Market Brief - April 14, 2024

A correction is brewing

Welcome to The Predictive Investor Market Brief for April 14th, 2024!

Stocks closed down after a volatile week, driven by sticky inflation and higher yields. That said, we were overdue for a correction, so none of this is a surprise.

We’ve long said the strength of the consumer is the key to this bull market, and this week we’ll get updated numbers for retail sales and jobless claims.

Aside from that, here’s what we’re keeping an eye on this week.

War in the Middle East

The immediate market impact of Iran’s attack on Israel will be a continuation of trends that were already taking shape over the last few weeks: volatility up, energy prices up and gold prices up.

The attack was telegraphed well ahead of time, which suggests Iran’s goal was to cause some damage but avoid mass casualties. No one in the region wants a wider regional war, but much depends on Israel’s response.

If the violence escalates we could see a rally in treasuries, which will lower rates, ultimately providing a favorable backdrop for equities.

More good news for energy

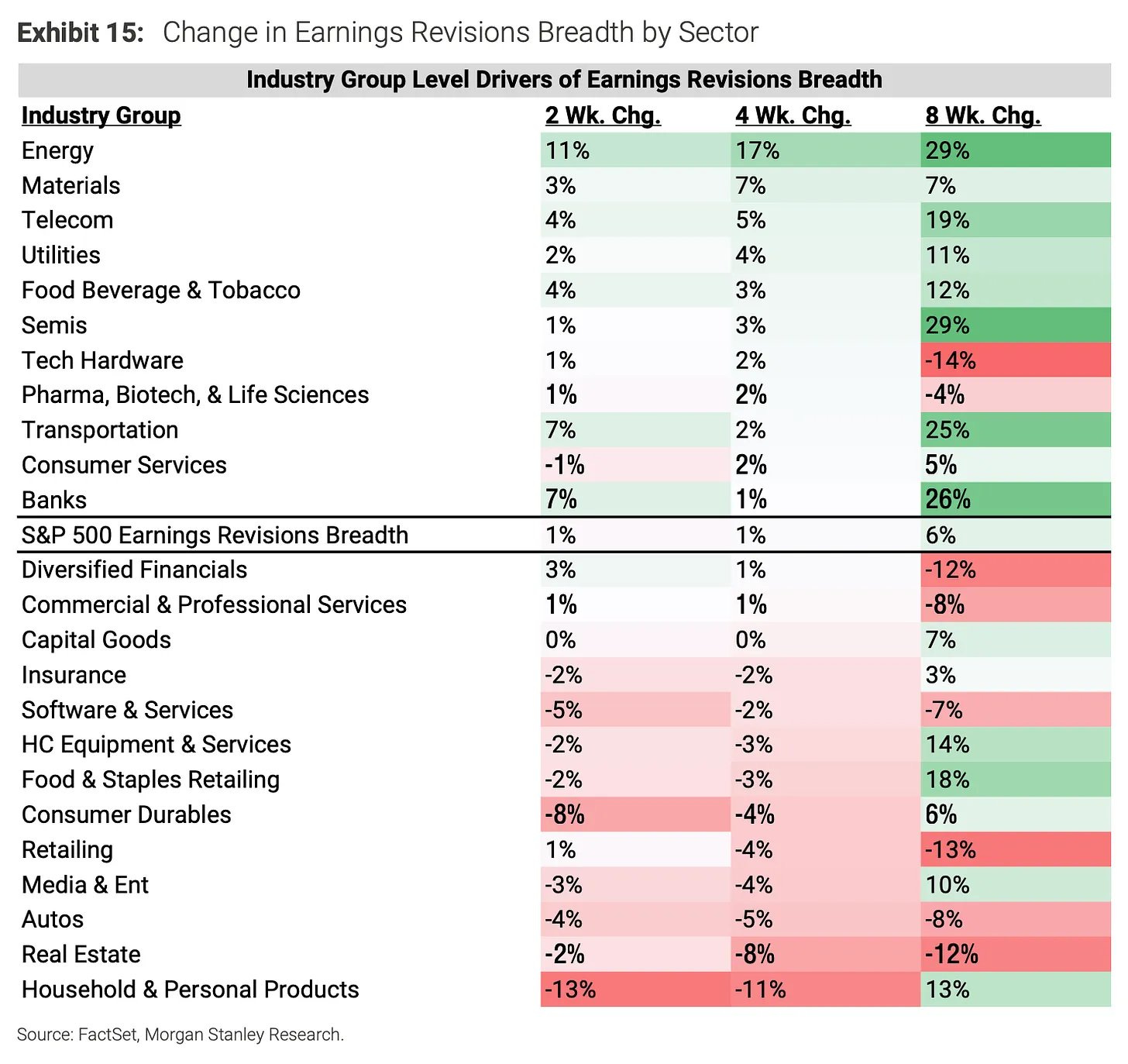

The energy sector has seen some of the largest upward earnings revisions heading into earnings season.

Our portfolio already includes some of our favorite energy plays, and we’re watching closely for new opportunities. Stay tuned.

India remains the best emerging market to invest in

Tesla is the latest global company to invest in India. (Read)

While the news is mostly focused on what this means for Tesla, investors should consider what it means for India. We highlighted India’s potential last summer, and the iShares India ETF is up about 20% since then. As China continues to stumble, India will be a major beneficiary.

Two ways to play this: the India ETF (INDA) is the most direct way to add exposure to India. Alternatively, the Australia ETF (EWA) is an indirect way to invest in the region. Australia sells natural resources to both India and China, and with a yield of 3.7%, the ETF is a great way to profit regardless of which country wins the race.

Debt: the next financial crisis

The Congressional Budget Office reports that government debt is on track to hit 116% of GDP by 2034. (Read)

The truth is these are conservative projections, and without significant cuts the debt burden will be much worse.

The real question is how this will impact the markets and the economy. Economists have been warning about government debt levels for decades, yet it hasn’t impeded economic growth.

The difference now is that interest rates are rising, which means as debt is refinanced, interest costs will represent a larger and larger percentage of the government budget. That will impact fiscal policy, which impacts economic growth.

All of this will come to a head later this decade (likely 2026-2029). For now, we continue to believe treasury bills represent the best option to store cash. Signs that debt levels have hit a tipping point will be declining demand at treasury auctions and rating agencies dinging the Treasury for its fiscal condition.

Market Technical Analysis

S&P 500 (SPX)

The rate-induced selloff continues. The SPX has failed to break above the 3/28 AVWAP four times in a row, and is now sitting at its 50-day moving average. This certainly looks like the beginning of a correction, especially considering a spike in the VIX, rising rates and rising oil prices, and RSI falling below its trading range. We’ll continue to use the 3/28 AVWAP as an indicator for whether the bulls or bears are in control.