Market Brief - June 23, 2024

Rally shows signs of stalling

Welcome to The Predictive Investor Market Brief for June 23rd, 2024!

Stocks were up modestly last week as consumer spending came in slightly lower than expected. Traders are betting that falling demand could help push inflation down, speeding up the Fed’s timeline to cut rates.

It’s no secret that we’ve been in the higher-for-longer camp. There are structural factors, such as the reshoring of supply chains, that are inflationary in nature. We believe these factors will make it very difficult to get inflation down to the Fed’s 2% target.

Either rates will remain higher than the market is currently pricing in, or the Fed will accept an average inflation rate higher than 2%.

This will all get worked out over the next several months. But short term, there are other factors at play.

Here’s our takeaways from the week.

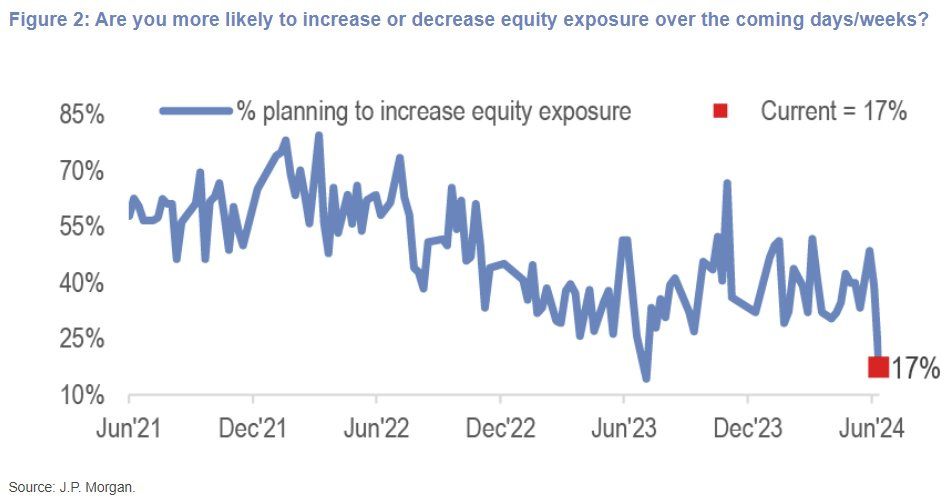

No love for stocks

The latest J.P. Morgan survey shows very little interest among institutional investors to increase equity exposure. This is the most hated bull market in recent memory.

At the same time, July is historically a very positive month for stocks. The S&P 500 closed up in July 100% of the time over the last 10 years, and 79% of the time over the last 20 years.

The negative sentiment against positive seasonality suggests we should view any short-term consolidation as a buying opportunity.

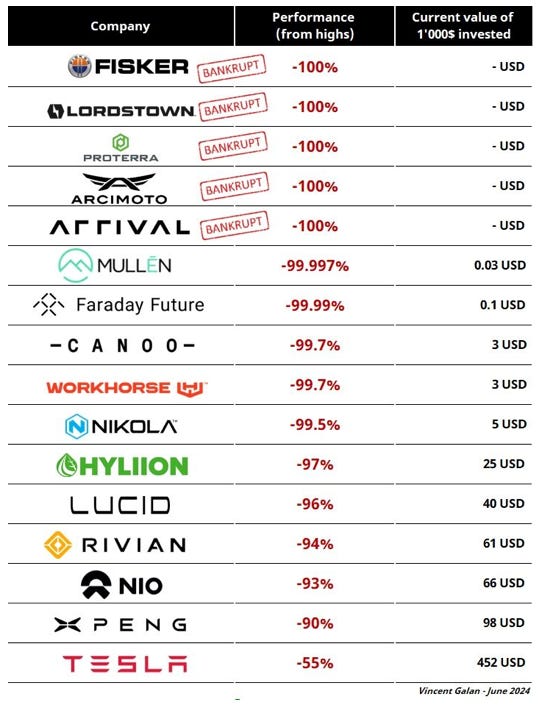

EV industry imploding

Fisker declared bankruptcy last week, adding to the long list of EV companies that have crashed or gone belly up. Which makes Tesla’s accomplishments all the more remarkable.

The collapse of these once high-flying EV stocks indicates the importance of adopting a disciplined, rules-based approach to investment decisions. If you haven’t upgraded to a paid subscription yet, you can join us by clicking here. We would love the opportunity to earn your business.

Another ship sinks in the Red Sea

A second freight ship sank in the Red Sea this week, causing further disruption to global trade, along with potentially more loss of life. (Read)

Many investors in shipping companies are nervous, but we’re sticking with our positions for now.

We bought both of our shipping stocks at significant discounts to book value. Additionally, freight rates have surged more than 2X year-over-year. Most of these companies have fixed costs, so higher rates will go directly to the bottom line.

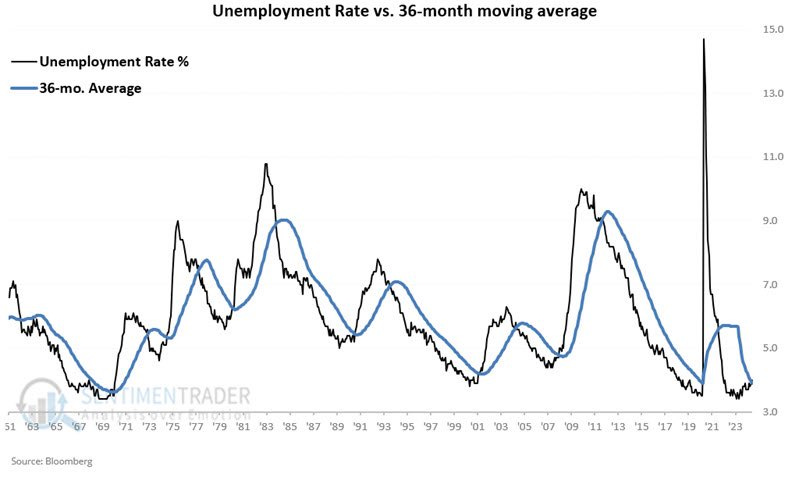

Consumer spending moderates

We’ve long maintained that the key to this bull market is the strong labor market. Unemployment has been at 4% or lower for 30 months, something we haven't seen since the 1960s. The fact that wages remained strong and unemployment remained low formed the basis of our “higher for longer” interest rate posture.

Which is why we found the below analysis from Sentimentrader curious. The unemployment rate has just crossed above its 36-month moving average, indicating a possible change in trend.

The Fed’s dual mandate of price stability and full employment is becoming more difficult to manage. If unemployment creeps up before inflation hits 2%, the Fed may have to pick one goal or the other.

Market Technical Analysis

S&P 500 (SPX)

The market has very narrow leadership. As the SPX continued up to new highs over the last month, more and more of the index's stocks were falling below their 200-day moving averages. RSI remains overbought and Friday saw a more than 2X increase in volume on a flat day with very narrow range. This indicates a lack of directional conviction among traders. The good news is bonds remain in an uptrend. But given the SPX technicals we would not be surprised to see further consolidation over the next couple of weeks.