Market Brief - January 28, 2024

Mega cap tech earnings set the stage for increased volatility

Welcome to The Predictive Investor Market Brief for January 28th, 2024!

Last week’s advance was driven by GDP and inflation numbers. Q4 GDP growth came in at 3.3%, better than the 2.2% that was expected. The CORE PCE Index dropped to 2.9% from 3.2% back in November, the lowest reading in nearly three years. Both of these re-affirm the soft landing scenario that we’ve been talking about since last summer.

But we also saw some volatility around earnings reports, most notably with Tesla and Intel, which could be a sign of things to come. Next week is a big week for mega cap tech, with Apple, Amazon, Alphabet, Microsoft and Meta all reporting earnings. Additionally we have Fed meetings on Tues/Wed.

As we highlighted last week, February has been the worst performing month for tech stocks over the last 20 years. Sentiment is decidedly bullish, along with overbought technicals. This creates conditions that are ripe for profit taking, even with mostly positive earnings results.

Weekend Reads

Welcome to 2034: What the world could look like in ten years, according to nearly 300 experts (Atlantic Council)

“Picture a world with competing power centers, an unstable Russia stumbling into its post-Putin era, a nuclear-armed Iran emerging in the midst of an unruly nuclear age, and a United Nations incapable of carrying out its core functions—including convening the world’s countries to tackle problems, such as climate change, that no one state can solve and that pose a grave threat to global security and prosperity.”

Small-Cap Stocks Look Like Winners. It’s Time to Buy. (Barron's)

“This isn’t just about technicals, however. The S&P 600 trades at about 13.7 times analyst’s earnings expectations for the coming year, almost a third lower than the S&P 500’s 19.8 times. That’s near its largest discount in the past decade, according to FactSet data.”

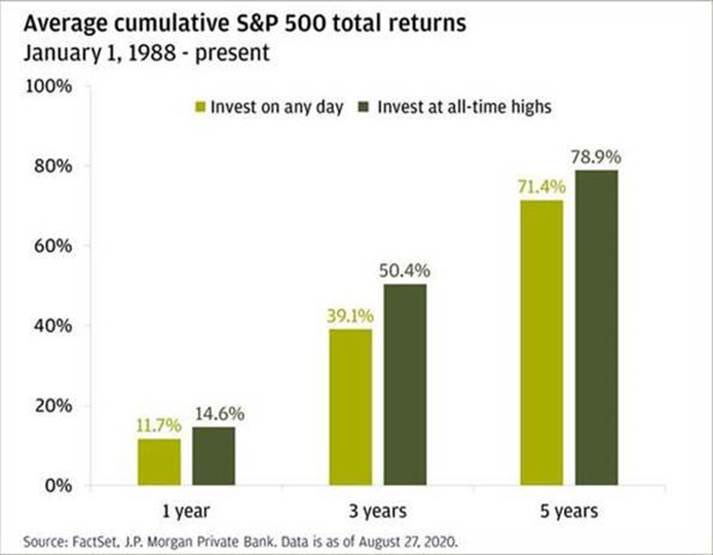

Money invested when the market is at all time highs has outperformed money invested on any given day. (@PeterMallouk)

Market Technical Analysis

S&P 500

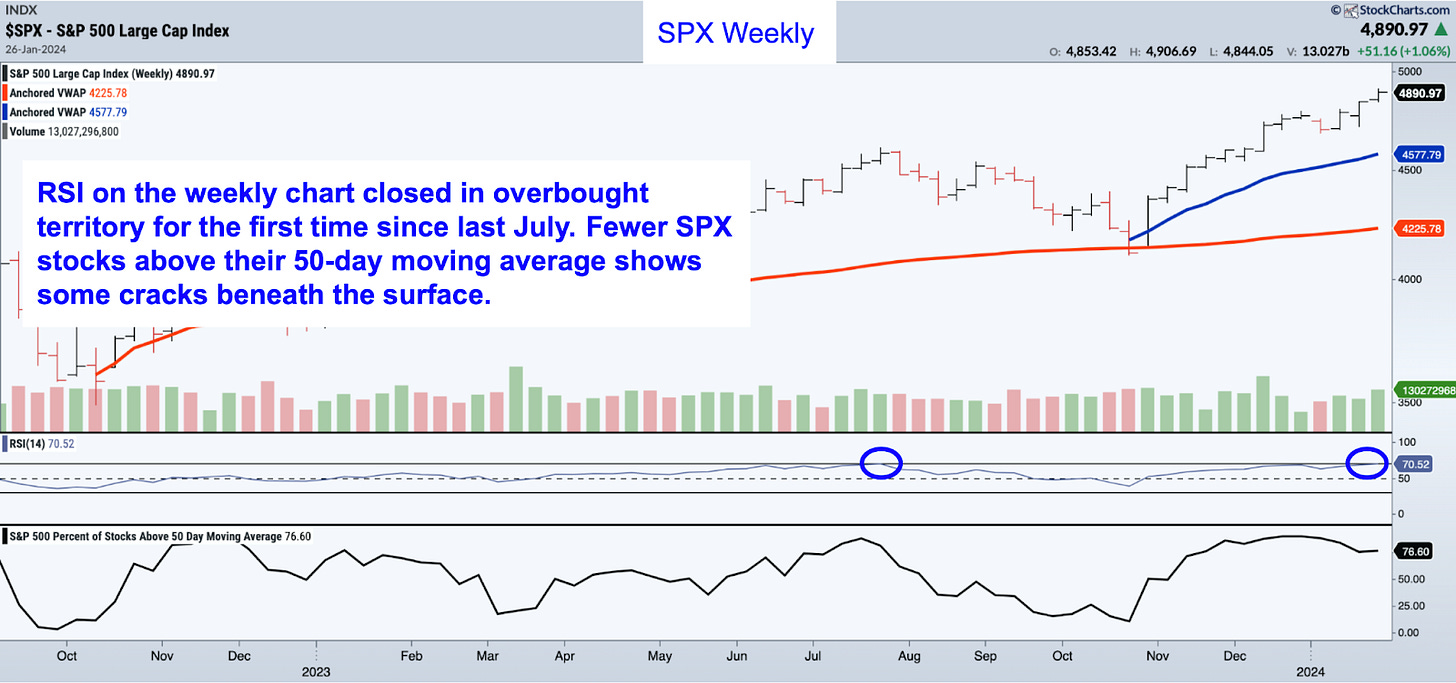

RSI on the weekly chart closed above 70 for the first time since last July, just before a 10% correction in the SPX. While the index closed at a new all time high, the number of S&P stocks above their 50-day moving average has declined over the last month. While a breakout to new highs is bullish over the long term, these are all signs the current rally is overstretched on a short-term basis. We would be cautious with large caps and especially tech over the next 3-5 weeks.