Market Brief - June 16, 2024

Traders stop caring about the Fed

Welcome to The Predictive Investor Market Brief for June 16th, 2024!

The indexes closed mostly up for the week on cooling inflation and rising jobless claims. Traders view both as indicators of a soft landing, which may encourage the Fed to start cutting rates sooner. We remain in the “higher for longer” camp, as the Fed’s own estimates now suggest just one rate cut in 2024 (down from 3 just a few months ago).

That said, this week’s price action shows traders have stopped caring about the Fed. This week’s decline in yields allows traders to apply more leverage, and that money is clearly heading into stocks.

Here’s our takeaways from the week.

Crash of a lifetime?

Economist Harry Dent is at it again, predicting the “crash of a lifetime” in 2024 that will take the Nasdaq down 92%. (Read)

While these kinds of predictions can sound convincing, it’s important to recognize them for what they are: great marketing. They generate headlines and help sell books and other products.

The problem is they’re often wrong.

Dent published a book in 2011, predicting the Dow would crash to 3,000 by 2013. The book was a bestseller, but those who followed his advice missed out on some major gains. He doubled down a few years later, saying in 2016 that the Dow would end up between 3,000-5,000. It hit 40,000 just a few weeks ago.

Eventually he will be right, and the markets will crash. But here’s the truth: the markets have a clear upward bias over time, and it’s a very costly mistake to confuse marketing with market research.

Higher valuations are justified

The challenge with assessing predictions like the above is that there’s usually some kernel of truth in them. Government debt is out of control, record money printing by the Fed has contributed to inflation and valuations in some areas have become stretched.

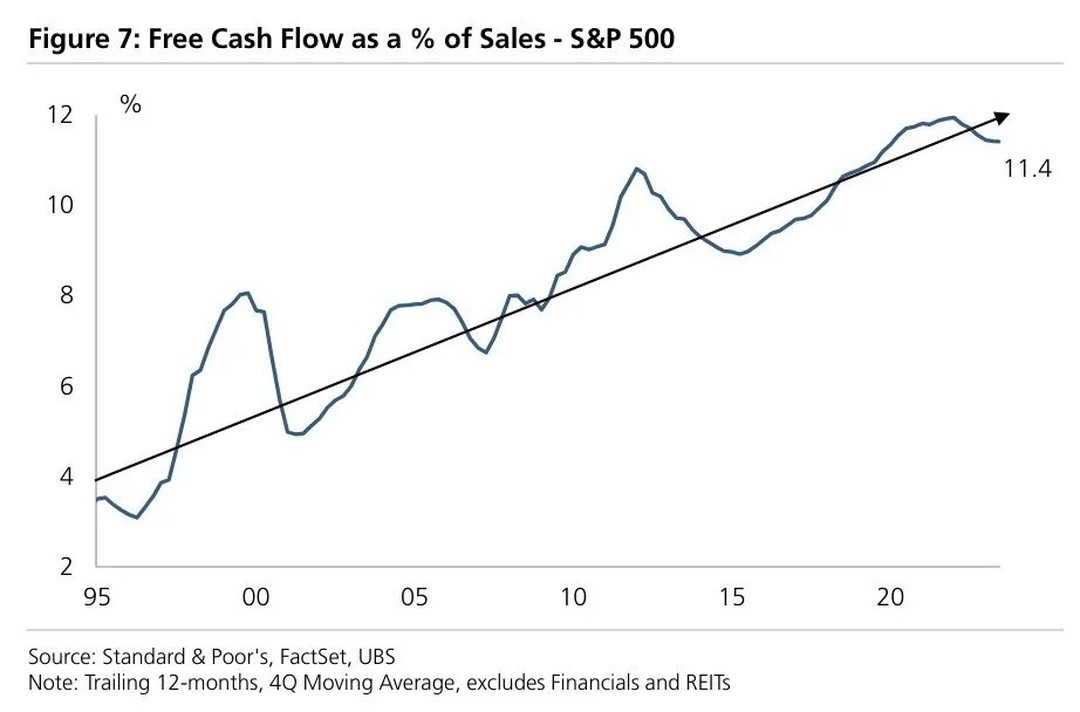

However, it’s important to look beneath the surface. The fact is U.S. companies have been delivering significantly more free cash flow to investors over the last 30 years, which justifies higher valuations in many cases.

Simply comparing the market’s PE ratio to a historical standard does not provide an accurate assessment if the fundamentals beneath the surface have changed.

Energy as a contrarian play

The California Legislature intends to cancel a $400M loan to help extend the lifespan of the state’s last nuclear power plant. (Read)

This is the latest development in a long series of disputes over whether to keep or close the facility. Currently it provides about 9% of the state’s electricity.

But this story illustrates a larger point: environmental regulation is constraining supply at a time when demand continues to rise. Which must lead to higher prices as long as it continues.

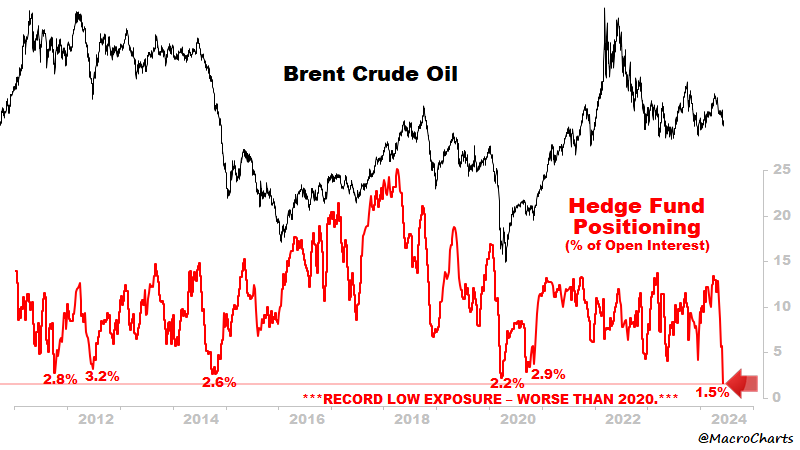

While some of our energy picks are lagging, we remain bullish over the long term. And hedge fund exposure to oil is at a record low, making energy the ultimate contrarian play.

Market Technical Analysis

Treasury Bonds (TLT)

Last week we noted declining breadth in the SPX as a potential reason for consolidation. Obviously that didn’t happen, because the most important story from a technical perspective is the rally in bonds. TLT is now comfortably above the 12/28 AVWAP (red line), and has made a series of higher highs and lower lows. A continued advance toward the December high will be very bullish for stocks, as low rates allow traders to apply more leverage to their investments.

Last Week’s Trades

We added two stocks to the portfolio last week.