Market Brief - July 14, 2024

Breakout!

Welcome to The Predictive Investor Market Brief for July 14th, 2024!

CPI came in lower than expected, leading to lower bond yields and a rally in stocks. Rate-sensitive areas of the market saw the biggest gains, with the Russell 2000 gaining 5.4% for the week vs. 0.9% for the SPX.

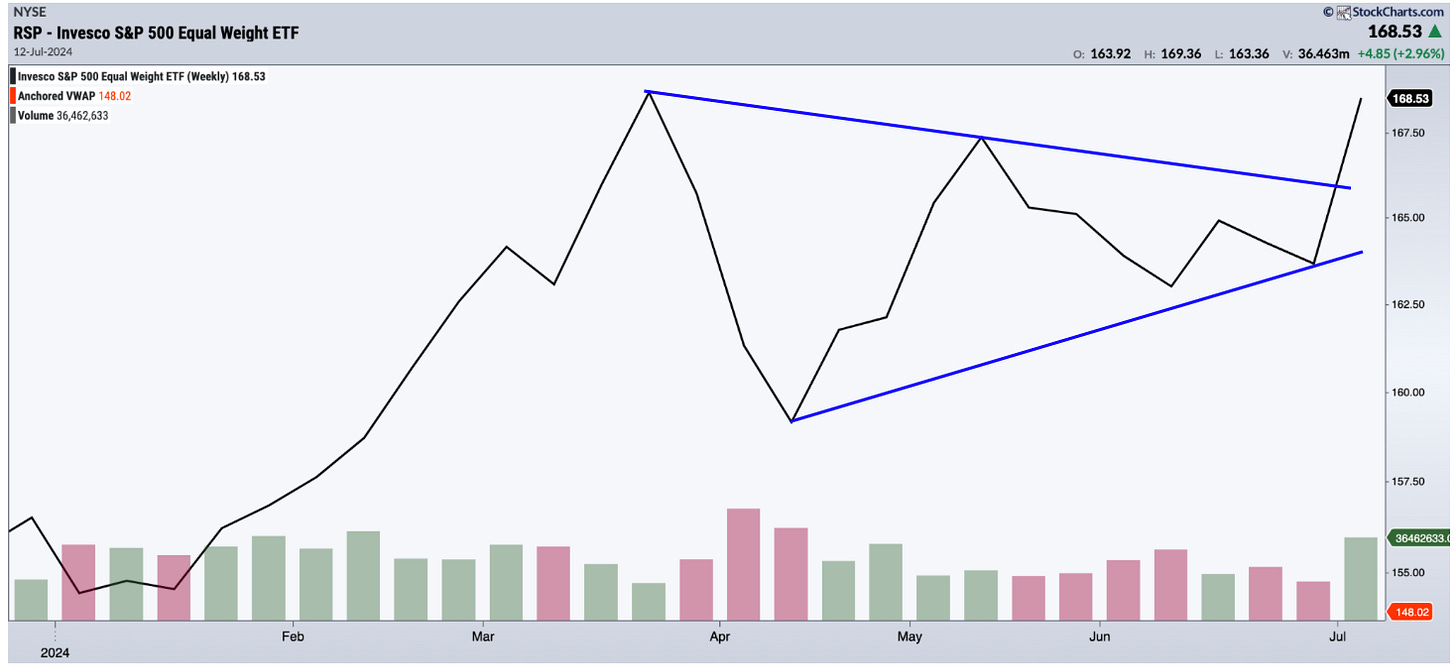

The S&P 500 Equal Weight Index broke out of a three-month consolidation pattern, confirming a broadening out of this bull market.

The technicals are reflecting the anticipation for Q2 earnings, with 8 of the 11 S&P sectors expected to report year-over-year growth.

Here’s our takeaways from the week.

Fed will cut rates

Fed swaps are now pricing in a 93% chance of a rate cut in September, up from 53% a month ago.

While the CPI remains above the Fed’s 2% target, the data is delayed. The Truflation rate, which tracks inflation using real-time data, is now at 1.86%.

Over the intermediate term, inflation is on a downtrend and the fundamentals for a continuation of this bull market are there.

Longer term, we still have concerns. At some point, the high U.S. debt levels are going to cause a crisis of confidence, as a larger and larger share of tax revenue goes toward interest payments. The government will either have to print more money to pay it off, leading to more inflation, or raise taxes. Our bet is they will have to do a combination of both.

Given that the fiscal path the U.S. is on is unsustainable, we continue to avoid bonds, especially government bonds.

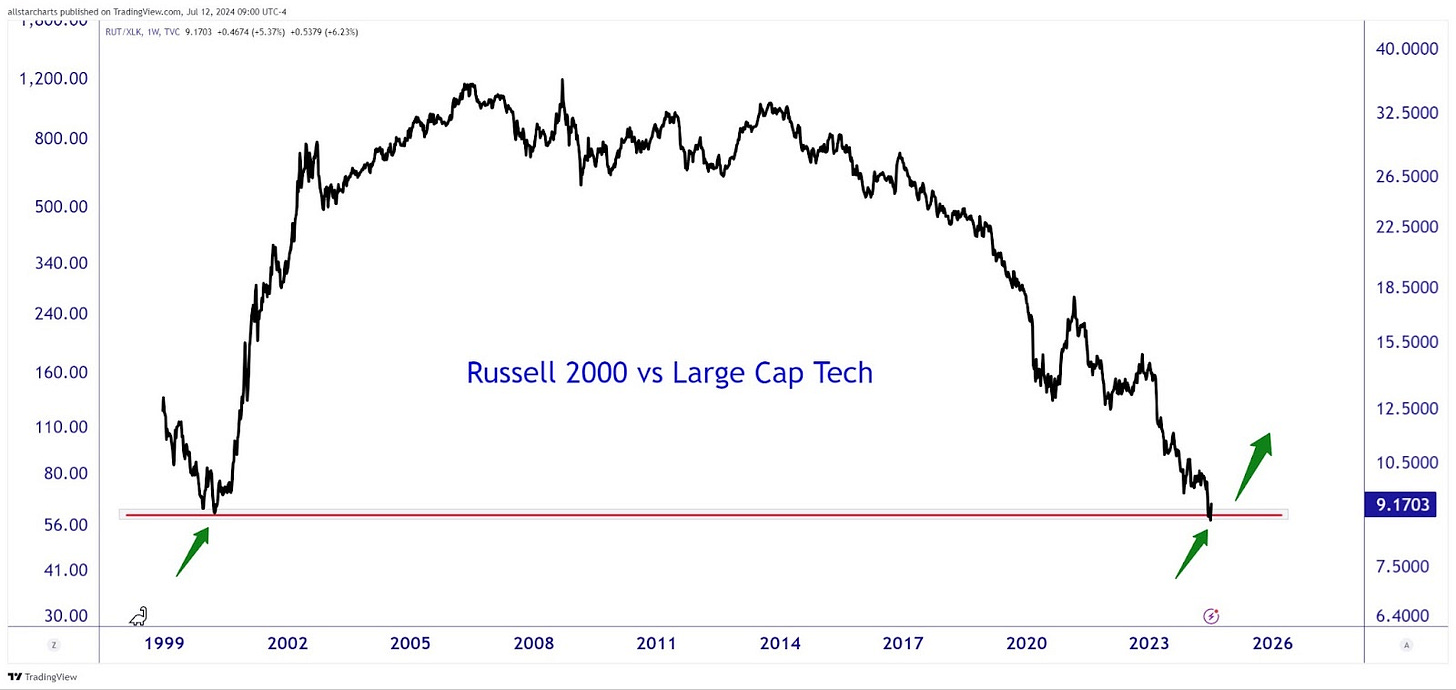

Small caps set for a historic comeback

In the meantime, we’re up 11% on our small cap positions in 4 days!

After the small cap to tech ratio hit a historic low, small companies had their widest margin of outperformance in 20+ years.

We’ve been saying for months that small caps will join the bull market soon, in part due to government spending on infrastructure and reshoring of supply chains.

We hope you’re well positioned to take advantage of this. And if not, upgrade to paid. We would love the opportunity to earn your business.