Market Brief - July 30, 2023

Welcome to The Predictive Investor Market Brief for July 30th, 2023!

Another solid week of gains for the S&P 500, Russell 2000 and Nasdaq, mostly driven by earnings and solid GDP growth. Last week, out of the 159 S&P 500 companies that reported Q2 results, 136 beat consensus EPS expectations. We did see a spike in volatility on Thursday, but not for the reason we expected. It was mostly driven by a surge in treasury yields after the BOJ announced a change to its yield curve control policy.

Market moving events to watch next week

Weekend Reads

Commercial Real Estate Is in Trouble, but Not for the Reason You Think: In the meantime, the long, slow metamorphosis happening in the office segment of the commercial real estate market is soaking up oxygen from another story that’s rapidly unfolding in commercial real estate markets. Remember those other categories? The biggest one, beating office by a few hundred billion dollars, is multifamily residential. Multifamily residential buildings are typically apartment complexes that are owned by commercial landlords. Real estate loans in this area are looking especially wobbly, for three primary reasons. (Morningstar)

Our notes: Most of the potential crisis scenarios are already priced into REITS and other commercial real estate stocks, and many are now trading at very attractive valuations. Brandywine Realty Trust, Park Hotels & Resorts, and Vornado Realty Trust all come to mind as worthy of further research.

Investors are still so scared: Last summer we saw some of the most pessimistic sentiment towards stocks in history. Some of that sentiment has started to shift a bit, like in the AAII and II polls. We’re back somewhere towards the middle in those. You need, at least, some bulls to buy stocks to have a bull market. But when it comes to Fund Managers, Cash is still their largest position, and they’re most bearish on equities. This is not something we see historically right before a major market selloff. Quite the opposite, in fact.This is fuel for further gains. This cash needs to be put to work. (All Star Charts)

Our notes: Large cash positions among institutional funds is one of the reasons the pullbacks YTD have been so modest. Tech is also flagged as a crowded trade. While we wouldn’t bet against these stocks, they are overbought and due for a correction.

What Alphabet's Layoffs, Current Headcount, and Unemployment Claims Tell us about the Erstwhile Tech Layoff Tsunami: With the big tech and social media companies, it followed the same pattern: Big layoff announcements globally, but a smaller headcount reduction because hiring continues to this day, and only a portion of the headcount reduction took place in the US, and then those workers got picked up quickly by other companies that have been struggling for talent, and a lot of them ended up in new jobs that still paid very well – but less than their prior jobs. (Wolf Street)

Our notes: Great explanation of what’s going on behind the tech layoff headlines. The strength of the labor market is a major reason we’ve managed to avoid a recession, which is something no one thought possible just 6 months ago.

Market Technical Analysis

Russell 2000 (IWM)

IWM is less extended, on both a price and valuation basis, than the large cap indexes. While it may stall at $200, there’s solid support at $190, which limits downside risk at current levels.

S&P 500 (SPY)

RSI is entering overbought territory as the index approaches a band of price resistance between $460 and $470. Unless Apple or Amazon disappoints with their Q2 results, the S&P looks increasingly likely to test the all time highs before any real correction.

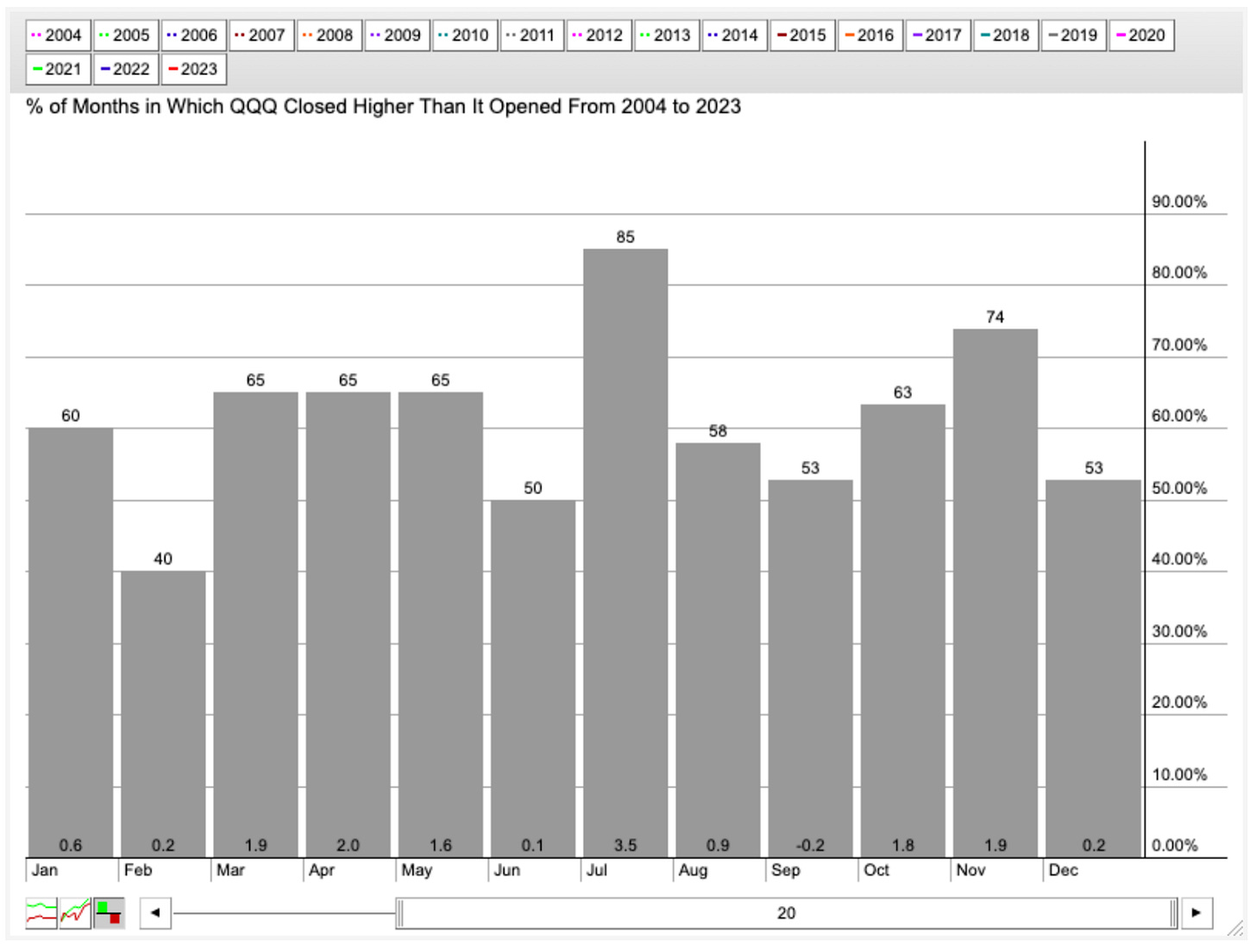

Nasdaq (QQQ)

RSI has been in overbought territory for 2 months, and historically August and September are weak months for tech stocks. Apple and Amazon and set to announce their Q2 earnings results on Thursday. While good news from both could propel the market toward its all time highs, the risk of a correction remains high.

Market Sentiment

The CNN Fear & Greed Index closed the week at 78, keeping the index in extreme greed territory since June 27th. Readings above 80 tend to coincide with market corrections. The AAII Investor Sentiment Survey saw a slight drop in bullish sentiment, but optimism remains above historical average for the eighth week in a row.

The bottom line: Sentiment indicators remain elevated and August and September are historically weak months for big cap tech stocks. That said, Apple and Amazon’s earnings announcements will have an outsized impact on the market next week. Good results mean the indexes will test their all time highs. But a correction is becoming increasingly likely over the next few months.