Is Trump the boy who cried tariff?

The Predictive Investor - 5/25/25

Once upon a time in the bustling village of Wall Street, there lived a shepherd named Donald who guarded the sheep of global trade. Every few weeks, he'd leap onto a golden podium, wave a phone with a half-eaten apple on it, and yell, "A tariff is coming! A big, beautiful tariff!"

The villagers panicked. Markets stumbled. CNBC anchors hyperventilated. And CEOs across the land fired off strongly worded memos. But each time, just before the harshest tariffs struck, Donald would grin and say, “Never mind. It was just a negotiating tactic. We’re making the best deals, folks.”

This happened again and again—tariffs on steel, on phones, on French cheese. Each time, he’d backtrack, and eventually, the villagers stopped reacting. “He’s not serious,” they muttered. “It’s just another bluff.”

That’s where we find ourselves today, with Trump’s latest announcement of a 50% tariff on the EU and 25% on Apple.

Whether this latest round of tariff talk ends like the fable — with real damage because warnings were ignored — or fizzles like the others remains to be seen. But either way, it reminds us of a key investing lesson.

We don’t have to predict the story’s ending to prosper. We just need to stick to our rules-based plan to manage risk, no matter how loud the yelling gets.

Here’s what we’re watching, and why it matters.

Last week’s pullback should surprise no one

Last week’s pullback was textbook. The S&P 500 had been ripping higher, and a breather was inevitable.

In fact, we flagged the gap between 5,691 and 5,786 as a potential target for a modest pullback. The index dipped into that range and closed the week just above its 200-day moving average.

Wall Street will likely try to generate some volatility over Trump’s latest tariff threat. It’s the perfect excuse to whip markets around, shake out retail investors, and re-enter positions at better prices.

The headlines may be real, but the overreactions? Often orchestrated.

Stay grounded, and let the noise serve those who need it.

About that big, beautiful bill

Last week the House passed Trump’s big beautiful bill, aligned to the administration’s fiscal priorities. The bill now moves to the Senate, where it will likely narrowly pass despite some objections.

In short, the bill extends the 2017 tax cuts, introduces temporary tax exemptions on tips and overtime, and increases the state and local tax deduction cap. While there were some modest cuts to Medicare and Medicaid, the bill is projected to increase the federal deficit by $3.8 trillion over the next 10 years.

I’ll leave it to the political folks to argue whether this is good or bad. But the implication for markets is clear: Congress is just not serious about cutting spending. And bondholders have taken notice.

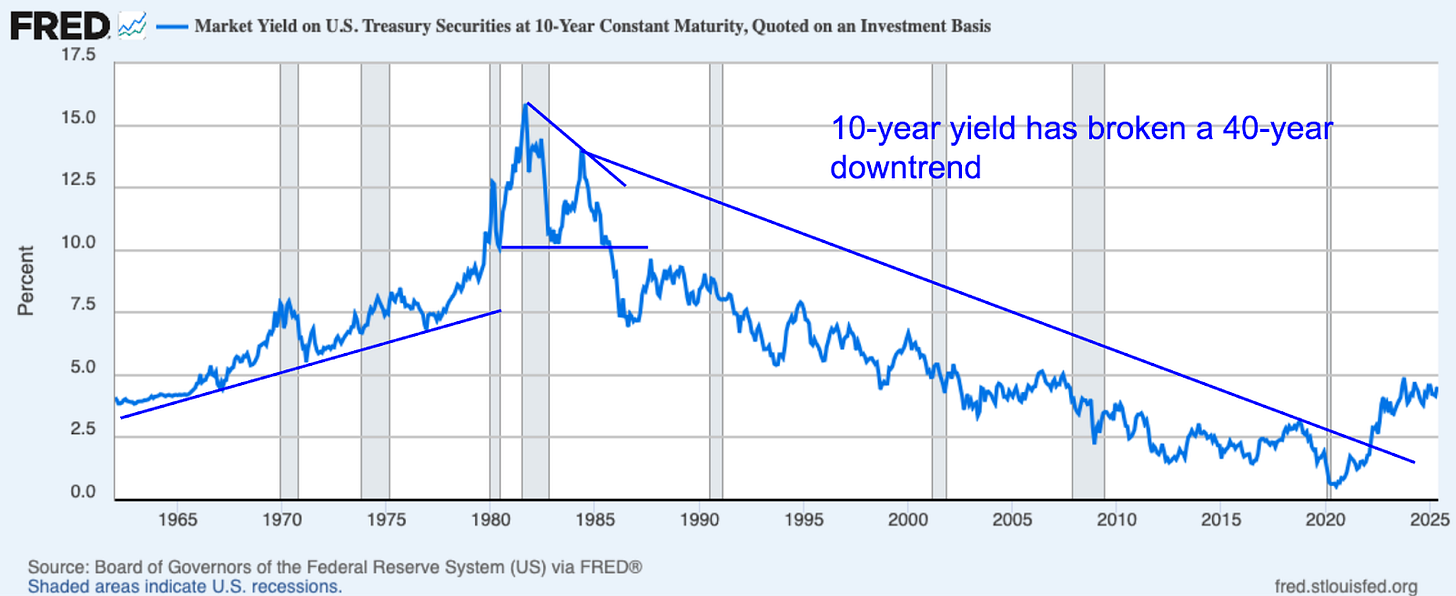

Last week’s 20-year Treasury auction saw low demand, which raised rates. Long term yields broke their 40-year downtrend nearly 3 years ago, and show no signs of retreating.

With inflation starting to spike from tariffs, and yields climbing, the Fed will not be cutting rates as much as previously expected. Their priority is keeping inflation down. And they're going to have their work cut out for them.

It’s increasingly looking like the Fed will need to implement some form of yield curve control to keep rates under 5%. Because anything higher will make it impossible to service the debt.

And this isn’t just a U.S. problem. Governments all over the world have too much debt.

Which is why we’ve always recommended having some allocation to gold. For fixed income, we continue to prefer inflation-linked bonds, floating rate bonds and short-term treasuries over long term bonds.

The Europe trade is not working out as expected

The “Sell America, Buy Europe” narrative gained traction earlier this year as investors panicked over political uncertainty in the U.S. and valuation gaps between American and European stocks.

We advised against jumping ship, and so far the EU trade hasn’t played out as expected.

The U.S. is still seeing stronger earnings growth and higher profit margins. Innovation is still concentrated in the U.S. and Europe’s economic outlook is fragile at best.

And once again, the ratio of iShares Europe to the SPY has failed to break its downtrend.

Valuation alone is not a catalyst. Investors are sticking with what’s working, and for now that’s still the U.S.

Corporate America remains confident

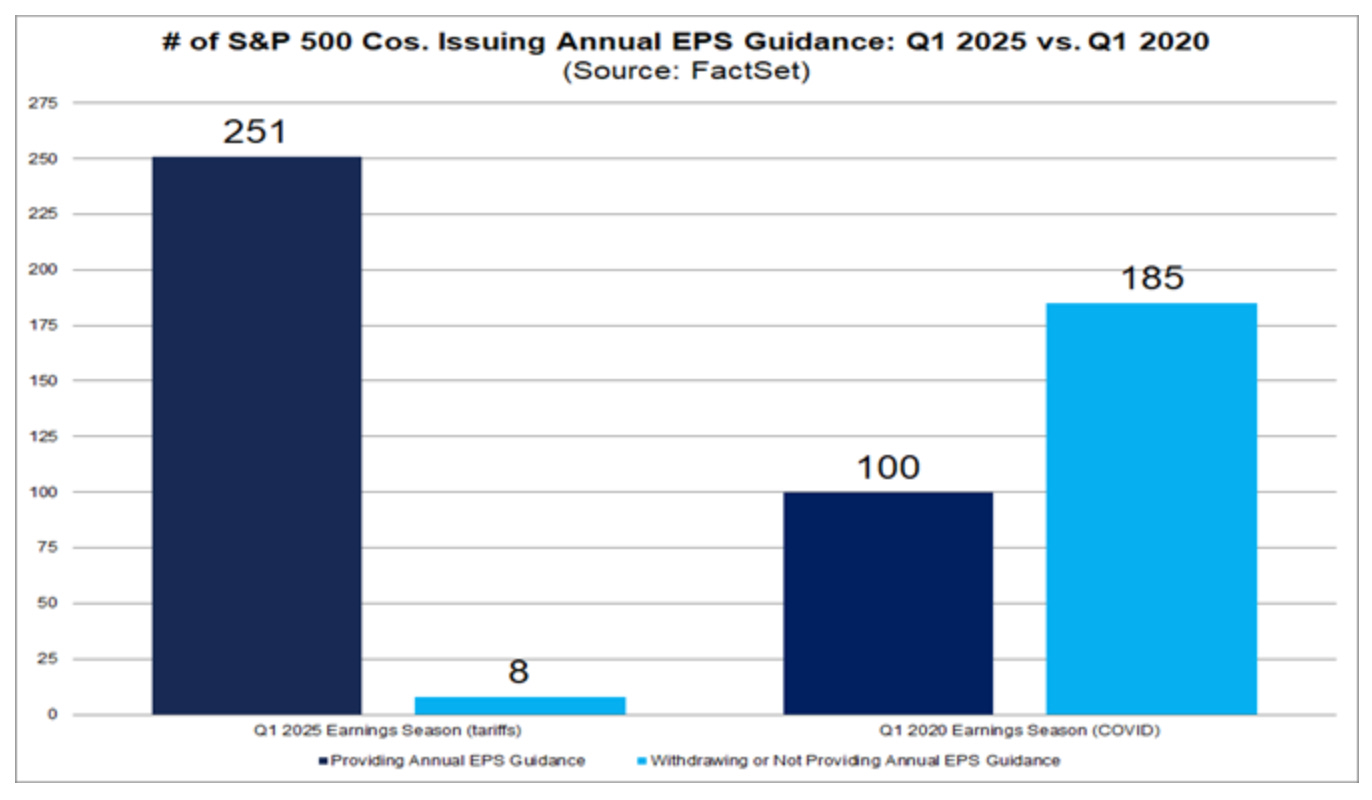

Speaking of what’s working, the vast majority of S&P 500 companies are maintaining their EPS guidance for 2025 despite the uncertainty. (Read)

According to Factset, of the 478 companies that reported results through May 22nd, 259 have commented on guidance for 2025. And of the 259, only 8 companies (~3%) withdrew or chose not to update their EPS guidance. Far below the number of companies that withdrew guidance during Covid.

This is a strong vote of confidence from America’s largest companies, and suggests that they are either effectively managing potential risks or are cautiously optimistic about their ability to navigate the current economic landscape.

It’s never been more important to tune out the noise and stay the course.

Wishing you all a wonderful Memorial Day, and a big thank you to all the brave men and women who serve our country.