Market Brief - August 6, 2023

Welcome to The Predictive Investor Market Brief for August 6th, 2023!

Stocks declined last week, led by the Nasdaq (down 2.8%) with a more modest decline for the Russell 2000 (down 1.2%).

A few takeaways from the economic news of the week:

The downgrade of U.S. credit by Fitch Ratings will have little long term impact. This was not based on any new information and represents more of an excuse for investors to take profits than a signal on the economy.

Continued contraction in the manufacturing sector should surprise no one. The Covid lockdowns spurred demand for goods and depressed services. Those trends are now reversing, and growth this year will continue to be driven by services.

Mixed news in the labor market: a larger than expected increase in ADP private sector payrolls aligns with the soft landing scenario. But wage growth beating expectations means the Fed will be more likely to keep rates higher for longer.

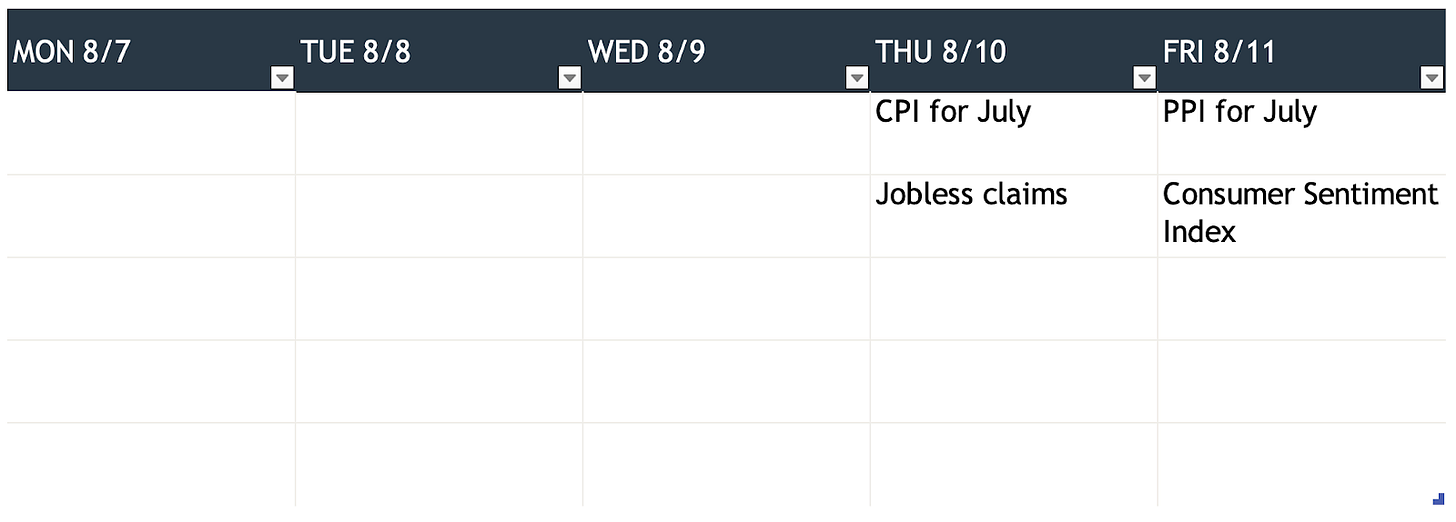

Market moving events to watch next week

Weekend Reads

JPMorgan backs off recession call even with ‘very elevated’ risks: JPMorgan Chase economists on Friday bailed on their recession call, joining a growing Wall Street chorus that now thinks a contraction is no longer inevitable. While noting that risks are still high and growth ahead is likely to be slow, the bank’s forecasters think the data flow indicates a soft landing is possible. That comes despite a series of interest rate hikes enacted with the express intent of slowing the economy, and several other substantial headwinds. (CNBC)

JP Morgan joins Bank of America and Goldman Sachs in reversing their recession forecasts for 2023. Economists are notoriously terrible market timers, and we can’t help but wonder if this is an indicator of a short term extreme in bullish sentiment. Capitulation from major Wall Street banks, combined with weakening momentum (see below) suggests a correction could arrive sooner than later.

How Feasible Is It to Turn Office Buildings Into Apartments? Transforming these buildings into affordable housing will be costly with required subsidies to keep those apartments affordable, and expensive retrofitting only adds to that cost. Schulze believes that private-public partnerships can ease the burden. Cities provide the incentives to meet affordability requirements, and building owners create partnerships with outside industries. (Dwell)

We’ve long maintained that the doom and gloom over commercial real estate is overdone. Building owners will adapt to the changing market, and public-private partnerships will begin to incentivize this. We highlighted a few individual stocks last week, but another way to play this is with a high quality REIT. Investors seeking income should check out Cohen and Steers Quality Realty Income Fund (RQI), one of our favorite closed-end funds in this space, which currently trades at a 5.6% discount to NAV and yields 8.25%.

Lots of US Homeowners Want to Move. They Just Have Nowhere to Go: Locked into cheaper borrowing costs and unable to find a new place that fits their budgets, countless people are opting to remain in their current homes, adding to an acute shortage of available properties. (Bloomberg)

The investing opportunity here is in home improvement. 61% of Americans have a mortgage below 4%, which means moving would entail a huge cost of living increase at today’s mortgage rates. The home improvement boom that started during Covid will continue as more homeowners realize they will be staying put for a while. We have exposure to this sector in our portfolio, but investors looking outside the micro cap universe should consider Home Depot (HD), Lowes (LOW) and Floor & Decor Holdings (FND).

Market Technical Analysis

S&P 500 (SPY)

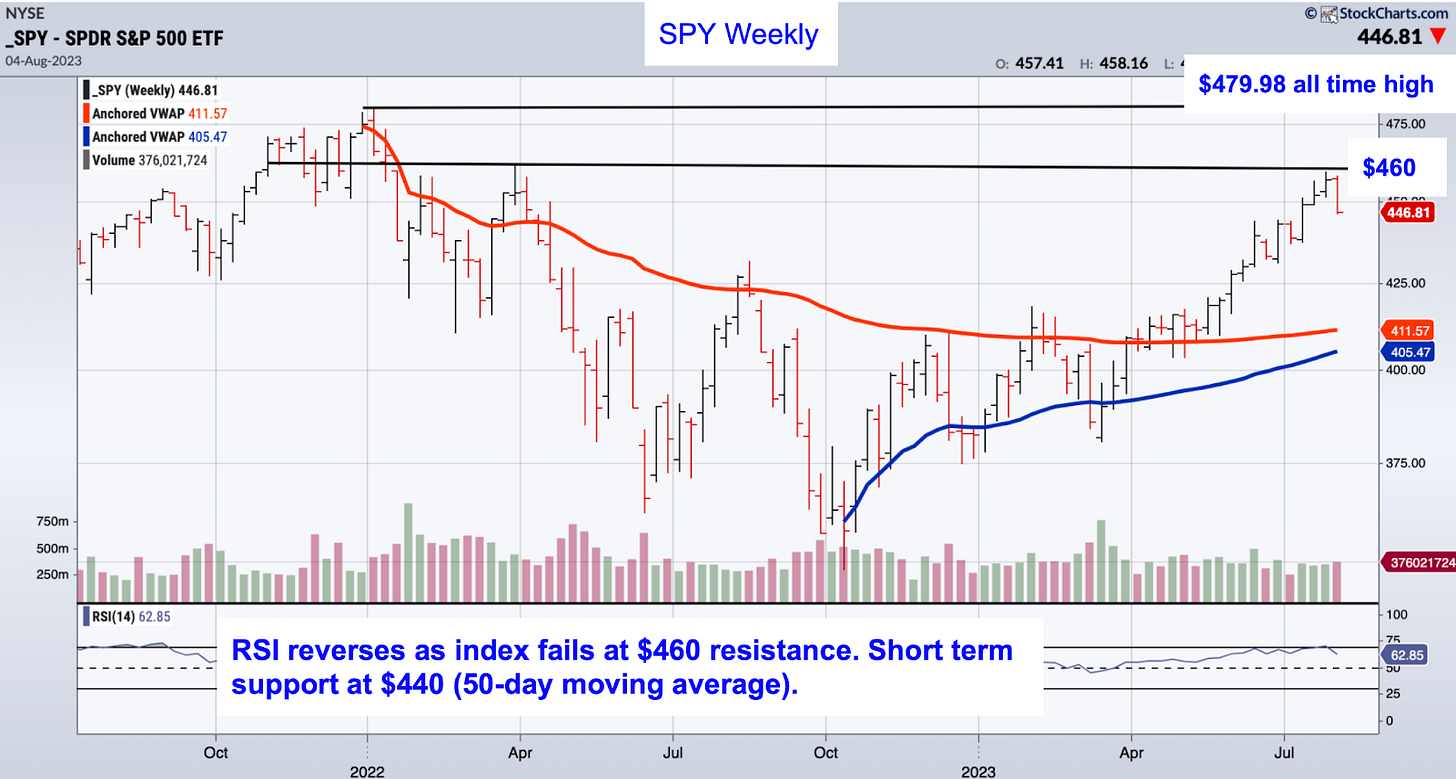

Last week we noted the resistance zone between $460 and $470 as a potential area for the market to take a pause. SPY failed to break $460 and RSI has now reversed. Momentum has been so strong since March that we’ve only had very minor pullbacks. Initial downside target is the 50-day moving average (currently $439.14). If this turns into a real correction we’ll be looking at the 12/27/21 AVWAP and 10/10/22 AVWAP as potential downside targets. They’re currently set to converge around $410.

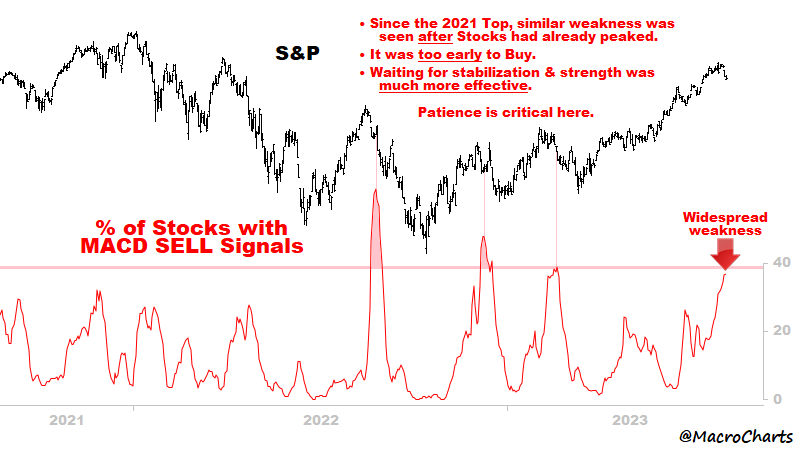

Our outlook for the intermediate term remains bullish but the potential for an 8-10% correction in the near future is strong. Over the last few weeks an increasing number of stocks have flashed MACD sell signals (chart below), which historically has preceded market corrections.

Market Sentiment

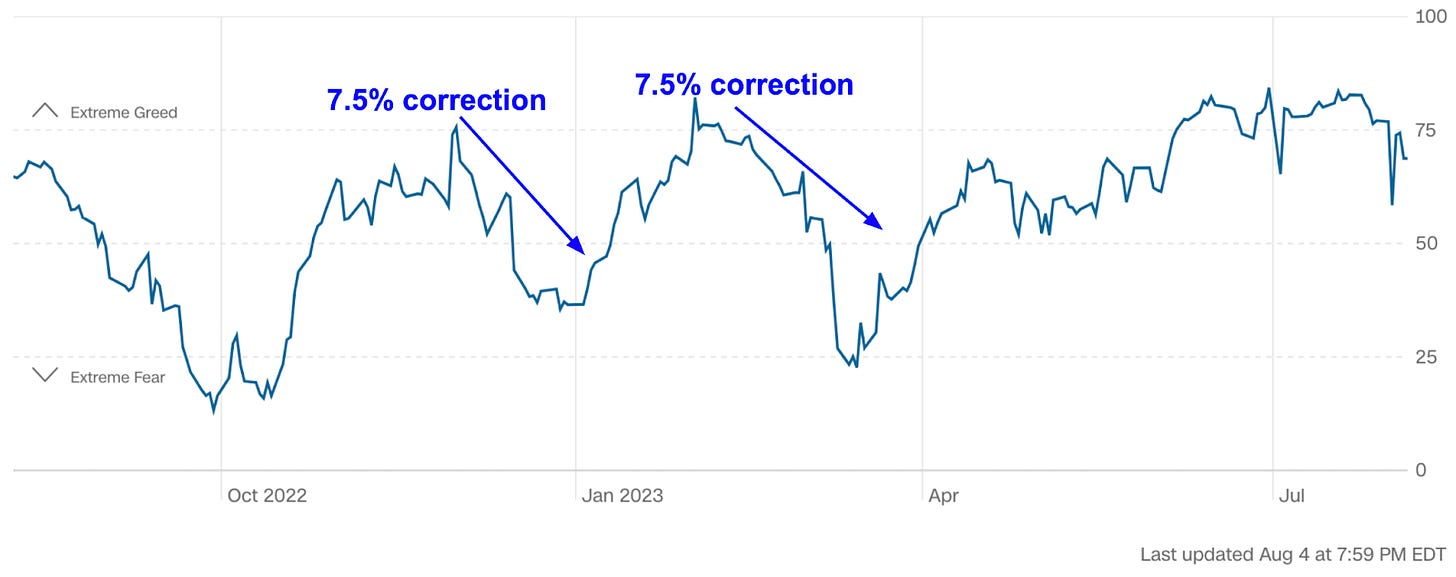

The CNN Fear & Greed Index appears to have reversed trend after spending weeks in extreme greed territory. The last 2 times this happened we saw a 7.5% correction in the S&P 500.

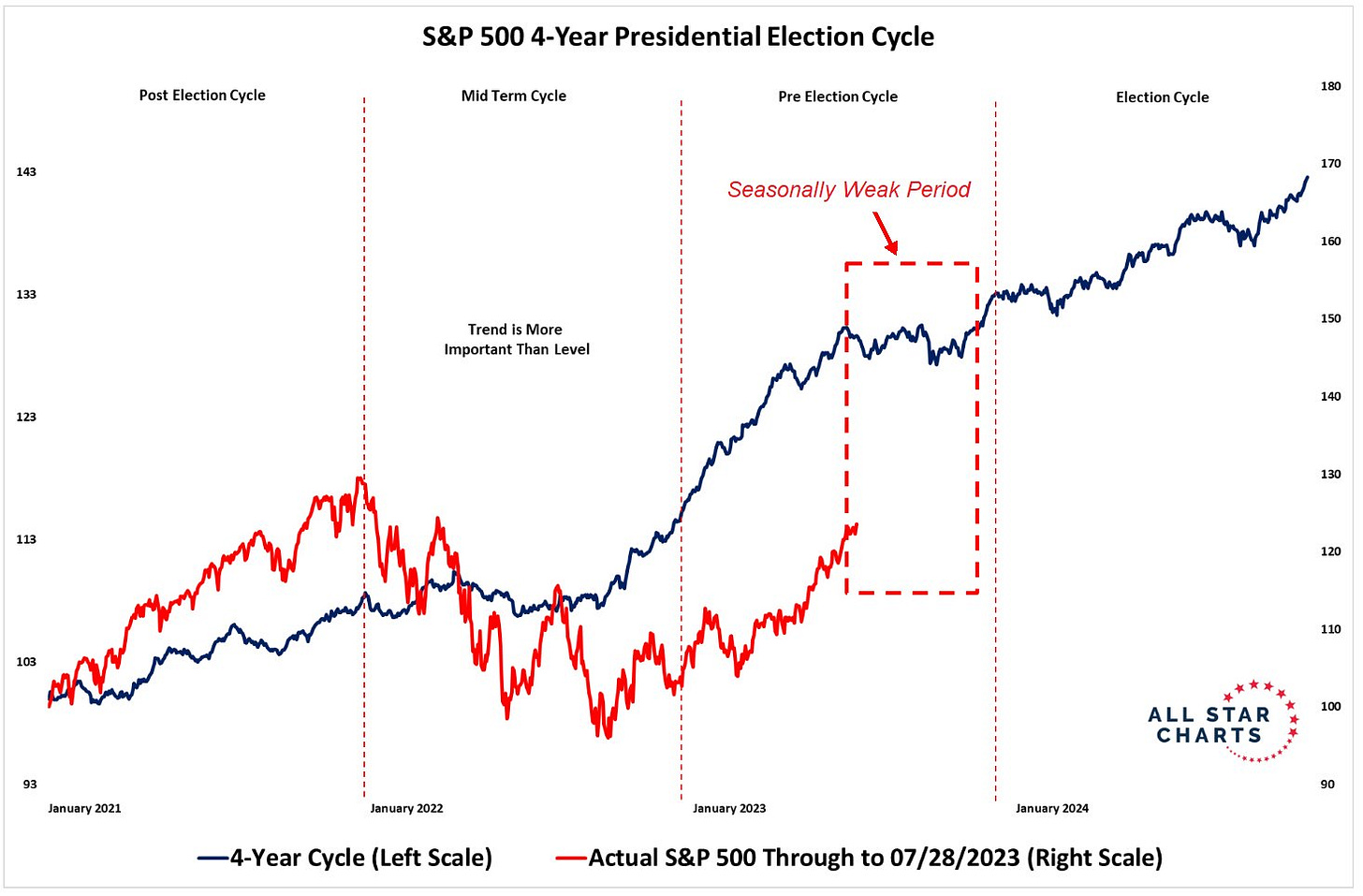

Additionally, we are entering a stretch of time that historically has seen consolidation in the stock market (chart below). While pre-election years typically see strong returns for stocks, August through October are historically weak.

The bottom line: Waning momentum, capitulation by major Wall Street banks, weak seasonality and a reversal in the Fear & Greed index all seem to point to a short term reversal in bullish sentiment. Small cap stocks are less extended than large caps, so we will use any weakness to add to the portfolio. But investors should remain cautious and alert for a market correction.