Market Brief - July 2, 2023

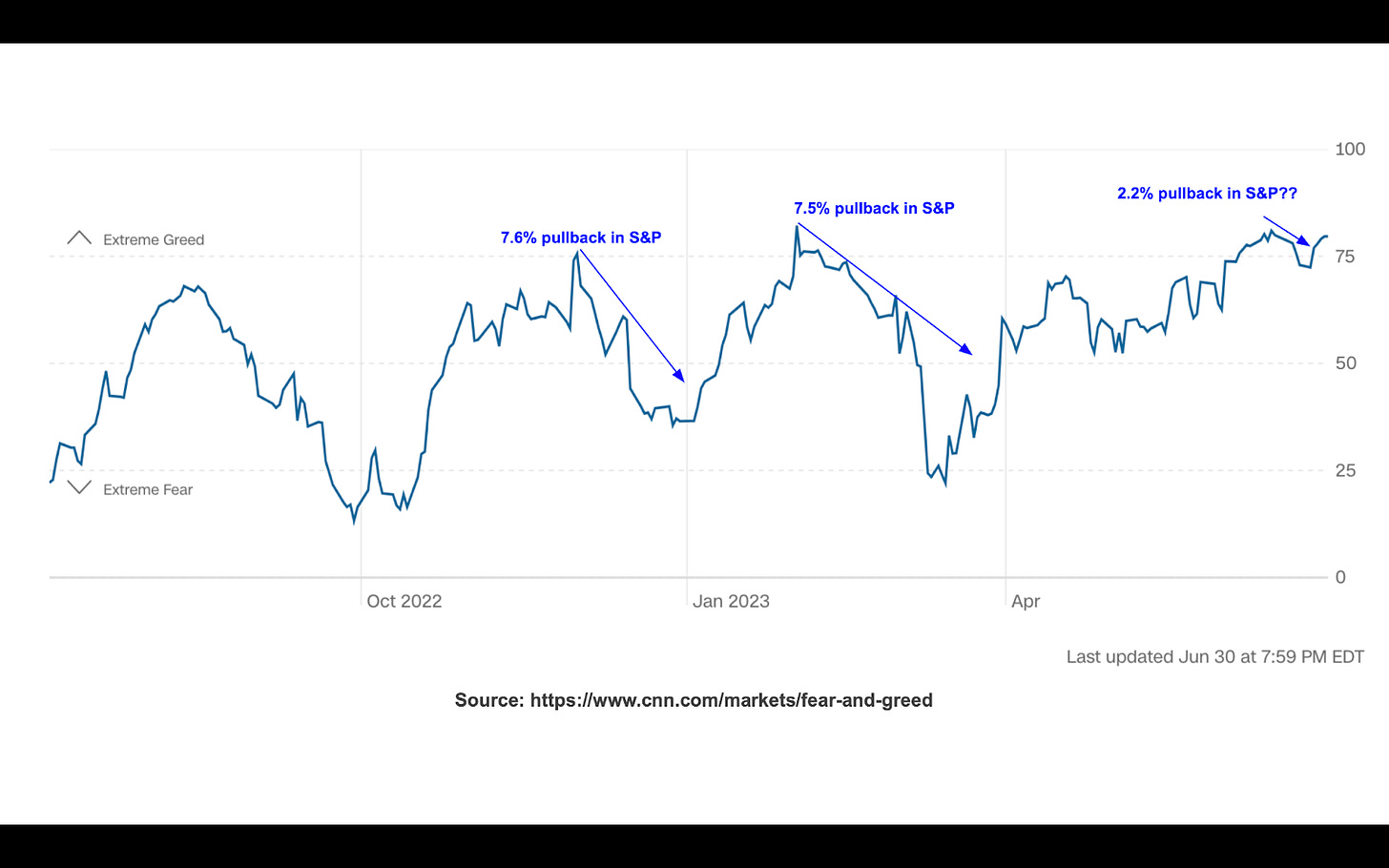

Though relative strength (RSI) for the major indexes did fall out of overbought territory, the associated pullback we expected did not occur. SPY retreated just 2.2% before closing the week at a new high for the year.

Additionally, the S&P 500 equal weight ETF (RSP) gained 3.4% last week (vs. 2.5% for SPY), indicating buying interest is starting to go beyond mega cap tech stocks.

Despite being wrong about the short term direction of the market, our portfolio is still up 13% year-to-date. Bullish sentiment remains at an extreme, but this market clearly isn’t ready to correct just yet. Employment and manufacturing data come out next week, and if the reports align with the soft-landing scenario, upward momentum will continue.

Russell 2000 (IWM)

Last week saw a successful retest of $180, but IWM continues to be stuck between the cumulative average prices from the bear market top (red line) and bear market low (blue line). This is partially why we’ve been so cautious - the bulls are not yet in control of the small cap index.

Nasdaq (QQQ)

QQQ did not deliver the pullback we expected, hitting a low of $357.59 on Monday vs. our short term target of $355. QQQ did not break above its mid-June high like SPY, but did gap up on Friday with strong volume, indicating further upside ahead. Overall, the market is still due for a pullback. We’ll be watching $380, the next major point of resistance for the tech ETF.

Dow Jones Industrials (DIA)

DIA nearly hit our first downside target of $355 but quickly recovered. Overall, the sideways consolidation continues and the ETF is struggling to break $345.

S&P 500 (SPY)

SPY did not correct as much as we thought, but did manage to successfully retest its August 2022 high. Friday’s gap up on strong volume suggests further upside ahead.

Market Sentiment

The CNN Fear & Greed Index closed the week at 80, placing it back into extreme greed territory. A 2.2% pullback in the S&P 500 is not exactly what we had in mind when the index entered into extreme greed territory 2 weeks ago. While the fact remains when the index is at or above 80, the risk for a significant pullback is elevated, extreme optimism can often persist until there is a full capitulation by the short sellers.

The bottom line:

From a technical perspective, the market is incredibly bullish. If we were not seeing extreme sentiment readings and softening macro data, we would have been buying more aggressively. Though next week is a short week, we may take an additional trade or two. The market is still overdue for a pullback, so we will continue to trade lightly until that happens.