Market Brief - December 24, 2023

A breakout week for small caps

Welcome to The Predictive Investor Market Brief for December 24th, 2023!

Stocks continued to edge upward, led by the Russell 2000, which was up 2.5% for the week. The S&P 500 has now closed in the green for eight consecutive weeks, one of the longest win streaks in 50 years. This highlights the importance of staying in the game, as markets can reverse rather quickly.

Markets are closed Monday, with very little economic news slated this week. We wish everyone the happiest of holidays. See you in the new year!

Weekend Reads

A comprehensive round-up of all the 2024 investment outlook reports (FT)

“It should be noted that some of the predictions are already hilariously out of date, after the Federal Reserve last week pencilled in three interest rate cuts next year. Which says something about the transitory, futile nature of annual outlooks that no one will remember by the time November 2024 comes around.”

Home Prices Are Historically High Next to Rents. Don’t Panic. (Bloomberg)

“Take a longer view, with the ratio of US home prices to rents calculated by the Organization for Economic Cooperation and Development, and prices are historically high — with the price-rent ratio about 6 percentage points higher than in the lead-up to the housing price collapse of 2006 to 2011.”

The Layoffs That Hammered the Tech Industry (The Atlantic)

“As my colleague Derek Thompson wrote in January, “When interest rates were low, investors valued growth narratives, and tech companies (or companies that called themselves tech companies) had a monopoly on these narratives … When inflation and interest rates increased, the companies that were making long-term promises were most at risk, and they got clobbered.””

India overtakes Hong Kong to become the world's seventh largest stock market (CNBC)

“India has been a standout market this year in the Asia-Pacific region. Increased liquidity, more domestic participation and improving dynamics in the global macro environment in the form of falling U.S. Treasury yields have all boosted the country's stock markets.”

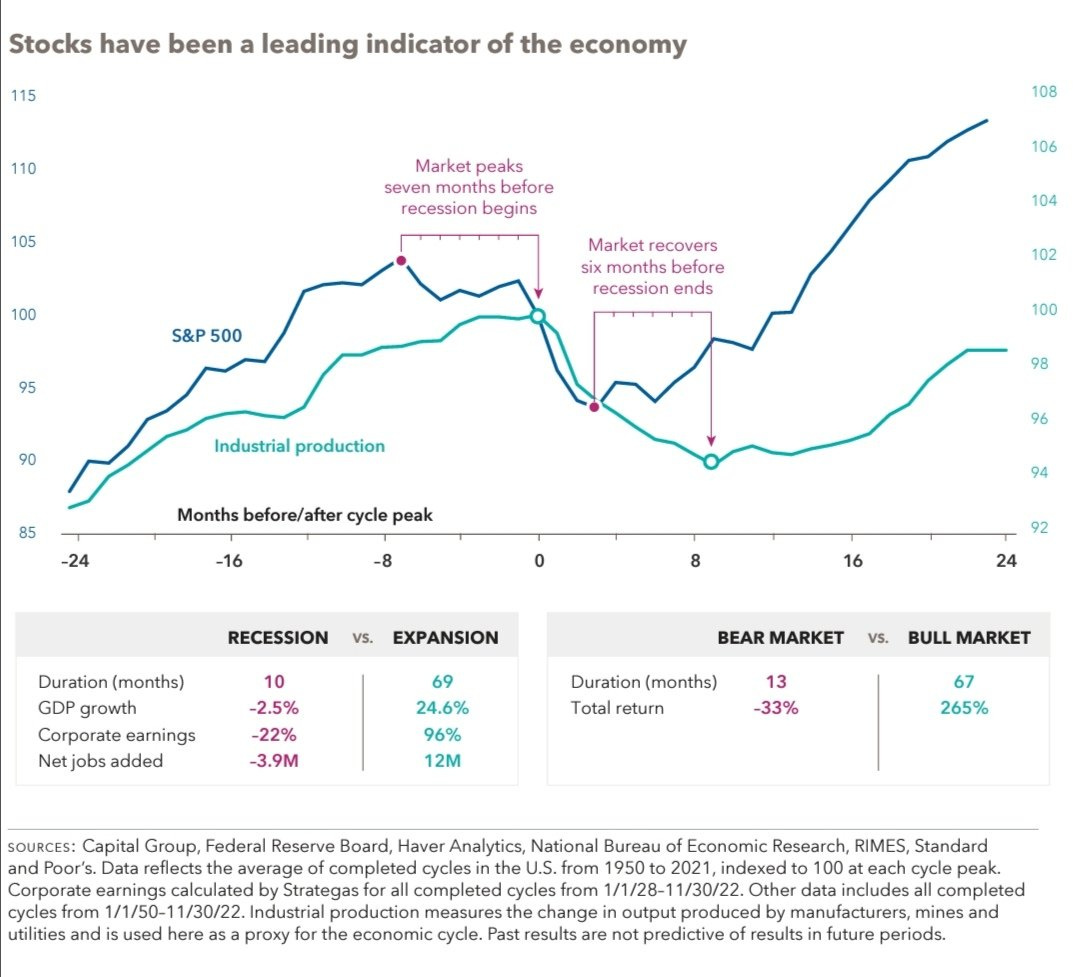

Stocks Lead Economic Fundamentals

Source: @ssinvestments8

Market Technical Analysis

S&P 500

The SPX edged closer to its all time high, closing the week just 1.3% below the intraday all time high of 4,818. RSI has cooled off a bit, but is still overbought. Momentum favors the bulls, and next week is likely to be relatively uneventful given the holidays. But we expect to see choppy price action along with some increased volatility as the index approaches 4,800, an area of significant resistance.

Russell 2000 (IWM)

Small caps have led the rally, both on a percentage and breadth basis. IWM is back above the 11/8/21 AVWAP, a level that has served as resistance since the index peaked in the fall of 2021. We expect the rotation into small caps to continue, as lower borrowing costs have a more meaningful impact to the bottom line for small companies.