Market Brief - August 25, 2024

The Fed finally has permission to cut rates

Welcome to The Predictive Investor Market Brief for August 25th, 2024!

The big economic news last week was the downward revision in the jobs numbers by 818,000. The revision covers April 2023 through March 2024, and represents 30% of job gains reported over that time period.

These revisions happen all the time, although this one was particularly large. Stocks closed up anyway. There’s a few reasons why.

The revision numbers are preliminary, and Goldman Sachs estimates that it’s overstated by as much as 600k, since unemployment insurance records don’t include immigrants without legal status, a huge contributor to job growth over the last few years.

Consumer spending and corporate earnings matter more to the stock market, as those numbers are reflective of what people are actually experiencing in the economy.

And more importantly, weaker employment numbers give the Fed permission to cut rates. If you’ve been reading along, none of this should come as a surprise. We’ve been highlighting lower inflation and rising unemployment for over a month now.

While the market will continue to be especially sensitive around any weak economic numbers, we’re still bullish. Here’s our takeaways from the week.

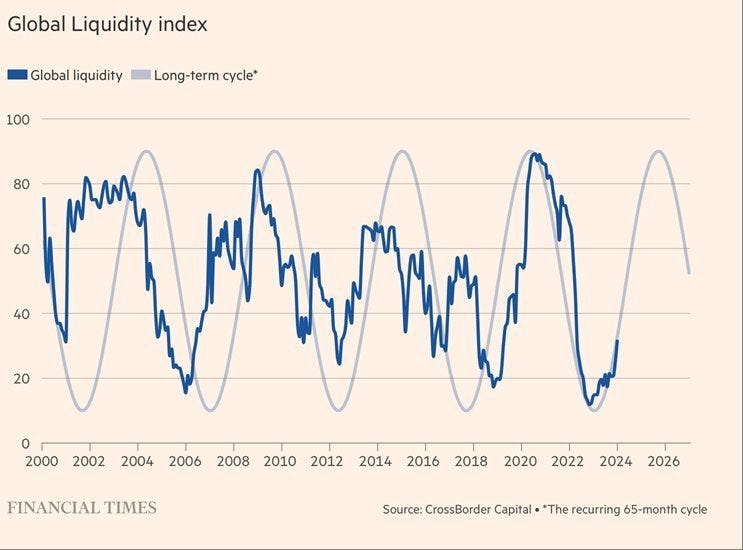

Global liquidity on the rise

Global liquidity has been surging, following a long-term cycle that peaks in 2026. This will fuel continued economic expansion, providing a tailwind to stocks and other risk assets. It also aligns with our longer-term view of an economic peak later this decade.

Beware long term bonds

Speaking of an economic peak later this decade, we believe the next crisis will be triggered by rising government debt globally. The financial media has been pushing bonds as a way to play impending rate cuts. We remain skeptical.

New research analyzing Treasury securities in the wake of the Covid shutdown concludes that Treasury bonds were not any safer than bonds of other governments or even big corporations. (Read)

In short, investors did not rush into treasuries as they did in previous crises. The market was pricing in a surge in government spending and wanted higher yields to compensate for the added risk of rising debt levels.

Crises around government debt tend to unfold slowly, as the consequences start with low growth, and often lead to inflation and higher taxes. Sound familiar? Government bonds are one of the riskiest asset classes in that sort of environment.

The U.S. cannot pay off its $35 trillion in debt without debasing the US dollar. Stocks, real estate, and precious metals will preserve your purchasing power. Long term bonds will not.

AI could destroy SaaS multiples

In a leaked recording, AWS CEO said that coding will be a thing of the past due to AI, and that the job of a developer will change significantly. (Read)

What’s missing from the commentary on this is how AI could change the fundamentals of SaaS companies. AI will make it cheaper to create software, which lowers the barriers to entry, leading to increased competition.

As software becomes commoditized, multiples on the average SaaS company will come down. Software companies that are not enabling mission-critical use cases are ripe for disruption.

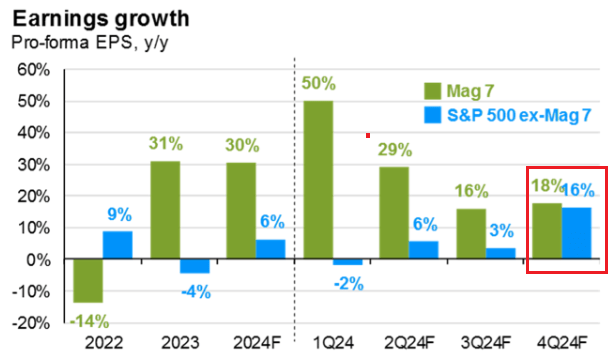

Broader EPS growth ahead

The S&P 500 equal-weight index closed the week at an all-time high, just ahead of the market cap weighted index, which remains below its July high. This is one of the few times in recent memory that the equal-weight index has led, and demonstrates that the bull market is broadening out, as expected.

And this is supported by improving fundamentals. EPS growth for the rest of the S&P 500 is expected to catch up to the Mag 7 by next quarter. And small caps are expected to deliver even large quarter-over-quarter EPS growth in Q4, as they are more rate-sensitive than larger companies.

There is no shortage of potential triggers for volatility heading into the fall, but we continue to view those as buying opportunities.