Market Brief - June 2, 2024

Weak guidance drives profit taking

Welcome to The Predictive Investor Market Brief for June 2nd, 2024!

Stocks ended the week lower on weak guidance from cloud software companies, including Salesforce and MongoDB.

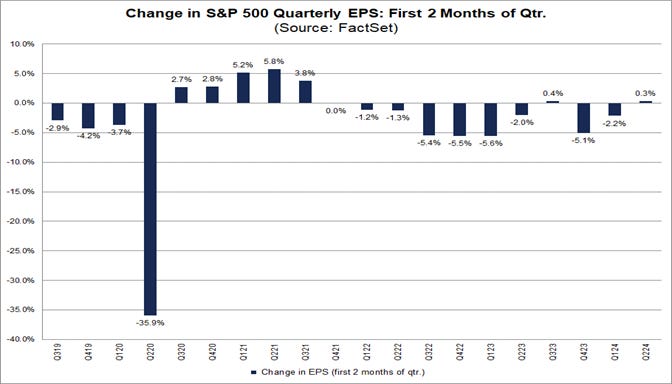

Despite the volatility, analysts have actually increased EPS estimates by 0.3% QTD. Typically analysts decrease estimates in the first two months of a quarter. Over the last 10 years the average decline in EPS estimates during the first two months of a quarter has been 2.7%. Given the improving earnings outlook, we feel recent volatility is mostly driven by profit-taking.

Inflation - more of the same

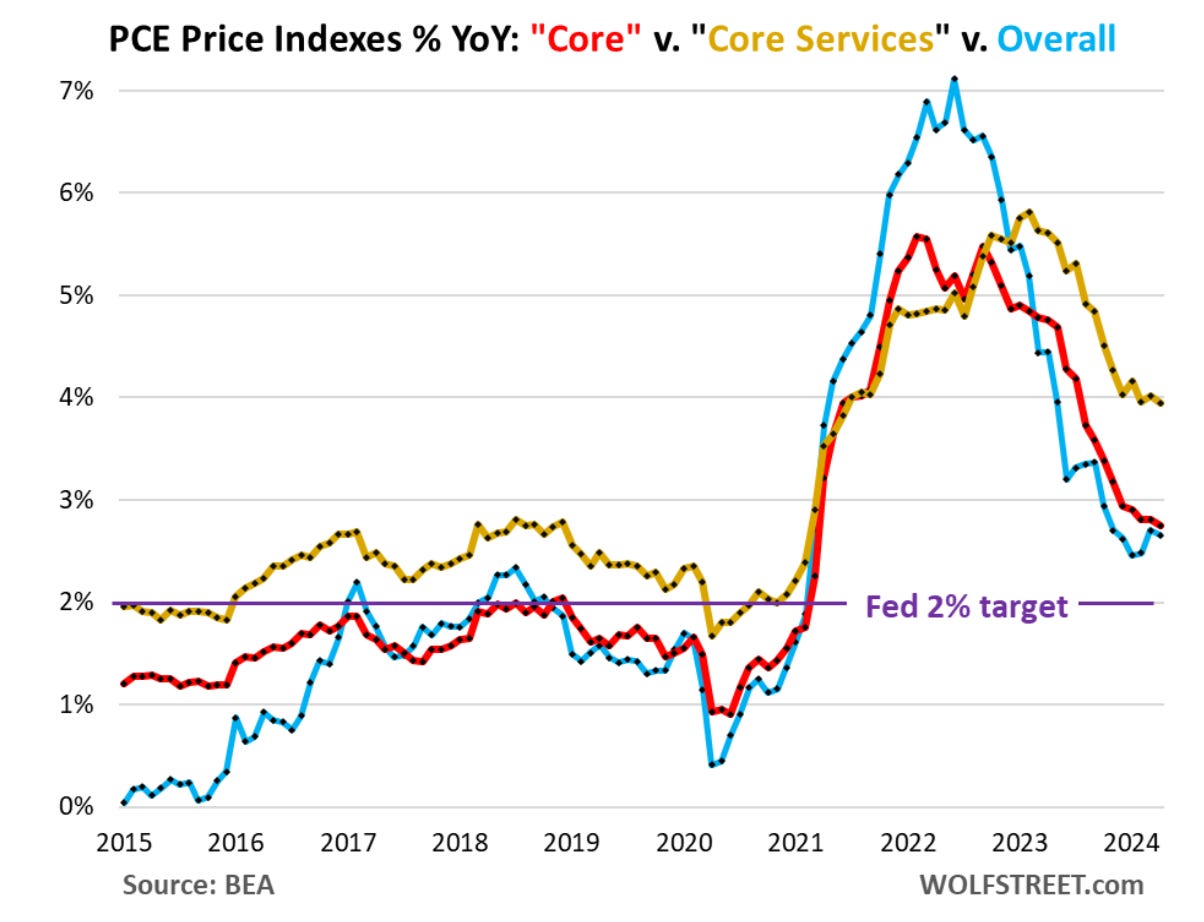

Headline inflation was in line with expectations, but core services remains elevated far above the Fed’s 2% target. Core services comprises the majority of consumer spending, including housing, healthcare, insurance and entertainment. This data gives the Fed very little reason to lower rates. Translation = higher for longer.

Rally broadens

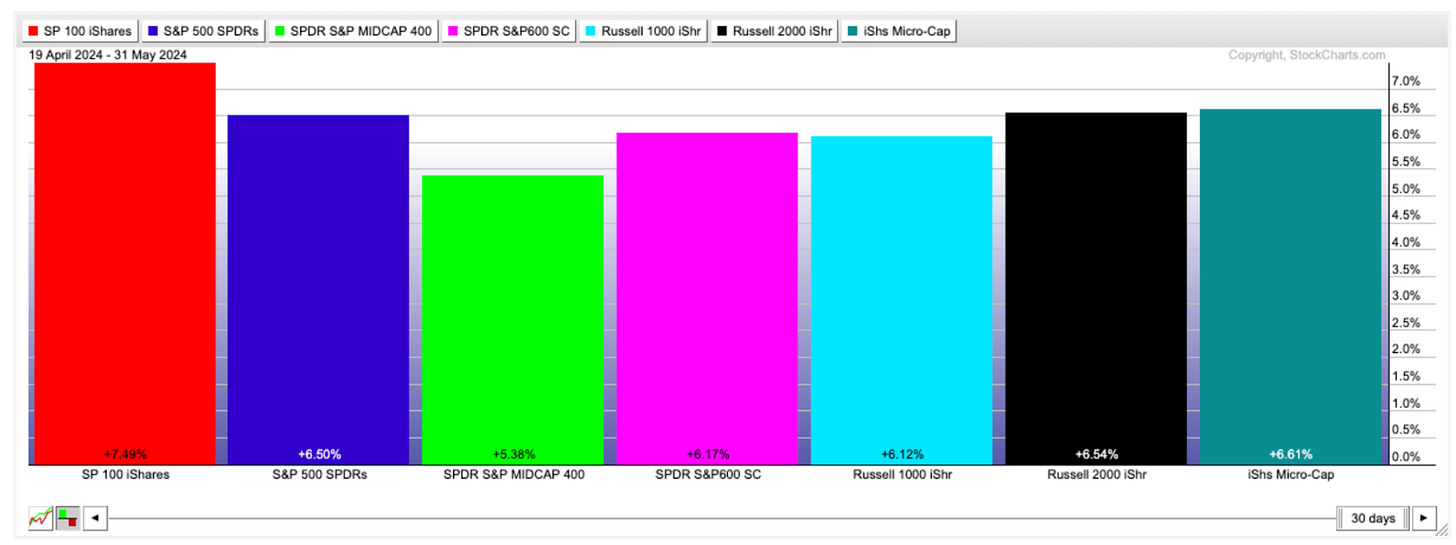

Since the market bottomed on April 19th, small and micro cap stocks have pulled ahead of the S&P 500. Utilities have also pulled ahead of Tech. We see this as an early sign that the rally is starting to broaden out beyond big tech.

Market Technical Analysis

S&P 500 (SPX)

The SPX closed the week with a bullish reversal bar on high volume, bottoming near the 50-day moving average. While the 50-day has not been a stopping point in the recent past, this level coincides with the convergence of the 3/28 and 4/19 AVWAPs. Therefore we think this is an important short-term support level. June is seasonally weak for the market, but we’ll need to hold this level to see a sustained advance through the summer.