Market Brief - July 16, 2023

Welcome to The Predictive Investor Market Brief for July 16th, 2023!

Stocks had a good week, despite Friday’s selloff hitting small caps and energy companies particularly hard. We took advantage of the selloff and added 3 positions to the portfolio (see This Week’s Trades below).

Some highlights from the week:

CPI increase for June came in at 3%, vs. 4% in May. The market expects another rate hike in July, but is betting the Fed will pause after that.

University of Michigan released its preliminary consumer sentiment reading, showing a jump to 72.6 in July from 64.4 in June. The improvement was primarily due to slowing inflation.

JPMorgan beat both top and bottom line earnings estimates, and CEO Jamie Dimon was relatively optimistic for the rest of the year. This means we will likely see solid earnings results from the many banks reporting on Tuesday, including Bank of America, Charles Schwab, and Morgan Stanley.

Market Technical Analysis

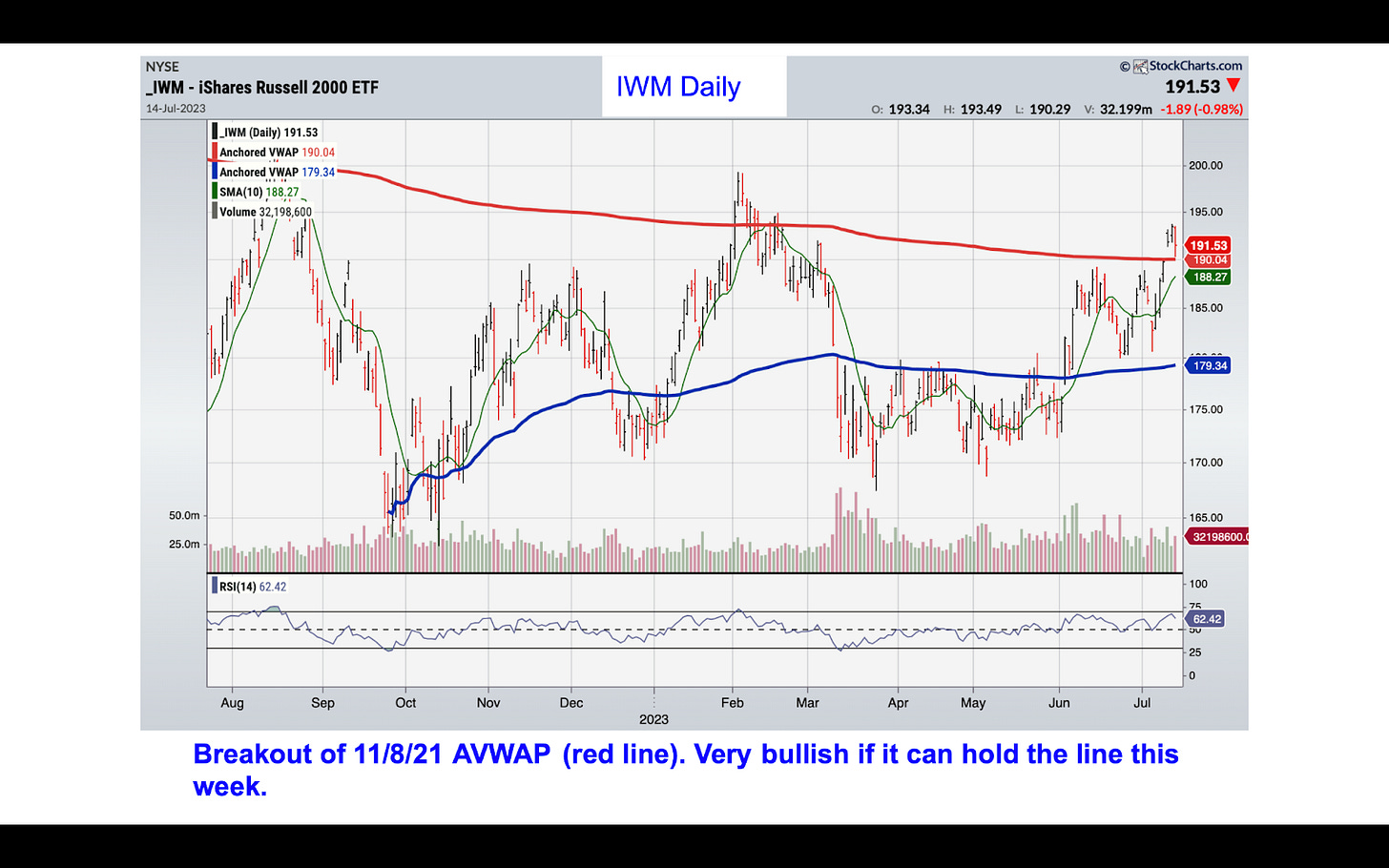

Russell 2000 (IWM)

IWM closed the week above the 11/8/21 AVWAP, which is the cumulative average price since the all time high. At a practical level, this means the average buyer/short seller since the market topped in 2021 is near breakeven, and therefore there’s very little psychological resistance. Speculators have already been reducing short positions since February, and buyers are unlikely to sell given the recent market momentum. This is the 5th time IWM attempted a breakout of the 11/8/21 AVWAP, so this week will be critical. We added 3 positions to the portfolio to take advantage of Friday’s selloff. If IWM can hold above $189 this week it will be a very bullish sign for small caps.

S&P 500 (SPY)

SPY is approaching overbought territory on the weekly chart, and there’s some overhead resistance at $453. But technicals will take a back seat to earnings. Several large cap financial and tech companies are due to report next week, and if guidance is solid, the index will test the 2021 highs over the next several weeks.

Market Sentiment

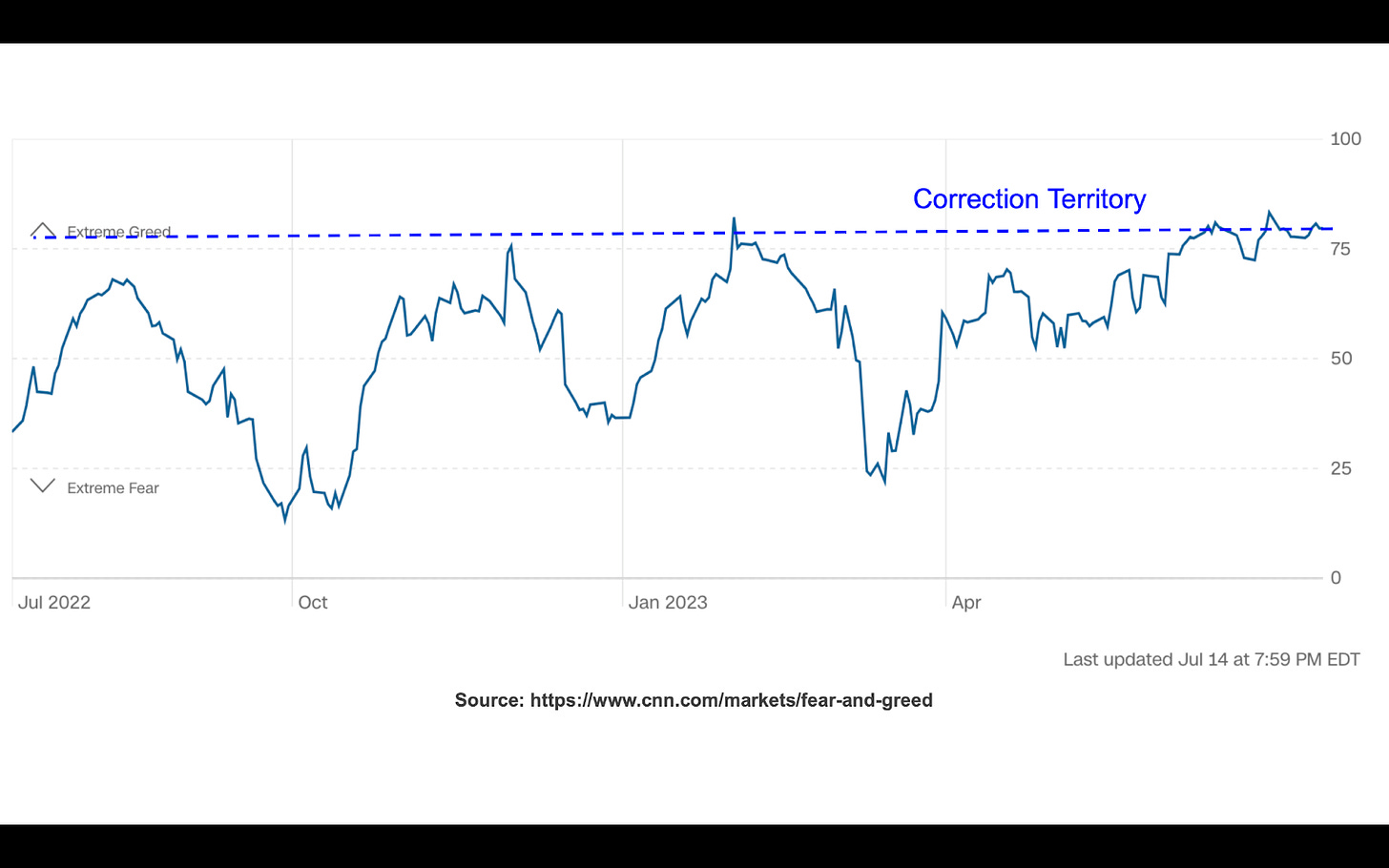

The CNN Fear & Greed Index closed the week at 80, keeping the index in extreme greed territory since June 27th. Readings above 80 tend to coincide with market corrections.

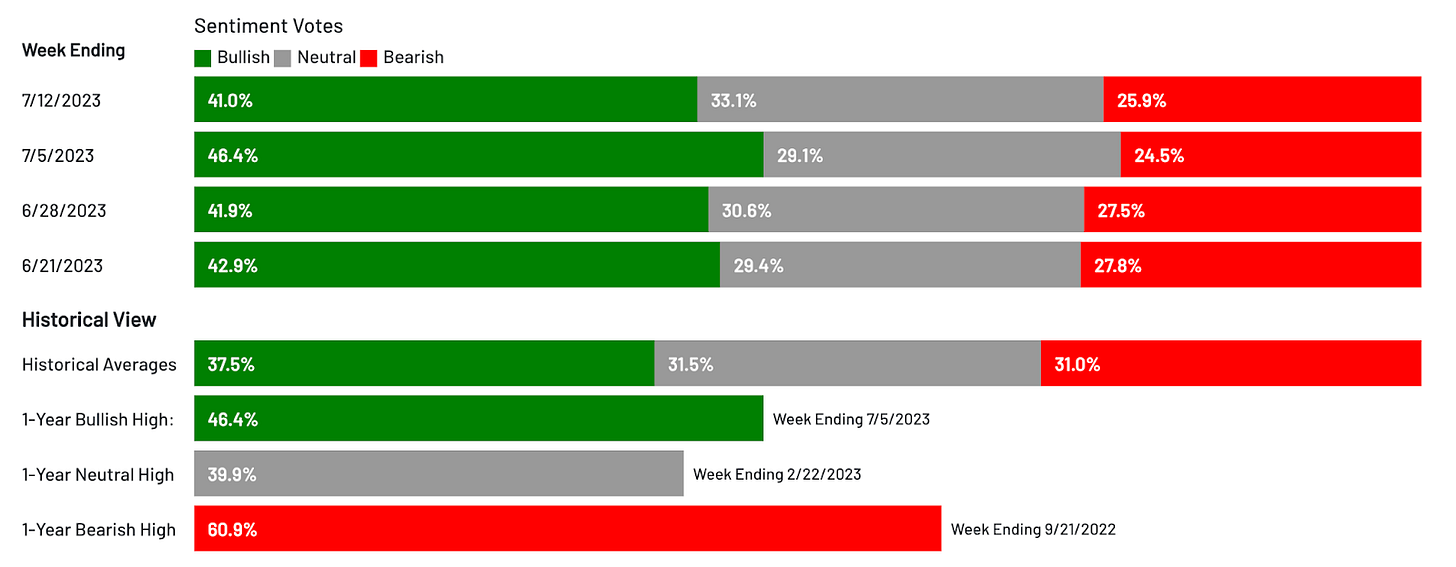

Bullish sentiment in The AAII Investor Sentiment Survey decreased week-over-week, but was above average for the 6th week in a row. There’s no hard rules as to when to take a contrarian position, but we’ll be on the lookout for a short-term top when more than half of investors surveyed are bullish.

CFTC S&P 500 Speculative Net Positions

Short positions are near record levels, but speculators began turning bullish in February. The unwinding of bearish positions should continue to provide fuel for this rally. We likely won’t see a correction until a stronger capitulation occurs.

The bottom line:

From a technical perspective, there’s very little resistance to stop this rally despite being overdue for a correction. Several large financial and tech companies are due to report Q2 earnings this week. We likely won’t add any positions to the portfolio until Thursday, when we’ll have a sense of how the market digests guidance for the second half of the year.