Market Brief - August 18, 2024

The bulls are back in control

Welcome to The Predictive Investor Market Brief for August 18th, 2024!

The S&P 500 is up 8.5% from its low last week. The media would have you believe this is due to moderating inflation and positive economic data. But both of these trends were in place for some time now.

The sudden selloff was due to some large investor (or several) needing to bail out of a very crowded trade. Needing to get out at any price typically happens when they’re on the wrong end of an unexpected event (i.e. Japan raising interest rates). Add computerized trading on top of that, and the swings between greed and fear can happen very quickly.

While these volatile swings are very common, the situational triggers and degree of selloff are different every time, making them difficult to predict. The fall is a notoriously volatile period for equities, and this year includes an election and a fair amount of geopolitical uncertainty. So we will likely hit some more bumps over the next few months.

But for now, the VIX has collapsed, and the bullish trend has resumed.

Here’s our takeaways from the week.

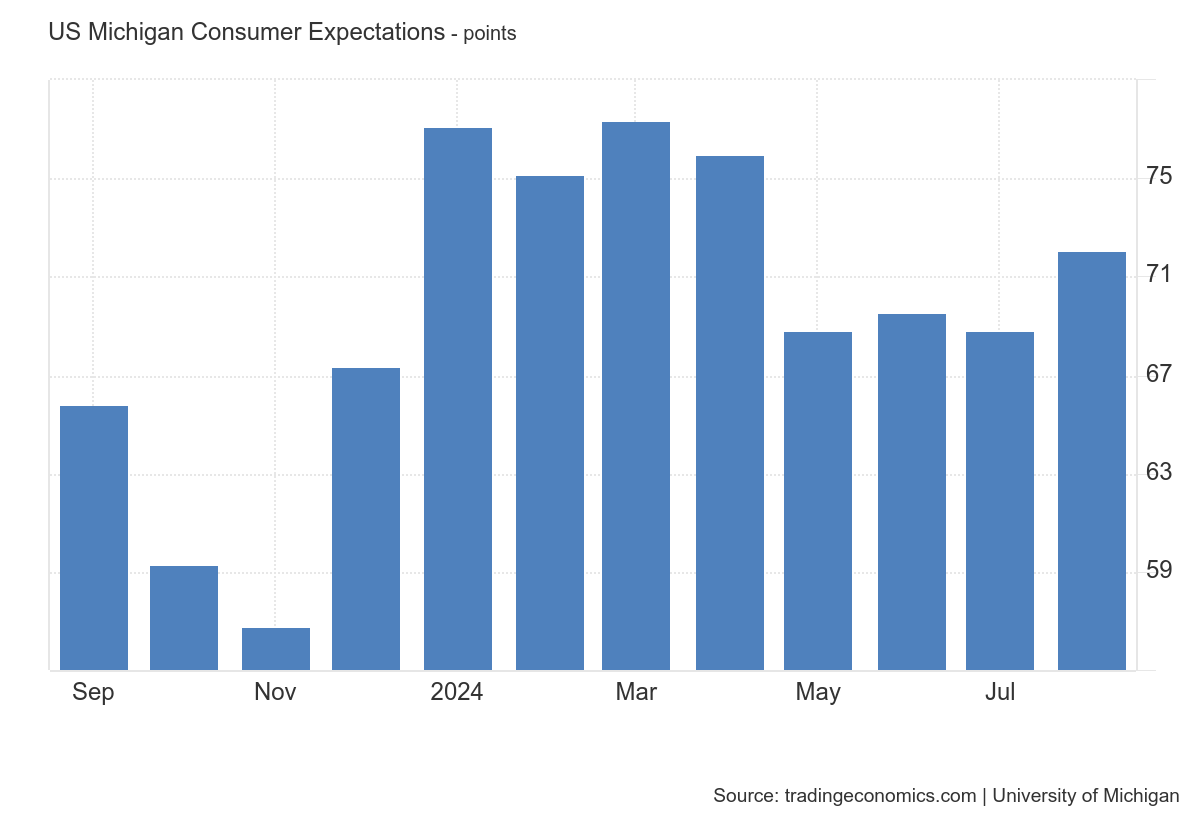

Consumer expectations hit a 4-month high

The consumer expectations index came in at 72.1 (vs. forecast of 68.5), and measures consumers’ views on their own financial situation and forward prospects for the economy.

Improving consumer sentiment is translating into behavior, with retail sales up 1%, above the 0.4% that was expected and up from 0% a month ago.

While consumers remain frustrated by inflation, the argument that consumer spending would collapse has just not come to fruition. Consumers are perhaps more price sensitive as they shift spending patterns, but they have not stopped spending. Which is very good news for an economy that is heavily dependent on a strong consumer.

The market will stop caring about inflation very soon

Both CPI and and PPI year-over-year readings came in below expectations. The shelter component of the CPI alone accounted for 90% of the increase. Outside of shelter and auto insurance, the rest of the CPI was down a combined 0.1%.

And there are signs the rental market is cooling down. Zillow has reported that an increasing number of property managers are offering concessions on rental listings. (Read)

A month ago we highlighted the fact that real-time inflation readings dropped below 2% would set the stage for a Fed rate cut in September. We still believe that’s true.

Business investment accelerates

Corporate investment continues to rise and net income for the corporate sector has increased to 2.6% of GDP. Not exactly a sign of recession.

When you add this to all the fiscal stimulus around infrastructure and reshoring manufacturing, it’s hard not to see this as the precursor to an economic boom once the uncertainty around the election and Fed policy is resolved.

If you haven’t yet upgraded to paid, it’s not too late. There are plenty of opportunities in this market.

Bulls take back control

Last week we highlighted some improving technicals and said bears would remain in control until the SPX closes above the 7/16 AVWAP. That has now happened, which means the bullish uptrend has resumed.

Last week’s rally created a gap between 5463 and 5501. Although not required, traders may look to fill that gap if any weak economic news comes out. Ultimately the SPX will need to remain above the 7/16 AVWAP (red line) for the uptrend to remain intact.