Market Brief - February 4, 2024

Watch out for a rug pull

Welcome to The Predictive Investor Market Brief for February 4th, 2024!

While we did have a slight uptick in volatility mid-week, large cap stocks are in melt-up mode. The Fed confirmed what we’ve been saying all along: no rate cut in March, and increased probability of a higher for longer interest rate environment.

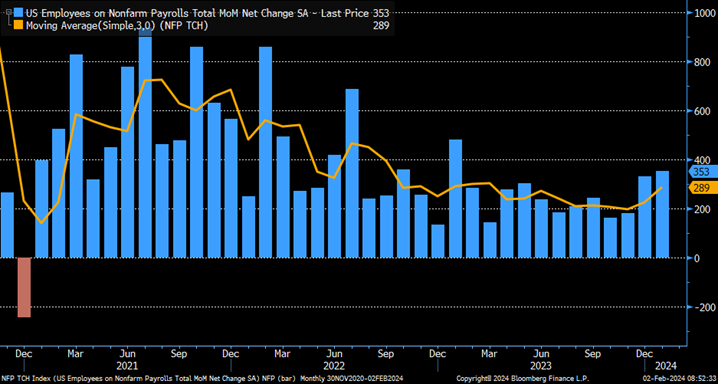

But the latest jobs report delivered blowout numbers: 353k payrolls added in January, double the consensus estimate, and the strongest monthly gain in more than a year. We’ve been saying for months that the soft landing scenario depends entirely on the labor market, and the latest report means the economy is stronger than many analysts previously thought.

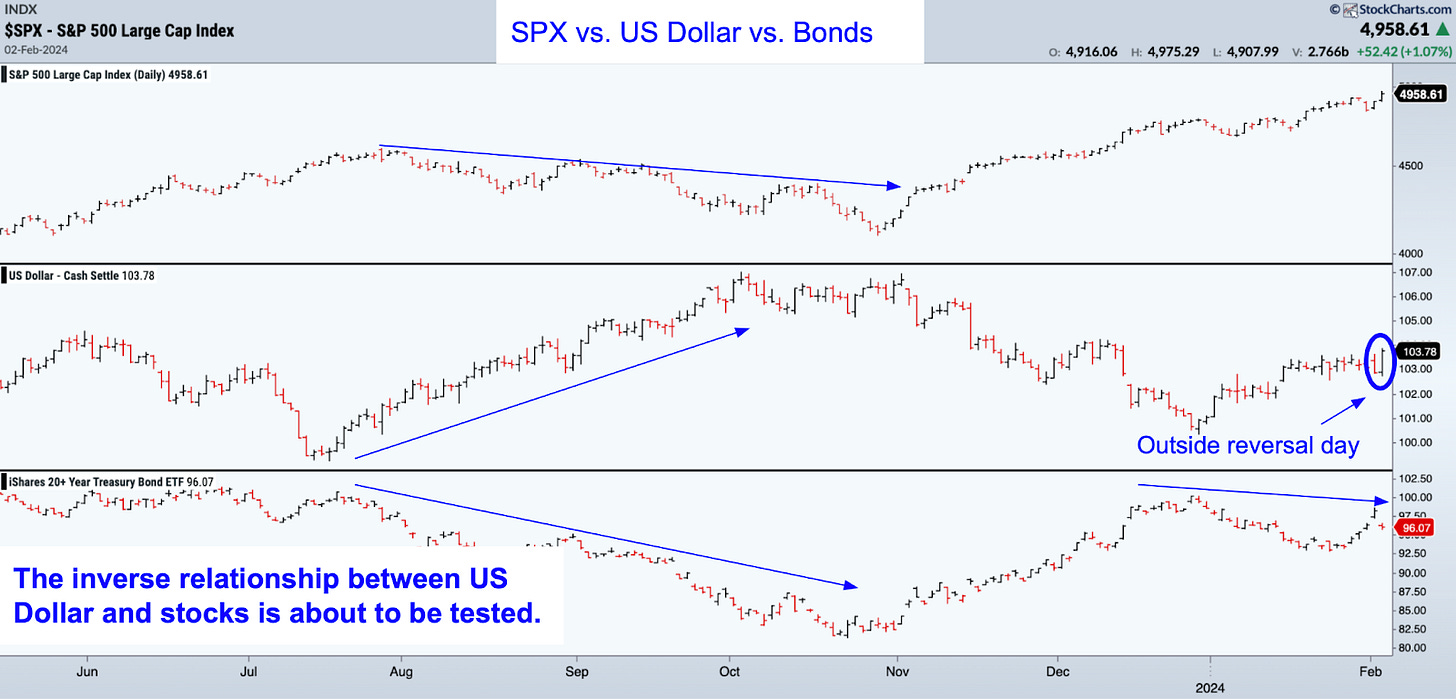

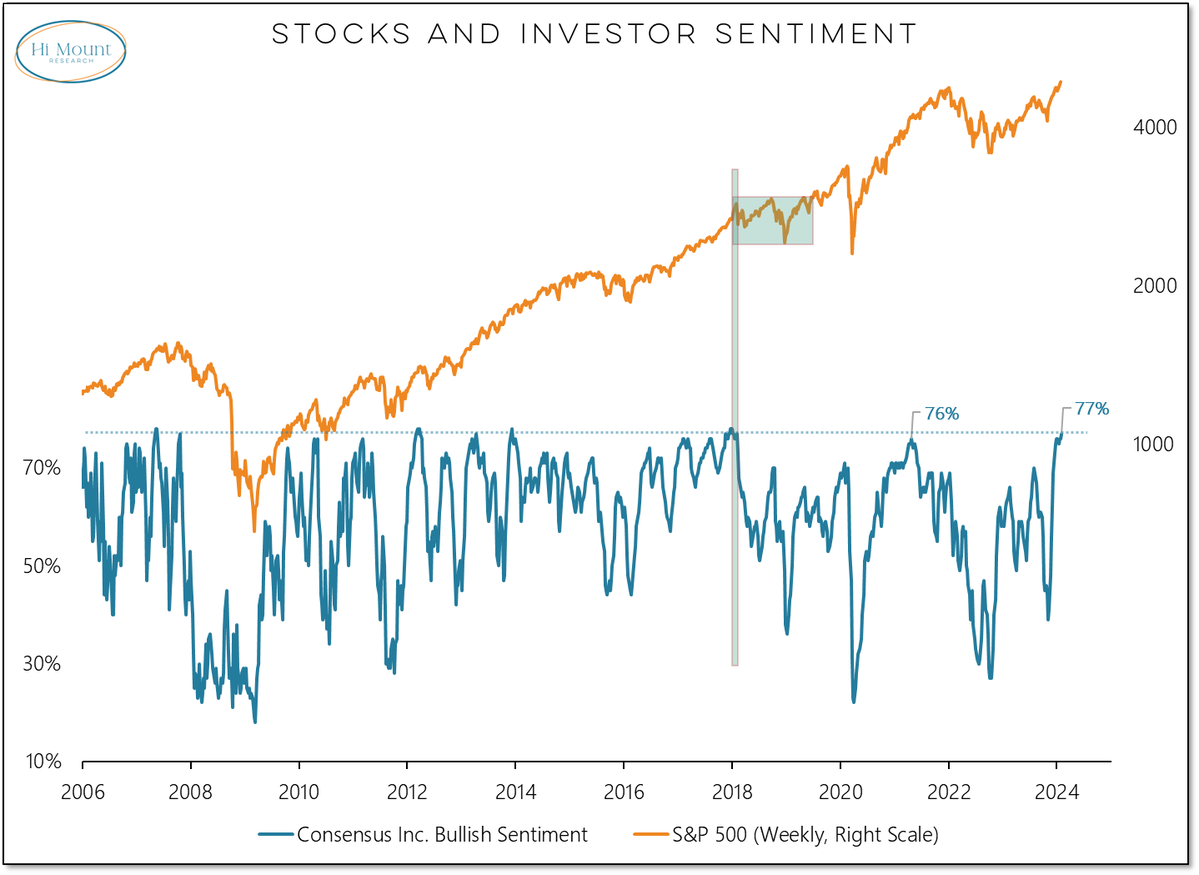

That said, markets never go up in a straight line, and we’re seeing signs of short-term exhaustion. Consensus Inc. bullish sentiment is at a 6-year high (chart below), a level that is highly correlated with consolidation. We’re also seeing an uptick in yields and strength in the US dollar, both of which are bearish for stocks. This is the perfect environment for large traders to orchestrate a rug pull, taking profits while shaking out weak hands.

Consensus Bullish Sentiment at a 6-Year High

Weekend Reads

Investors may be getting the Federal Reserve wrong, again (The Economist)

“Yet the past few years have shown how eager investors are to believe that cuts are coming, and how frequently they have been wrong. And so it is worth considering whether they are making the same mistake all over again. As it turns out, a world in which rates stay higher for longer is still all too easy to imagine.”

The U.S. Stock Market’s Real All-Time High Is Not Yet Reached (Forbes)

“Instead, it means investing in an inflationary period is especially challenging. Seemingly easy dollar gains can trail inflation, producing real losses in purchasing power. Moreover, an inflationary period has mean streaks that can reverse even those inadequate nominal gains.”

A $560 Billion Property Warning Hits Banks From NY to Tokyo (Yahoo Finance)

“The concern reflects the ongoing slide in commercial property values coupled with the difficulty predicting which loans might unravel. Setting that stage is a pandemic-induced shift to remote work and a rapid run-up in interest rates, which have made it more expensive for strained borrowers to refinance. Billionaire investor Barry Sternlicht warned this week that the office market is headed for more than $1 trillion in losses.”

The labor market is much stronger than previous reports suggested (@KathyJones)

Market Technical Analysis

Much of traditional technical analysis is broken in this news-driven market, but intermarket relationships still offer a strong clue to forward price action. In fact, it was the bullish outside reversal day for bonds last fall that led us to call for a rally in stocks through the end of the year. Last week we saw weakness in bonds (i.e. higher yields) and a bullish outside reversal day in the US dollar. A strong dollar is bearish for the market, as it makes US goods and bonds more expensive for the rest of the world. February is historically very bearish for big tech, which has been driving the market higher. Caution is warranted.