Market Brief - July 21, 2024

Tech selloff accelerated by software glitch

Welcome to The Predictive Investor Market Brief for July 21st, 2024!

The tech selloff started mid-week after the announcement of chip export restrictions to China (Read) and accelerated with the global tech outage caused by a Crowdstrike software update.

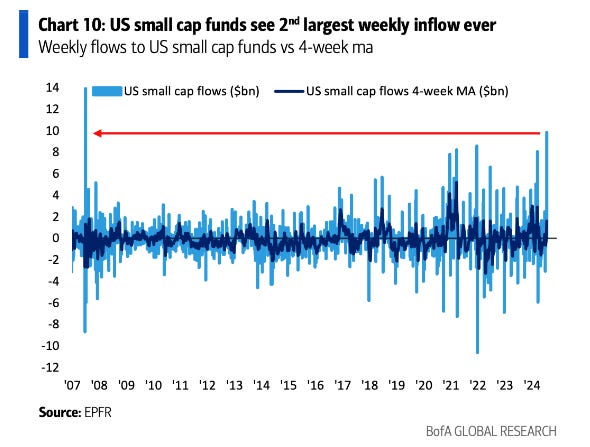

That said, the Russell 2000 closed the week up nearly 2% and saw the 2nd largest weekly inflow ever.

The Russell 2000 is incredibly rate-sensitive, so this is the clearest indicator yet that the big money is betting on a soft landing with a rate cut later this year.

We hope you have sufficient exposure to small companies. If you’re looking for guidance, upgrade to paid. We would love the opportunity to earn your business.

Here’s our takeaways from the week.

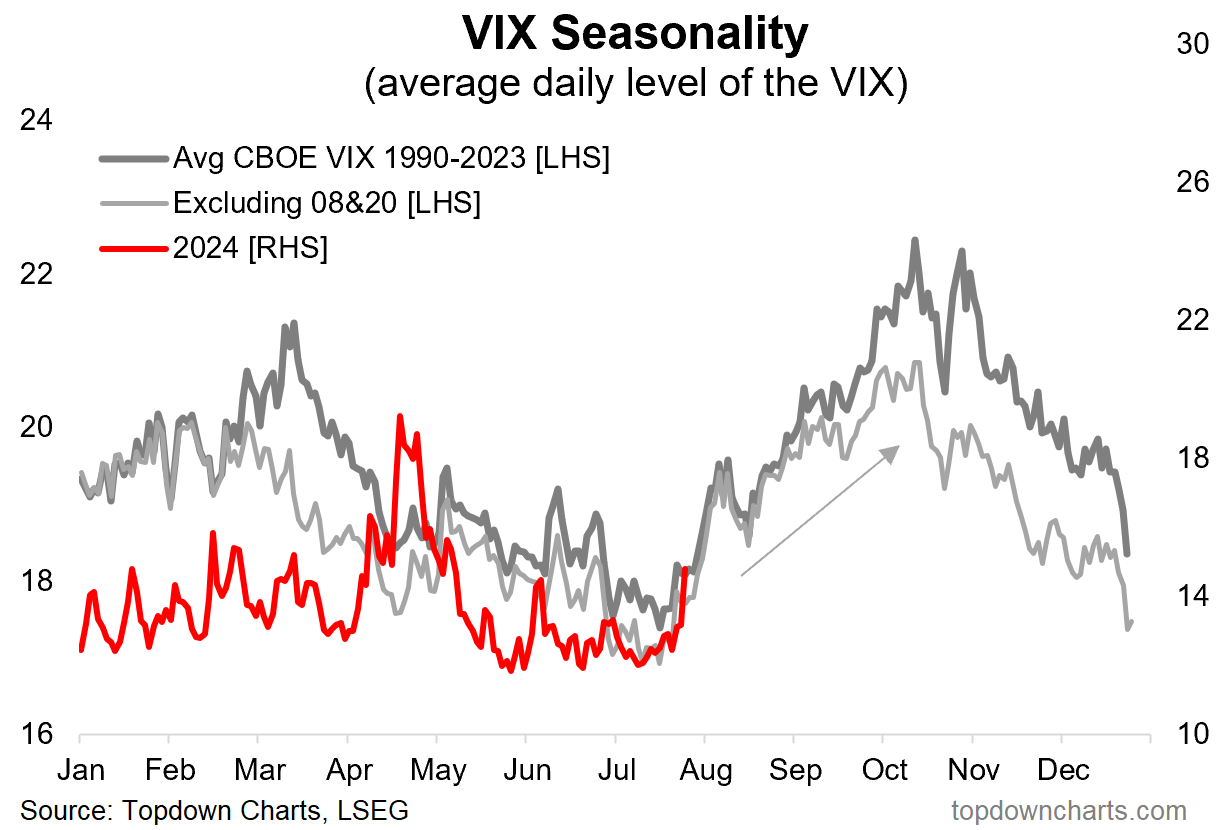

Prepare for higher volatility

The Fall is a notoriously difficult period for stocks. As we said last month, over the last 20 years the S&P 500 closed higher in July 80% of the time. But that number drops to 53% in August and September.

This doesn’t mean we should retreat from the market, but it does mean we should be selective about putting new money to work and monitor our buy list closely. Qualifying companies that hold up during periods of higher volatility often gain the most during the ensuing recovery.

Forward tech earnings take a hit

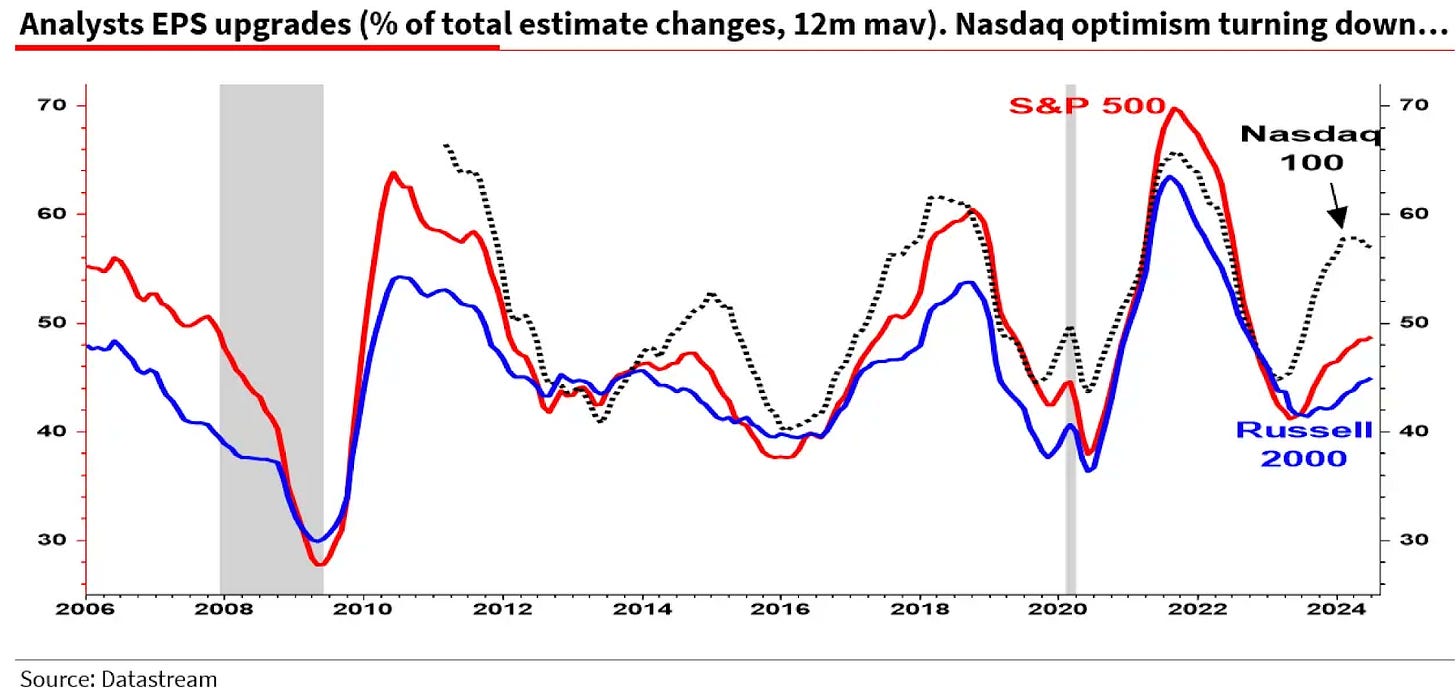

One major factor driving money into small caps is that earnings upgrades for tech have been falling, while upgrades for the S&P 500 and Russell 2000 are increasing.

Earnings drive stock prices, and the data indicate that a broadening of the bull market is underway.

We’ve said for a while that the AI-driven mega cap tech trade is very crowded and priced for perfection. Tons of money has been spent on AI infrastructure, but investors are going to need some indication that the technology can be monetized in order to justify these high valuations. Google’s earnings release on Tuesday will be the first in a series of Q2 results that will help us understand how this plays out over the next few months.