Market Brief - August 11, 2024

The economy is not crashing

Welcome to The Predictive Investor Market Brief for August 11th, 2024!

The volatility continued last week, as the yen carry trade unwinds. Despite the ups and downs, the S&P 500 was essentially flat week-over-week.

Although the market appears to have stabilized, we are still in a short-term downtrend, and no one knows exactly how much money is in the yen carry trade and how long it will take to unwind. Therefore we should expect continued volatility as institutional funds adjust their portfolios.

Here’s our takeaways from the week.

The labor market is not as bad as you think

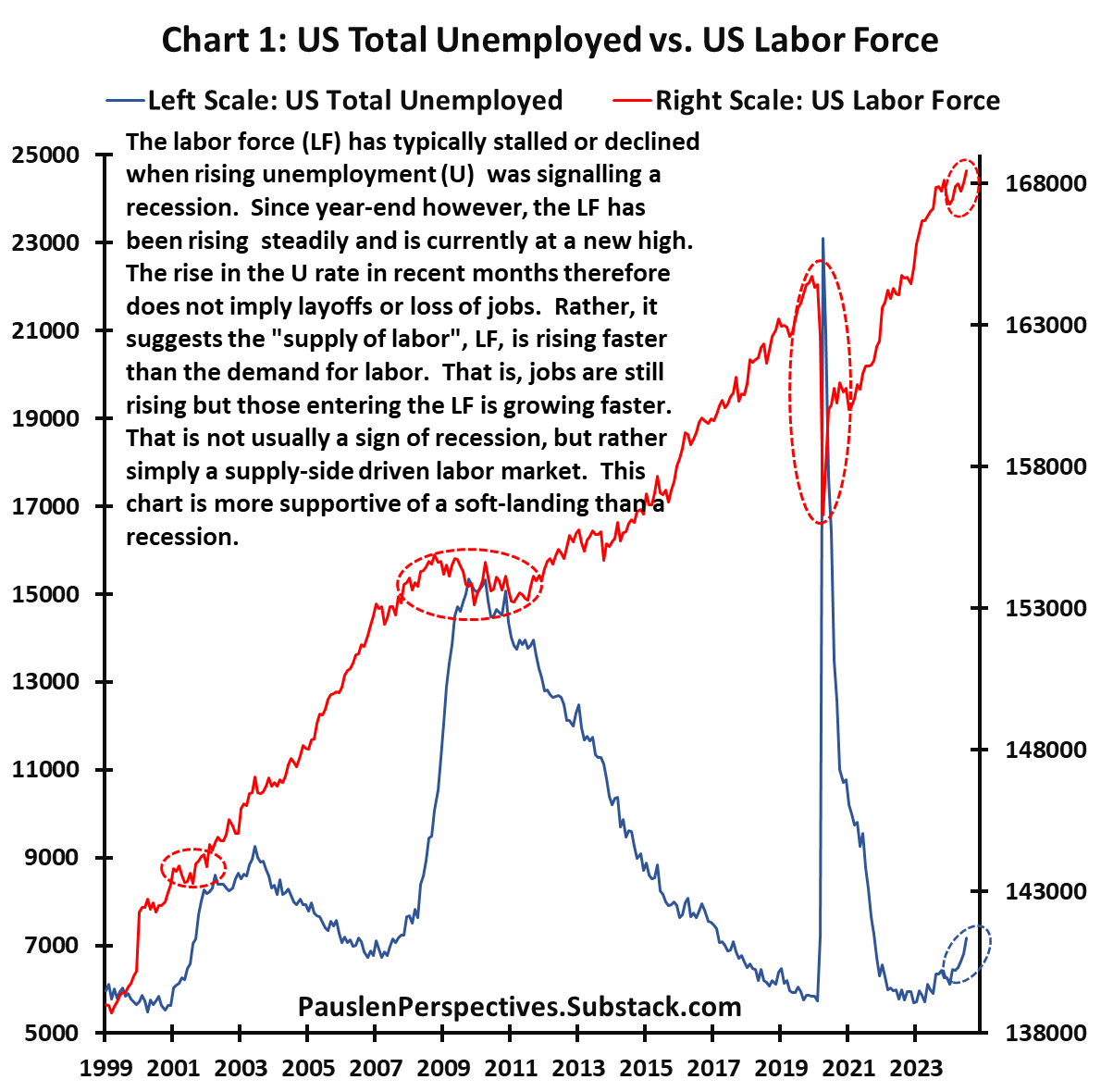

While the unemployment rate has been rising, it’s not time to panic just yet. Typically during a recession the rise in unemployment coincides with a shrinking labor force, as more existing workers lose their jobs.

But that’s not happening this time. The US labor force continues to grow (chart below), suggesting that people are entering the labor force at a faster rate than job growth.

Nearly the entire increase in unemployment YTD is due to the surge in labor force entrants and a jump in temporary layoffs last month, mostly due to all the summer storms in the south.

As of now the situation remains consistent with a soft landing.

Corporate earnings are holding up

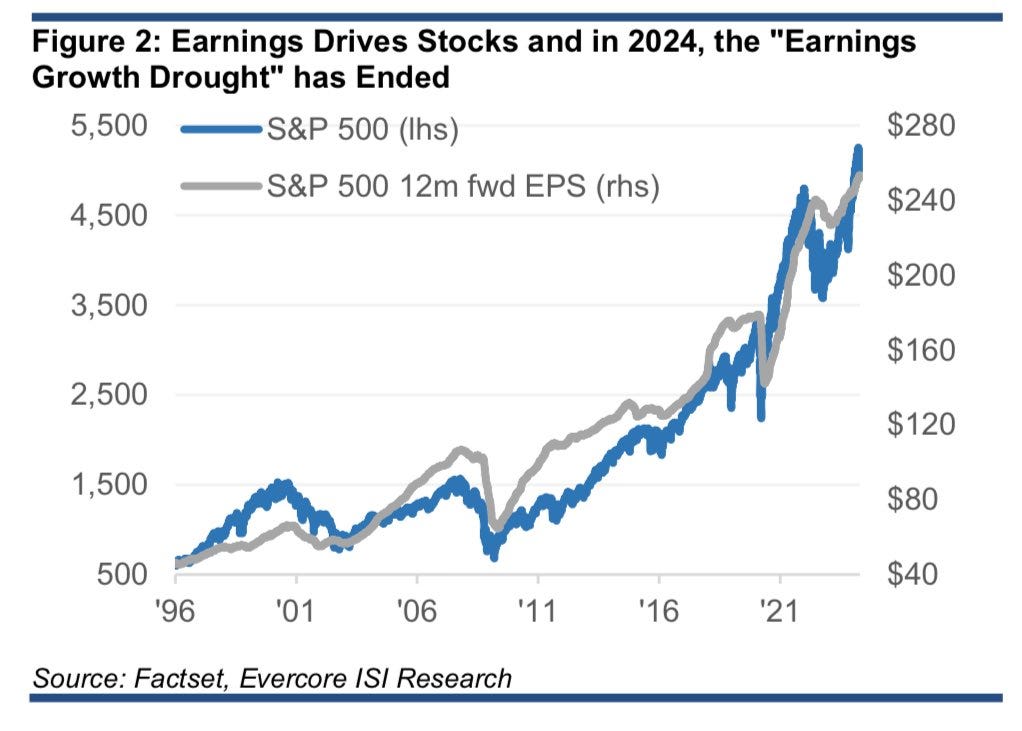

With 91% of S&P 500 companies having reported earnings, year-over-year EPS growth is at 10.8%, the highest since Q4 2021. Estimates are holding relatively steady for 2024 and 2025, despite signs the economy is softening.

Earnings drive stock prices, and all indicators point to higher numbers ahead.

If you haven’t yet upgraded to paid, it’s not too late. There are plenty of opportunities in this market.

Business applications are still near record highs

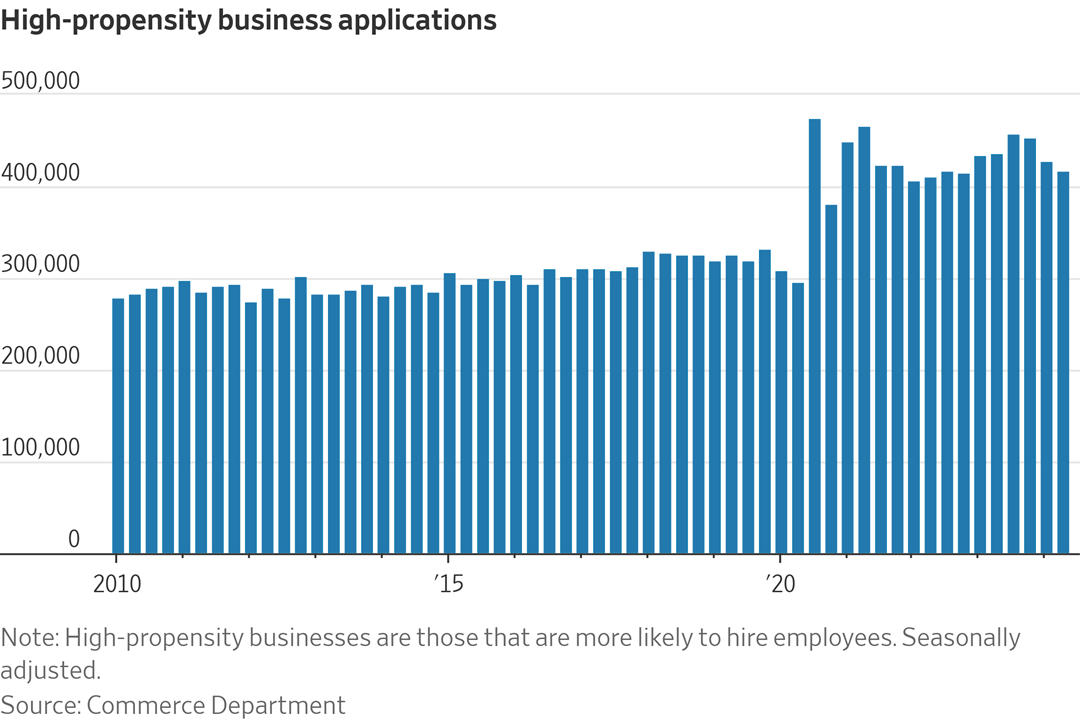

Longtime readers know if there’s only one data point we could use to justify the continuation of this bull market, it’s new business applications.

Applications for high-propensity businesses (i.e. those likely to hire employees) remain near record levels.

The last time we saw such a large surge in new business formation was during the 90s tech boom. The widespread willingness to take on the risk of establishing a new business only happens when entrepreneurs are confident in the business outlook ahead.

SPX finds support

Last week we pointed to a downside target in the SPX of 5260. The index dropped about 3% below that on Monday and rallied the rest of the week, closing at 5344.

This selloff didn’t just happen suddenly. It started on July 16th, and the bears will remain in control until the index closes above the 7/16 AVWAP, currently at 5433.

That being said, there were some constructive technical developments last week. RSI bounced off 30 as the index found support near its YTD VWAP (blue line), both of which marked a near-term bottom back in April.