Market Brief - January, 7 2024

Employment data reaffirms soft landing scenario

Welcome to The Predictive Investor Market Brief for January 7, 2024!

The pullback scenario we highlighted last week has come to pass, which is not surprising after 9 weeks of gains.

The good news is the latest employment data from the BLS shows continued strength in the labor market - 216,000 jobs added in December (higher than expected), unemployment rate has stayed below 4% for two years, and average hourly wage growth continues to outpace inflation. A strong labor market is key to the soft landing scenario and is the reason why we’re expecting only a modest pullback in stocks near term.

Weekend Reads

Ten business trends for 2024, and forecasts for 15 industries (Economist)

Artificial intelligence (ai) will be the buzziest of tech buzzwords. Businesses will look to ai and other new technologies to enhance productivity, cut costs and manage risks. But AI will not generate as much revenue as advocates hope.

US office buildings face $117BN debt time bomb: Mortgages due this year threaten to sink US economy as thousands of workplaces remain empty (Daily Mail)

Economists last month found 40 per cent of office loans on bank balance sheets were underwater - owing more than the property is worth. Smaller regional banks who loaned the money to buy them could themselves be at risk if the loans default as they are not big enough to handle the losses. Moody's Analytics estimates 224 of the 605 loans that will expire soon will be tough to repay or refinance because their owners have too much debt or the buildings aren't making them enough money.

U.S. Moves Closer to Filing Sweeping Antitrust Case Against Apple (DNYUZ)

Specifically, investigators have examined how the Apple Watch works better with the iPhone than with other brands, as well as how Apple locks competitors out of its iMessage service. They have also scrutinized Apple’s payments system for the iPhone, which blocks other financial firms from offering similar services, these people said.

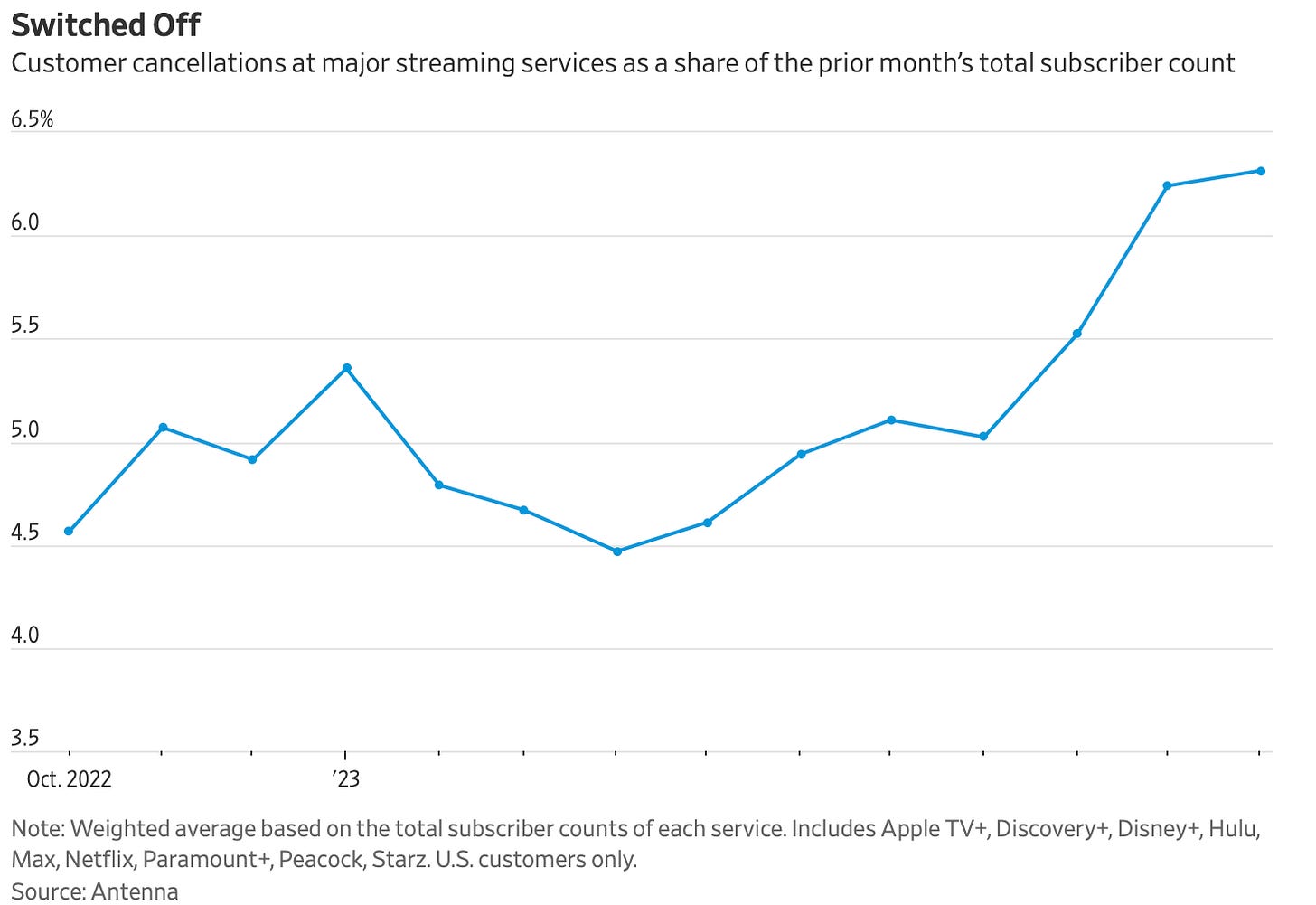

Americans Are Canceling More of Their Streaming Services (WSJ)

Market Technical Analysis

S&P 500

Both price and RSI are trending down over the short term. Next area of support is at 4,600 which would mean a decline of 4% from December highs. Below that are the 7/27 and 10/27 AVWAPs, which are currently 5% and 7% below December highs. We don’t see any reason to expect anything more than a modest pullback.