Market Brief - December 17, 2023

Santa Claus rally commences

Welcome to The Predictive Investor Market Brief for December 17th, 2023!

The Fed gave us a nice Santa Claus rally led by small caps, which were up 5.5% for the week vs. 2.5% for the S&P 500. While it was widely expected they would leave rates unchanged, Powell’s language has started to shift from previous meetings. He officially endorsed the soft landing scenario, with the expectation that the unemployment rate would remain steady through next year.

Markets are pricing in 3 rate cuts next year, and with inflation cooling this sets the stage for small caps and other underperforming sectors of the market to outperform in the year ahead.

Weekend Reads

Things You Don’t See in A Recession (Carson Group)

All we hear about is how bad the consumer is doing and they will be tapped out soon. Fortunately, if you take the time to look at the actual data that isn’t the case. Would you believe real incomes are at an all-time high? Given consumers make up close to 70% of the economy, this bodes well for continued spending.

Chinese Amusement Park Operator Falls 90% a Month After Hindenburg Short (BNN Bloomberg)

“Unfortunately, the Nasdaq exchange is littered with dozens of obvious China-based scams. These companies commonly lure in unsuspecting U.S. retail investors through Telegram, Discord, or WhatsApp chat groups then exit through the kind of ‘rug pull’ decline we are seeing with Golden Heaven,” Anderson, founder of Hindenburg Research, said in an email, adding that he has raised the issue with Nasdaq.

Claudia Sahm: it’s clear now who was right (FT)

The soft landing is not here yet. But it is in the bag. Barring an unforeseen massive disruption, we are landing this plane. Now, there’ll be some turbulence as we approach the runway. I fully expect we’re going to have some disappointing reads on inflation. To me, a soft landing is 2 per cent inflation or spitting distance, say under 2.5 per cent, while unemployment stays low, right around 4 per cent or below. We’ll have it next year. You can see the landing strip.

You’re Better Off Going All In on Stocks Than Bonds, New Research Finds (Bloomberg)

After the beating they took in bonds over the last two years, investors can be forgiven for wondering if it was ever a good idea to rely on fixed income to lay up for old age. New research validates these suspicions.

How Does a Person’s Lived Experience Tell them the Local Economy Is Good, but the National Economy Is in the Tank? (CEPR)

In my working hypothesis, when people tell us the national economy is bad, they are not reporting on their lived experience, they are repeating what they have heard directly or indirectly from the media. Everyone knows the economy is bad, they don’t want to look stupid so they give what they have been told is the correct answer.

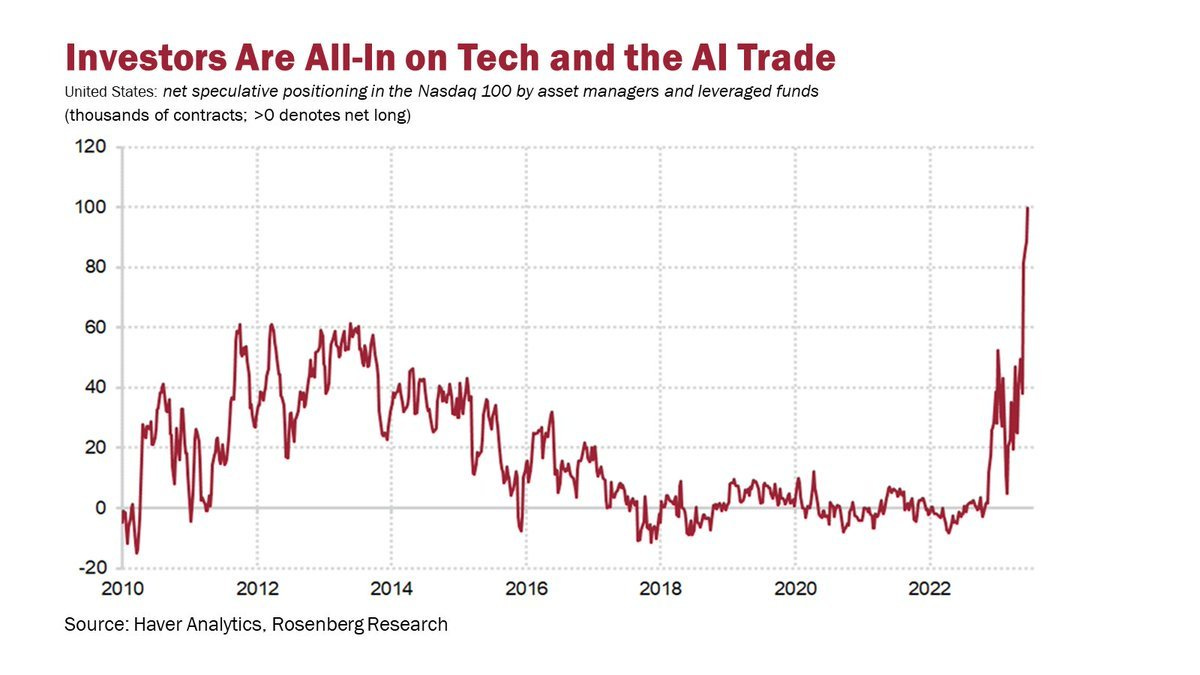

AI is a VERY Crowded Trade

Source: @MPelletierCIO

Market Technical Analysis

S&P 500

The SPX closed the week just 2% below its all time high from nearly two years ago. Over the intermediate term, we are still bullish, but also must recognize the index is overbought over the short term. Since the bull market began last October, RSI has spent very little time in overbought territory before a pullback. We took some profits last week should a pullback materialize soon, but we see no reason to think it will be steep. The market is just as likely to consolidate sideways as it is to test the 10/27 AVWAP (currently 4,487.76).

Dow Jones Industrial Average

After trending sideways most of this year, the Dow set a new all time high last week, another sign that the bull market is broadening beyond mega cap tech. We are watching the Dow Transports closely for a Dow Theory buy signal, which will happen when it confirms the industrials breakout by setting a new all time high. Transports lead in the direction of the eventual trend in the previous two non-confirmations, failing to set a new high in early 2022, and breaking above resistance in early 2023. A new high in the transportation average in the coming days will be critical.

Last Week’s Trades

We added two stocks and removed one stock from the portfolio last week.