Market Brief - December 3, 2023

Weekend Reads, Insider Buys, and Technical Analysis

Welcome to The Predictive Investor Market Brief for December 3rd, 2023!

Stocks continued their advance last week, closing out November with 9% gains, one of the best monthly returns in the last 30 years. The fundamentals continue to support further gains ahead. The rate of inflation is slowing down, with core PCE showing the smallest year-over-year increase since April 2021. And GDP for Q3 was revised upward to 5.2% (from 4.9%).

Investor sentiment has shifted rather dramatically, beginning November with high levels of fear and ending with high levels of greed. But we’re not in extreme reading territory yet, so we feel there’s more upside ahead.

Weekend Reads

Financial markets may be reacting to data swings that 'aren't reality,' a former Fed economist says: Federal surveys measuring prices, job openings, and other stats have been seeing declining response rates. (Business Insider)

Wages are rising. Jobs are plentiful. Nobody’s happy. It’s a good time to be a worker and a bad time to be a consumer — the problem is most people are both. (Vox)

Nobody wants U.S. Treasury bonds: Once a symbol of America’s economic might and accepted as a global coin of the realm, they have fallen badly out of favor, with serious consequences for taxpayers, investors, and financial markets. (Semafor)

The Biggest Delivery Business in the U.S. Is No Longer UPS or FedEx: Amazon is eclipsing both carriers, and the gap is growing. (WSJ)

The Unexpected Winner in the Craziest Week in AI: Microsoft Chief Executive Satya Nadella made a huge bet on the world’s hottest AI company. After it nearly blew up on him, he now emerges with closer ties to its leader, Sam Altman. (WSJ)

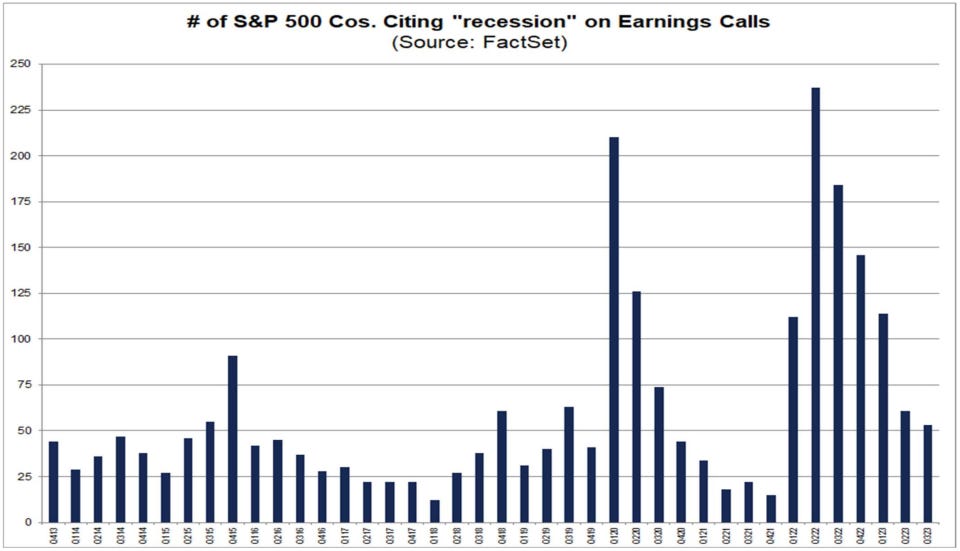

Corporate America hasn't talked this little about recession in two years

Source: Yahoo Finance

Notable Insider Buys

Microcap companies that meet our size and value criteria where insiders are significantly expanding their positions or making a sizable investment. We watch insider buying and institutional purchases as these are often precursors to a sustained uptrend.

Citi Trends Inc. (CTRN) - Fund 1 Investments increased their position by 27.8% with the purchase of 270,600 shares at $22.95.

Ranger Energy Services Inc. (RNGR) - CFO Melissa Cougle increased her position by 27.8% with the purchase of 10,000 shares at $9.99. CEO Stuart Bodden increased his position by 11.5% with the purchase of 15,000 shares at $9.80.

Market Technical Analysis

S&P 500 (SPY)

SPY blew past $456 resistance and seems to want to test its all time high set in Jan. 2022. While RSI is overbought on the daily chart, we’re not anywhere near an extreme reading on the weekly. Pullbacks should be short and shallow. Support is at 7/27 AVWAP (currently $437.76).

Russell 2000 (IWM)

The head and shoulders bottom pattern that we highlighted 2 weeks ago is playing out nicely on the daily chart, and IWM is close to our initial upside target of $186. On the weekly chart, IWM closed just above the 11/8/21 AVWAP, which has been a point of resistance since the index topped in 2021. A continued advance followed by a retest of the 11/8/21 AVWAP would give us more confidence that the long term trend is changing for small caps.