Market Brief - July 7, 2024

A return of the 90s?

Welcome to The Predictive Investor Market Brief for July 7th, 2024!

We hope you all had a wonderful Independence Day!

The S&P 500 closed the week at a new all time high after consolidating over the last two weeks. But overall volume was light due to the holiday.

This week brings a host of economic data, including inflation readings and the start of Q2 earnings season. We should therefore be prepared for an uptick in volatility.

Here’s our takeaways from the week.

A return of the 90s boom?

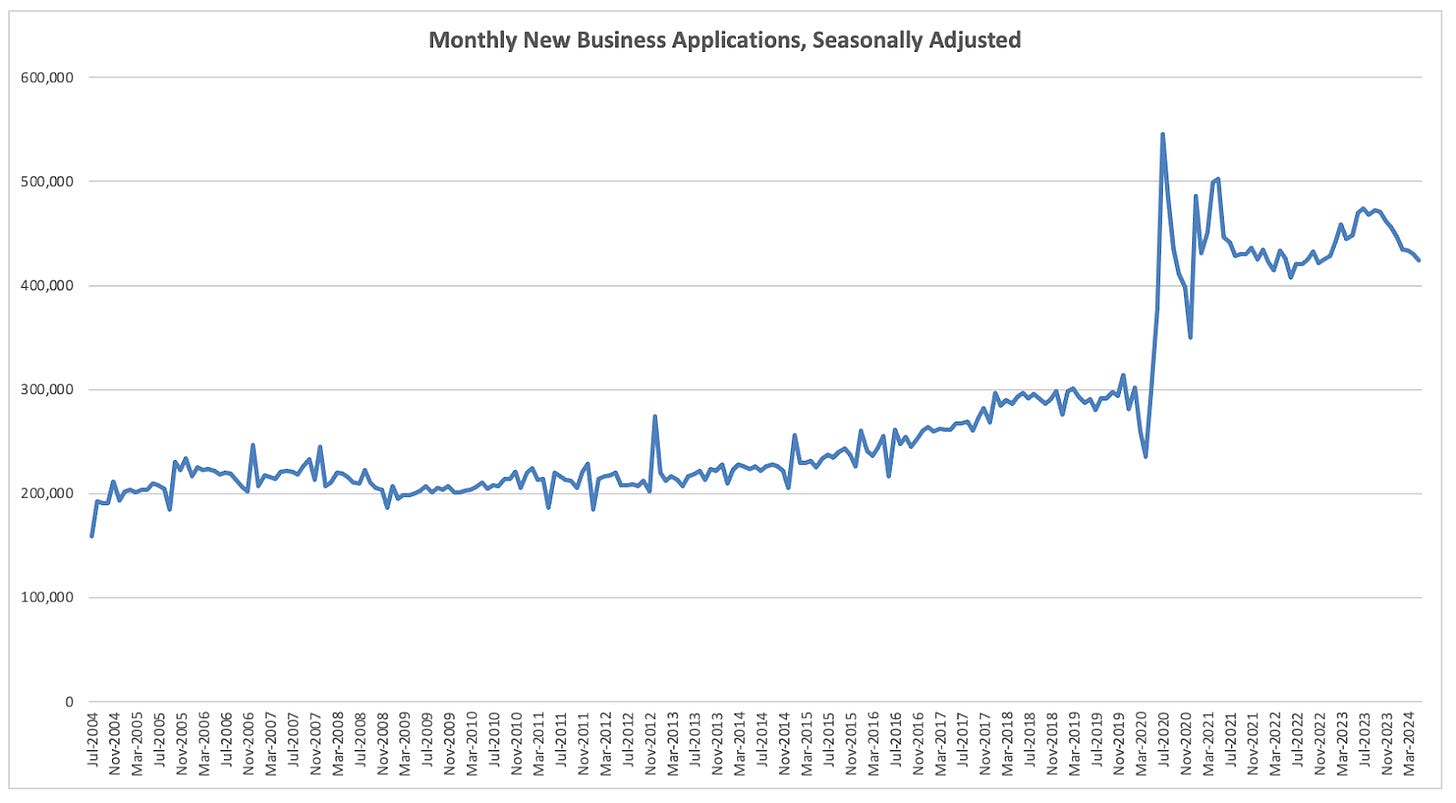

The post-Covid boom in entrepreneurship continues to defy expectations, with monthly new business applications surpassing 400,000/month for more than three years.

While many say they’re pessimistic about the economy, their actions speak otherwise. Forming a new business represents a willingness to take risk, which is typically associated with optimism about the future. A boom in new businesses is also typically an early indicator of future economic growth.

A large driver of this is investment in artificial intelligence. The last time we saw such a large boom in entrepreneurship was back in the 90s, which was also driven by new technology.

Right now, the bulk of AI-related investment gains in tech have come from areas that enable AI - chips, data centers and energy. And some are already calling AI a bubble. But this investment is real, and the number of businesses being formed is a clear indicator that AI will lead to broader-based gains for the economy.

Labor market softens

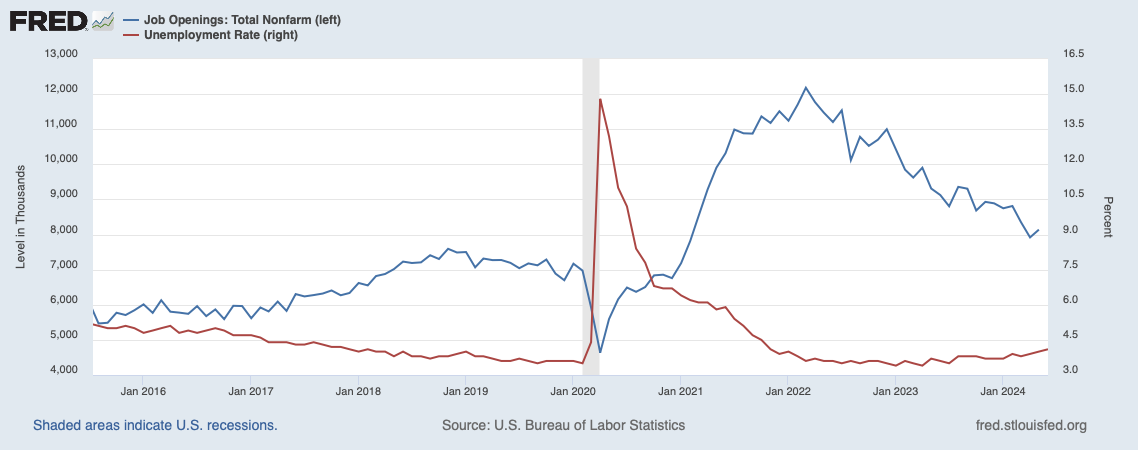

Monthly job gains came in above expectations, and there are still more jobs available than those unemployed (although that ratio is shrinking).

The chart below shows the trend in job openings vs. unemployment. The current unemployment rate of 4.1% is a two-year high, but well below the long term average of 5.5%.

Overall the data shows a gradual cooling of the labor market, consistent with the Fed’s soft landing scenario, which no one thought they could accomplish. The market views this as a precursor to lower inflation, making this week’s inflation data all the more important.

Earnings will drive stocks higher

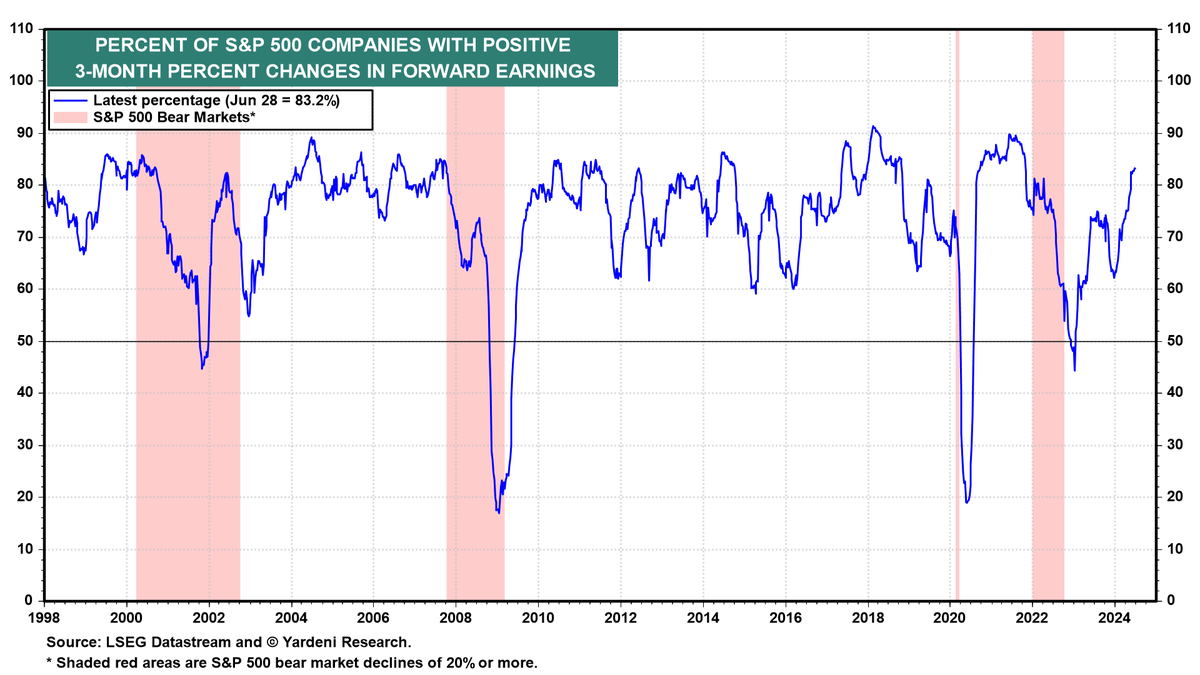

Earnings drives stock prices, and the percentage of SPX companies with positive 3-month changes in forward earnings projections has been increasing. This suggests we should expect broadening of the bull market beyond mega cap growth.