Market Brief - July 28, 2024

Small caps outperform once again

Welcome to The Predictive Investor Market Brief for July 28th, 2024!

Q2 GDP growth came in at 2.8%, above the forecast of 2.1%. (Read)

Growth, easing inflation and a likely Fed rate cut later this year will continue to benefit stocks. Despite strong GDP growth, large caps closed down while the Russell 2000 gained 3.3%. What’s going on?

Here’s our takeaways from the week.

Mag 7 retreats

For nearly two years, the outperformance of mega cap tech was masking broad weakness among the rest of the market. We’re now starting to see the reverse.

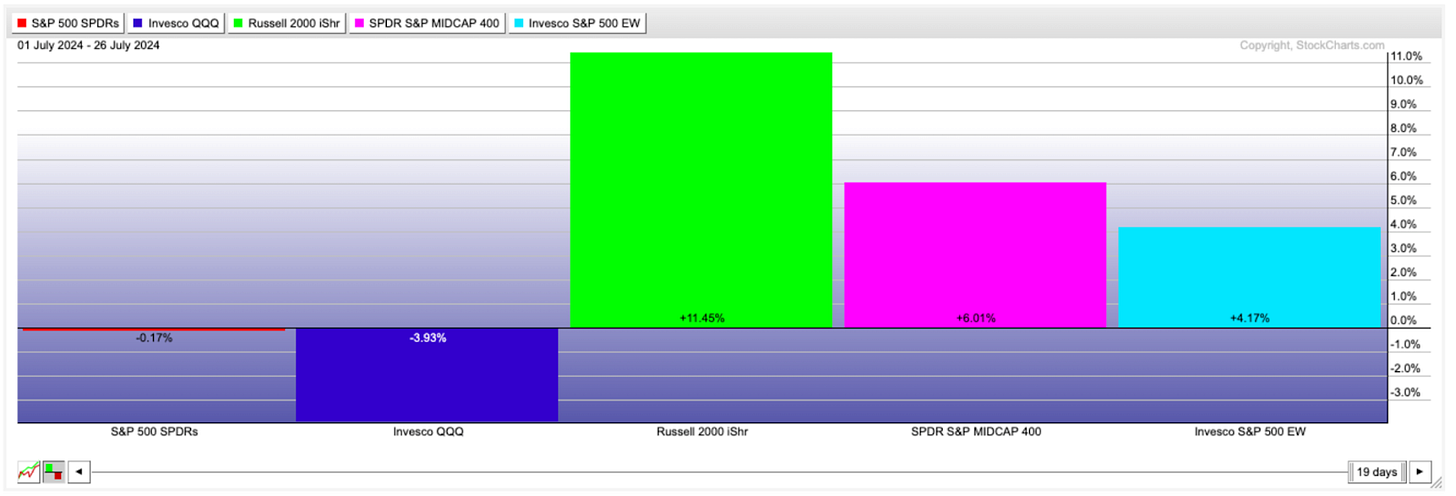

Since the first of the month, the S&P 500 is essentially flat while the equal-weight S&P 500 is up over 4%. The tech-heavy QQQ is down 4% while the small and mid-cap ETFs are up 11% and 6% respectively.

The weakness in mega cap tech is now masking broadening market leadership. Overall we view this as a healthy correction, and certainly one that’s beneficial to our portfolio.

Index Performance (month to date)

Google might be in trouble

OpenAI announced the release of SearchGPT, an AI-powered search engine that allows users to ask follow-up questions on their search queries, in the same way you would in a live conversation. (Read)

The fear within Google is real. While they’ve enhanced search results with AI, the fact that more than half their revenue comes from search ads is preventing them from fundamentally improving the search experience. This puts them at risk of losing significant market share to a disruptive upstart like OpenAI.

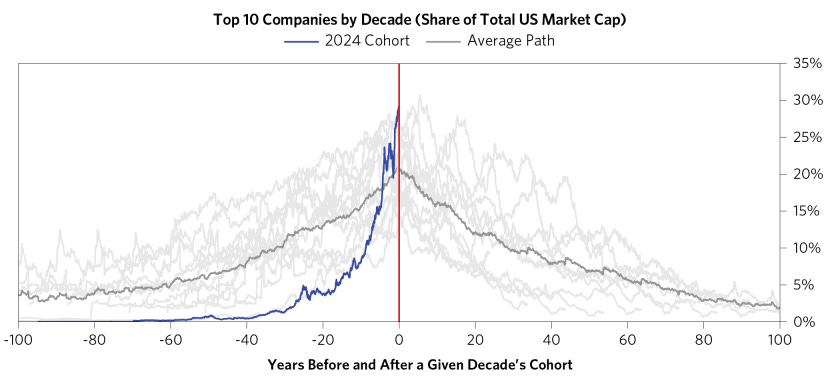

The chart below from Bridgewater caught our eye, showing that market leaders rarely stay on top forever. We’re certainly not going to bet against the Magnificent 7. Just keep in mind their success through the next wave of innovation is not a foregone conclusion.

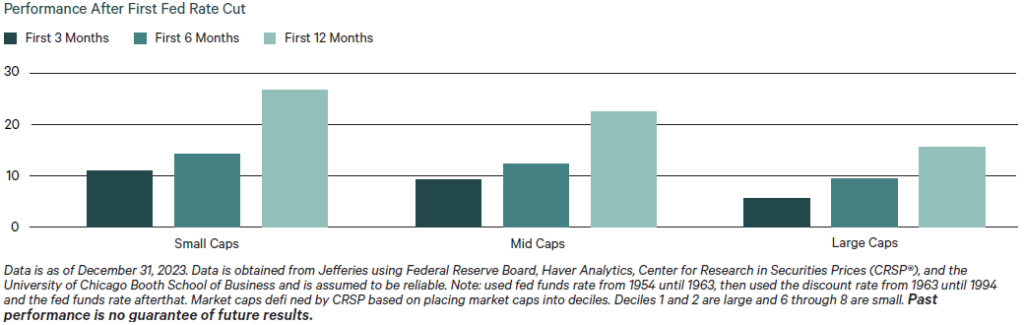

Rate cuts will benefit small caps the most

Historically, small caps outperform large caps as interest rates decline. Cheaper borrowing costs have a more meaningful impact on smaller companies' bottom line. It also fosters more M&A activity, as it becomes easier to acquire smaller companies at a premium.

Our last 2 portfolio additions are up an average of 20% in 3 weeks. If you’re not yet on board and looking for ways to play this, upgrade to paid. We would love the opportunity to earn your business.