Market Brief - June 30, 2024

Rising yields blunt equity momentum

Welcome to The Predictive Investor Market Brief for June 30th, 2024!

The Nasdaq and S&P 500 briefly hit new all time highs on Friday, but rising yields caused a selloff, leading to bearish reversal days in both indexes.

However, our portfolio did quite well as small caps outperformed both tech and industrials. While some of last week’s price action could be due to quarter-end rebalancing, there are some reasons to be bullish on small companies over the long term. More on this below.

Here’s our takeaways from the week.

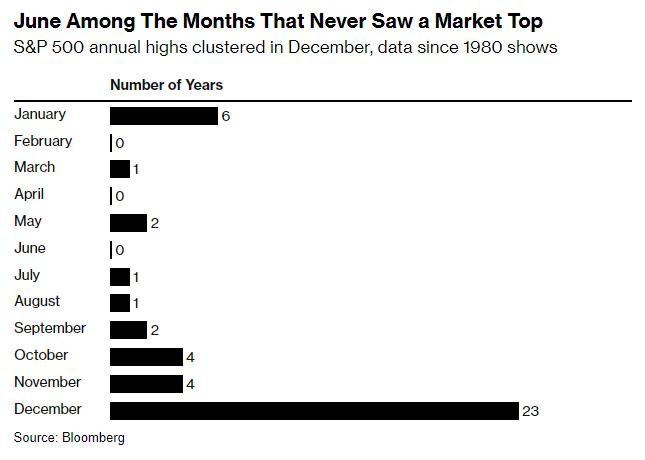

Stocks rarely peak in June

Last week we flagged some technical signs of a stalling rally, and that theme continued to play out this week. But we continue to believe this is nothing more than short term consolidation. Stocks almost never peak in June. And while this year hasn’t exactly followed historical seasonality, there are very few catalysts over the next month that would drive a significant pullback in stocks.

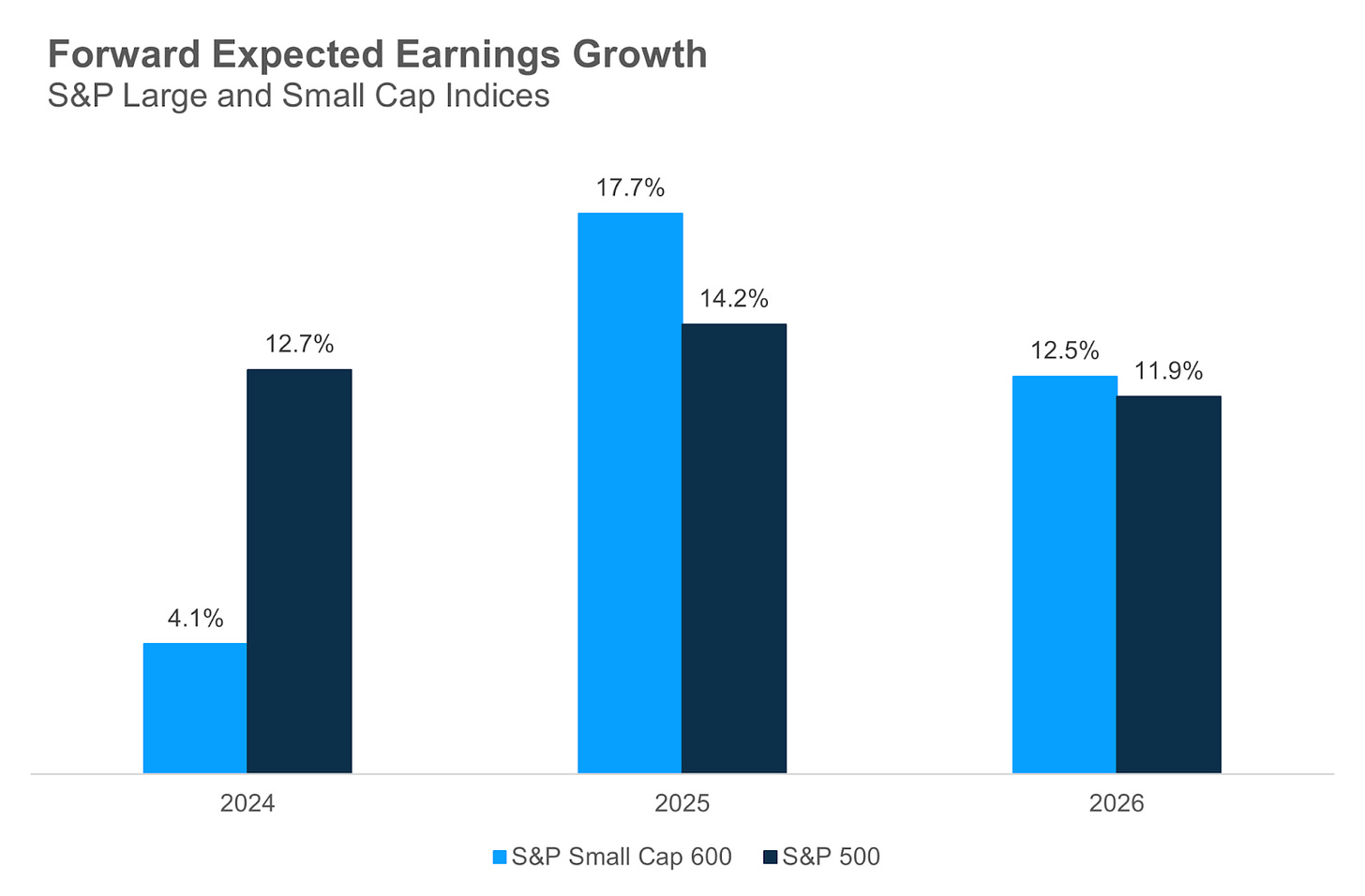

Small caps set to outperform

As you know, stock prices are driven by earnings. And while mega cap growth has been pulling the market higher, that may be about to change. Forward expected earnings growth for small caps is above that of large caps over the next two years. As the effects of government stimulus to reshore supply chains and upgrade our infrastructure continue to work their way through the economy, we continue to believe small caps are set for explosive growth.

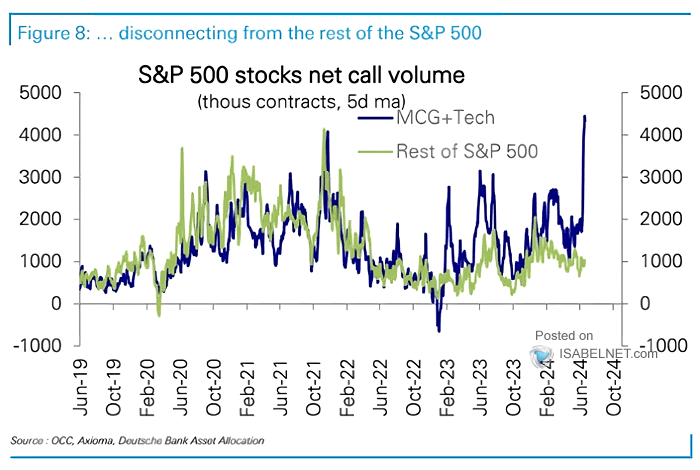

Optimism in mega cap tech

Not to mention the fact that there is historic optimism for mega cap tech. Call volume for mega cap growth and tech is significantly higher than the rest of the S&P 500, and above the level when the market peaked in 2021. Mega cap growth continues to be a very crowded trade.

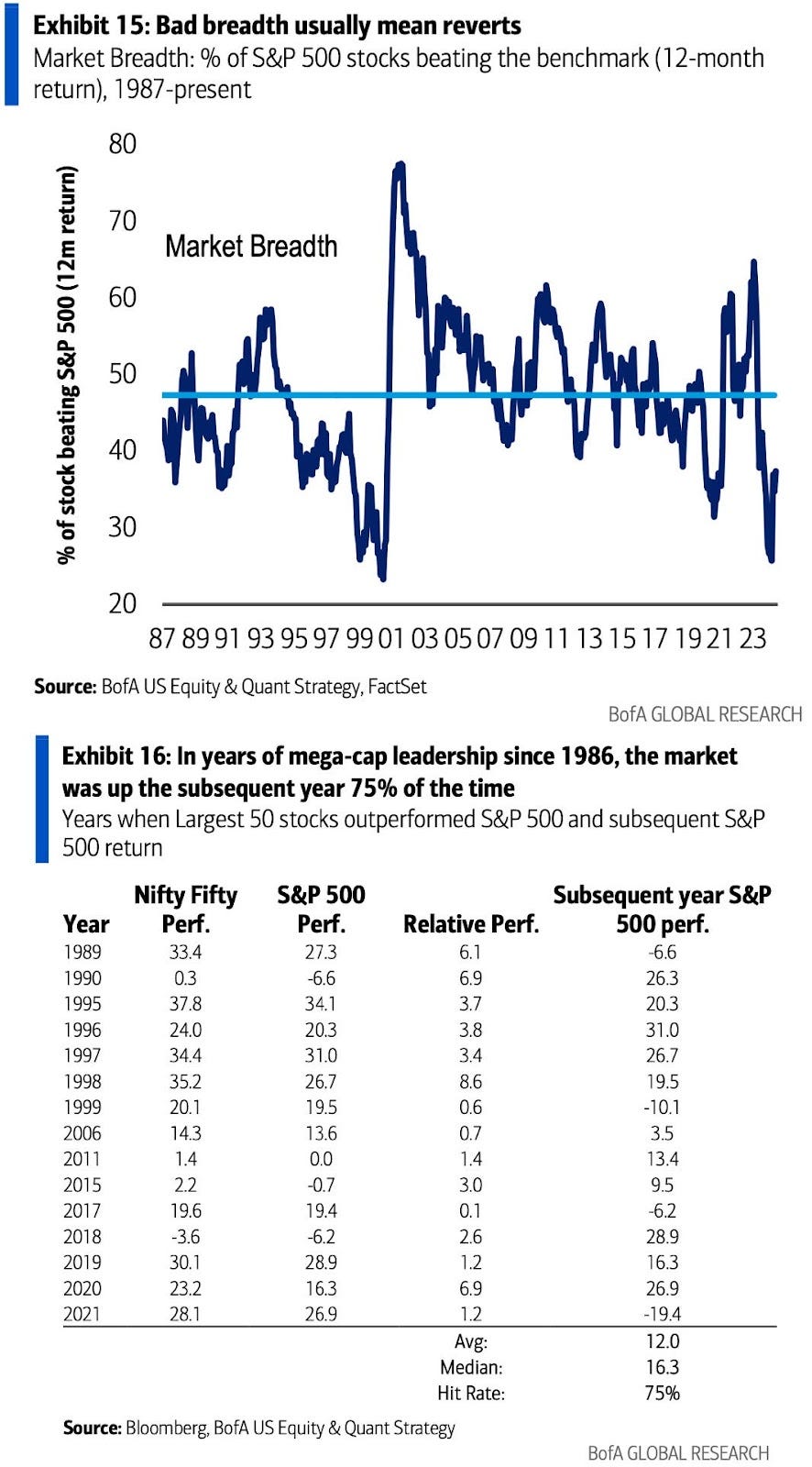

Mean reversion in breadth

While market breadth has been weak, there is some evidence to support a broader-based rally going forward. In years when the largest stocks have led, the market closed the following year higher 75% of the time. Yes, tech has dominated recently, but nothing lasts forever in the stock market. History suggests overlooked areas of the market are set to fuel future gains.

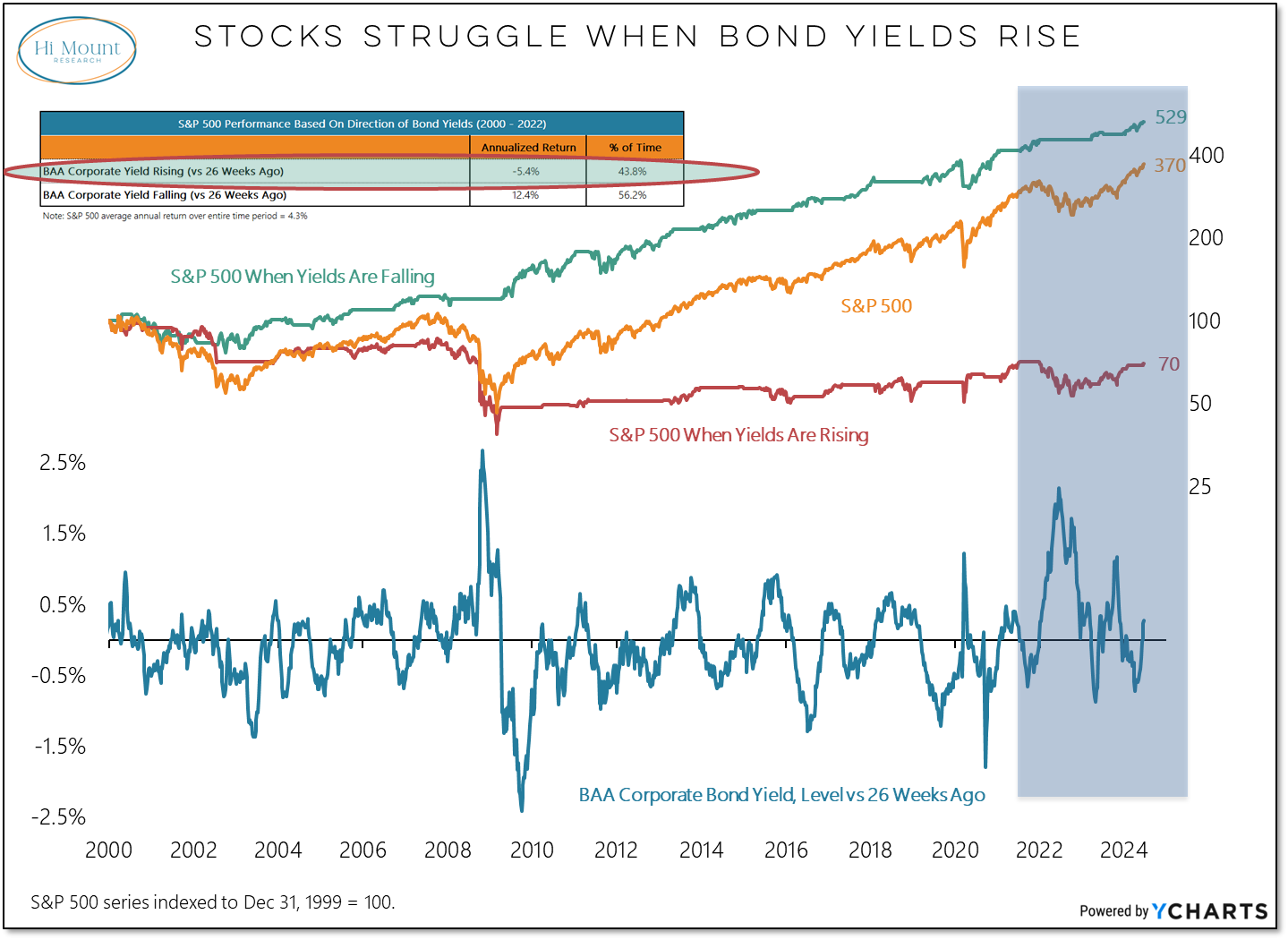

Stocks vs. yields

Here's a great chart that illustrates why we’ve been so focused on the direction of yields. Almost all of the net gains in the SPX have come when the 6-month momentum in corporate bond yields was falling. Low yields allow traders to take on more leverage, borrowing at low rates and investing in equities. Outside of geopolitics, interest rates remain the biggest risk for the market.