Market Brief - February 18, 2024

Brace for higher volatility

Welcome to The Predictive Investor Market Brief for February 18th, 2024!

Stocks were down modestly last week, after the latest inflation reading came in higher than expected and the market pushed out expectations for a rate cut to June. This is the “higher for longer” scenario we flagged last fall.

Despite closing the week lower, stocks have held up relatively well. This is mostly due to positive corporate earnings. Although we’ve taken no new positions in the last month, our portfolio continues to benefit from improving earnings, with a number of our companies delivering blowout results.

We’ve taken so few new positions since the start of the year because most of the compelling opportunities among qualifying stocks are already in our portfolio. This can be difficult, especially as markets continue to make new all time highs. But the best times to initiate new positions are during corrections. And we continue to believe there will be a buying opportunity in the coming weeks. Here’s a few reasons why.

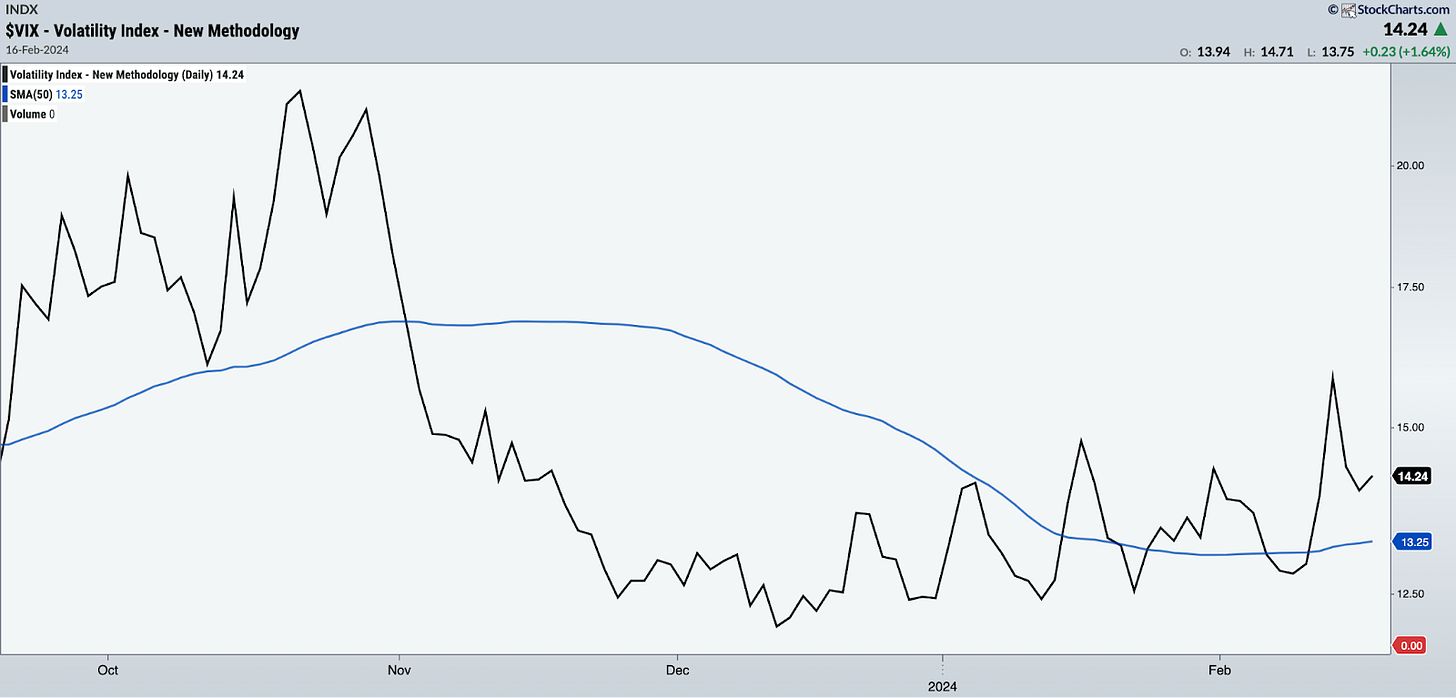

1. Volatility is on the rise

The VIX has made a series of higher highs and higher lows since the start of the year, and its 50-day moving average has now turned up. Increased volatility will fuel profit-taking, especially among mega cap tech.

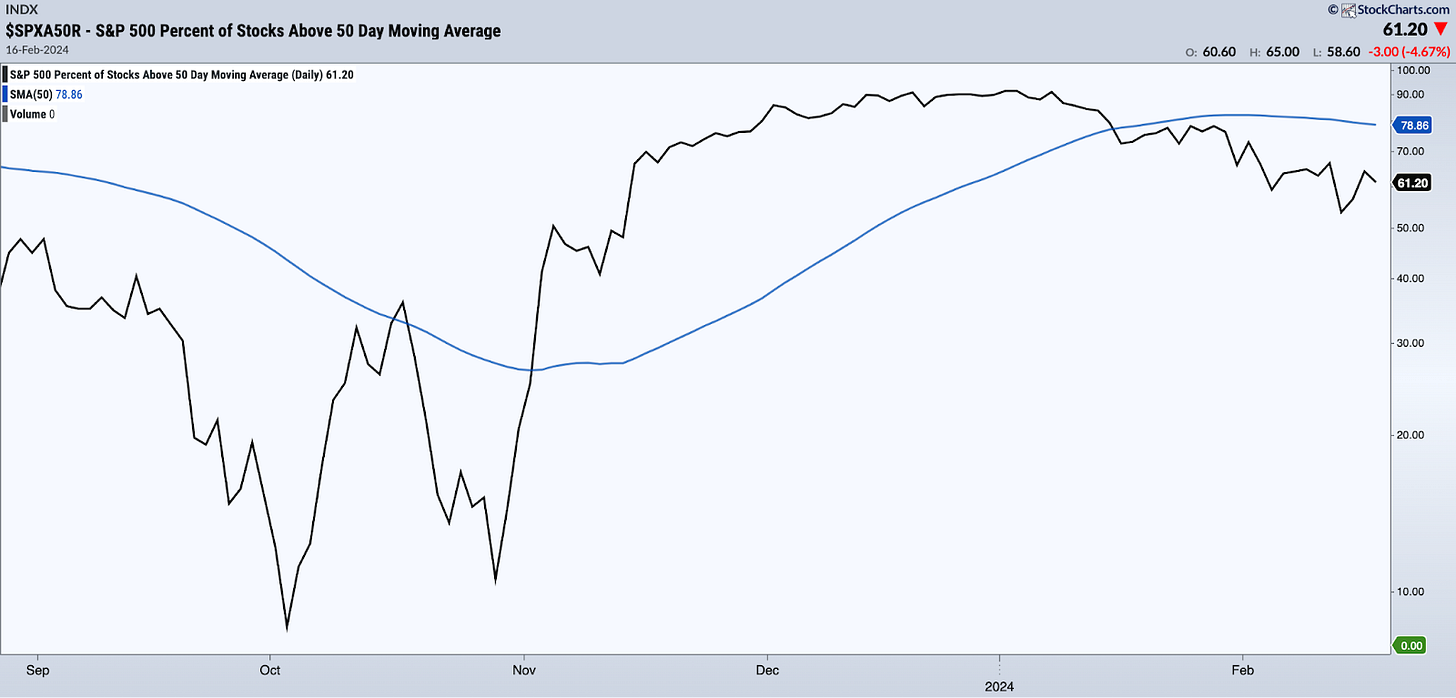

2. Declining breadth

Breakouts with staying power are supported by an increasing number of stocks participating in the upswing, like we saw last November. The current breakout to new highs is driven by fewer and fewer stocks. The percentage of S&P 500 stocks trading above their 50-day moving average has been declining since the start of the year. Same thing happened last July, before the correction in the fall.

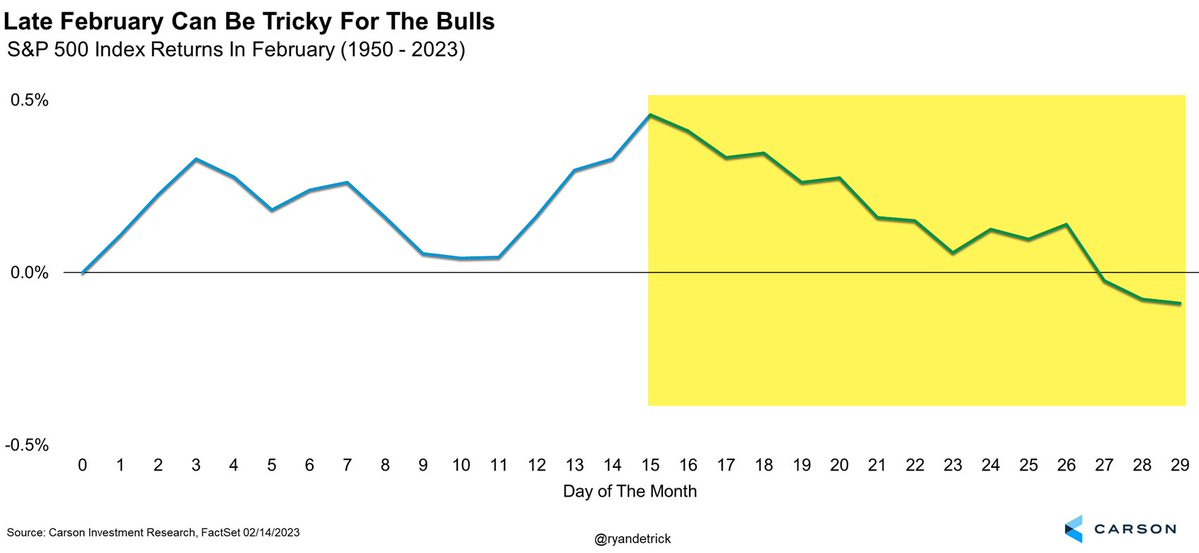

3. Seasonality and sentiment favor a correction

Sentiment is extremely bullish, and February has been the worst month for stocks over the last 20 years, with most of the declines coming in the second half of February. Now just because this happened in the past doesn't guarantee it will happen this year. But given all the other signs that momentum is slowing, caution is warranted.

Weekend Reads

The Confusingly Strong Economy Told in Three Stories (WSJ)

“Depending on the explanation you prefer for the unusual strength, you should be piling into stocks, worrying about government debt or fearing recession. Uncertainty about which of the three is right helps to explain why no one—including the Federal Reserve—seems to be able to settle on a single story about what’s going on.”

Too early to call impact of layoffs on macro economy (Yahoo Finance)

“According to the most recent monthly Job Openings & Labor Turnover Survey from the BLS, employers laid off 1.6 million people in December. That’s a large number. But as the chart below shows, monthly layoffs during much of the current economic recovery have bounced around between 1.3 million and 1.8 million. During the prepandemic economic expansion, this figure trended between 1.6 million and 2 million.”

For First Time in Two Decades, U.S. Buys More From Mexico Than China (DNyuz)

“New data released on Wednesday showed that Mexico outpaced China to become America’s top source of official imports for the first time in 20 years — a significant shift that highlights how increased tensions between Washington and Beijing are altering trade flows. Economists say the relative decrease in trade with China is clearly linked to the tariffs imposed by the Trump administration and then maintained by the Biden administration.”

Squatters Are Taking Over Homes All Over The Nation On An Industrial Scale And Turning Them Into Dens Of Crime (ZeroHedge)

“Thanks to online listings, it is easier than ever to identify properties that are vacant, and many states have laws that make it exceedingly difficult to get squatters out once they have settled in. In some cases, squatters are able to live rent free in beautiful homes for months or even years. This is becoming an absolutely massive problems, especially in certain areas of the country. For example, it is being reported that squatters have taken over approximately 1,200 homes in the Atlanta area.”

Boeing is a wake-up call (Business Insider)

“Boeing is a quintessential example of America’s rotting business culture over the past 40 years. The company relentlessly disgorged cash to shareholders when it could’ve spent it on building a better (and safer) product. Investments that could’ve benefited employees, communities, and other corporate stakeholders were often sacrificed at the altar of efficiency and free cash flow. Boeing focused on pleasing Wall Street because that’s how American executives believe companies should operate.”

Market Technical Analysis

S&P 500 (SPX)

Last week we said if TLT broke below $92.80 it would trigger a selloff in stocks. That is exactly what happened. Although TLT had a slight rebound, it is still trending down over the short term, which means higher rates ahead. As SPX has made new highs, RSI has been making a series of lower highs since December. If we do get a correction this month, a reasonable downside target would be the 50-day moving average (currently 4,813).