Market Brief - January 1, 2024

The 2024 Non-Forecast Issue

Welcome to The Predictive Investor Market Brief for January 1, 2024!

Happy New Year! And welcome to all of our new subscribers. We wish everyone a happy, healthy and prosperous 2024.

It’s forecast season on Wall Street, with all the major investment banks weighing in on what to expect in the year ahead. We rarely make any sort of forecast beyond the short term, as the market is notoriously hard to predict. You probably remember it was last year at this time when nearly every major investment bank was predicting a recession in 2023, which never came to pass. The stock market is best analyzed in real time as events unfold.

However, after reading dozens of Wall Street forecasts, here are some things we know for sure about the environment we’ll face in 2024:

Interest rates: Higher for longer

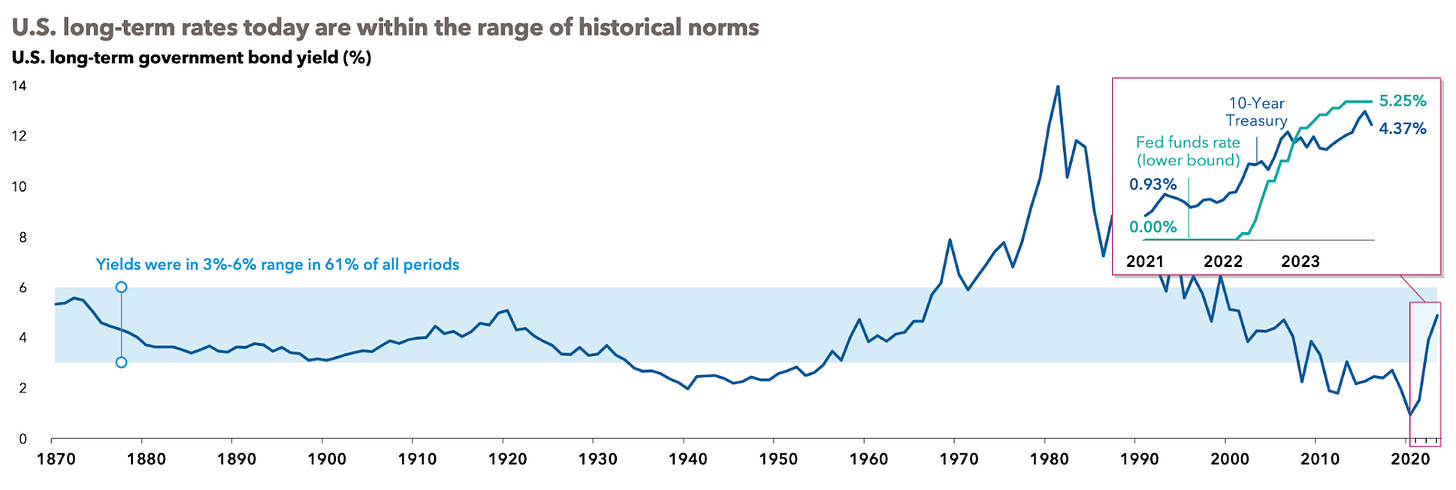

Yields on U.S. government bonds are within the normal range over the last 150+ years despite all the Fed rate hikes (image below). While we’ve gotten used to below average rates for much of the last 15 years, we are unlikely to return to an environment of cheap money any time soon.

Contrary to popular belief, the Fed follows the market in setting its funds rate. And given the excessive government spending and debt levels, investors are likely to require better compensation for holding government debt even if inflation continues to fall. A higher discount rate means the rising tide that favored index investing over the last 10 years is gone, which creates an environment that favors active stock picking.

The Economy: Soft landing, hard landing, or no landing?

Many investors are anticipating the expected 2023 recession to show up in 2024. Many others are forecasting a soft landing, with slowing growth but no recession. It makes little difference to us. Our strategy is designed to sell when price momentum starts to wane.

But for those who’ve asked, we favor the soft landing scenario. While it’s true that recessions follow most interest rate hike cycles, soft landings occurred in 1984 and 1995 despite rising rates. The economy in both years was characterized by a tight labor market and significant household savings, conditions that are also present today.

Sticky Inflation

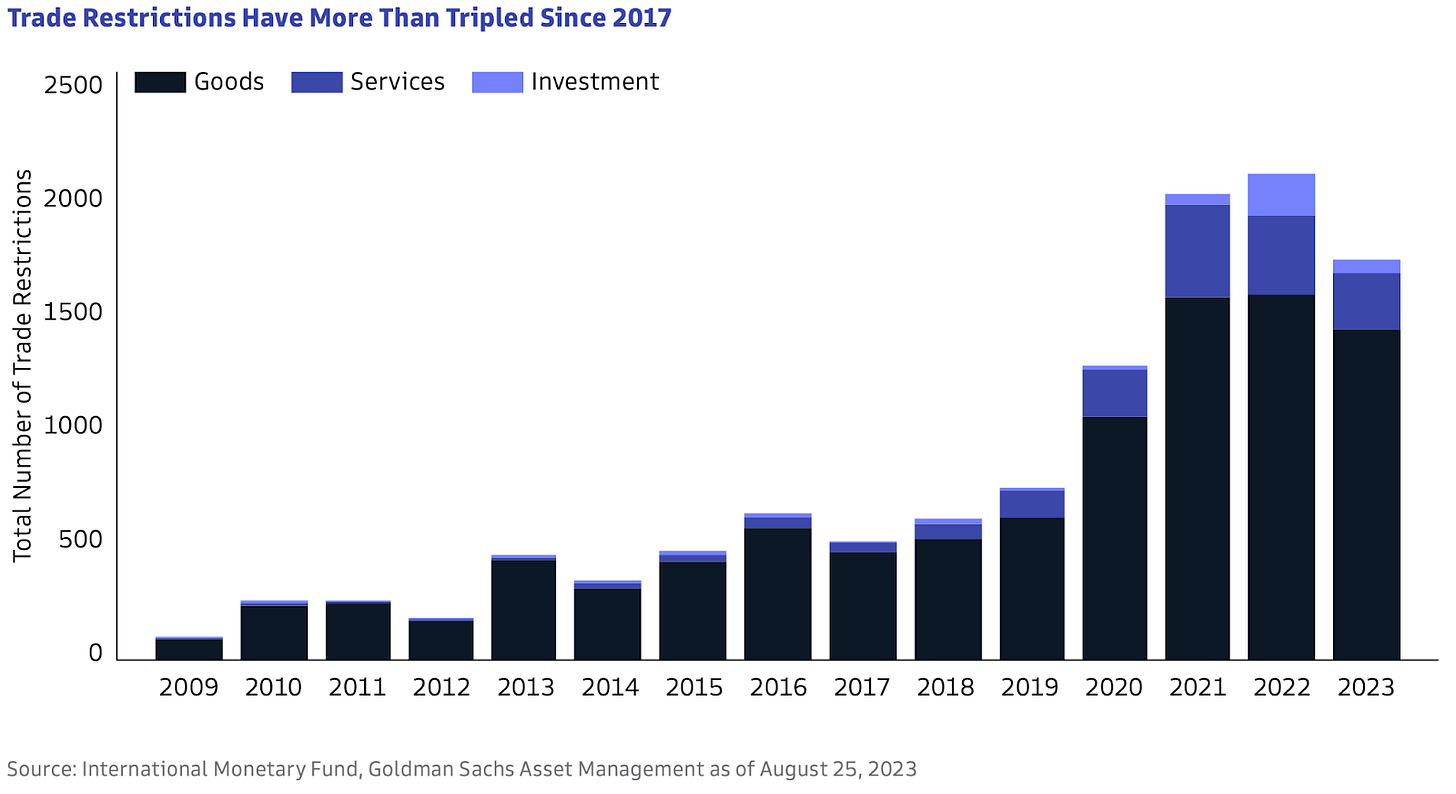

The rate of inflation is coming down. But here are some conditions that will make it very difficult to reach the Fed’s 2% target. The last few years have seen a surge in protectionism. The costs of navigating trade restrictions and adjusting supply chains will be passed on to the consumer in the form of higher prices.

Higher energy costs will also contribute to inflation, as emerging market countries will need significant energy to support their economic growth, not to mention the potential for an energy shock due to war and other geopolitical conflicts.

Fiscal Stimulus and CapEx to Power Growth

We’ve already seen significant commitments from the U.S. government to invest in clean energy, domestic manufacturing, and boosting the domestic semiconductor industry, resulting in an uptick in capital expenditures as a percentage of GDP.

Capital Group reports that the U.S. government has committed $1.4 trillion over the next seven years for capital projects. This will be a huge boon to small companies, as sales growth for small-cap firms is 85% correlated with CapEx growth.

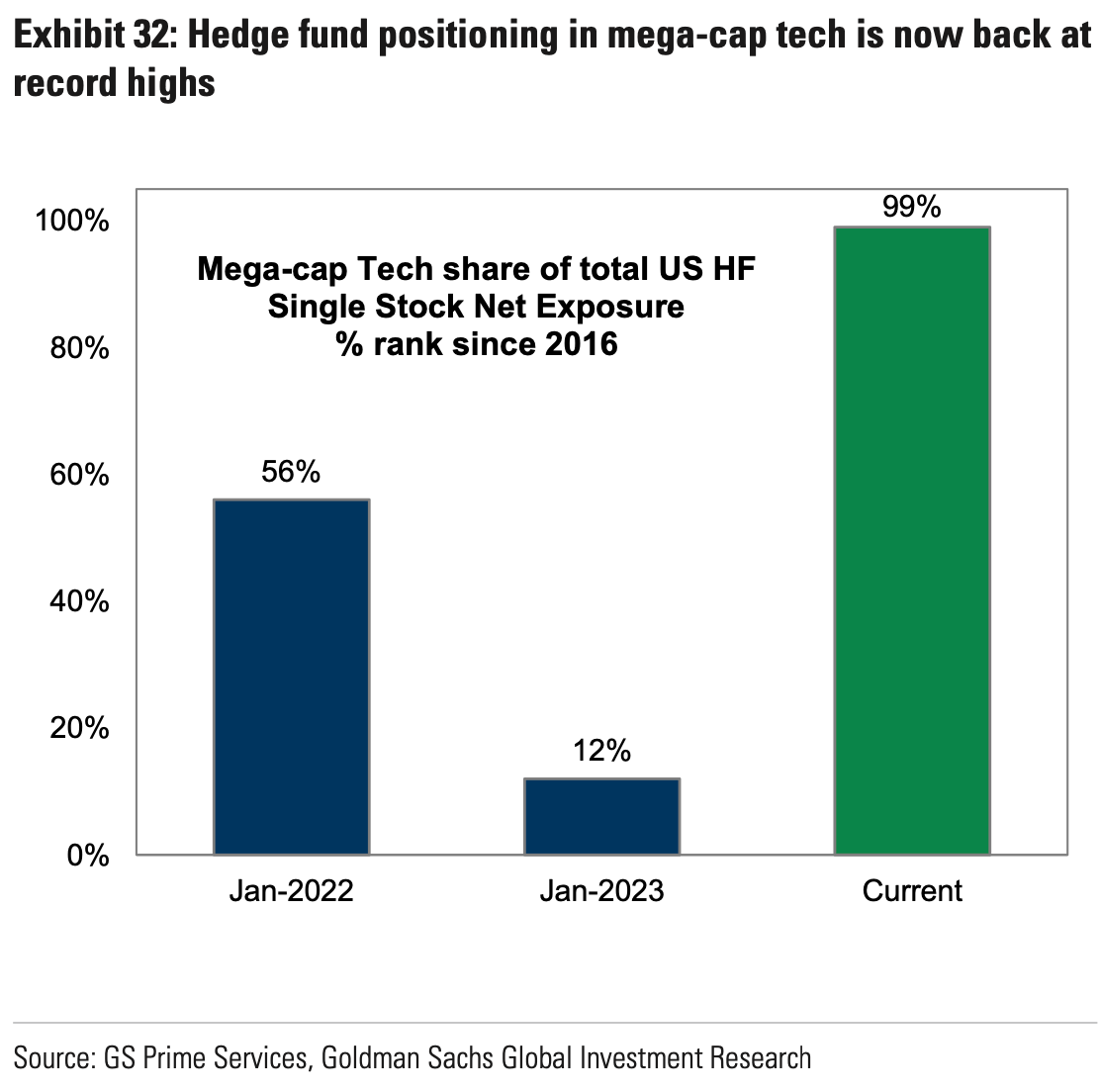

There was near-unanimous sentiment among Wall Street banks on the investment potential for AI. BNY reports that by 2030, AI will boost global GDP by $16 trillion. But for any subscribers trying to invest in these macro trends, we would advise caution on AI stocks over the short term. As we’ve said before, AI is a very crowded trade. And hedge fund commitment to mega cap tech is at record highs (chart below). There’s very few buyers left to propel prices higher.

What Could Go Wrong?

Most of the time it’s something unknown that causes a crisis. But the list of known risks this year is particularly long. Here are some of the risks that have the potential to cause significant volatility in the year ahead:

Unsustainable debt: increased borrowing costs could spur a wave of corporate bankruptcies or government defaults.

Inflation: a second wave of inflation could be spurred by war or additional shocks to the supply chain.

Commercial real estate: the wave of loan defaults that was expected in 2023 could easily occur in 2024.

Antitrust regulation could disrupt big tech.

Chaos surrounding the U.S. election in November.

Geopolitical tension: Israel/Hamas, Russia/Ukraine, China/Taiwan.

The bottom line is there’s no reward without risk. But we feel confident our strategy will continue to deliver the rewards expected from investing in small company stocks.

New Year’s Reads

‘Everyone Got Burned’: Wall Street Missed the Great Stock Rally of 2023 (Bloomberg)

Stocks were supposed to slump and bonds rally as the Fed drove the US into a recession. It didn’t play out as strategists expected.

More big companies set to collapse in 2024, industry experts warn (Yahoo Finance)

Official figures from the Insolvency Service earlier this month showed the total of company failures over the first 11 months of 2023 was more than reported during the entirety of 2022.

2024: The year AI gets real (Axios)

Wedbush analyst Daniel Ives predicts a "new bull market for the tech sector" driven by a 20-25% increase in cloud and AI spending. At the same time, tougher regulation of mergers and acquisitions in both the U.S. and Europe could dampen venture capital and startup growth.

How Electric Vehicles Are Losing Momentum with U.S. Buyers, in Charts (WSJ)

Dealers and carmakers say many American car buyers are still reluctant to ditch their gas vehicles for an electric model, put off by the relatively high price of the technology and concerns about their ability to recharge them easily.

Market Technical Analysis

S&P 500

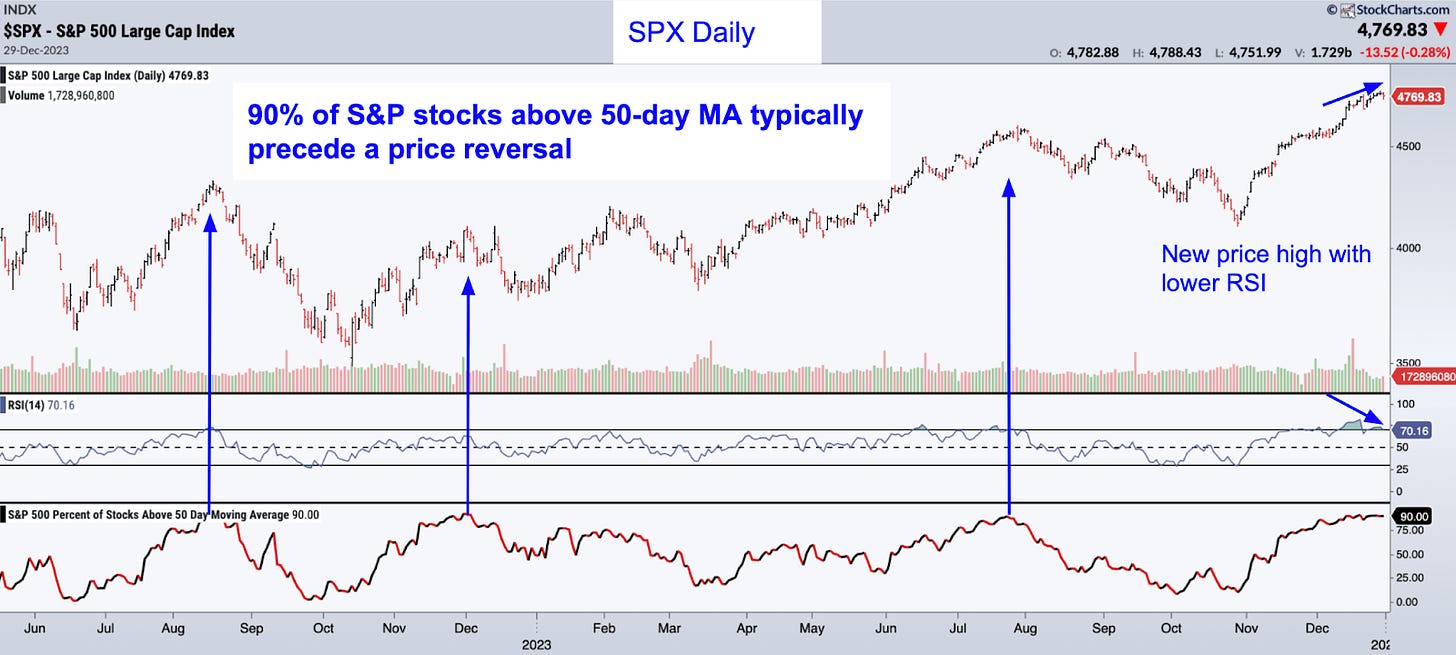

We think the market is due for a pullback. Last week the SPX made a new price high on lower RSI. 90% of the S&P 500 stocks are above their 50-day moving average, a level that has preceded every significant pullback over the last year. We may very well get a sideways correction like we did the first quarter of 2023. But either way the market appears overextended.

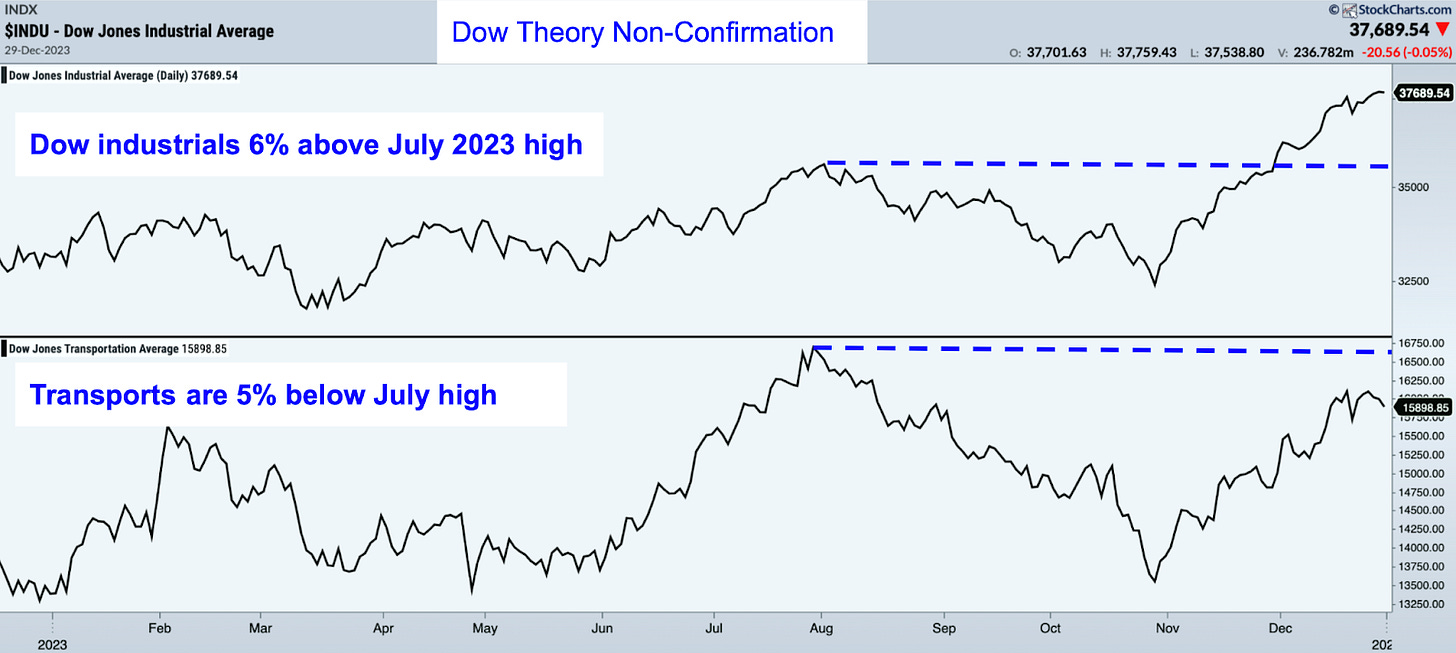

Dow Theory Non-Confirmation

The Dow Industrials broke above its July 2023 high just over a month ago, and the Dow Transports has yet to confirm the bullish move higher. Short term momentum is waning on the transports, which led the way during the previous two non-confirmations.

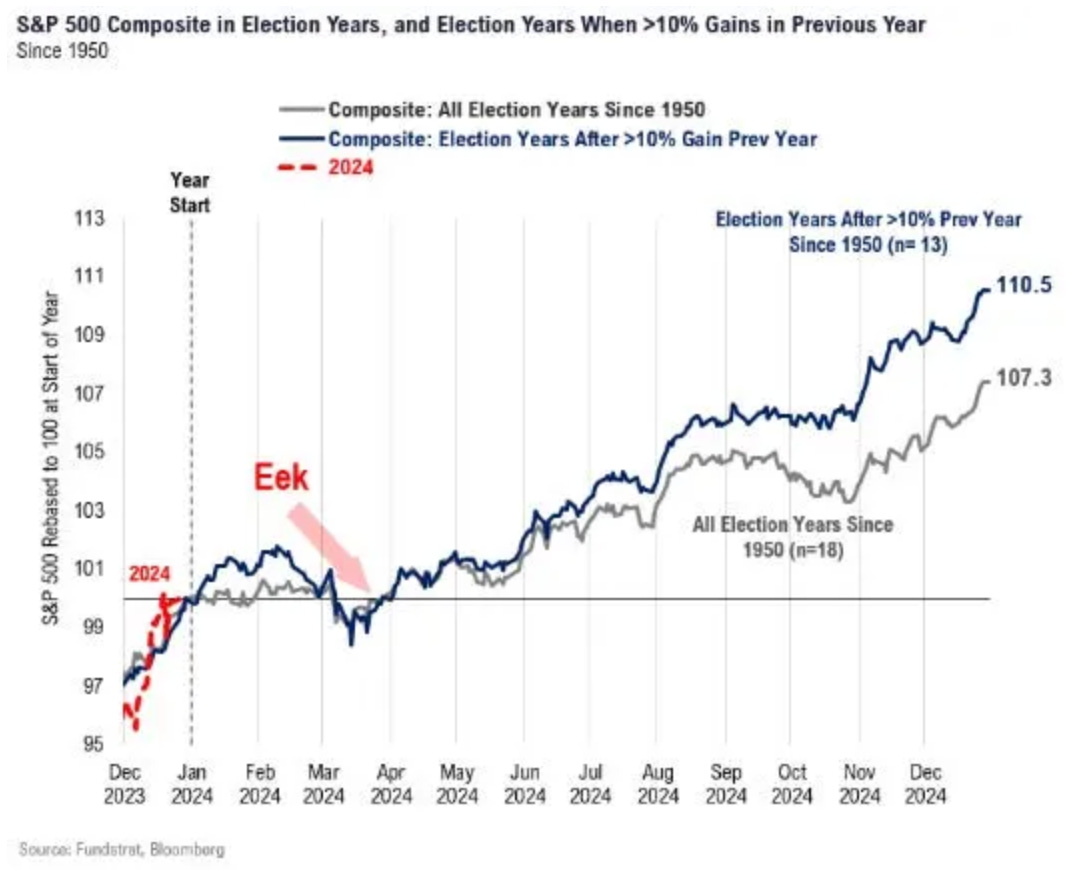

Seasonality Points to a Bearish Start

Election years are overwhelmingly positive for stocks. But Q1 in particular is very weak. With sentiment at a bullish extreme and technicals overextended, we begin the year on a cautious note.