Market Brief - December 10, 2023

Jobs and inflation signal a Fed pivot

Welcome to The Predictive Investor Market Brief for December 10th, 2023!

Stocks were up modestly last week as the labor market showed signs of cooling off. The economy added more jobs than expected in November, but job openings are at a two year low. This gradual retreat favors the soft landing scenario.

Inflation will be the central focus this week, with the CPI coming out on Tuesday and the Fed meeting on Wednesday. The market is expecting the Fed to hold rates steady, and is currently pricing in rate cuts starting in March. It is unlikely the Fed will deliver any major surprises, especially entering an election year, but we shall know soon enough.

Weekend Reads

INFLATION IS YOUR FAULT (The Atlantic)

“The sales of new cars, dishwashers, cruise vacations, jewelry—all things people tend to give up when they are watching their budget—remain strong. Consultants keep anticipating a recession precipitated by the “death of the consumer.” Thus far, the consumer is staying alive.”

The first humanoid robot factory is about to open (Axios)

“Sensitive to the concern that robots will take jobs from humans, Amazon teamed up with MIT in October for a project that aims to study automation's impact on work. Amazon says the 750,000 mobile robots it has deployed in the last decade have helped create 700 new categories of jobs for humans.”

Biggest Blowout in Bonds Since the 1980s Sparks Everything Rally (Bloomberg)

“Investors frantically bid up the price of Treasuries, agency and mortgage debt, sparking the best month since the 1980s and igniting a powerful pan-markets rally in everything from stocks to credit to emerging markets. Even obscure cryptocurrencies, the sort of speculative, uber-risky assets that struggled when yields were soaring, posted big gains.”

Did the Meme Stock Revolution Actually Change Anything? (Promarket)

“Finally, the advent of meme investing and growth in retail interest has coincided with a sharp downturn in the profitability and productive expenditures at meme companies. We find that meme companies have experienced a sharp decline in profits in recent years, even after the 2021 meme surge allowed companies like GameStop and AMC to raise large sums of money by selling stock at elevated prices (known as the “at-the-market” offerings).”

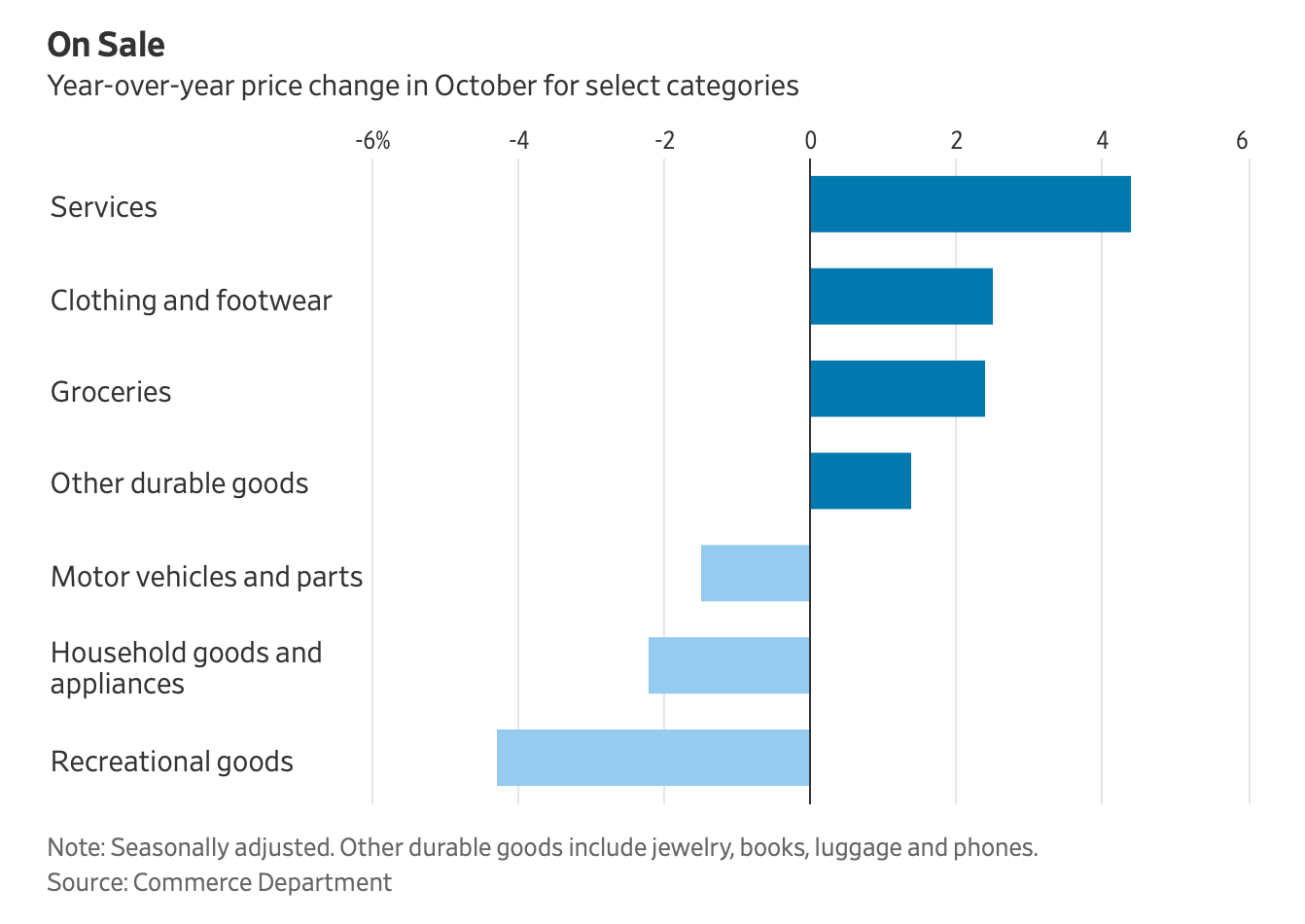

Goods Deflation Is Back. It Could Speed Inflation’s Return to 2%.

Source: WSJ

Market Technical Analysis

S&P 500 (SPY)

SPY closed at a high for the year, and is within striking distance of its all time high of $467.13. Trading activity over the last week has been flat, as the bulls are hesitant to drive prices higher with the market so overbought over the short term. This is normal after the strong rally we had last month. We’re at a point where the Fed could easily cause some volatility to the upside or downside. Our portfolio is well positioned to capture any continued upside momentum. And if we get a pullback, we’ll be watching the 7/27 and 10/27 AVWAPs as downside targets, both 4-5% below current levels.