Market Brief - February 25, 2024

Is Nvidia really worth $2 trillion?

Welcome to The Predictive Investor Market Brief for February 25th, 2024!

The hardest part of our strategy is maintaining the discipline to stick to it, when the rest of the world is focused somewhere else. This week that ‘somewhere else’ was Nvidia.

Is Nvidia really worth $2 trillion? The market says yes, with this week’s post-earnings surge. While it’s natural to feel some FOMO, I won’t be buying shares any time soon. Here’s why.

1. It’s very unlikely the average investor will realize any profits

Time and time again investors pile into stocks at the wrong time, buying the hype and selling after a crash. More recently we saw this with crypto and meme stocks, while retail investors were buying while the professionals were cashing out. This week it was reported that Jeff Bezos sold $8.5 billion of Amazon shares in the last two weeks. Mark Zuckerberg sold $661 million of Meta shares over the last month. Profitable investors buy low and sell high. Our rules-based approach helps us do that consistently.

2. Valuation is insane

Nvidia’s PE ratio of 66 is more than double the historical average PE ratio of large cap tech. Buyers of the stock are betting that the hype will continue, allowing them to sell at an even more insane valuation later on. Why play that game when there are so many great companies trading at reasonable prices?

3. Bubble psychology

There’s no question AI will be a huge driver of growth in the years to come. But the euphoric sentiment around AI stocks makes it increasingly likely that professional investors will take profits, delivering disappointing returns to individual investors. We saw this with Tesla, which is now valued at 50% less than its peak market cap of $1.2 trillion in early 2022. Other car companies jumped into the space, putting downward pressure on margins. We would not be surprised if the same thing happened with Nvidia. Many chip companies are devoting R&D resources to AI, setting the stage for increased competition in the space.

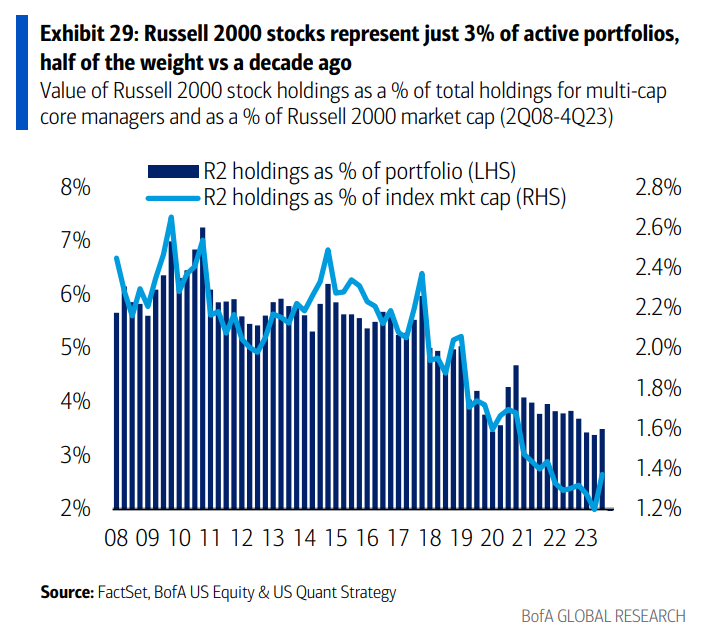

Meanwhile, small caps had one of their largest weekly inflows in nearly 2 years, and active manager exposure to Russell 2000 stocks is just 3%. As the economy continues to improve, portfolios will be rebalanced, providing a huge tailwind for small company stocks.

Weekend Reads

Why Japan’s stock market is breaking 35-year records even as its economy falls into recession: Welcome to the investing world of ‘not that bad’ (Fortune)

“One reason for investor optimism over Japan is a stronger corporate sector. Earnings for the last quarter of 2023 were 45% higher year on year, according to Goldman Sachs analysts. That’s partly due to the weak yen, which makes Japanese exports from companies like Toyota cheaper overseas. Japanese markets are also pushing the country’s sprawling conglomerates, known as keiretsu, to streamline their complicated organizational structure.”

The more Americans that take Ozempic, the faster the US economy will grow, Goldman Sachs says (Business Insider)

“The bank said in a note on Thursday that US GDP would grow by an extra 1% if 60 million Americans took GLP-1 drugs by 2028. The thinking behind Goldman's forecast is that poor health burdens economic growth because it can weigh heavily on the total labor supply and hours worked through elevated frequencies of "missed days" at work, early death, and informal caregiving that takes people out of the workforce.”

The cruelty of crypto (Aeon)

“Buying in at the height of the market, most were left holding the bag. Crypto did not level the playing field. It exposed the vulnerable to fraud and scams. It offset risk on to the poorest in society, all while paying lip service to a dream.”

Market Technical Analysis

Although there are a few more days left in February, the market clearly did not deliver the correction we expected this month. But we did see strong post-earnings momentum in many of our positions. This week we’ll be looking for opportunities to take profits and re-invest in compelling qualifying companies.

From a technical perspective, this is what we’re watching to assess market direction:

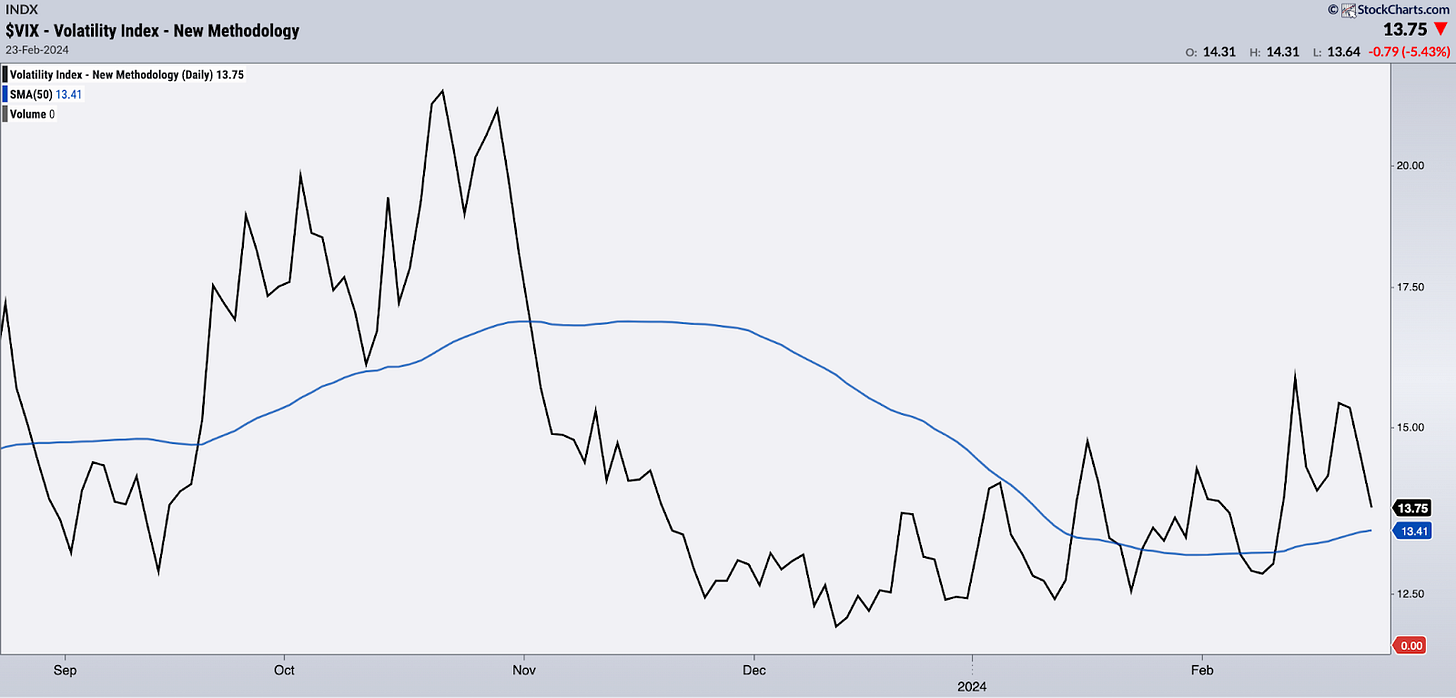

VIX

Volatility retreated last week, but the intermediate trend is still up. If the VIX bounces off its 50-day moving average we could still see a pullback in stocks, similar to last fall.

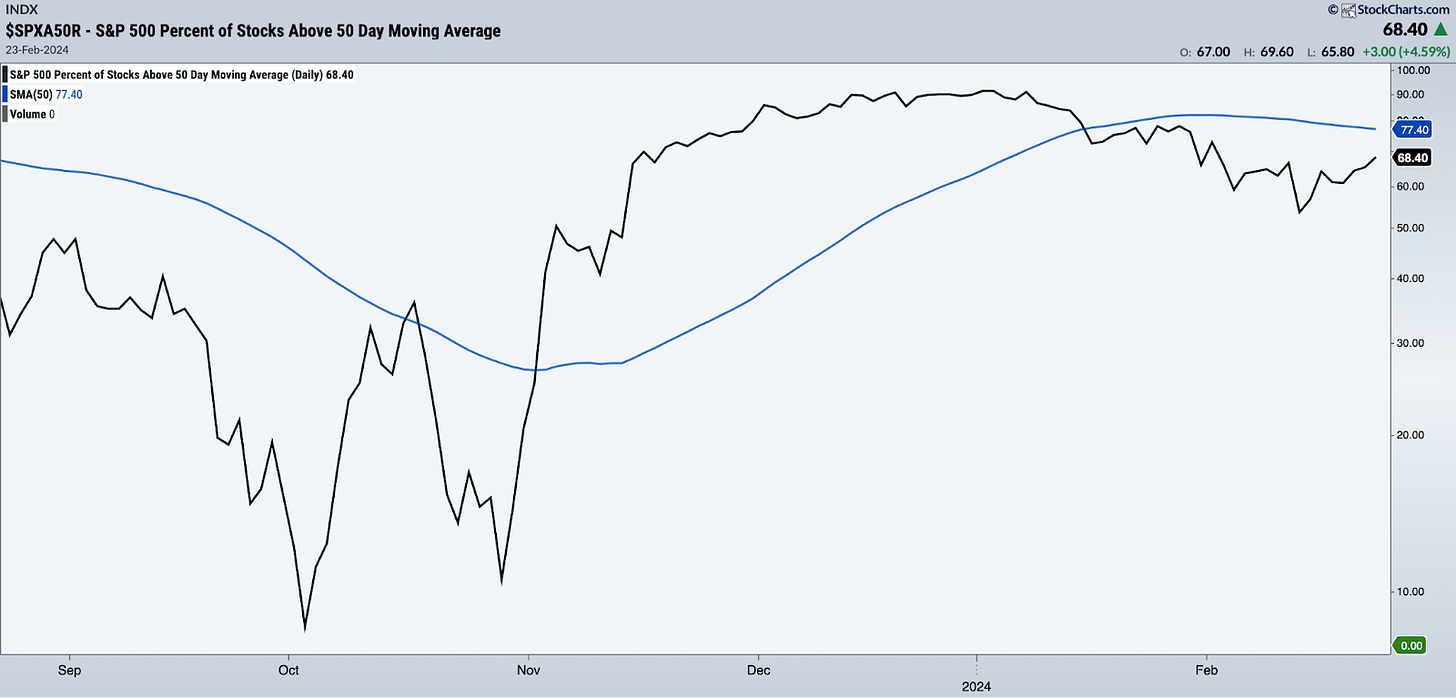

Breadth

Breadth improved last week as the market made new highs, but the intermediate trend is still down. Without broad participation, we will continue to see a highly fragmented market.

Interest Rates (TLT)

Interest rates pulled back as bonds rallied, but the intermediate trend for bonds is down, which means higher rates. If TLT breaks its 50-day moving average, that could provide the fuel the continuation of this rally.