Market Brief - June 25, 2023

The rally has finally started running out of steam. Last week gave us the first weekly decline in 9 weeks for QQQ and 6 weeks for SPY and IWM. While technical momentum indicators have started to pull back, bullish sentiment remains at extreme levels. We’ve listed some downside targets below, and would like to see a meaningful decline in bullish sentiment before taking additional positions.

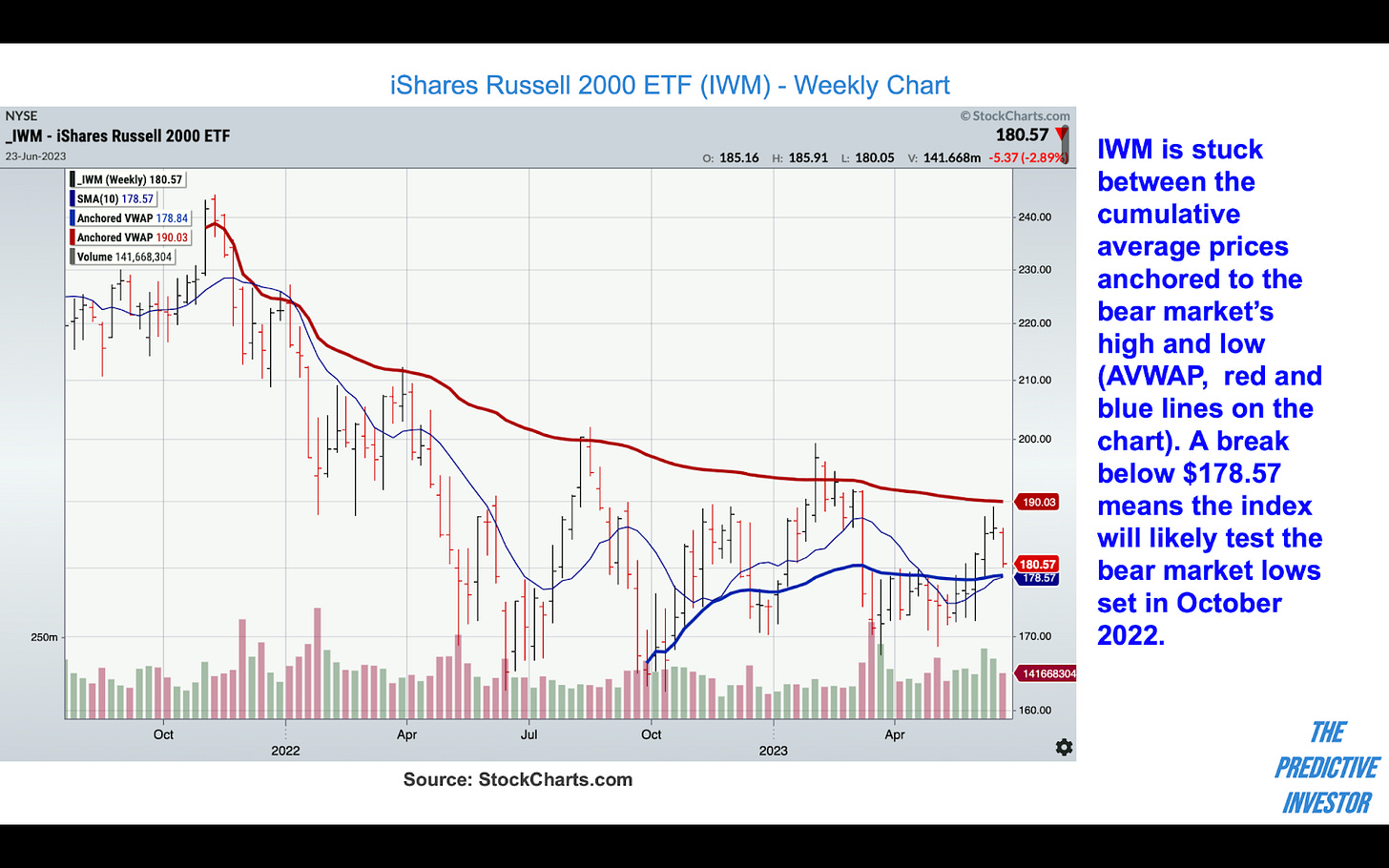

Russell 2000 (IWM)

The bulls are in control of all the major indexes except for Russell 2000. IWM is squeezed between the cumulative average price since the index topped (AVWAP, red line on chart below) and the cumulative average price of the bear market low (AVWAP, dark blue line on chart). The bear market high AVWAP (currently at $190) has been a significant point of resistance since the index topped in November 2021. If IWM breaks below $178.57 we will likely see a retest of the October 2022 lows.

Nasdaq (QQQ)

QQQ relative strength is showing signs of a short-term trend change. Our original call for a 7%-8% pullback would bring it down to $340-$345. But we’ll be watching the $355 range, where the ETF has previous price support.

Dow Jones Industrials (DIA)

DIA continues to be stuck in a sideways consolidation. The ETF closed at its 10-week moving average on Friday. Short term price targets:

$335- 50 - day moving average

$329.70 - cumulative average price since Sep. 2022 bottom

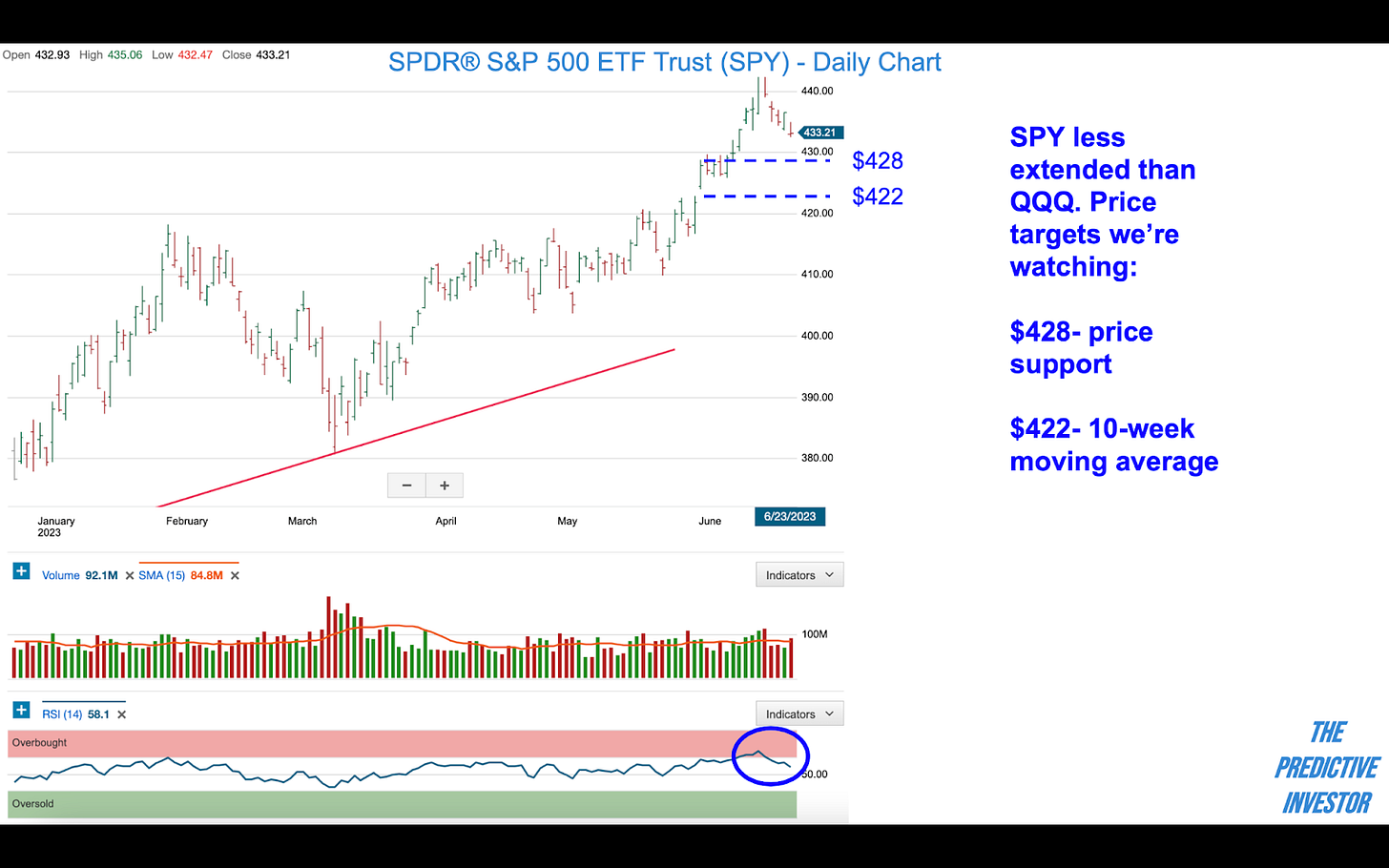

S&P 500 (SPY)

SPY is less extended than QQQ and RSI has pulled back considerably. A logical stopping point would be the 10-week moving average (currently $422.15), which would also fill the gap created on June 2nd.

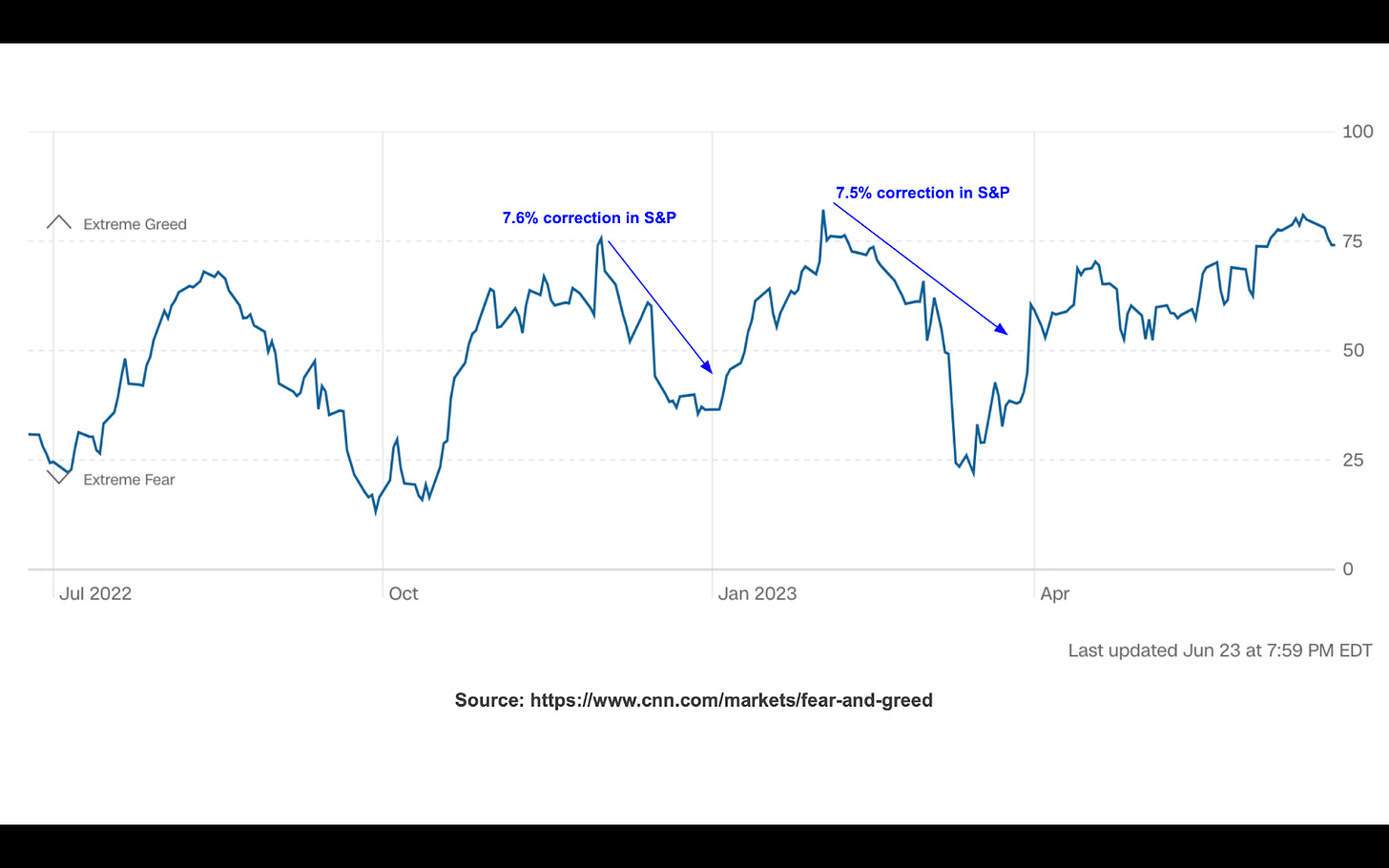

Market Sentiment

The CNN Fear & Greed Index retreated from its recent high of 81 on June 15th, but is still near extreme levels. Though there’s no guarantee we’ll get a 7%-8% correction like we did the last two times the index reached this level, the potential for that should be respected.

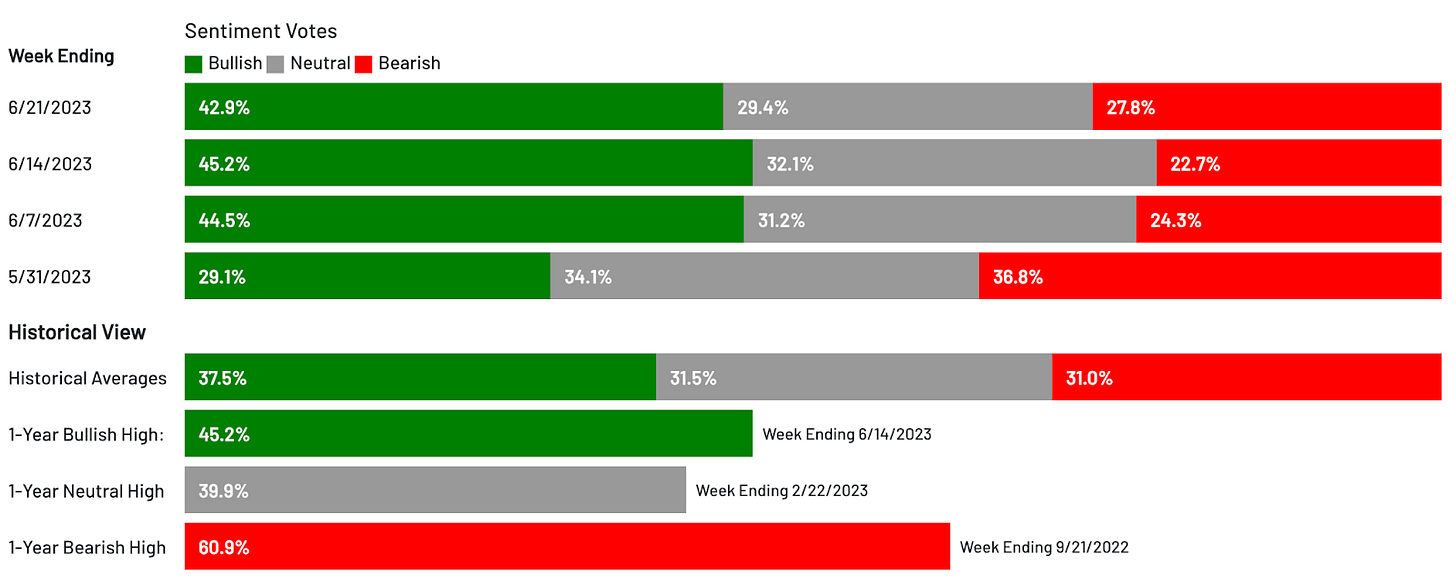

Bullish sentiment in the AAII Investor Sentiment Survey has been above average for 3 weeks in a row. Bearish sentiment has been below 30% for 3 consecutive weeks, an unusual absence of pessimism that has not been seen since the fall of 2021.

The bottom line: The pullback we’ve been waiting for is here. While RSI readings have started to retreat, sentiment indicators are still at extreme levels. We added one position to the portfolio last week, and will wait to see how the market trades early this week before adding more.