Market Brief - January, 14 2024

Portfolio manager sentiment collapses

Welcome to The Predictive Investor Market Brief for January 14th, 2024!

Tech was up strong last week, with smaller gains for the S&P and a flat week for small caps. There was some volatility late in the week due to the latest CPI reading, which came in at 3.4% vs. last month’s 3.1% reading. The PPI came in below expectations, declining 0.1% month-over-month. Inflation did not go up in a straight line, and it will not go down in a straight line either. At this point, unemployment levels will have a bigger impact on the economy, and is something we’ll keep watching closely.

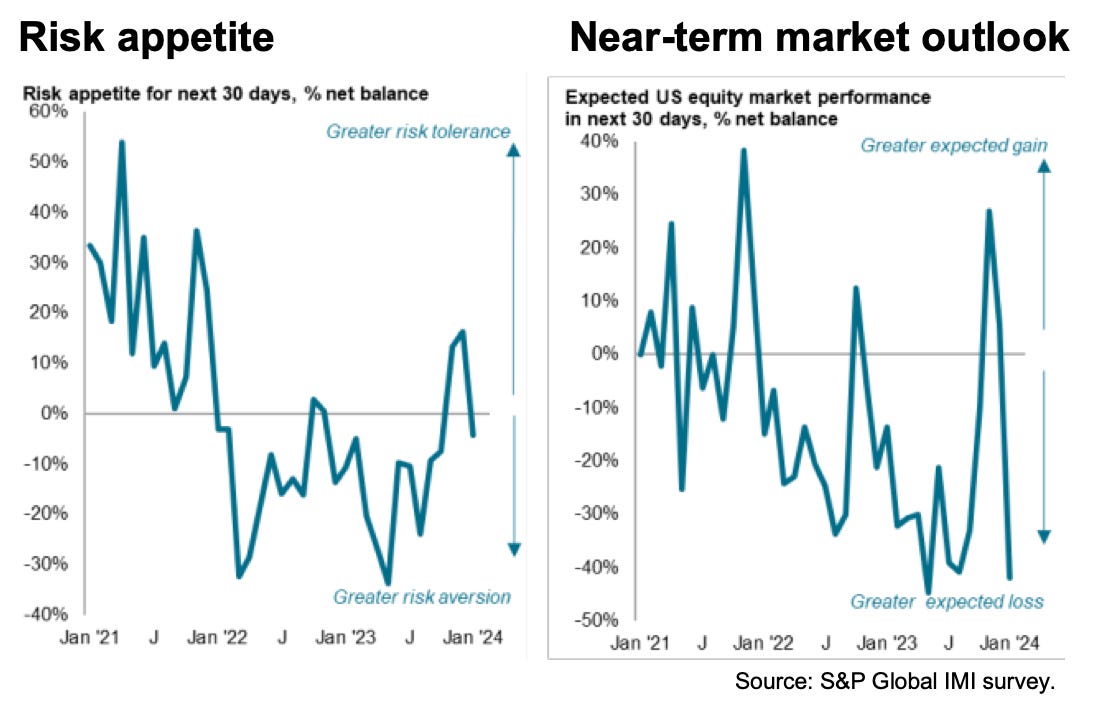

In other news, sentiment among portfolio managers turned drastically lower in the latest S&P Global Investment Manager Index (see Weekend Reads below). Contrarianism is often more art than science, but it’s rare that such a drastic shift in sentiment would lead to a prolonged decline. Typically major corrections are preceded by extreme bullish sentiment. While there is some technical weakness in the indexes, we continue to believe any pullback should be treated as a buying opportunity.

Weekend Reads

TOP RISKS 2024 (Eurasia Group)

“The wild card, more than ever, is technology—specifically, artificial intelligence. The upsides will start materializing more dramatically as new applications find their way into every major corporation across every economic sector. And as hundreds of millions of people begin to upskill themselves in their jobs, AI will become a copilot before it takes over your job. But the technology is also developing far faster than the ability to govern it, and a technopolar world for artificial intelligence means crisis response and reaction will come only after things break … let's hope in 2024 those things aren't that big.”

Private U.S. companies increasingly going bust as profit shrinks (BNN Bloomberg)

“Larger companies have been mostly insulated from the pain so far. But these corporations often use mid-sized private firms as suppliers, and the failure of smaller businesses could disrupt supply chains and boost costs for bigger enterprises, according to the report from Marblegate Asset Management and Rapid Ratings on Monday.”

Offices Around America Hit a New Vacancy Record (WSJ)

“A staggering 19.6% of office space in major U.S. cities wasn’t leased as of the fourth quarter, according to Moody’s Analytics, up from 18.8% a year earlier. That is slightly above the previous records of 19.3% set in 1986 and 1991 and the highest number since at least 1979, which is as far back as Moody’s data go.”

Big banks mull the unthinkable: suing the Fed (Semafor)

“The stakes are high: Banks warn they’ll pull back from lending, particularly to small businesses and borrowers with lower incomes or credit scores. Some of that is posturing, but the rules would eat into bank profits, pushing them in some lines of business below the returns they have promised shareholders.”

China Wants To Ditch The Dollar (NOEMA)

“For now, China’s development of an alternative financial infrastructure does not pose a credible threat to U.S. leadership in financial markets or the dollar’s status as the world’s reserve currency. The U.S. dollar remains the dominant currency in nearly all aspects of international trade and finance. However, history reminds us that no previously dominant currency, such as the British sterling, lasted forever; in fact, the sterling’s decrease in dominance echoed the United Kingdom’s reduced profile on the global stage over the last century.”

Equity investor risk appetite slides amid concerns over geopolitics and valuations (SP Global)

Market Technical Analysis

S&P 500

The SPX is struggling in an area near two previous highs: the all time high of 4,818 and the all time closing high of 4,796. Small caps have retreated further than their large cap counterparts, and we may use the opportunity to add a couple stocks to the portfolio this week. But overall investors should maintain a cautious stance until a breakout occurs.