Vice President at Dimensional Fund Advisors, puts it this way:

"At Dimensional, we think of factor investing as a systematic way to design and implement investment strategies to pursue higher expected returns than the market. It's a rules-based approach that takes some of the emotion out of investment and replaces it with rigorous research and efficient implementation."

This perspective highlights the importance of a structured methodology in navigating the complexities of investing.

Key Takeaways

Successful investing is built on three essential pillars: clear goals, systematic rules, and unwavering discipline. Start by defining specific and measurable financial targets. For instance, instead of a vague goal like "saving for retirement", aim for something concrete, like accumulating $500,000 by age 65.

Your rules act as a guide during uncertain times. Whether it's setting limits on position sizes, rebalancing your portfolio quarterly, or adhering to pre-determined entry and exit strategies, these rules help you avoid emotional decision-making. Consider this: missing just the 25 best trading days since 1970 would have slashed total returns by over 77%. This statistic underscores the critical importance of staying the course and sticking to your rules, rather than attempting to outguess the market.

Discipline is what separates successful investors from the rest. For example, during the market crash of March 2020, investors who stayed disciplined and followed their rebalancing plans saw significant gains as stocks rallied to new highs by the end of the year. When you know exactly what you own, why you own it, and when you’ll make adjustments, market volatility becomes less of a stressor and more of a background hum.

With these fundamentals in place, the next step is turning them into action.

Taking the Next Step

Embarking on a rules-based investing journey doesn’t require perfection - just a commitment to start. Begin by setting clear financial goals with specific amounts and timelines. From there, create straightforward rules for selecting stocks, determining position sizes, and rebalancing your portfolio. Even simple criteria, like focusing on companies with solid profits and strong balance sheets, can provide a solid starting point.

For beginners, basic filters such as price-to-earnings ratios, manageable debt levels, or steady revenue growth can serve as an effective foundation. As you gain confidence and experience, you can refine these rules and incorporate more advanced criteria. The key is consistency - sticking to your rules even when it feels uncomfortable or when alarming headlines tempt you to stray.

For those looking for additional guidance, The Predictive Investor offers a structured framework for identifying high-growth, lesser-known stocks. Authored by a Silicon Valley veteran with a history of outperforming the S&P 500, this rules-based newsletter provides actionable insights that can turn market unpredictability into opportunities for growth.

FAQs

How do I find the right balance between risk and reward when creating a rules-based investing plan?

Finding the right balance between risk and reward begins with a clear understanding of your financial goals, how much risk you’re willing to take, and the time you have to invest. Think about what level of risk feels manageable for you and what kind of returns you’ll need to achieve your objectives.

One way to manage risk is by diversifying your portfolio across various asset types and setting specific rules to keep risks in check. For instance, you could decide to allocate 70% of your investments to stocks and 30% to bonds. Another approach might be setting a rule to limit any single trade to no more than 2% of your total portfolio. These strategies can help you maintain focus and discipline, all while working toward steady, long-term growth.

How can I keep my investment goals relevant as my financial situation and life circumstances change?

To keep your investment goals aligned with your life, it’s essential to revisit them regularly, especially when significant changes occur - like a career shift, a new addition to the family, or an unexpected financial challenge. Begin by reassessing your financial objectives, factoring in your current priorities, comfort with risk, and the time you have to reach your goals.

Establish specific, measurable milestones but stay open to adjustments. Life happens, and when it does, you might need to tweak your asset allocation or rethink your investment strategy to better match your new situation. Aim to review your plan annually or after major events. This routine check-in helps ensure your strategy reflects where you are now and where you want to go. The key to long-term success? Discipline paired with flexibility.

How can I stay disciplined and avoid emotional decisions when following a rules-based investing strategy during market volatility?

Managing emotional reactions during market ups and downs starts with being aware of your feelings and staying committed to your investment plan. Following a rules-based strategy - like keeping a diversified portfolio, using dollar-cost averaging, and rebalancing your investments regularly - can help you stay grounded and avoid rash decisions.

Equally important is keeping a long-term mindset and steering clear of the urge to time the market. Take a moment to reflect on your financial goals and the reasons you adopted a disciplined approach in the first place. By sticking to your plan and not letting emotions take over, you'll be in a stronger position to weather market swings and work toward your financial success.