Market Brief - April 7, 2024

Up 13% in 4 days - I hope you’re on board

Welcome to The Predictive Investor Market Brief for April 7th, 2024!

Last week we urged subscribers once again to increase energy exposure in their portfolios. As if right on cue, oil rallied nearly 4% last week amid a bullish technical setup. (Read)

We remain very bullish on energy, and our energy holdings are positioned well for continued gains.

In other news, March payroll numbers were higher than expected and the strongest monthly gain in almost a year. Numbers like this make it harder for the Fed to justify rate cuts, so yields rose, triggering a selloff in stocks.

These intermarket relationships have almost become too predictable. Still, should we be more worried about inflation or valuation?

Here’s what you need to know.

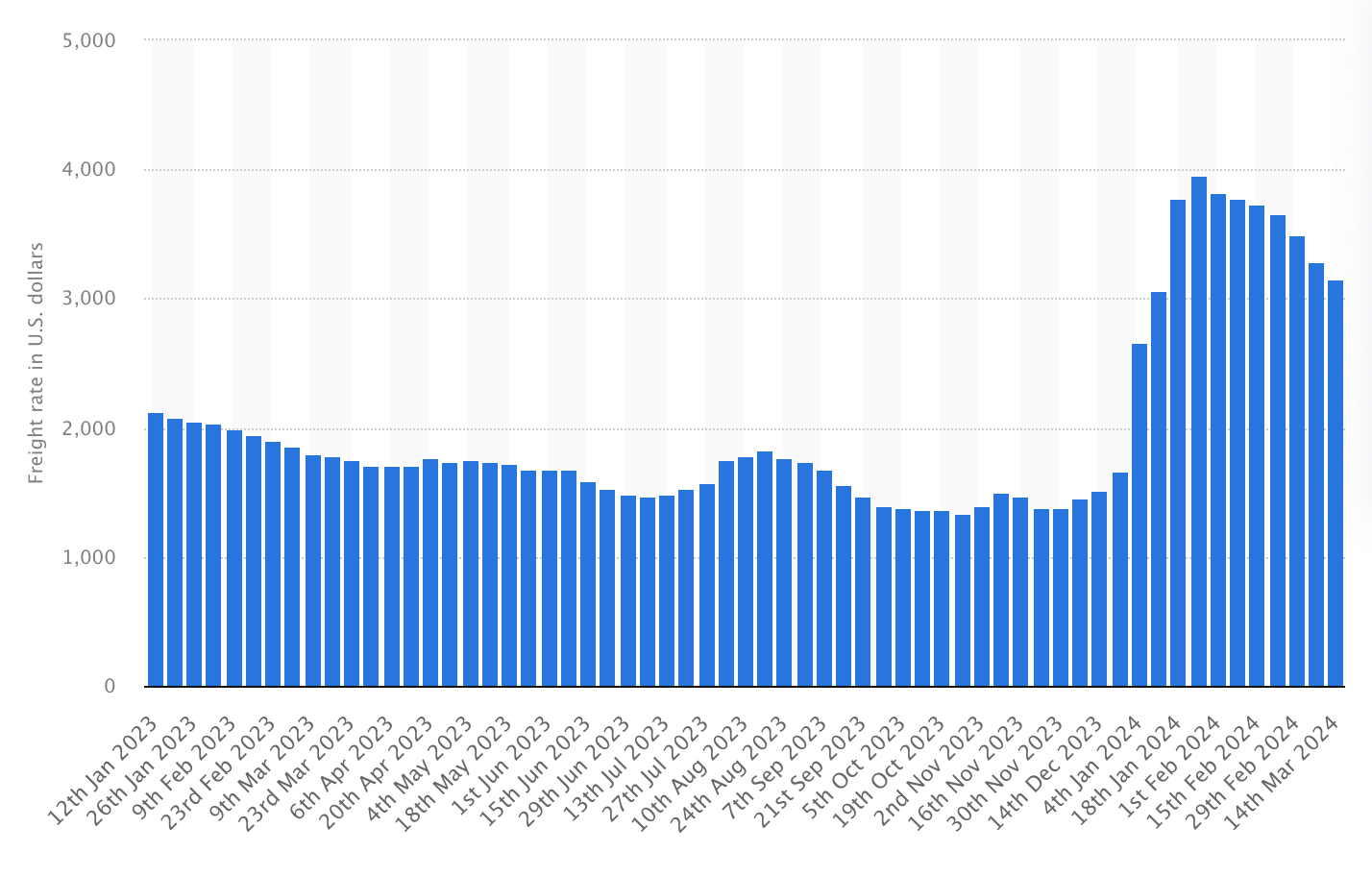

Soaring freight rates = Revenue $$$

Here’s a story that virtually no one is talking about. Global container shipping rates have soared since the start of the year. And yet, the industry continues to trade for less than book value. Most logistics companies have fixed costs, so rate increases go directly to the bottom line. Our latest shipping company rec. Is up 13% in 4 days, and it’s still trading for 89% LESS than book value!

Global Container Freight Rate Index (in $US/container)

U.S. Manufacturing Index heads into expansion territory

ISM’s manufacturing index closed March at 50.3, surpassing the 48.3 that economists expected. (Read)

Readings above 50 indicate a manufacturing expansion, and this is the highest reading since October 2022. The Inflation Reduction Act, infrastructure modernization and reshoring of supply chains will all provide a tailwind for continued expansion. This is great news for small domestically-focused companies - exactly the kind we’re invested in.

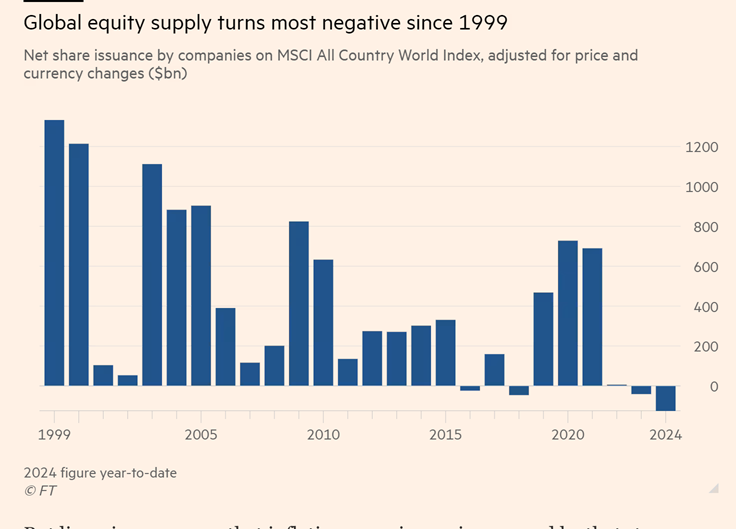

Supply of equities favors higher prices

The laws of supply and demand apply to equities too, and supply has been shrinking at a rapid pace. Fewer IPOs, along with massive buyback programs have resulted in a contraction in net shares issued. Yet one more reason why the current environment favors higher equity prices.

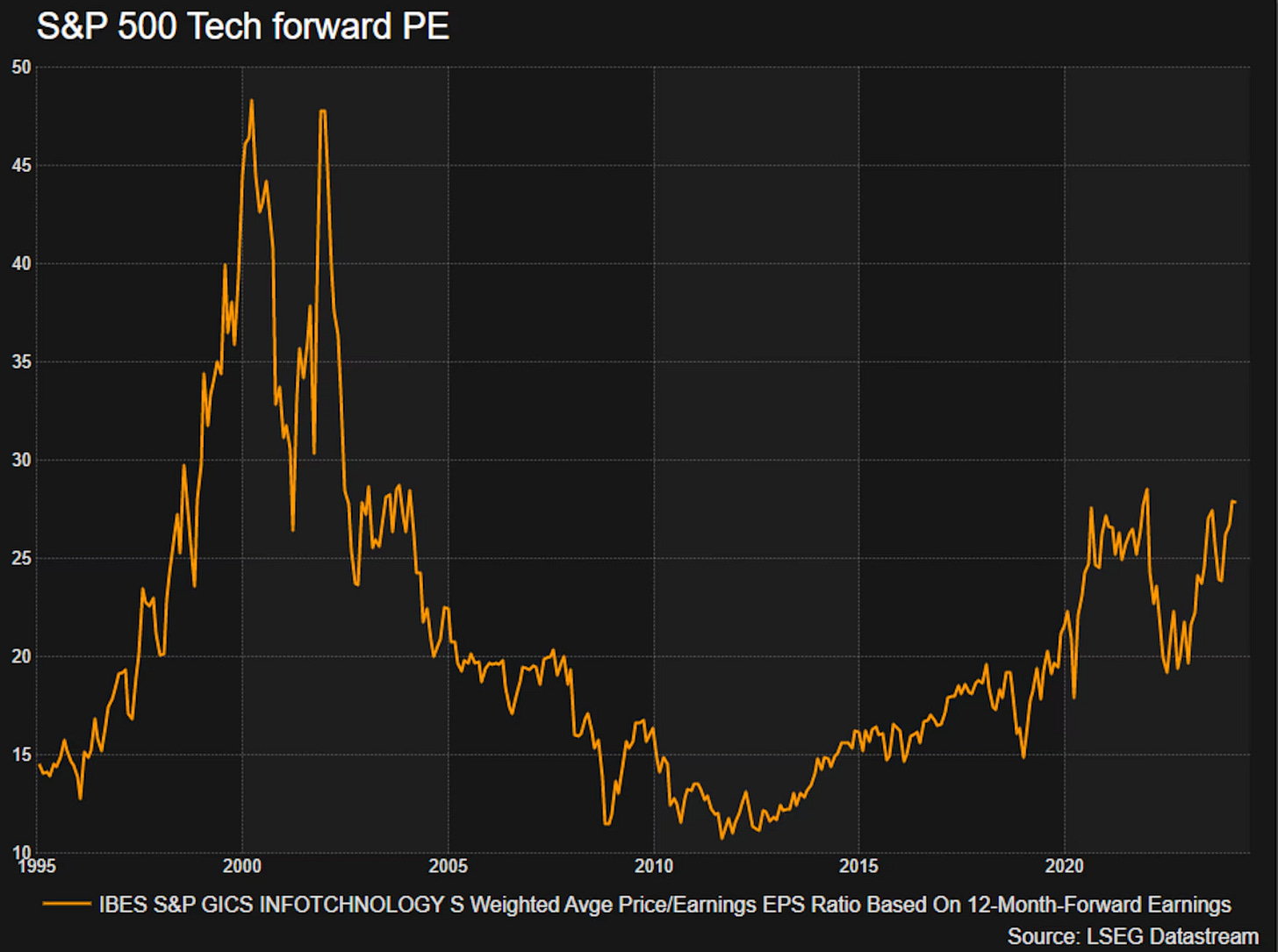

Forward PEs nowhere near dot com highs

While it’s true that some tech PE ratios are exceedingly high, these valuations are amidst the backdrop of rising earnings. Using predicted earnings (aka forward PE ratio), valuations are nowhere near the highs reached during the dot com bubble.

Despite the volatility around the timing of Fed rate cuts, last week’s jobs report shows growth remains on an upward trajectory despite higher rates. So for now, the risk of a bubble is overstated.

Market Technical Analysis

S&P 500 (SPX)

Three weeks ago we said if TLT broke below $92.15 it would trigger a selloff in stocks. And that’s exactly what happened. The SPX is off just over 1% from the 3/28 high with a jump in volatility. We are still bullish long term, but short term we are overdue for a correction. And the downtrend in TLT could provide the trigger for profit-taking. If you’re putting new money to work, try dollar cost averaging over the next few weeks to mitigate the volatility risk.

Last Week’s Trades

We added one stock and removed two from the portfolio last week.