Market Brief - April 28, 2024

Can the bounce be sustained?

Welcome to The Predictive Investor Market Brief for April 28th, 2024!

Despite the volatility around the GDP report, companies continue to put up good numbers, giving the SPX a 2.7% bounce last week.

There will likely be some additional volatility around the Fed meeting on Wednesday, but ultimately whether the pullback is over depends on yields, which have yet to decline, leading us to believe there will be some continued consolidation ahead.

But as is often the case, the most important insights fly under the radar. Here’s why we’re not too concerned about the GDP miss:

GDP growth slows, but demand remains strong

Yes, GDP growth came in lower than expected - 1.6% vs 2.4% forecasted. (Read)

That said, domestic demand remains strong. Excluding inventory, government spending and trade, the economy grew at 3.1%. So while high inventory levels depressed the number, consumer spending remains strong. Companies continue to deliver solid earnings results. And jobless claims remain low.

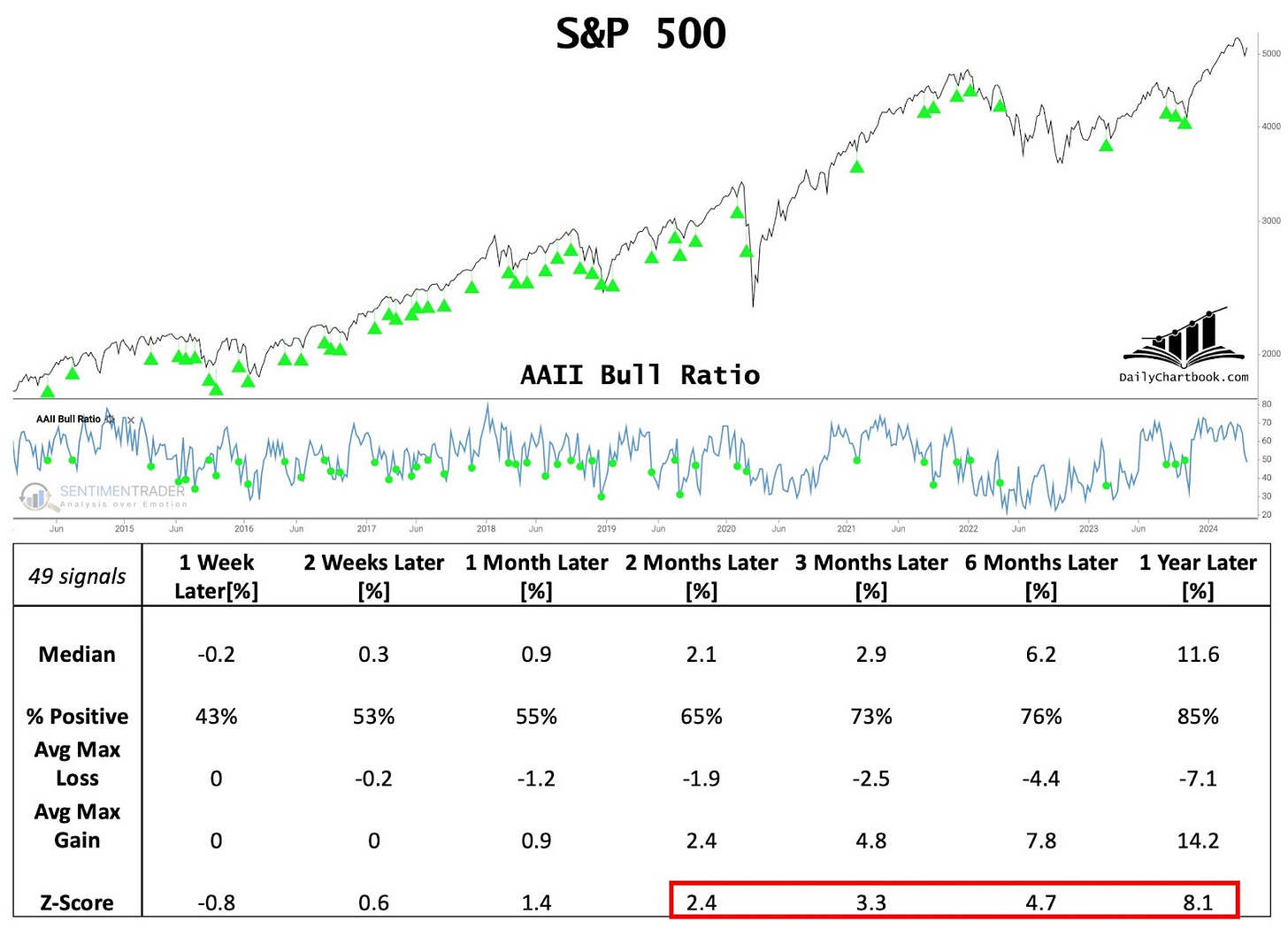

Bears overtake bulls for the first time in months

The AAII Bull/Bear ratio dropped below 50 last week, which signals a buildup of pessimism that historically has served as a good contrarian indicator. Be greedy when others are fearful!

Last call for India

We made a bullish call on India last summer and the media is starting to take notice. (Read)

As China continues to stumble, the India growth narrative will get more coverage.

The iShares India ETF (INDA) is up over 20% since last summer, and we believe there’s continued upside ahead.

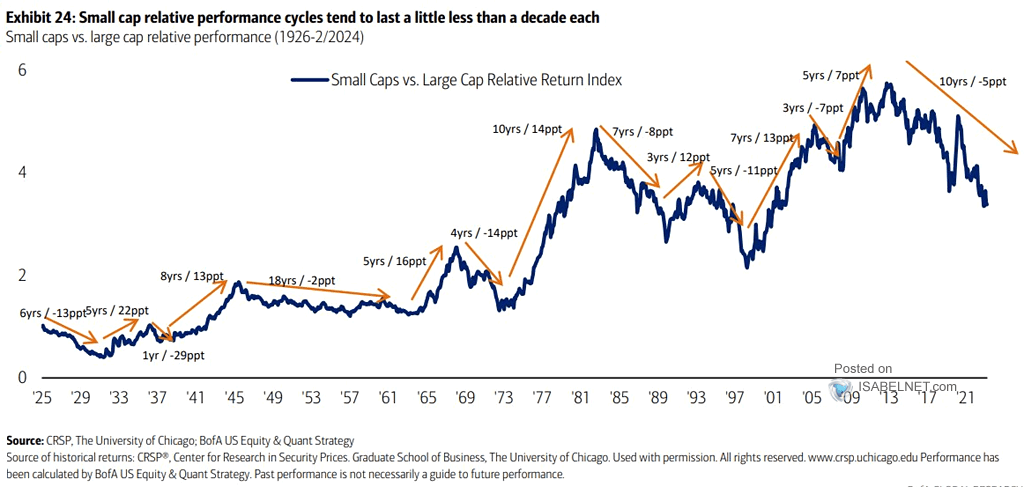

Small companies for the win?

We’ve been expecting a broadening of the bull market that would benefit small caps for a while now. While higher rates continue to be a headwind for the Russell 2000, small cap relative performance tends to move in cycles, and seems overdue for an upswing. Our strategy is based on 50+ years of historical data, and even in this difficult environment we continue to deliver better returns than the market indexes. Stay the course! A rules-based strategy will continue to reward you over time.

Market Technical Analysis

S&P 500 (SPX)

That “brief bounce” we highlighted last week arrived right on time! The SPX is now back at the 3/28 AVWAP. If the pullback is over, it will have been pretty shallow by historical standards. Yields haven’t reversed, so we’re skeptical. Much depends on guidance from the Fed this week. We did take advantage of the weakness to add two stocks to the portfolio that have held up pretty well.

Last Week’s Trades

We added two stocks to the portfolio last week.