Investing in Stocks vs. Real Estate: Pros and Cons

Explore the pros and cons of investing in stocks versus real estate, including returns, risks, and management requirements to help you make informed choices.

Stocks or real estate - which is better for growing your wealth? Here's a quick breakdown to help you decide:

Stocks: Offer higher long-term returns (~10% annually), are easy to buy and sell, and require minimal upfront money (start with $50 or less). However, they’re more volatile and lack tangible ownership.

Real Estate: Provides steady rental income, tax perks, and leverage opportunities. It’s more stable but requires significant upfront costs (20% down payment) and active management.

Quick Comparison

If you want fast entry and growth potential, stocks are your go-to. If you prefer stability and tangible assets, real estate might be better. Many investors combine both for a balanced portfolio.

$100,000 in Stocks vs. Real Estate over 25 Years

Key Factors to Compare

When deciding between stocks and real estate, four major factors stand out as crucial to your investment journey. By understanding these differences, you can better align your choice with your financial goals and personal circumstances.

Risk and Volatility

Stocks are known for their higher daily volatility compared to real estate. Stock prices can swing wildly due to news, investor sentiment, or market shifts. For example, the S&P 500 plunged 33% in early 2020 and dropped 4.8% in April 2025, while the VIX spiked over 40.

In contrast, real estate tends to move at a slower, steadier pace. During that same 2020 downturn, the median U.S. home price dipped just 3.4%, from $329,000 to $317,700. This stability stems from real estate’s tangible nature - people will always need housing.

Long-term data highlights the difference in risk: since 2000, homebuyers faced a 26.4% chance of seeing a price drop greater than 5%, while S&P 500 investors faced a 62.3% chance of the same decline. However, location plays a huge role - markets like Las Vegas see more dramatic price swings, while areas like Buffalo remain relatively stable.

"Real estate remains one of the most stable and resilient assets - and that gives you a major advantage." - Coldwell Banker Premier Realty

Next, let’s look at how these risk levels translate into income and returns over time.

Returns and Income Potential

While risk measures volatility, return metrics reveal the earning power of each asset. Historically, stocks have delivered higher overall returns. Between 1992 and 2024, the S&P 500 achieved an average annual return of 10.39% (including dividends), while U.S. housing prices grew by about 5.5% annually.

Interestingly, REITs have outperformed traditional stocks in certain periods. From 1972 to 2019, REITs delivered an average annual return of 11.8%, compared to 10.6% for the S&P 500. Real estate also stands out for its higher income yields - in 2024, REITs offered an average dividend yield of 4.1%, compared to the S&P 500’s 1.3%.

Tax benefits further enhance real estate returns. Investors can deduct property depreciation, defer capital gains with 1031 exchanges, and write off various expenses. Doug Kinsey, a certified financial planner, highlights the leverage advantage in real estate:

"The numbers don't tell the whole performance story. You also have to look at the impact of tax advantages, income yield, and the fact that real estate investments often allow for significant leverage. You can finance a home purchase, putting no more than 20% of your own money down, for example."

Liquidity and Access

Stocks are incredibly liquid - you can buy or sell shares in minutes during trading hours. This flexibility allows you to act quickly, whether chasing opportunities or addressing urgent needs. Real estate, on the other hand, is far less liquid. Selling property can take weeks or months and typically involves fees and commissions totaling 6–10% of the sale price. Shaun M. Jones, president of Jones Fiduciary Wealth Management, explains:

"There is absolutely a premium to be earned on investments that lack complete liquidity. Logically, this makes sense because nobody would give up liquidity for a return that is the same or worse than liquid investments."

REITs offer a middle ground, providing real estate exposure with stock-like liquidity. However, they don’t include all the tax perks or leverage opportunities that come with owning property directly.

Initial Capital Requirements

Stocks have a much lower entry barrier. With fractional shares, you can start investing with as little as $50–$100 on most brokerage platforms. Many brokers also offer zero-commission trading, making it easy to build a portfolio right away.

Real estate, by contrast, demands a larger upfront investment. You’ll typically need $10,000 or more for down payments, closing costs, and ongoing maintenance. These higher costs mean you’ll need significant savings to get started.

Ramit Sethi, host of Netflix’s How to Get Rich, sums it up well:

"Stocks are easier to start, cheaper to buy, and simpler to manage. Real estate offers leverage, tax breaks, and monthly income - but takes more money, time, and effort."

These four factors - risk, returns, liquidity, and capital requirements - are at the heart of choosing between stocks and real estate. Your financial goals, risk tolerance, and timeline will help determine which option fits best into your wealth-building strategy.

Stock Investing: Pros and Cons

Here’s a closer look at the strengths and weaknesses of stock investing, building on the key factors previously discussed.

Stock Investing Advantages

Instant Liquidity

One of the biggest perks of stocks is how quickly you can turn them into cash. With just a few clicks during market hours, you can buy or sell shares, giving you quick access to funds. As Financial Samurai aptly puts it:

"With stocks, it's so nice to be able to simply click a couple buttons and be done."

Even better, many major brokers like Charles Schwab, Fidelity, and E*TRADE have eliminated commission fees for most trades, making transactions virtually cost-free.

Easy Diversification

Stocks make it simple to spread your investments across various markets and asset classes, even with a modest budget. You can go beyond just stocks by adding U.S. government bonds, corporate bonds, options, ETFs, or even ADRs for exposure to international companies. The U.S. stock market’s sheer size highlights this potential, with the New York Stock Exchange (NYSE) and NASDAQ having a combined market cap exceeding $50 trillion.

Impressive Long-Term Returns

Historically, stocks have delivered strong returns. Over the last 60 years, they’ve averaged about a 10% annual return, far outpacing real estate’s 4%. From 1978 to 2024, the S&P 500 achieved an average annual return of 12.25%, and when you factor in dividends, that number jumps above 14%. Between 2013 and 2024 alone, the S&P 500 saw cumulative growth of approximately 404.47%, or an annualized return of 14.66%.

Tax-Advantaged Growth

When held in tax-advantaged accounts like 401(k)s, IRAs, or Roth IRAs, stocks can grow either tax-deferred or tax-free, making them an effective tool for long-term wealth building.

Low Maintenance

Unlike real estate, stocks don’t require hands-on management. You won’t have to deal with tenants, repairs, or upkeep. For those looking for a passive investment option, stocks can be a great choice.

Stock Investing Disadvantages

While stocks offer plenty of benefits, they come with their own set of challenges.

High Volatility and Risk

Stocks are subject to market, political, currency, and liquidity risks, which can lead to sharp short-term declines. This volatility can make some investors uneasy, as all investments carry the possibility of losing their entire value.

Emotional Decision-Making

Fear and greed often drive poor investment decisions. Investors might buy during market highs or sell during downturns, which can hurt long-term returns. Lack of knowledge may also lead to chasing trendy stocks, poorly timed trades, or inadequate diversification.

Tax Considerations

While stocks have relatively straightforward tax rules, they still come with obligations. Dividends are taxed in the year they’re received, and capital gains taxes apply when you sell profitable positions. Although long-term capital gains rates are favorable, they don’t offer the same deferral strategies available in real estate, such as 1031 exchanges.

No Tangible Asset or Leverage

Unlike real estate, stocks don’t provide a physical asset you can use as collateral. Typically, investors pay the full price for stocks upfront, limiting the ability to use leverage to amplify returns.As one investment professional points out:

"The key to successful long-term investing is understanding the risks and rewards involved. You can then determine the appropriate amount of risk for you and your financial goals."

Comparing the Pros and Cons

Here’s a quick summary of the main advantages and disadvantages of stock investing:

Stocks offer a combination of growth potential and convenience, making them attractive for many investors. However, they may not be the best fit for those who prioritize stability or prefer tangible assets.

Real Estate Investing: Pros and Cons

Real estate has long been a key player in building wealth in the U.S., offering a mix of opportunities and challenges that set it apart from stock investments. Below, we break down the main advantages and disadvantages of investing in real estate, explaining how they play out in practice for investors.

Real Estate Investing Advantages

Steady Cash Flow and Predictable Income

One of the biggest draws of real estate is the steady rental income it can provide. Even during economic downturns, rental income tends to remain stable, making it an attractive option for those seeking reliable cash flow.

Tax Perks

Real estate investors enjoy several tax benefits. Common expenses like mortgage interest, property taxes, insurance, and maintenance are often deductible. Plus, the IRS allows property depreciation over 27.5 years for residential properties and 39 years for commercial ones, which can further reduce taxable income.

Leverage for Bigger Returns

Real estate lets you amplify your returns through leverage. With just a 20–25% down payment, you can control a property worth four to five times your initial investment. For example, buying a $500,000 property with a $100,000 down payment and seeing it appreciate 5% annually translates to about $25,000 in yearly gains - a 25% return on your investment.

Inflation Protection

Real estate also serves as a hedge against inflation. As costs rise, property owners can often increase rents and benefit from property appreciation, helping to preserve the asset's value over time.

Diversification for Your Portfolio

Real estate’s performance often moves independently of stocks and bonds, offering a way to balance out portfolio risk. This low correlation can help reduce overall portfolio volatility.

Tangible Asset

Unlike stocks, real estate is a physical asset. Owning something tangible can provide reassurance to investors, especially when markets are volatile.

Real Estate Investing Disadvantages

High Initial and Ongoing Costs

Getting started in real estate requires a significant upfront investment. Down payments typically range from 20–25% of the property’s price, plus closing costs of 2–5%. For a $400,000 property, that adds up to a hefty initial expense. Beyond the purchase, ongoing costs like property taxes (around 1.1% of the assessed value annually), insurance (usually $800–$2,500 per year), maintenance, and property management fees (8–12% of monthly rental income) can quickly add up. As Elizabeth Welgemoed, Senior Content Marketing Manager at New Silver, advises:

"Accurate projections of carrying costs are essential to a profitable strategy. Failing to factor them in can turn what looked like a great deal on paper into a financial misstep."

Limited Liquidity

Unlike stocks, real estate is not easily sold. It can take months to sell a property, and in urgent situations, you may have to accept a lower price to close the deal quickly.

Location and Market Risks

The value of real estate depends heavily on local factors. Economic downturns, job losses, or neighborhood decline can hurt both property values and rental demand. Additionally, real estate investments are tied to specific locations, which limits diversification.

Active Involvement Required

Owning real estate isn’t a passive investment. It involves managing tenants, collecting rent, and handling maintenance issues. Even if you hire a property manager, you’ll still need to stay involved in key decisions.

Current Market Challenges

The real estate market has become more challenging in recent years. Rising financing costs - climbing from under 4% to over 7% - have affected property values and returns. The commercial sector is under strain, with nearly $1.8 trillion in loans maturing by the end of 2026. Additionally, more than half of renters spend over 30% of their income on housing, which could limit future rent increases. Poor market analysis has also led to the failure of about 50% of multiple-property real estate businesses within their first five years.

Environmental and Regulatory Risks

Climate-related events are an increasing concern for real estate investors. In 2023, the U.S. experienced $28 billion in damages from climate disasters - the highest on record. On top of that, stricter environmental regulations and sustainability requirements could impact property values and lead to costly upgrades. These factors highlight the need for thorough analysis when investing in real estate.

Real estate can be a powerful tool for building wealth over time, but it requires careful planning, sufficient financial reserves, and a solid understanding of market conditions. These pros and cons illustrate the unique aspects of real estate investing and set the stage for comparing it to stock investments in the next section.

Side-by-Side Comparison

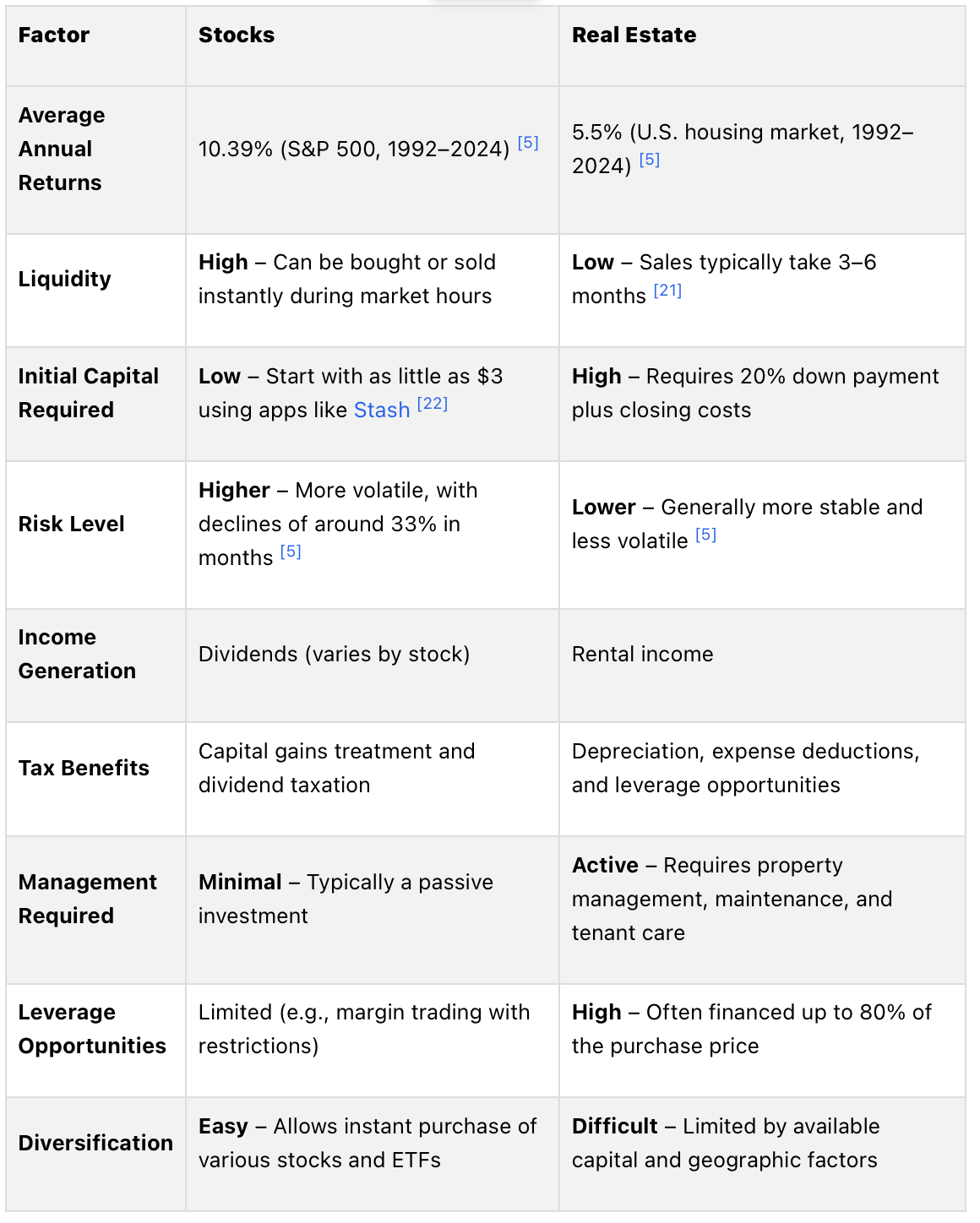

Stocks and real estate differ in several critical ways, shaping how investors approach these assets. The table below summarizes the key distinctions, followed by insights that delve deeper into these contrasts.

Comparison Table

Key Takeaways

Several factors stand out when comparing these two investment types. Liquidity is a prime example - stocks can be traded in seconds during market hours, while selling real estate often takes months. Similarly, the capital required to get started differs significantly. Stock investing has been made accessible to nearly everyone, with apps allowing fractional share purchases for as little as a few dollars. In contrast, real estate usually demands a hefty upfront investment, including a 20% down payment plus additional costs.

Doug Kinsey, a certified financial planner at Artifex Financial Group, highlights the broader picture:

"The numbers don't tell the whole performance story. You also have to look at the impact of tax advantages, income yield, and the fact that real estate investments often allow for significant leverage. You can finance a home purchase, putting no more than 20% of your own money down, for example."

He also emphasizes the responsibilities tied to real estate ownership:

"Of course, if you buy real estate directly, you also need to factor in your time in managing the property and maintenance and repair costs. Comparing the rates of return has to include all these elements."

Stocks, while more volatile, typically require less active involvement. Real estate, on the other hand, demands ongoing management and decision-making. Yet, real estate offers a unique advantage through leverage. For instance, with a 20% down payment, you can earn returns on the full property value. If the property appreciates 5% annually, that gain applies to the entire value, effectively turning a modest appreciation into a much larger return on your initial investment.

While stocks and real estate have their strengths and challenges, many experienced investors choose both. By combining these assets, they build portfolios that balance growth potential, stability, and income generation.

Conclusion: Choosing the Right Investment

Deciding between stocks and real estate ultimately depends on your personal financial situation and goals. For younger investors, stocks often appeal due to their potential for long-term growth. On the other hand, older investors might lean toward real estate for its stability and reliable income streams. These preferences, combined with individual circumstances, help shape the best mix for your portfolio.

Your risk tolerance plays a major role in this decision. Stocks typically deliver annual returns of 7%–10%, but they come with significant volatility. Real estate, while generally more stable, provides the added comfort of owning a tangible asset.

If your capital is limited, stocks may be the more practical option since they require less upfront investment. In contrast, real estate demands a larger financial commitment, including a 20% down payment and other closing costs.

This discussion ties back to earlier comparisons of liquidity, returns, and management requirements for both asset types. A well-rounded strategy that incorporates both stocks and real estate can take advantage of their respective strengths. Such a balance not only fosters growth but also ensures stability and diversification. As financial advisor Michael Ross puts it:

"There is only one financial goal: #justbuildwealth. And both Stocks and Real Estate are involved in building wealth. It's the balance that is key."

By adopting The Predictive Investor's systematic approach, you can make these decisions with greater clarity and discipline. Our rules-based framework helps you avoid emotional pitfalls by focusing on risk tolerance, time horizon, and financial objectives. This method allows your strategy to evolve with your circumstances while aiming for consistent results.

A practical starting point could be investing in low-cost index funds, gradually expanding into real estate as your knowledge and resources grow.

FAQs

What should I consider when choosing between investing in stocks or real estate?

When weighing the choice between stocks and real estate, it's important to reflect on your financial goals, risk tolerance, and investment timeline. Stocks generally offer the potential for higher returns over the long haul and are relatively easy to buy or sell, giving you flexibility. However, they can be unpredictable, with values often swinging due to market trends or global events. Real estate, on the other hand, is usually steadier, provides the opportunity for consistent rental income, but requires a larger upfront investment and ongoing management.

Consider how hands-on you want to be. Stocks can be a more passive option, while real estate often calls for active involvement, especially when managing properties. Other factors like tax advantages, the location of a property, and your ability to ride out market ups and downs also play a role. The right choice ultimately hinges on what fits your financial plan and how much risk you’re comfortable taking on.

What are the key tax differences between investing in stocks and real estate?

In the U.S., investing in real estate comes with several tax perks. You can deduct mortgage interest, property taxes, operating expenses, and even depreciation, all of which can help lower your taxable income. These deductions often translate to ongoing tax savings for as long as you own the property.

On the other hand, stock investments are taxed differently, primarily through capital gains and dividends. If you hold stocks for over a year, your long-term capital gains are taxed at lower rates - either 0%, 15%, or 20%, depending on your income level. Similarly, qualified dividends might also be taxed at these reduced rates. However, short-term capital gains (from stocks held for a year or less) and non-qualified dividends are taxed as ordinary income, which can result in a higher tax bill.

In general, real estate offers more immediate tax benefits, while stock investments are taxed mainly on realized gains and dividends. The right choice ultimately depends on your financial goals and how you approach tax planning.

Can I include both stocks and real estate in my investment portfolio, and how should I approach it?

Yes, blending stocks and real estate in your investment portfolio can be an effective way to balance risk and rewards. Both asset classes bring distinct advantages - stocks offer liquidity and the potential for significant long-term growth, while real estate provides stability, physical assets, and a steady income stream through rents.

To get started, consider your risk tolerance, financial objectives, and investment timeline. A well-rounded portfolio often includes a mix of stocks, bonds, and real estate to help spread risk and cushion against market ups and downs. Tailor your allocation to fit your specific situation, remembering that diversification is a cornerstone of a strong, long-term investment strategy.